New deals and big hits as the Paterson Province enters its prime

Pic: Getty

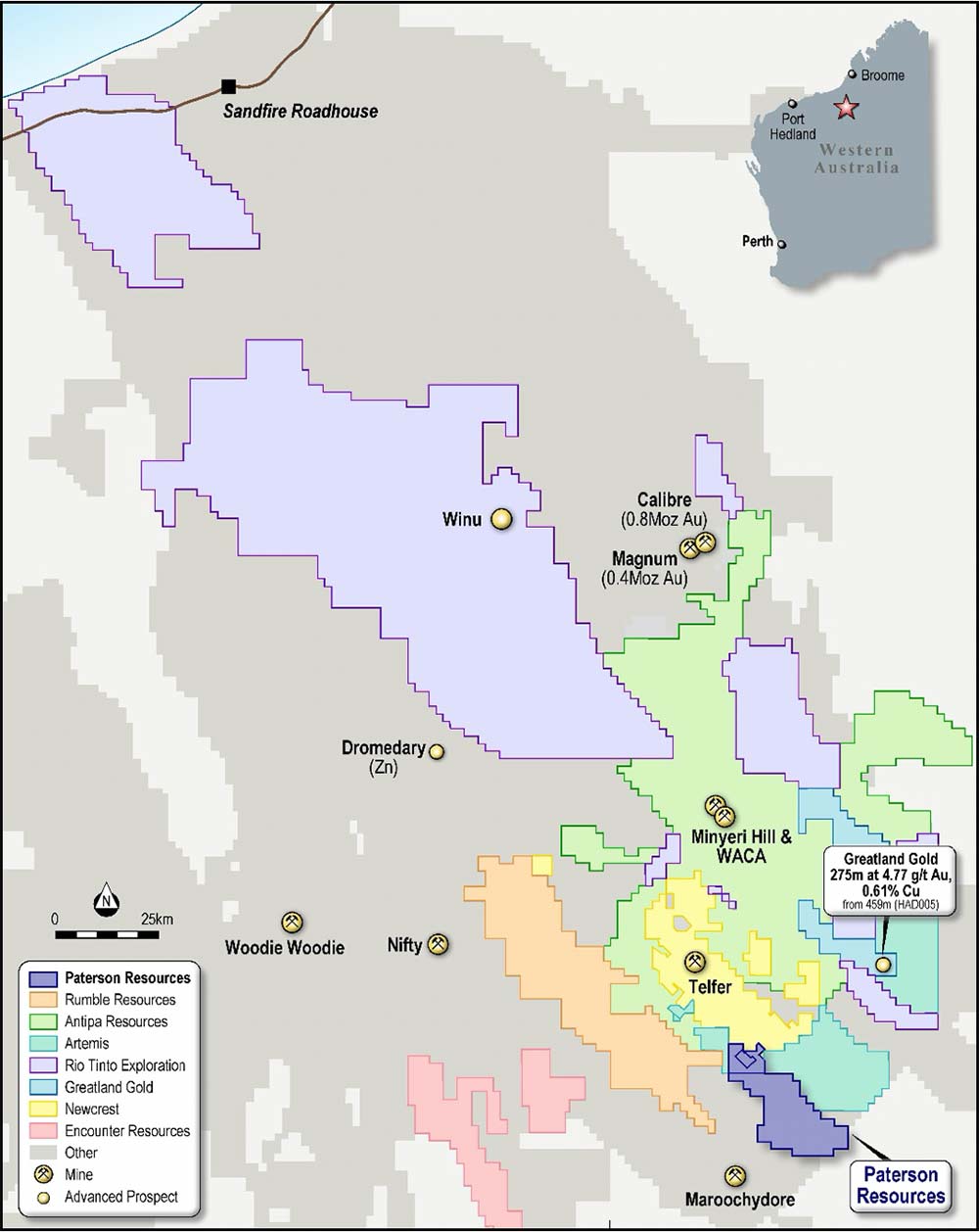

The Paterson Province’s status as one of the country’s hottest addresses for mineral exploration has been reaffirmed with the signing of another big farm-in agreement and some of the best drilling results to date from the mammoth Havieron gold discovery.

The spotlight has been on the Paterson since early 2018 when rumours of a major copper discovery by Rio Tinto (ASX:RIO) began to filter out.

Subsequent confirmation of the Winu find by Rio and the discovery of Havieron by AIM-listed Greatland Gold in the same year only intensified the interest.

What followed was a pegging rush that has seen the majors and a host of smaller companies establish or increase landholdings in the region.

Mid-tier Independence Group (ASX: IGO) is one that has been attracted to the Paterson’s untapped exploration potential.

On Thursday, it announced it was increasing its exposure through a $32 million farm-in and joint venture agreement with small miner Metals X (ASX: MLX).

The agreement covers 2,394km2 of ground in the western and southern Paterson surrounding but not including Metals X’s Nifty copper mine, which is currently on care and maintenance.

Like the Paterson’s biggest mine, the Newcrest-owned Telfer gold operation, Nifty was discovered due to mineralisation outcropping at surface.

That was in the early 1980s; the exploration undertaken today often involves the use of advanced geophysics to generate drill targets beneath the cover that blankets much of the region.

Under the terms of the agreement with Metals X, IGO can earn a 70 per cent interest in the ground by sole funding $32 million of exploration over the next 6.5 years.

“We have recognised the exploration potential of the Paterson Province for some time,” IGO managing director Peter Bradford said.

“The joint venture with Metals X over 2,400km2 of highly prospective ground further consolidates our presence in this highly endowed yet underexplored province.”

IGO first signalled its interest in the Paterson in November 2018 when it announced an agreement with explorer Encounter Resources (ASX:ENR) to advance the Yeneena copper-cobalt project.

In March this year IGO exercised its right to enter a farm-in agreement to earn a 70% interest in Yeneena by spending up to $15 million on exploration.

READ: Miners throw cash at Paterson explorers as Winu, Havieron edge towards development

Big-figure farm-ins

Similar earn-in agreements carrying big headline numbers have been a feature of corporate activity in the Paterson going back to 2015 when Rio announced a deal with Antipa Minerals (ASX:AZY) to earn up to 75 per cent in the Citadel project by spending $60 million on exploration.

Rio passed the expenditure milestone to earn a 51 per cent interest in Citadel, which contains a mineral resource of 1.6 million ounces of gold, 127,300 tonnes of copper and 1.2 million ounces of silver, at the start of the year and soon after committed to spend another $9.2 million on exploration on the joint venture in 2020, a major sum for a single project in a single year.

Around the same time the 2020 Citadel budget was announced, Antipa – one of the early movers in the Paterson, assembling its extensive landholding in 2011 and 2012 – announced another $60 million earn-in agreement over 2,180km2 in the south of the province, this time with Newcrest.

Clearly eager to extend the life of Telfer, which is scheduled to run out of ore in 2023, Newcrest has also taken a liking to Havieron, striking a deal with Greatland in March last year to earn up to 70 per cent of the project by spending US$65 million on exploration.

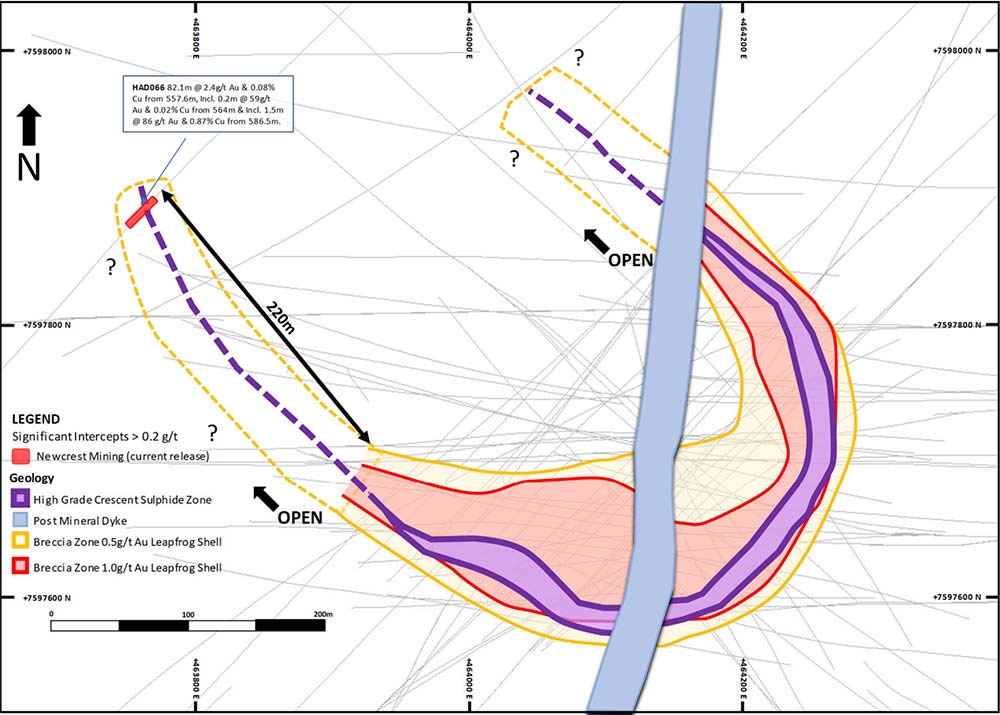

On Thursday, the gold major said infill drilling at Havieron had produced the best intercept to date – 109m at 6.3 g/t gold and 0.71 per cent copper from a depth of 668m – while ‘step-out’ drilling had extended known mineralisation by a further 220m.

Newcrest is focused on delivering a maiden inferred resource for Havieron, which is deep but high grade, in the second half of the year, as well as continuing to define the extent of the mineralisation.

Another potential source of feed to keep Telfer going lies 25km to the south of the mine in a tenement controlled by Paterson Resources (ASX:PSL), which is going through the process of relisting on the ASX.

Paterson’s Grace Project, which contains a shallow gold resource of 69,000 ounces at 1.35 g/t, features outcropping mineralisation extending over more than 4km of strike and could have ‘Telfer-style’ potential at depth.

Paterson is hopeful of relisting by the end of the month and could be drilling at Grace by the end of September after completing the compilation of historic data and reprocessing geophysics.

At Stockhead, we tell it like it is. While Antipa and Paterson Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.