Resources Top 5: A close Encounter of the REE kind

Pic via Getty Images

- Encounter Resources has made contact with REE-niobium carbonatites in WA

- Meanwhile, the lithium-hunting narrative picks up through Ragusa in the NT, and…

- … James Bay Minerals in, er, James Bay – of course

Here are the biggest resources winners in early trade, Tuesday October 31.

Encounter Resources (ASX:ENR)

Copper, lithium and REEs hunter ENR has made a close encounter of the third kind on that list – new niobium-REE carbonatites in the West Arunta region of WA.

ENR is currently up about 20% on the news.

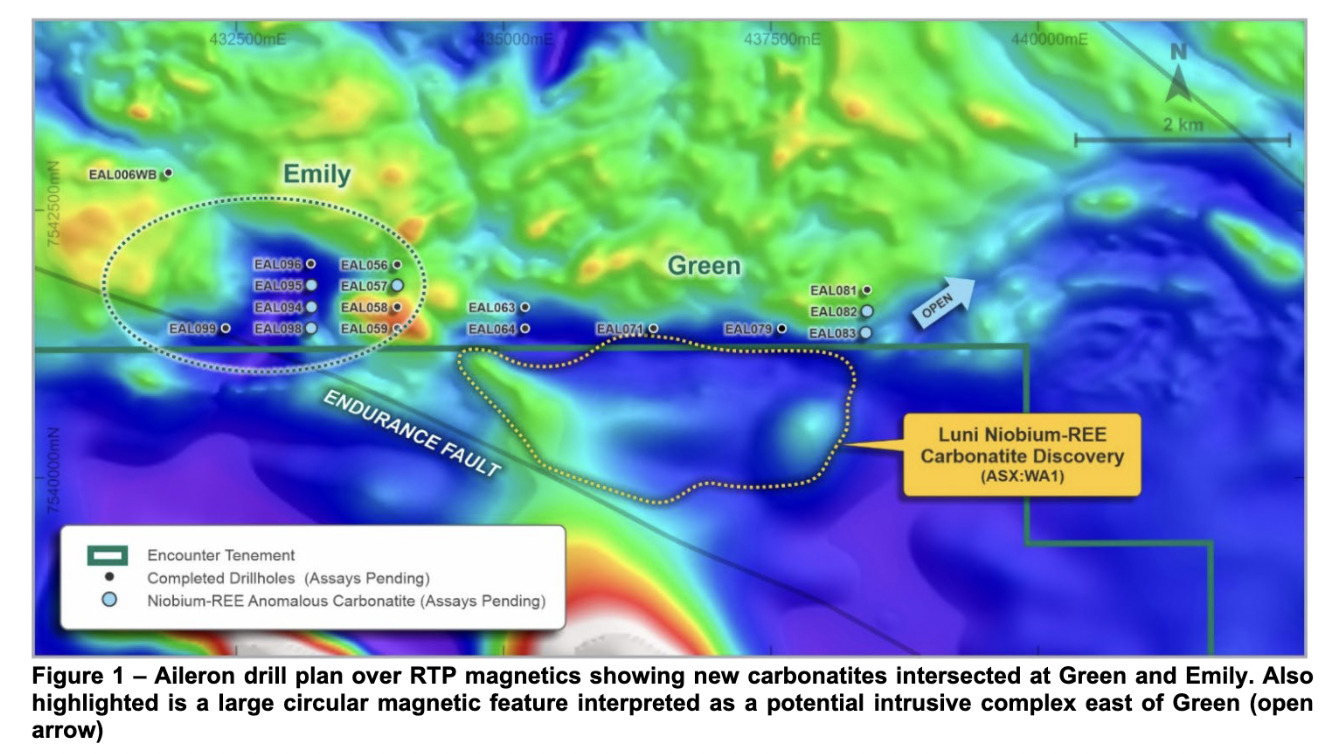

The company notes that RC drilling has intersected the carbonatites at the Green and Emily targets in the south of the wholly Encounter-owned Aileron project.

Two, 200m-spaced holes have been completed in the eastern part of the Green target, hitting carbonatites that are “variably anomalous in niobium and REE”, and with the mineralised trend remaining open to the east towards a “large circular feature defined in magnetics and interpreted as a potential intrusive complex”.

At Emily, meanwhile, a magnetic low located 2km north-west of WA1 Resources’ (ASX:WA1) Luni discovery, has intersected carbonatites from ~50m depth which Encounter says were variably mineralised in niobium-REE to the end of the hole.

Assays from both sites are due to hit company directors’ in trays some time in December or possibly January 2024.

Encounter’s MD Will Robinson was in no danger of feeding a flat narrative, enthusing:

“The targeting models used in the West Arunta are evolving rapidly and are delivering an extraordinary success rate in drilling niobium-REE mineralised carbonatites.”

Niobium, by the way, is a ductile metal that has versatile industrial use partly due to its high resistance to heat and wear. About 90% of niobium is used in the steel industry as a micro alloy to make steel lighter and stronger.

The metal’s use case in lithium-ion batteries is also a growing narrative, however. You can read a bit more about that here.

ENR share price

Ragusa Minerals (ASX:RAS)

As we noted earlier this month, this lithium-rare earths explorer has been hammered in 2023 alongside most of its resources brethren, down a precipitous 90% over the past 12 months.

No real reason for that, altough rock-bottom market sentiment across various sectors has certainly played its part on centre stage at various times this year.

But, RAS has remained confident there’s something worth finding at its NT lithium project, which is not far at all from Core Lithium’s (ASX:CXO) new Finniss mine.

And today, RAS is up on the back of an update that appears to provide further ballast regarding the project’s lithium potential.

Ragusa highlights that:

• An RC drilling program has been completed, with six separate pegmatite bodies intercepted.

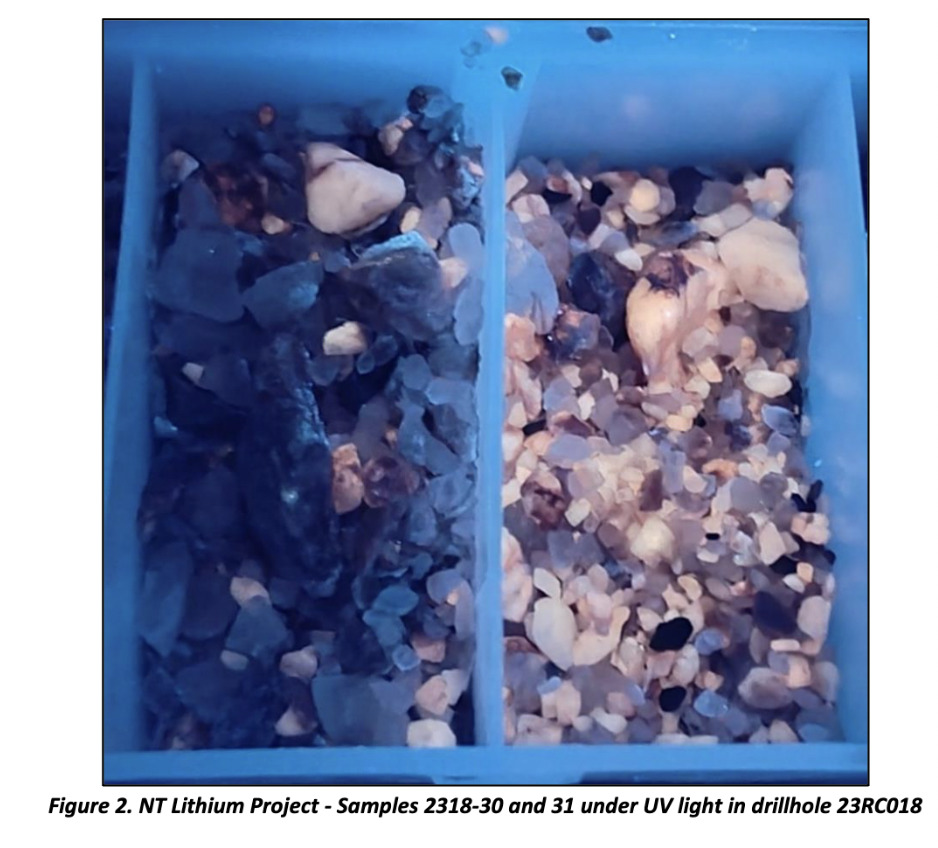

• Fluorescent salmon-coloured minerals have been identified under UV light in RC drill-chip samples (see example, below).

• Select pegmatite drill samples have been delivered to the lab for lithium analysis.

• And pegmatites have been intercepted in five out of six drill holes.

Ragusa chair, Jerko Zuvela, said: “We are encouraged by the preliminary observations of spodumene potential at shallow depths, noting the scale of the pegmatite zones encountered within our project area. We look forward to receiving the lithium assay results in coming weeks.”

RAS share price

James Bay Minerals (ASX:JBY)

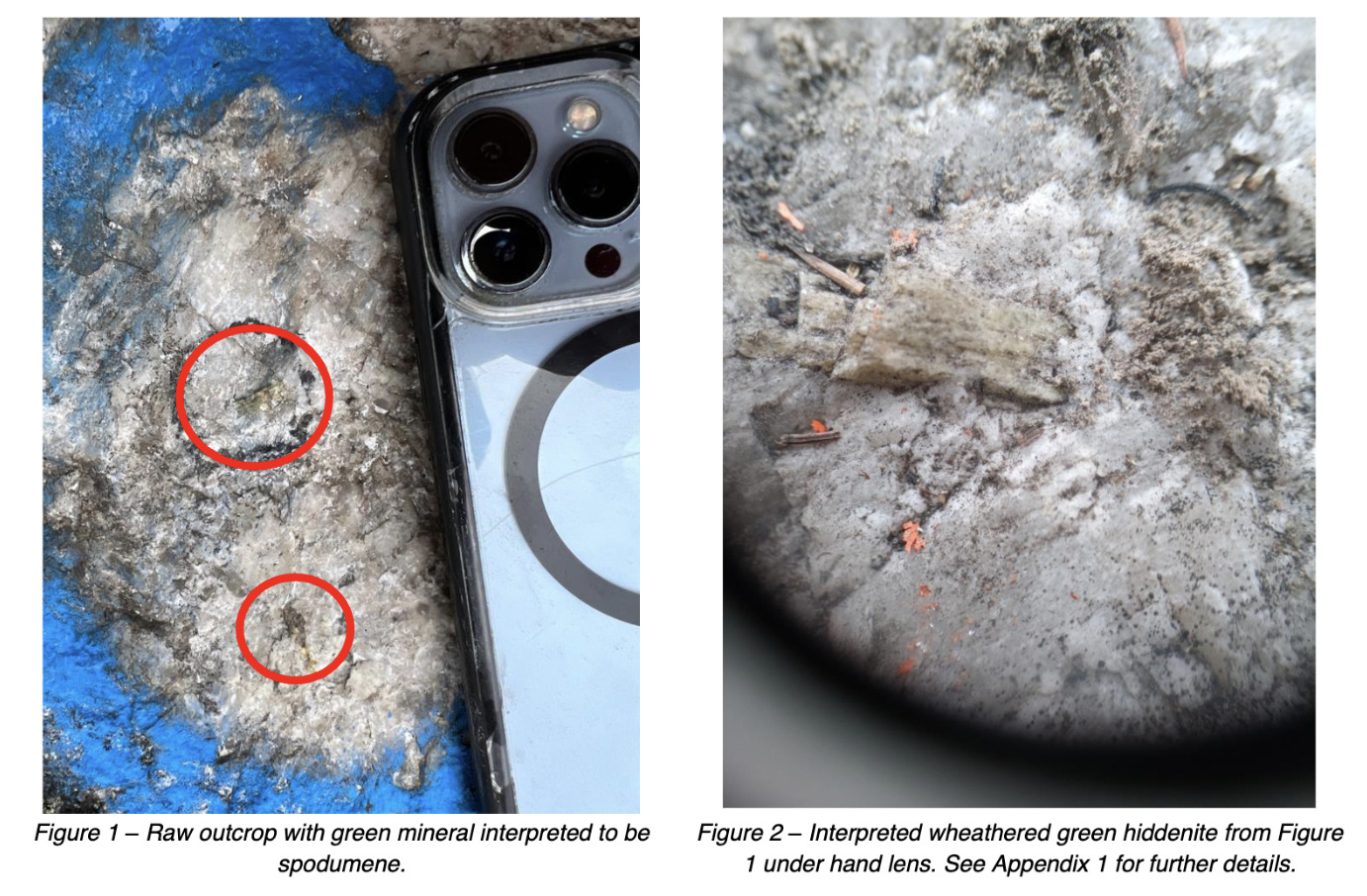

ASX newcomer James Bay Minerals keeps on spodding on, announcing a “significant” new discovery of spodumene crystals within the Warhawk pegmatite at its Aero tenure, confirming its prospectivity.

JBY has one of the largest lithium portfolios in Canada’s James Bay region in Quebec, covering 224km2 across four projects – the flagship Joule, Aero, Aqua (all part of the broader “La Grande” project) and Troilus to the south.

The Warhawk pegmatite is a 560m-long, up to 20m wide body full of spodumene crystals. Here’s some visualisation for you, spod fans – courtesy of JBY’s ASX announcement this morning…

Aero consists of 89 continuous claims across 43.65sq km and contains about 12km of deformation zones considered highly prospective to contain LCT pegmatites.

Nearby Cancet West, owned by Winsome Resources (ASX:WR1) , and Patriot Battery Metals’ (ASX:PMT) Corvette lithium projects both have similar deformation zones running through their properties and have had significant exploration success to date.

As our report on the find also details, the JBY discovery could be a continuation of Fin Resources’ pegmatites with “abundant spodumene crystals”, 250m from tenement boundary, discovered recently at FIN’s Cancet West project.

JBY share price

Power Minerals (ASX:PNN)

Diversified explorer Power Minerals is one of the main ressie pack leaders today, currently up about 18%.

This comes on the back of announcing it received the first tranche (worth $3.125m) of significant funding from Summit Nanotech Corporation – a Canadian-based cleantech organisation focused on EV batteries and the global energy transition.

This first amount will be used for the funding and development of the Incahuasi salar (salt flat) at Power’s Salta Lithium project, which is in the “Lithium Triangle” of Argentina. This comes as the two parties move to execute an Option and Joint Venture Agreement (PNNJV) regarding Incahuasi.

Power notes it plans to expand the Incahuasi JORC mineral resource, and the funds will go towards pumping wells, water drilling and the engineering studies required to complete a Prefeasibility Study (PFS) at the project.

Summit is a leading sustainable Direct Lithium Extraction (DLE) technology provider and its patented denaLi™ DLE technology is reportedly able to produce lithium from brines with over 95% lithium recovery and over 98% impurity reduction.

We've received the first tranche of $3.125m from Summit Nanotech for the development of the Incahuasi salar at our Salta #Lithium Project, Argentina. Funds will be used to expand the JORC Mineral resource and support a Prefeasibility Study.

Read more: https://t.co/E2oo4Q9QhW$PNN pic.twitter.com/brid4aAHcz— Power Minerals Limited (ASX:PNN) (@PowerMin_PNN) October 30, 2023

Read more about Power’s recent activity here, specifically regarding its priority Pink Slipper target, first identified by Rio Tinto, at its Musgrave nickel-copper-cobalt-PGE project in South Australia.

PNN share price

King River Resources (ASX:KRR)

(Up on no news)

Goldie KRR was one of the best-performing ressies in early trade today, but there’s not a lot that’s immediately apparent for its out-the-gates 18% rise.

We refer you back to some of its most recent news of note from earlier in the month…

In which it announced the completion of its 2023 geophysics program in the Tennant Creek region in the NT, and the allocation of a $2m drilling budget to test resulting targets, which kicks off on November 10 this year.

King River Resources (formerly King River Copper) has holdings at Mt Remarkable in the Kimberley region of northern Western Australia, as well as at Tennant Creek.

The company’s geophysical program has been targeting prospective iron ore copper oxide areas at Rover East, Tennant East, Barkly and Kurundi, including multiple targets along strike of geophysical and geological trends associated with other known significant deposits of high-grade copper and gold including Rover, Bluebird and Mauretania.

Now the program is done and dusted, processing and interpretation is underway. Results received to date “are excellent”, noted the company, with new drill targets generated at several locations, particularly Lone Star East.

As part of its Quarterly Activities Report, released on October 18, KRR also noted it received the second payment of $2.5 million from the sale of the Speewah vanadium-fluorite project to Tivan (ASX:TVN).

KRR share price

At Stockhead we tell it like it is. While Power Minerals, Patriot Lithium and James Bay Minerals are Stockhead advertisers at the time of writing, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.