Not even top gear: Hillgrove copper-gold resource upgrade supercharges Kanmantoo economics

Mining

Mining

Hillgrove has unleashed a resource upgrade and economic assessment sparkling with examples of how lucrative underground mining at Kanmantoo copper-gold mine can be.

The company now expects the project to deliver post-tax free cash flow a sliver off $200m from the initial three-year plan, thanks in large part to an 82% increase in overall resources – that’s nearly 5.7 million tonnes – with grades of 1.1% copper and 0.3 grams per tonne (g/t) gold.

But what is putting Hillgrove Resources (ASX:HGO) on an international footing is the expectation Kanmantoo will now deliver net present value (NPV) and internal rate of return (IRR) – both measures of a project’s profitability – of $166m and 389% from the initial production of 36,000t of copper and 10,000 ounces of gold.

This with capex of just $26m -making for one of the lowest capital intensity projects in the world – at just US$1,550 per tonne of copper produced, and all-in-sustaining costs of $6,991/t.

Start-up is also expected to be rapid with the company anticipating first copper sales within seven months of an investment decision.

The low costs and rapid turnaround times are a nod to HGO having all the infrastructure – including a commissioned process plant and tailings dam – maintained in absolute ready restart condition, and with all permitting in place.

Kanmantoo also benefits from established infrastructure including access to grid power, mains water, a short transport route and a skilled local workforce without the Covid-exposure of fly-in fly-out (FIFO) requirements.

“The study confirms the excellent project potential,” says managing director Lachlan Wallace.

“Kanmantoo Underground Stage 1 presents a unique opportunity to produce copper in a Tier 1 jurisdiction at a time of record prices, generating post-tax cash flows of $196M in the initial stage, with resource upside through depth extensions, strike extensions, and additional lodes.”

Wallace says the strong potential economics also reinforces management’s confidence to start the underground decline development ahead of a final investment decision.

“The first 500m of the decline is being established under trial conditions using a continuous mining machine which has the potential to transform existing mining development processes; making them safer, faster, more cost effective, and as a fully electrical machine, has the potential to facilitate industry’s transition towards zero emission mining,” Wallace adds.

“The initial 500m of decline is funded through a $2m grant from the South Australian government, and deferred payment terms with Komatsu.”

“Orchestrating funding in this manner enables Hillgrove to establish the decline for very little up-front capital outlay, accelerating what is already a very short time to first copper, whilst at the same time, enabling this technology to be tested for the benefit of the mining industry.”

And there’s potential for further improvements with Wallace pointing out just 40% of the facility’s capacity will be utilised under the Stage 1 plan, leaving further opportunities to streamline operating costs by increasing annual throughput.

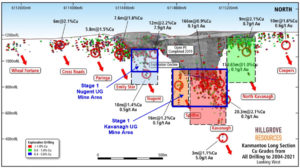

This improvement again comes down to the increase in overall Kanmantoo resources, which in turn were supercharged by a jump in the Kavanagh underground resource to 5.01Mt at 1.08% copper and 0.11g/t gold on the back of drilling to 30 June.

Drilling has also upgraded confidence in the resource with 72% now in the Indicated category, more than enough to support mine planning.

Hillgrove says the updated Kavanagh resource, which collectively includes the West, Central and East Kavanagh, the Spitfire, and the South-West Kavanagh deposits, now covers an area 500m long, 200m wide and 500m.

The company says this resource is ‘thus far constrained only by the extent of drilling and not by geology,’ in short – there’s very, very strong potential for further growth both along-strike and down-dip.

Drilling is currently underway to convert the Inferred resources at Nugent, West Kavanagh, Spitfire and South-West Kavanagh to the Indicated category and to test drill the down-dip extension of the North Kavanagh mineralisation.

This 16,000m program seeks to bring these areas into the early stages of mining at Kanmantoo, which could increase annual production for a modest increase in Capex.

Determining the depth extent of mineralisation is also important as the current Stage 1 plan only extends 250m below the existing main open pit and 150m below the Nugent pit due to the lack of drill density.

Both of these areas remain open at depth and exploration drilling will continue in parallel with the Kanmantoo Stage 1 development, with a view to replace resource depletion from underground mining and to extend the mine life beyond Stage 1.

Wallace says the company is fully funded through the drilling of the current program but the growing interest already has discussions with potential partners well advanced.

But before that happens, Wallace and his team will be in position to make one of the sector’s more anticipated final investment decisions.

This article was developed in collaboration with Hillgrove Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.