Nickel output needs to ‘triple’ – fast. These ASX stocks have set up shop in ‘elephant country’

Pic: via Getty Images.

- Woodman says nickel output needs to increase three-fold by 2050

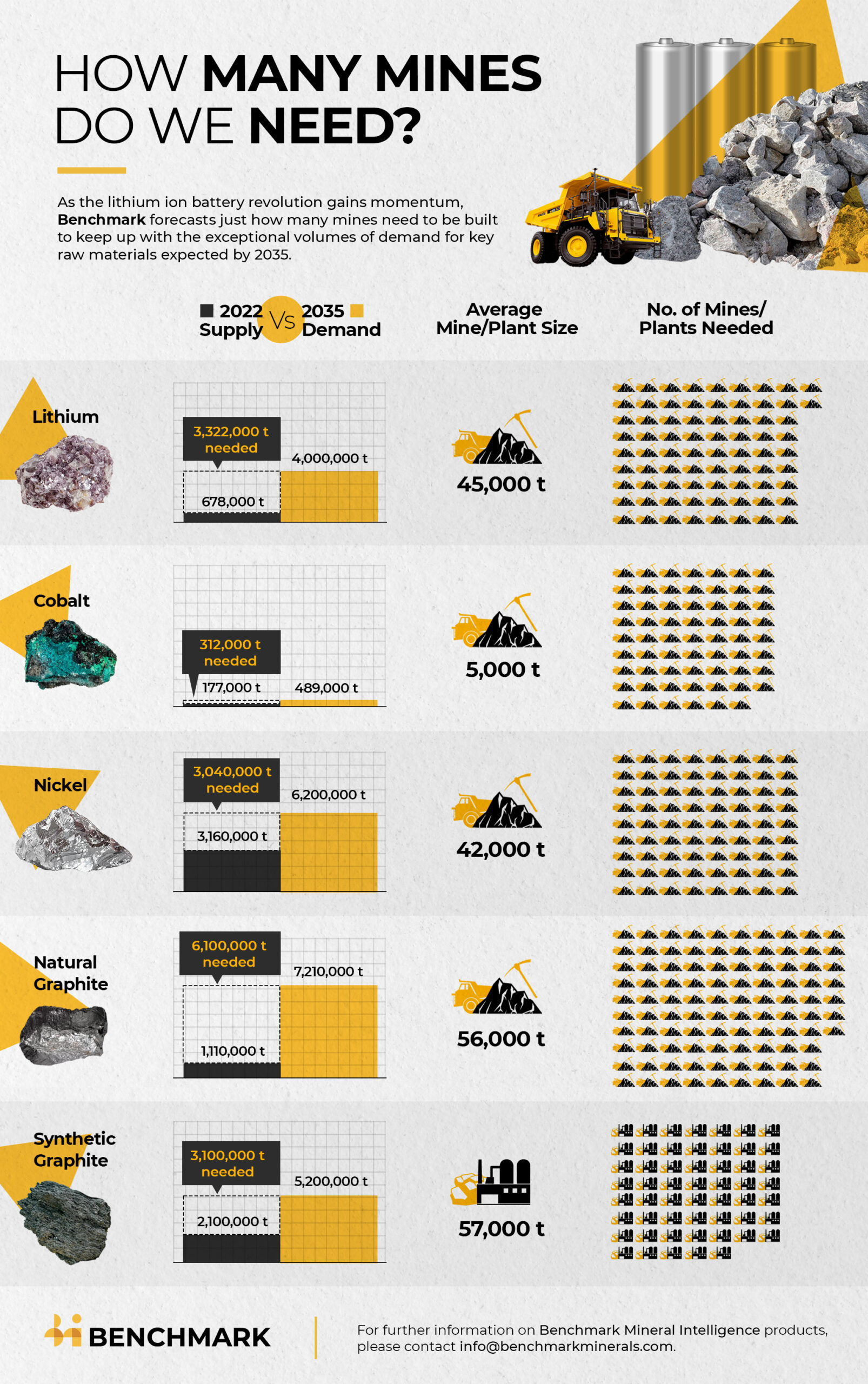

- Benchmark Minerals Intelligence says we need 72 new nickel projects by 2035

- Last year BHP invested US$100m in a Tanzanian nickel project

The nickel market saw massive gains last year, rising around 50% to its highest year-end price in 15 years at more than US$30,000/t.

Prices have dropped a wee bit since then (US$23,974/t yesterday) but demand is still booming, because the metal – which has traditionally been used in the stainless steel production process – is a key component of the cathode of NCM-chemistry lithium ion batteries.

It basically makes EV batteries more energy dense which translates to a longer driving range.

Wood Mackenzie estimates that in order to reach Paris Agreement targets of zero carbon by 2050 nickel output needs to rise three-fold.

Benchmark Minerals Intelligence reckons we need around 72 nickel mining projects with an average size of 42,500 tonnes in the next 12 years (by 2035).

And while it remains to be seen if prices will return to growth territory, Stockhead’s Josh Chiat recently noted that current prices offer good margins to most producers and remain well above the average of around US$18,500/t seen in 2021 and long term lows of US$7600/t in early 2016.

Gotta risk it for the biscuit

Big players like BHP (ASX:BHP) say demand for nickel to 2050 would increase 200-300% on the previous three decades, which is quite frankly insane numbers.

The company produces around 80-90,000t of nickel metal a year in WA, but it’s branching out into other countries, with an up to US$100 million investment last year in the Kabanga nickel project in Tanzania.

No wonder really, since the country is touted to host around 30% of global mineral wealth.

And yes, there have been several incidents in recent years that have underlined the risks of operating in Africa (the odd military coup here and there) but there is upside potential for explorers – plus some good deals on offer valuation-wise when they do make that transition into production.

US investment and nickel IPOs

The US certainly isn’t wasting time securing its slice of the supply chain, especially since nickel is included in the US critical minerals list, underpinned by the US Government’s Inflation Reduction Act

Last month, US Vice President Kamala Harris announced a US-supported processing plant in Tanzania that “will deliver battery-grade nickel to the United States and global markets as soon as 2026.”

Ecograf (ASX:EGR) was certainly pleased. The company is spinning out its battery cathode minerals subsidiary Innogy (ASX:IOG) which is gearing up to list on the 25th of May after IPOing at $8m at $0.20 per share.

Innogy is the largest nickel exploration tenement holder in the country with an exploration package of over 5,300 km2 of ground (comprising 2,300 km2 of granted tenure and 3,000 km2 of pending tenure) prospective for nickel sulphide mineralisation, along with lithium, cobalt and gold.

Support for Tanzanian Nickel! VP Kamala Harris announced the US will support Africa’s first nickel processing factory in Tanzania, delivering battery grade nickel for EV’s in the #US & global market by 2026!

View $IOG.ax IPO: https://t.co/VdNVEIGTZq#MVPinAfrica #Nickel #Lithium pic.twitter.com/uctorgQitC— EcoGraf (@EcoGraf) April 3, 2023

And it’s not alone in its Tanzanian nickel dreams.

XLR8 Metals, which is currently finalising an $4.5-$5.5 IPO at $0.20 per share to list on the ASX, is also a firm believer in nickel with a whopping 2,162km2 of granted tenements and tenement applications in five separate project locations in Tanzania.

Notably, the company’s Ntaka West project adjoins Indiana Resources’ (ASX:IDA) Ntaka Hill nickel sulphide project – which is currently the subject of arbitration through the International Centre for Settlement of Investments Disputes – BUT it hosts an estimated JORC mineral resource of 56.2 million tonnes at 0.63% nickel, 0.14% copper and 0.02% cobalt for 356,380t contained nickel.

Kabanga North is just 8km from the massive Kabanga deposit, which with a JORC compliant resource of 58Mt at 2.62% nickel (hint: that’s the one that’s scored a nice US$100m investment from BHP).

“When you think about nickel, Tanzania is truly elephant country. It is literally one of the best nickel provinces in the world,” executive chairman Shannon Green said.

“And we have two very hot positions and three other really good positions in both nickel belts, which gives us a lot of runway for ground and high potential for major discoveries.”

Who else has a nickel play in Africa?

Market Cap: $9.35m

Earlier this month the company flagged several distinct nickel sulphide targets, including a 15km copper in soil anomaly, that will form the basis of a 5,000m drill campaign at the Kabanga Jirani Nickel Project in Tanzania.

And it’s right next door to LifeZone and BHP’s massive Kabanga deposit.

ADD says recent wet season geochemical surveys played a significant role in refining nickel sulphide drill targets with several of the anomalies containing coincident gravity, electromagnetics, and historic ultramafic intersections.

Importantly, a copper in soil anomaly of over 15km strike has been defined, adjacent to elevated nickel and cobalt soil anomalies.

Drilling will commence with an initial reverse circulation (RC) and diamond drilling (DD) campaign of 5,000m, comprising 12 RC holes to ~150m depth and 8-10 DD holes to ~350m depth.

Downhole Electromagnetics (DHEM) and audio magnetotelluric (AMT) surveys will also be undertaken.

Market Cap: $5.2m

The explorer Armada listed on the ASX last year with a large land position covering 3,000km2 at its Nyanga nickel-copper-cobalt in Southern Gabon.

Guy Le Page, director at RM Corporate Finance said the stock is one to watch – its ‘Nyanga Project’ contains a number of drill ready targets and is led by managing director and CEO Dr Ross McGowan, a geologist with more than 20 years’ experience.

In Feb, the company identified new targets at the project with a series of natural source audio magnetotelluric (NSAMT) surveys are planned to follow up on the highest priority targets (flagged by Mobile Magnetotellurics (MobileMT) survey data) in advance of further drilling at the Project.

“We will now use the test survey flown over the existing Libonga targets to confidently extrapolate and define anomalies of potential exploration importance along both the Libonga-Matchiti and Ngongo-Yoyo Trends,” McGowan said.

“Further, ground-based programs will be used to de-risk any future drill programs and we are ready to start this work as we advance planned drill testing of our highest priority targets.”

Market Cap: $14.96m

The company holds the Kum-Kum nickel and PGE project in Namibia, however it’s kind of on the backburner, with the Swanson tantalum project and the Bitterwasser Lithium project the primary focus “due to their immediate potential to enhance the company’s value,” AM7 said in its December quarterly report.

During the quarter, company geologists and personnel from the University of Stellenbosch took samples for mineralogical investigation at the Uni – with results expcted to allow drilling program planning.

Market Cap: $6.72m

In Botswana, Si6 is currently carrying out field exploration programs at its Maibele North Project which hosts a resource of 2.4Mt at 0.72% nickel and 0.21% copper plus PGMs and cobalt and gold.

Notably, the nickel sulphide mineralisation is related to ultramafic intrusions within mobile belt rocks and is broadly similar in style to other ultramafic intrusion-related mobile belt nickel discoveries such as IGO’s (ASX:IGO) Nova-Bollinger, Chalice Minerals’ (ASX:CHN) Julimar and the globally significant Thompson Belt in Canada.

Exploration work for the December quarter focused on ground reconnaissance and desktop reviews with the company planning to drill this year.

In Uganda, Sipa also holds a Retention License over an intrusive-hosted Ni-Cu sulphide discovery with “significant scale potential.”

ADD, AMM, AM7 and SI6 share prices today:

At Stockhead we tell it like it is. While Adavale Resources and XLR8 Metals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.