Psst – wanna buy some lithium? Here are some of the cheapest stocks on the ASX

Pic: Tyler Stableford / Stone via Getty Images

Last week, ASX lithium stocks went gangbusters.

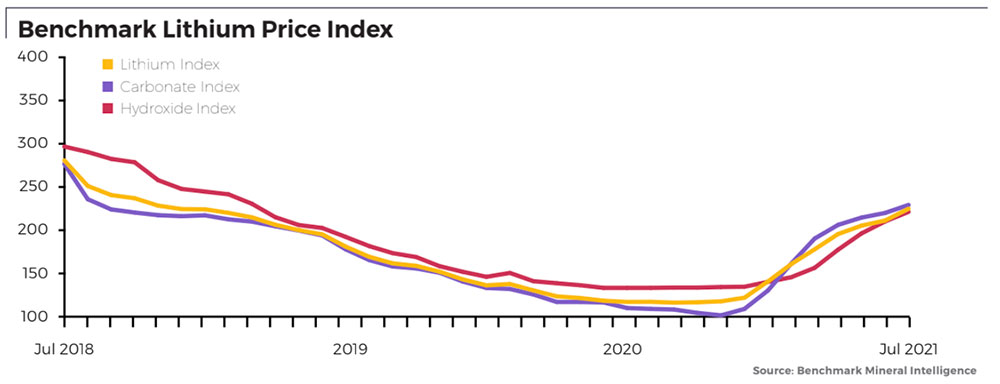

The groundwork was laid by a perfect storm of increasingly aggressive EV targets, rising raw material prices, and the growing sense there isn’t enough supply to go around.

Lithium shortages were supposed to start kicking in around 2023-2024, but you would swear the deficit is happening right now.

Two things happened last week to kick this investor FOMO up a gear.

One, miner Pilbara Minerals (ASX:PLS) set the lithium sector alight with its announcement that the first auction of spodumene — a lithium precursor — had gone off at an amazing $US1,250t.

That’s well above prevailing market price, and streets ahead of the ~$US380/t spod producers were accepting last year.

US President Biden then outlined an ambitious target for half of all new vehicles sold in the US in 2030 to be zero-emissions vehicles – including battery electric, plug-in hybrid electric, or fuel cell electric vehicles.

By setting clear targets for EV sales, the world’s #1 economy is hoping to become a magnet for private investment into its manufacturing sector – and get back in the lead on clean cars and trucks.

Biden is backed by automakers Ford, GM, Stellantis and BMW. Ford, Honda, Volkswagen and Volvo have all released targets of 40-50% EV sales share by 2030.

There was a rush to the doors for lithium stock exposure. Well over 90% of the stocks on our list finished in the green.

Standout winners included:

Lake Resources (ASX: LKE) +56%

Lepidico (ASX:LPD) +53%

Balkan Mining and Minerals (ASX:BMM) +41%

Jindalee Resources (ASX:JRL) +29%

… the list goes on.

Winners & Losers

Here’s how ASX-listed lithium stocks are performing:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop

Any stocks missing? Let us know at [email protected]

| CODE | COMPANY | 1 WEEK RETURN | 1 MONTH RETURN | 6 MONTH RETURN | 1 YEAR RETURN | PRICE | MARKET CAP |

|---|---|---|---|---|---|---|---|

| AAJ | Aruma Resources | 7 | -9 | -37 | -34 | 0.059 | $ 6,300,000.00 |

| RLC | Reedy Lagoon | 6 | 0 | -6 | 113 | 0.017 | $ 7,520,418.66 |

| PAM | Pan Asia Metals | 13 | 36 | -3 | -15 | 0.17 | $ 9,100,000.00 |

| CHR | Charger Metals | 87 | 87 | 0.43 | $ 13,800,000.00 | ||

| ADV | Ardiden | 6 | 12 | -60 | -37 | 0.0095 | $ 17,194,833.73 |

| BMM | Balkan Mining and Minerals | 41 | 0.62 | $ 18,525,000.00 | |||

| GL1 | Global Lithium | 9 | 13 | 0.3 | $ 23,578,612.44 | ||

| LEL | Lithium Energy | 39 | 77 | 0.645 | $ 27,000,000.00 | ||

| ESS | Essential Metals | 19 | 45 | 10 | 62 | 0.16 | $ 29,118,508.50 |

| ARN | Aldoro Resources | 1 | 16 | 70 | 280 | 0.475 | $ 38,500,000.00 |

| INF | Infinity Lithium | 3 | -17 | -55 | 21 | 0.1 | $ 40,291,455.60 |

| EUR | European Lithium | 21 | 23 | 3 | 53 | 0.069 | $ 58,837,943.05 |

| ASN | Anson Resources | 25 | 35 | -2 | 345 | 0.089 | $ 74,223,384.29 |

| LPI | Lithium Power International | 21 | 54 | 9 | 58 | 0.315 | $ 90,323,261.70 |

| TNG | TNG Limited | 3 | 13 | -28 | 3 | 0.072 | $ 92,462,780.96 |

| LIT | Lithium Australia | 13 | 18 | -13 | 117 | 0.13 | $ 113,989,594.63 |

| LPD | Lepidico | 53 | 92 | -18 | 229 | 0.023 | $ 123,041,648.92 |

| PSC | Prospect Resources | 25 | 47 | 108 | 188 | 0.375 | $ 139,986,090.28 |

| JRL | Jindalee Resources | 29 | 26 | 61 | 825 | 3.14 | $ 171,960,770.52 |

| AGY | Argosy Minerals | 16 | 26 | -9 | 184 | 0.145 | $ 175,038,038.56 |

| AJM | Altura Mining | 0 | 0 | 0 | 1 | 0.07 | $ 209,037,029.25 |

| EMH | European Metals | -5 | -2 | 35 | 447 | 1.615 | $ 213,350,822.60 |

| GLN | Galan Lithium | 28 | 34 | 155 | 767 | 1.3 | $ 294,363,189.60 |

| CXO | Core Lithium | 24 | 45 | 8 | 623 | 0.34 | $ 369,846,935.01 |

| FFX | Firefinch | 7 | 12 | 123 | 190 | 0.435 | $ 391,416,472.38 |

| NMT | Neometals | 9 | 37 | 121 | 300 | 0.72 | $ 394,800,000.00 |

| PLL | Piedmont Lithium | 7 | -23 | 20 | 714 | 0.79 | $ 431,137,950.00 |

| SYA | Sayona Mining | 27 | 11 | 151 | 1044 | 0.1 | $ 530,062,925.02 |

| LKE | Lake Resources | 56 | 84 | 123 | 1761 | 0.67 | $ 617,709,463.03 |

| AVZ | AVZ Minerals | 12 | 40 | 18 | 282 | 0.2175 | $ 659,383,732.67 |

| INR | Ioneer | 13 | 23 | 17 | 313 | 0.475 | $ 828,325,651.94 |

| VUL | Vulcan Energy | 38 | 63 | 49 | 2500 | 13.52 | $ 1,248,554,617.24 |

| LTR | Liontown Resources | 12 | 13 | 137 | 690 | 0.9475 | $ 1,826,798,630.40 |

| GXY | Galaxy Resources | 8 | 26 | 82 | 321 | 4.84 | $ 2,406,987,429.28 |

| ORE | Orocobre | 6 | 23 | 75 | 170 | 8.44 | $ 2,861,596,049.82 |

| PLS | Pilbara Minerals | 18 | 44 | 112 | 497 | 2.085 | $ 5,860,993,963.20 |

| IGO | IGO | 5 | 19 | 54 | 102 | 9.76 | $ 7,400,000,000.00 |

| MIN | Mineral Resources | -8 | 3 | 67 | 113 | 58.28 | $ 11,227,903,569.18 |

Who has room to run?

Here is a selection of the cheapest lithium-facing stocks on the ASX.

Aruma’s main game is gold, but it also has the early stage ‘Mt Deans’ lithium project near Norseman in WA.

The geology is similar to the nearby Mt Marion (Mineral Resources (ASX:MIN)), Bald Hill (US company Austroid) and Buldania (Liontown Resources (ASX:LTR)) deposits, the company says.

While explorers love to make these sorts of comparisons, Aruma is going to test the theory with a 40-hole drilling program in the New Year.

The gold-iron ore focused explorer has two Nevada lithium brine projects in its back pocket: Alkali Lake North and Clayton Valley.

These projects are ~25km from the Silver Peak lithium brine operation owned by major miner Albemarle, and 360km by road from the Tesla Gigafactory in Reno.

Reedy says these lithium brine projects are on hold “until technology enables production without evaporation”.

Which there is – it’s called Direct Lithium Extraction (DLE), and all the cool kids are doing it.

In mid-July, the recently listed tungsten-lithium explorer kicked off 24-hour-a-day drilling at its ‘Reung Kiet’ project in Thailand.

“Compelling” lithium drilling results at Reung Kiet supported a move to double shift drilling, the company says.

“This will allow PAM to accelerate the additional infill and extensional drilling required in order to support the objective of estimating a Mineral Resource in accordance with the JORC Code 2012 – which is anticipated later this year.”

One of the ASX’s newest lithium and base metals plays made news when New York-based fund manager Lind Partners took a substantial 7.34% stake.

In late July, Charger uncovered a new lithium target at the Lake Johnston Project in WA. The company plans to fast track targeting work “to allow drilling to be undertaken at the earliest possible time”.

It also has a lithium-gold project called ‘Bynoe’ in the Northern Territory, surrounded by tenements owned by advanced project developer Core Lithium (ASX:CXO).

Canadian gold explorer Ardiden — which spiked back when gold was cool but has since settled back to minnow status — recently reminded punters about its “strategically located high grade lithium assets”.

The explorer has inked a JV with “highly experienced lithium development team” Green Technology Metals (GTM) to explore and potentially develop its non-core lithium assets in Ontario.

GTM would progressively acquire up to 80% ownership of the lithium tenements for $9.2 million, subject to shareholder approval.

“Retaining a minimum 20% interest enables Ardiden to retain upside exposure to the battery metals market without having to deploy capital towards lithium exploration, while simultaneously providing capital for the gold exploration program at the Pickle Lake gold project,” Ardiden says.

BALKAN MINING AND MINERALS (ASX:BMM)

Balkan, recently spun out of Jadar Resources (ASX:JDR), is focused on the ‘Rekovac’ lithium project in the little-known jurisdiction of Serbia.

The project “has similar geological settings” to Rio Tinto’s world-class Jadar discovery, the company says.

The stock is currently selling for ~ 61c – a 204% gain on its IPO price of 20c per share – making it one of July’s best performing listings.

GL1’s main game is the ~240sqkm Marble Bar lithium project (MBLP) in WA’s Pilbara, a region which also hosts Pilbara Minerals’ (ASX:PLS) Pilgangoora operation and the Albemarle and Mineral Resources’ (ASX:MIN) Wodgina joint venture.

The company is drilling to find the edges of the 10.5 million tonne ‘Archer’ deposit, a swarm of spodumene-bearing pegmatites over a 3km by 1km zone which remains ‘open’ in all directions.

It is well funded, with $8.6m in the bank on June 30.

Lithium Energy almost has the approvals required to hit the ground at its ‘Solaroz’ lithium brines project in Argentina.

Upon approvals being received, the newly listed Strike Resources (ASX:SRK) spinout plans to undertake an extensive work program of geophysical surveys and drilling.

Solaroz is next door to some big players, including the current production assets of Orocobre (ASX:ORE) and the advanced lithium brine development project held by Lithium Americas Corporation (NYSE:LAC).

In June, Lithium Energy established a conceptual (theoretical, not real yet) exploration target of 1.5 to 8.7 million tonnes of contained Lithium Carbonate Equivalent (LCE) based on a range of lithium concentrations of between circa 500 mg/L Lithium (Li) and 700 mg/L Li.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.