Oil and gas stocks are surging as merger and acquisition activity heats up

Energy

Energy

Merger and acquisition activity is heating up in the oil and gas sector with Santo’s $3 billion bid for Quadrant on Thursday — and it’s having an impact on share prices in the small cap space.

Quadrant neighbour IPB Petroleum (ASX:IPB) closed up 67 per cent and in a trading halt after the ASX queried its rapid one-day rise.

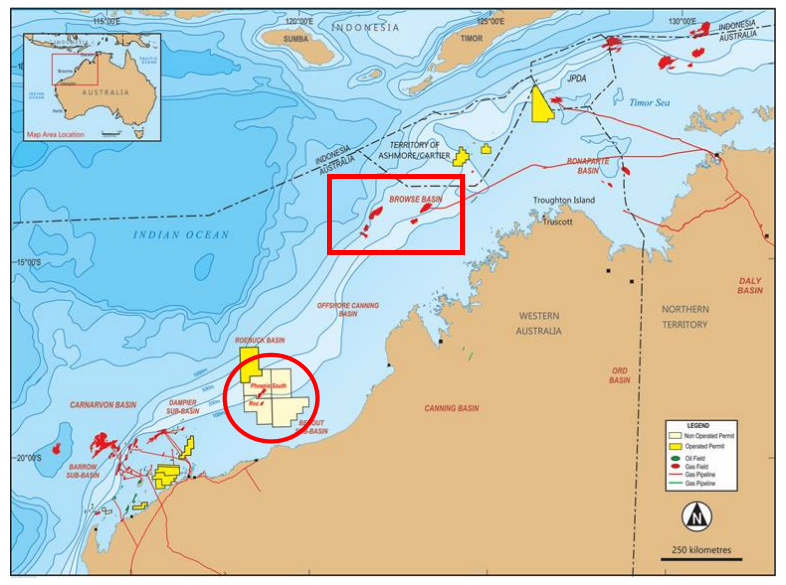

IPB boss Brendan Brown pointed to his offshore permits just down the way from Quadrant and partner Carnarvon’s (ASX:CVN) big Dorado oil discovery — and said the Santos offer likely had a lot to do with the share spike.

“People are starting to look at things a bit more positively than they have in the last four or five years,” Mr Brown told Stockhead.

“I think we’re in a positive phase of the cycle now. Ultimately the biggest litmus test is the oil price. You’ve also got very strong domestic gas prices and under-investment for almost five years, so it’s creating a bit of a perfect storm.”

Elsewhere in the neighbourhood 3D Oil (ASX:TDO) closed up 7 per cent at 14.5c.

3D has a block next door to Dorado which it picked up last year as the only bidder in the round. Managing director Noel Newell said many people thought they were “idiots”, until the Dorado discovery in July.

High Peak Royalties (ASX:HPR) was steady despite its 0.2 per cent royalty on a Bedout Basin Quadrant operated permit.

Carnarvon shares slipped 2.6 per cent to 37.5c after a huge spike following further oil discoveries.

Where next for Carnarvon?

On Wednesday Santos lobbed its $US2.15 billion ($2.9 billion) offer for Quadrant, a private company that is 48 per cent owned by Brookfield Asset Management, 21 per cent by Macquarie Capital, and 13.2 per cent each by Wesfarmers and iron ore heiress Angela Bennett.

Quadrant is the operator and 80 per cent owner of the Phoenix project where the Dorado oil discovery was made in July, and Carnarvon owns the remaining 20 per cent.

Wood Mackenzie analyst Daniel Toleman said the offer was a slight premium to his valuation of Quadrant’s portfolio, but the Dorado discovery offered “material value upside”.

“After rejecting Harbour Energy’s bid earlier this year, Santos’s management has had a point to prove to its shareholders – that the company had emerged from survival mode and is ready to grow again,” he said.

Carnarvon chief Adrian Cook was shy about putting a takeover target on his back, saying only that they were very pleased to have such as experienced operator joining as their new partner in the Bedout Basin.

“I hope what Dorado has done for the small cap space in our industry is to reinvigorate some faith that there are still some big discovery to be made on the north-west shelf,” he told Stockhead.

“The life blood of small companies like ours is investor support in our share prices and the provision of capital. I don’t know whether these other companies are on good things or not, but it’s good to see entrepreneurial spirit and hopefully investor support for that spirit.”

The next oil deal might be gas

Recapitalised oil companies in need of easy growth opportunities are starting to hunt around for deals, the latest of which was the Santos bid for Quadrant.

Blue Energy boss John Phillips if you think Santos only started looking at Quadrant after the mammoth Dorado oil discovery, you’ve missed the point.

He says Santos would have started casting around for a deal after ditching Harbour to show it was moving from cost cutting to growth.

“The turn around is after you get the balance sheet in shape and then look to growth,” he said.

Mr Toleman says more M&A is coming.

“2018 has been an exciting year for M&A in the Australian oil and gas market. The highlights include Santos buying Quadrant, Mitsui purchasing AWE, Woodside acquiring Exxon’s stake in Scarborough and Harbour’s failed approach for Santos,” he said.

“We believe M&A action is likely to continue on the back of the higher oil price. One option we are watching is Santos potentially farming down Dorado. Other possibilities include non-core asset sales in the Cooper Basin and/or a rationalisation of BHP’s oil and gas portfolio.”

Demand is still rising but infrastructure constraints are capping US oil output at an albeit record 11-22 million barrels a day and there are questions over just how much more Saudi Arabia can pump. Sanctions on Iran and political problems in Venezuela are biting into global supply.

In Australia, Mr Philips thinks the east coast is the most prospective area for M&A as the gas squeeze there and a global LNG shortage bites in 2020-21.

Mr Phillips says the LNG operators at Gladstone in Queensland, which are only working at about 70 per cent capacity, could take advantage of that if they had enough feed gas.

The easiest way is to buy other companies with proved reserves.

Cooper Energy’s (ASX:COE) Sole field is one of the few bringing new gas to production.