Resources Top 5: Gold stock pegs lithium ground, Renascor inks big graphite supply and equity deal

Mining

Mining

Here are the biggest small cap resources winners in early trade, Wednesday August 24.

Australasian Gold hit the bourse earlier this year with a focus on Queensland gold, but today’s re-rate is lithium related.

The stock has lodged a tenement application in the Mt Peake pegmatite district in Northern Territory.

The ground, which covers over 640sqkm and shares a boundary with Core Lithium’s (ASX:CXO) ‘Anningie’ lithium project, will be the focus on an upcoming field mapping campaign.

“I have been involved in lithium trading since 2016 and I know this space very well,” Australasian Gold managing director Dr Qingtao Zeng says he has been involved in lithium trading since 2016 and knows this space very well.

“There is great demand for spodumene concentrate and there are currently limited producers in the pipeline,” he says.

“That is where we see the opportunities.”

“In the lithium 1.0 boom, we saw new discoveries like Pilgangoora, Mt Holland and Finniss lithium projects.”

“Now we are in the era of Lithium 2.0; it is most likely that more discoveries will be made through exploration works in recognised pegmatite districts.”

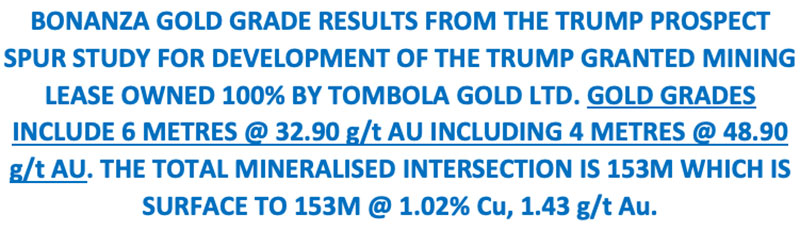

How’s this for a chaotic headline from the stock formerly known as Ausmex.

Translation: Development of the ‘Trump’ prospect could be prioritised as TBA preps for first gold production from the ‘Mt Freda Complex’ projects in Queensland next quarter.

Drilling completed late last year hit 6m @ 32.90g/t gold — including 4m at 48.90g/t — within a total intersection of 153m continuous copper /gold /cobalt mineralisation starting at surface.

This may look like new news, but it isn’t — the hit was first announced on December 3.

With the start of mining and production at the Mt Freda Complex projects due to kick off next quarter, the possibility of Trump contributing high grade gold ore to future production at Mt Freda and Golden Mile is under serious investigation, Tombola says.

“With the company’s successful capital raising with CPS Capital last week, the company has moved quickly into commencing pre-civil works, mobilisation of earthmoving equipment, surveyors, workshops, and administration offices for the Comstock gold mine (part of the Golden Mile),” the company says.

“The ore being mined from the Golden Mile will be processed at the Round Oak Minerals CIP processing plant in Cloncurry.”

Mining and production at Falcon & Shamrock historical gold mines (Golden Mile) and Mt Freda open cut gold mine will kick off shortly after, it says.

The $35m market cap stock is up 20% year-to-date.

(Up on no news)

Former mining contractor RDG acquired the ‘Lucky Bay’ garnet project in WA earlier this year.

High-quality alluvial garnet products are used in the abrasive blasting and waterjet cutting markets.

RDG says it intends to target coarse-grade markets in the first instance, “that are undersupplied and potentially in deficit”.

In July, drilling culminated in a 1,520% increase in resources.

“This significant Mineral Resource upgrade is an outstanding result and confirms the upside potential we identified when RDG first evaluated the potential at Lucky Bay,” managing director Andrew Ellison says.

“With 86% of the Mineral Resource in the Measured and Indicated categories, we can proceed with project development studies with a high level of confidence.

“The next step is to confirm our mining schedule as part of the Lucky Bay development studies ahead of a fast-tracked construction process.”

The $180m market cap stock is up 18% year-to-date.

(Up on no news)

The North American explorer is now up 94% over the past month, and 416% over the past year.

Last week, it announced a massive 216% increase in total rare earth elements (TREE) grade and a 90% hike in scandium grade during preliminary testwork at the ‘La Paz’ project in Arizona.

This follows a 117% increase in indicated resources.

Mineralisation remains open, ARR says, so there are opportunities to increase resources further.

RNU is the latest battery metals play to sign a big supply and equity deal, this time with $25 billion market cap South Korean conglomerate POSCO.

The Memorandum of Understanding (MOU) – a non-binding agreement which often comes before a binding one — provides for the purchase of 20,000 to 30,000tpa of Purified Spherical Graphite (PSG) from Renascor’s planned battery anode material operation in South Australia.

It also includes a potential equity investment in RNU by POSCO.

“We are delighted to be working with POSCO, a world leader in the supply of lithium-ion battery materials with an established track-record of working with Australian companies, including, most recently, Australian suppliers of battery minerals,” RNU managing director David Christensen says.

“The significant offtake requirements from POSCO represent a transformational step change for Renascor, as the demand from POSCO, together with our existing offtake partners, not only fulfils our current Stage 1 PSG capacity, but also warrants material PSG capacity expansions through an increase of Stage 1 and an expanded Stage 2.”

“The exceptional demand for Siviour PSG is a significant validation of Renascor’s strategy to become one the world’s largest suppliers of low-cost and secure PSG and places Renascor in a strong position as we progress toward binding offtake.”

$200m market cap RNU is up 1,050% year-to-date.