Resources Top 5: Little battler moves onto its ‘Core-like’ peggies, termites give glowing review

Picture: Getty Images

- Ragusa Minerals shifts focus to peggie site ‘similar to Grants Deposit’

- REE junior Caprice closes in on maiden drill campaign

- Haranga’s termite mounds look promising

Here are the biggest resources winners in early trade, Friday October 6.

Ragusa Minerals (ASX:RAS)

This lithium-rare earths explorer has been hammered in 2023 alongside most of its resources brethren, down a precipitous 90% over the past 12 months.

No real reason for that, other than rock bottom market sentiment and a couple of underwhelming lithium drill programs in the NT.

RAG has shrugged off these dusters. It remains confident there’s something worth finding at the NT lithium project, which is a proverbial stone’s throw from Core Lithium’s (ASX:CXO) new Finniss mine.

A new drill program is now set to target untested pegmatites with no historical drilling in the western portion of the project area.

“The target area differs from the remainder of the outcropping pegmatites, as it is located within a volcanic host intrusion against the presumed source S-type granite further to the west,” it says.

“Unlike the pegmatite bodies tested by Ragusa thus far, these targets (in relation to the assumed source) have not been geographically offset by faulting, similar to the spodumene bearing pegmatites currently being mined by Core Lithium at their Grants Deposit to the north.”

Fingers crossed.

It has a backup plan though, with desktop reconnaissance underway for prospective hard rock lithium deposits in Canada.

“Significant research and aerial imagery investigation has identified areas of intense pegmatite swarm intrusion,” it says.

“Ragusa has engaged a local geological consultant to carry out preliminary field reconnaissance exploration works scheduled for completion during October.”

The $5m capped stock had $1.9m in the bank at the end of June.

Caprice Resources (ASX:CRS)

(Up on no news)

CRS is part of the ASX’s IPO Class of 2018, which produced a batch of high profile winners including Adriatic Metals (ASX:ADT) and Vulcan Energy Resources (ASX:VUL), up 1650% and 1100% over the journey.

Other resources stocks like Tietto Minerals (ASX:TIE) and Nickel Mines (ASX:NIC) have also enjoyed astronomical growth, just not in market cap because dilution.

Some inspo perhaps for still-a-small-cap CRS, which is hoping for a rerate from its Mukinbudin rare earths project in WA.

Mukinbudin is nestled amongst ground held by majors IGO and Rio Tinto, and fellow ‘C-list’ juniors (haha) Codrus (ASX:CDR) and Cygnus (ASX:CY5).

In late September soil sampling extended Mukinbudin’s Gadolin target to +3.4km, and counting, with peak values of up to 3,839ppm TREO (14.0% MREO).

This sampling has also confirmed a 3.5km long target at Hadrian’s.

More sampling results are due soon from Hadrian’s and Colosseum, where CRS picked up one rock chip grading 5,068ppm (0.5%) TREO (24.8% MREO).

The approvals process for a highly anticipated maiden drill campaign is progressing, the company says.

The $5m capped junior had $686,000 in the bank at the end of June.

Bryah Resources (ASX:BYH)

This diverse metals junior explorer (copper, gold, manganese, nickel, cobalt) is up on news today regarding the manganese component of its exploration portfolio.

Manganese is a key stabilising component in the cathodes of nickel-manganese-cobalt (NMC) lithium-ion batteries used in electric vehicles.

Bryah, in a joint venture with OM (OMM), has announced it’s been granted two mining licences at the Bryah Basin manganese project in WA.

OMM has 51% of the JV and is a wholly owned subsidiary of OM Holdings (ASX:OMH), one of the world’s leading suppliers of manganese ores.

Commenting on the application, Bryah CEO Ashley Jones said: “The Mining Licences that have been granted are an important step in moving the Joint Ventures successful manganese exploration to the production stage.”

The licences have been granted over current JORC resources at the Brumby Creek and Black Hill Prospects, and the resource model was recently updated, in August 2023, to 3.07Mt at 20.1% Mn.

“Additional tonnes are expected to be added to the current JORC resource from recent drilling at Red Rum and Brumby Creek West. The Mining Licence applications and environmental permitting process are prerequisites to getting this manganese mining area back into production.”

In the new generation of battery chemistries of LMFP & NMx, #manganese accounts for 65% & 69% of the mass$BYH has achieved a ‘critical mass’ that allows the JV with @OM_Holdings to progress mining studies & planning towards productionhttps://t.co/DQkrKS0hhV @StockheadAU

— Bryah Resources Limited (@BryahRes) September 12, 2023

BYH share price

Haranga Resources (ASX:HAR)

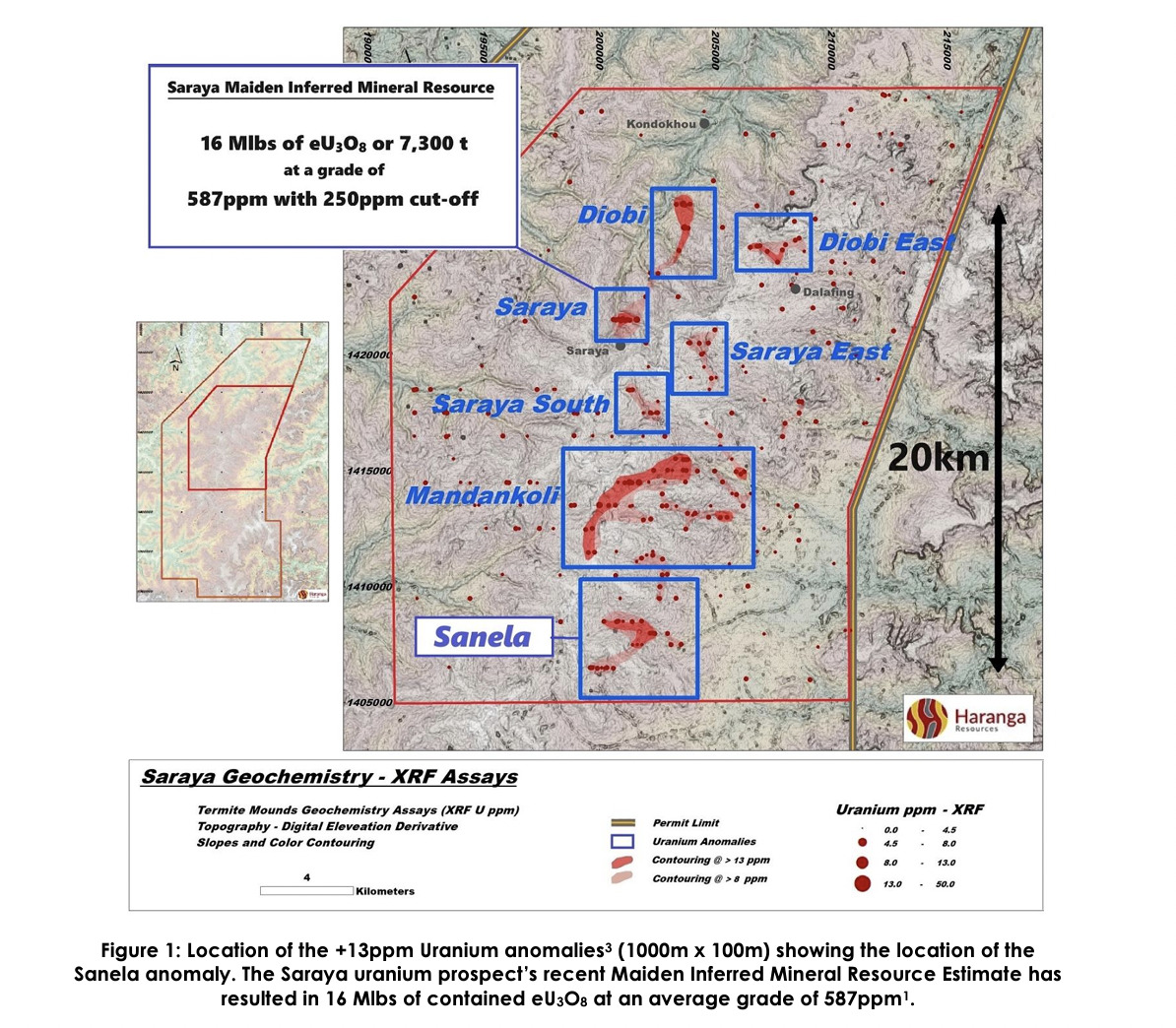

Near $10m market-capped uranium explorer Haranga is making news again on the bourse after recently securing commitments for $2.86m of funding to expand the company’s maiden JORC uranium resource at the Saraya uranium project in Senegal, West Africa.

Today’s update, though, centres around another of its prospects in the area: Sanela, where new uranium anomalies have been identified ahead of planning for drill operations.

The Sanela uranium anomaly extends over 2km along a NNE structural trend, similar to Saraya, the company reports.

Meanwhile, infill termite mound sampling and assaying over the anomalous Saraya South and Mandankoli prospects is on-going and expected to be completed before the end of the year.

Haranga managing director Peter Batten said: “These results from Sanela are timely, as they come close on the heels of our first Mineral Resource Estimate at the Saraya Prospect within our Saraya Project.

“The Saraya Mineral Resource Estimate at 16Mlbs Inferred and at a grade of 587ppm eU3O81 is a significant result, in itself, but is only the first of, at least, seven anomalies we will be testing within the Saraya Project and whilst the Saraya Prospect is the better defined anomaly, with over 65,000m of drilling, it is also the smallest of the seven anomalies identified, so far.

“The successful completion of the Sanela sampling now allows the Haranga geological team to include Sanela, along with Diobi and Mandankoli, in the next phase of drilling planned for this quarter.”

HAR share price

Sarama Resources (ASX:SRR)

(Up on no news)

This West African gold explorer and developer is focused on establishing a new mining district in Burkina Faso, owning a 100% interest in the Sanutura Project, about 350km southwest of Ouagadougou.

There’s no fresh news for SRR today. In fact, the last piece of major news for SRR was hardly great, and came in early September, when the company announced that the Ministry of Energy, Mines and Quarries of Burkina Faso had withdrawn the company’s rights to the 100% owned Tankoro 2 exploration permit.

The permit hosts the Tankoro Deposit, which is the central component of the multi-million-ounce Sanutura project.

Sarama said at the time that it’s evaluating its position and will advise further as events warrant. Maybe shareholders know something more today.

As Guy Le Page wrote recently for Stockhead:

“The junior gold sector and West African explorers in particular are a little unloved by the market at the moment. There is probably good reason for this if any of the Stockhead faithful have time to read the Sarama Resources ASX announcement on 6 September 2023…

“I think Mali, Burkina Faso and Niger are looking to finish on the podium this calendar year as the highest risk jurisdictions in Africa with investor confidence now at rock bottom. With Russia tightening its group on Niger, seemingly supported by Mali and Burkina Faso, expect more bad news to follow.”

SRR share price

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.