‘Proven resource, metallurgy, and jurisdiction’: Sagon’s Jeremy Robinson on the transformative Cummins Range rare earths project

Pic: Schroptschop / E+ via Getty Images

Special Report: It has the #4 biggest rare earths resource in Australia (already) and a low capex development strategy, boosted by the industry’s “exciting demand narrative”. The upside for $14m market cap explorer Sagon Resources is huge.

The potential elimination of Chinese rare earth supply from the market creates an opportunity for Australian producers “to step up and increase market share”, according to Deliotte’s October Commodity Review.

“[And] while the supply outlook is uncertain, the demand narrative is exciting,” national mining lead Ian Sanders says.

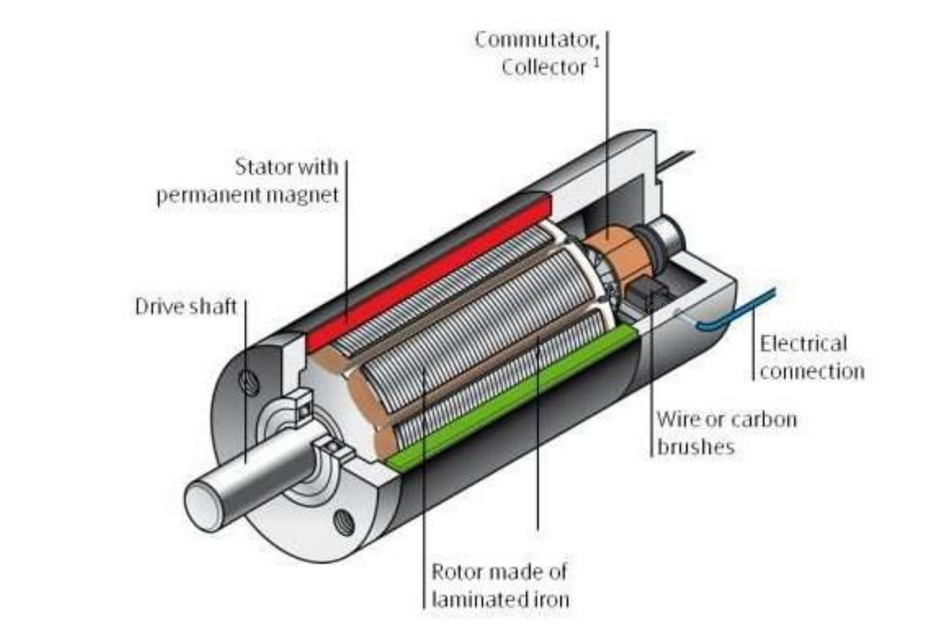

“Several metals in the rare earths family are integral to the rapidly expanding clean energy and transport electrification thematic.“It is the combination of (increasingly structural) supply constraints and the emergence of high growth customer markets that makes rare earths one of the most exciting commodity spaces to play in.”

Sagon Resources : playing to win

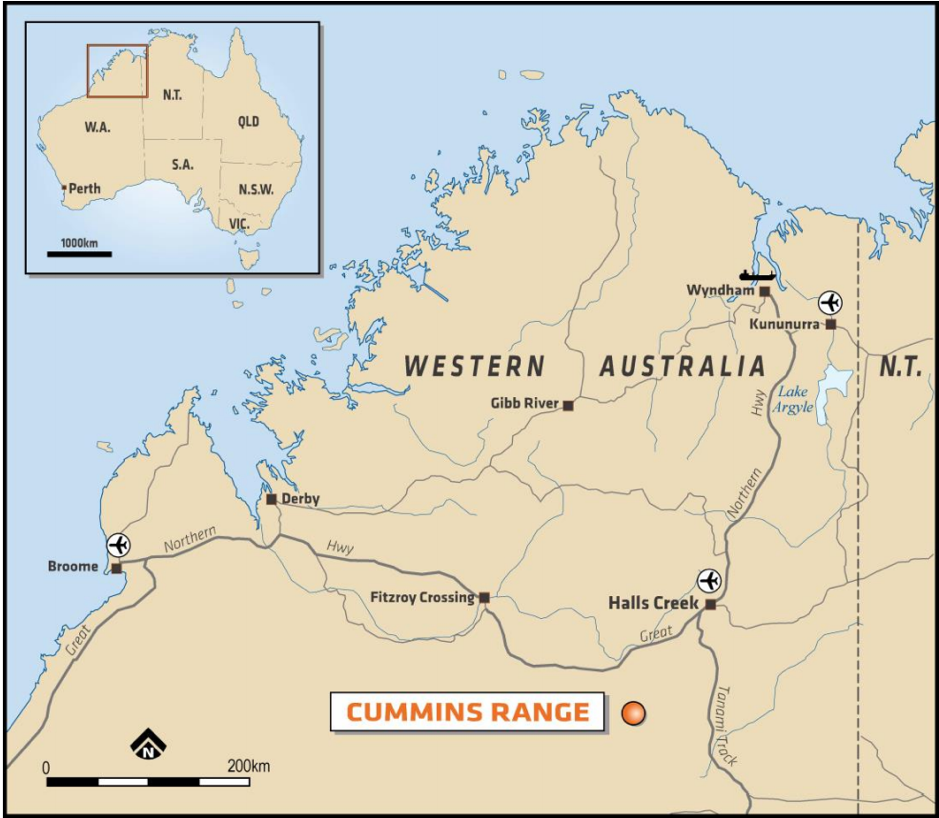

Sagon Resources (ASX:SG1) is 100 per cent focused on developing the advanced Cummins Range rare earths project in WA.

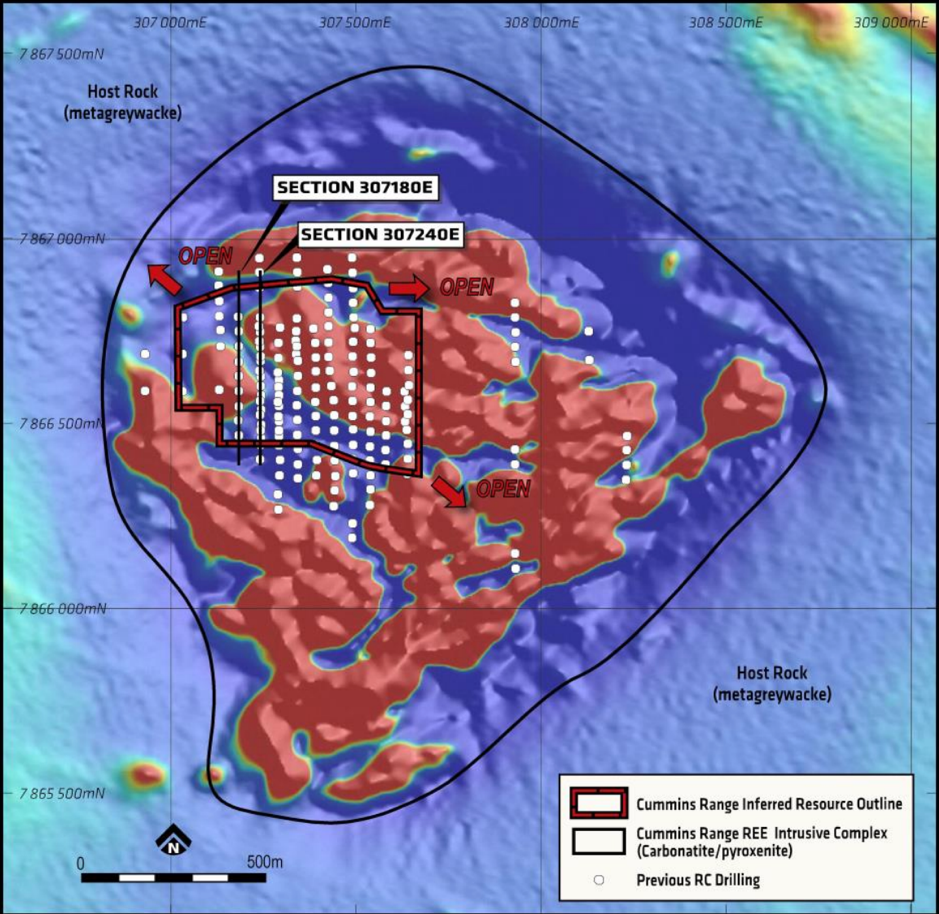

Sagon, which finalised the project acquisition in September, already has a maiden resource of 13 million tonnes grading 1.13 per cent total rare earths oxides (REO) in the bag, based on historical resource and geological data.

That’s the equivalent of about 147 million kg of total rare earth oxides, making it the fourth biggest project in Australia — just ahead of Northern Minerals’ (ASX:NTU) more advanced Brown’s Range project.

Cummins Range is believed to contain a high percentage of neodymium and praseodymium, critical elements used in permanent magnets which are critical to the manufacture of things like electric vehicles, wind turbines, and military hardware.

Sagon managing director Jeremy Robinson says deposits like this are very hard to find.

“What initially attracted us to Cummins Range is how advanced it is,” he told Stockhead. “It has proven metallurgy, a proven resource, and it is in a proven jurisdiction.”

A short history

Between 2007 and 2012, about $5m was sunk into Cummins Range exploration. Since then the project has just sat there, untouched.

“In 2011, there was a big spike in the rare earths price,” Robinson says.

“Navigator Resources, which owned the Cummins Range project, spun out a company called Kimberly Rare Earths on a pretty heavy valuation to develop the project.

“But as soon as Kimberly Rare Earths began work, prices crashed and the market fell out of love with rare earths; so it gave the project back to Navigator and moved on to something else.

“Navigator went into administration shortly afterwards.

“The Cummins Range project then sat with the administrator for the next three or four years, until the government finally took it off them.”

The project then went to a ballot, with about a dozen explorers in the running. Sagon purchased the project from the winner, Element 25 (ASX:E25).

“All we are doing is picking up where the last people to have a go at it in 2012 left off,” Robinson says.

The next step is commence exploration this month with a passive seismic survey being undertaken by our own team.

Next year will be the big push on exploration to grow the size of the resource.

“We think we can probably double it,” Robinson says

“That will put us right in line with the rest of our peers in Australia.”

Sagon’s peers include $96m market cap Arafura (ASX:ARU) and $170m market cap Hastings Technology Metals (ASX:HAS).

The market cap differential between ~$14m market cap Sagon and its peers is quite substantial. There’s lots of upside here.

“We are about 12 months behind them in terms of our evolution,” Robinson says.

“As we jump through the hoops — do the drilling, build the resource, settle down the met test work and launch into a PFS — we will see the share price increase pretty quickly,” Robinsons says.

A low-cost development plan

Longer term, Sagon will avoid the prohibitively expensive, plus-billion dollar development route paved by producer Lynas (ASX:LYC).

“We plan to produce what is essentially a monazite concentrate, a rare earths-rich mineral, which grades 30 to 60 per cent rare earths oxide,” Robinson says.

“We would upgrade that through gravity and flotation before selling it to pre-existing downstream processing plants.

The sale of monazite concentrates is a proven business model. South African mineral sands producers are selling monazite into China right now.

“WA mineral sands businesses also used to export monazite concentrates in the 80s, and I’m told producer Iluka (ASX:ILU) is about to start firing that business up again,” Robinsons says.

“It’s not a new idea — but we are progressing this project a little differently by investigating a low capex, rapid start business model.”

And to show Sagon is serious about development, experienced rare earths professional Gavin Beer has now been appointed lead consultant metallurgist.

Beer is a rare earths industry stalwart, responsible for developing flow sheets for eight rare earth projects globally.

As founder and principal of Met-Chem Consulting, Beer has been engaged by more than 20 rare earth companies globally including Hastings Technology Metals (ASX:HAS), Pensana Metals (ASX:PM8) and Mkango Resources (AIM:MKA).

Beer was also previously general manager metallurgy of Peak Resources (ASX:PEK) and manager metallurgy at Arafura Resources (ASX:ARU).

This story was developed in collaboration with Sagon Resources, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.