Rio Tinto and now Newcrest — has any Paterson province explorer besides Antipa (ASX:AZY) managed to lock in deals of this magnitude?

Antipa is a $22m market cap junior now backed by two of the world’s biggest mining companies.

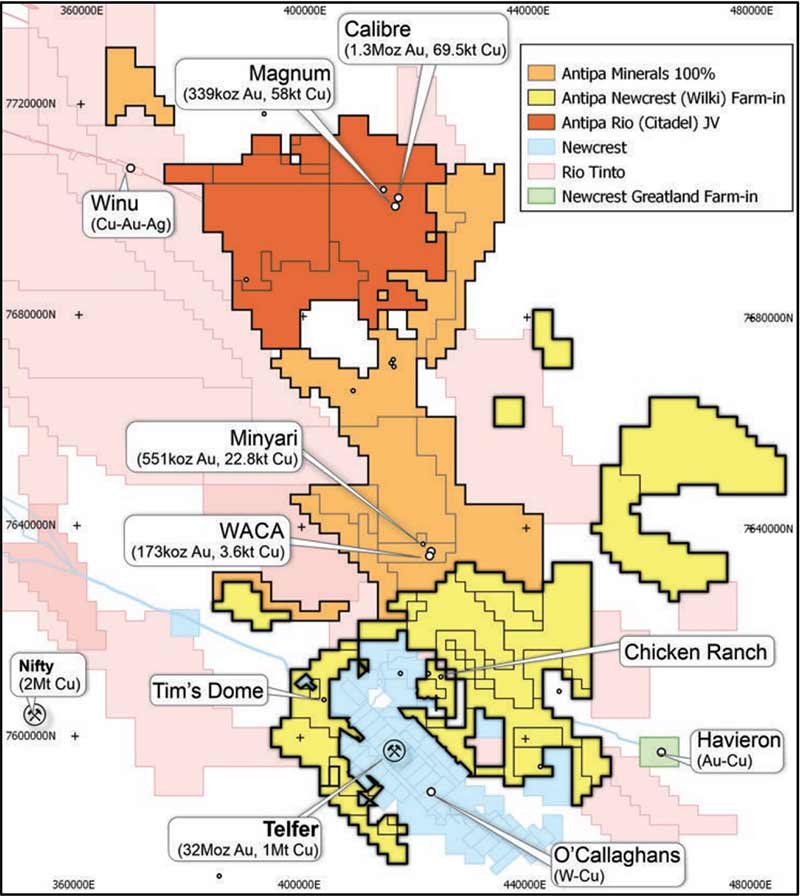

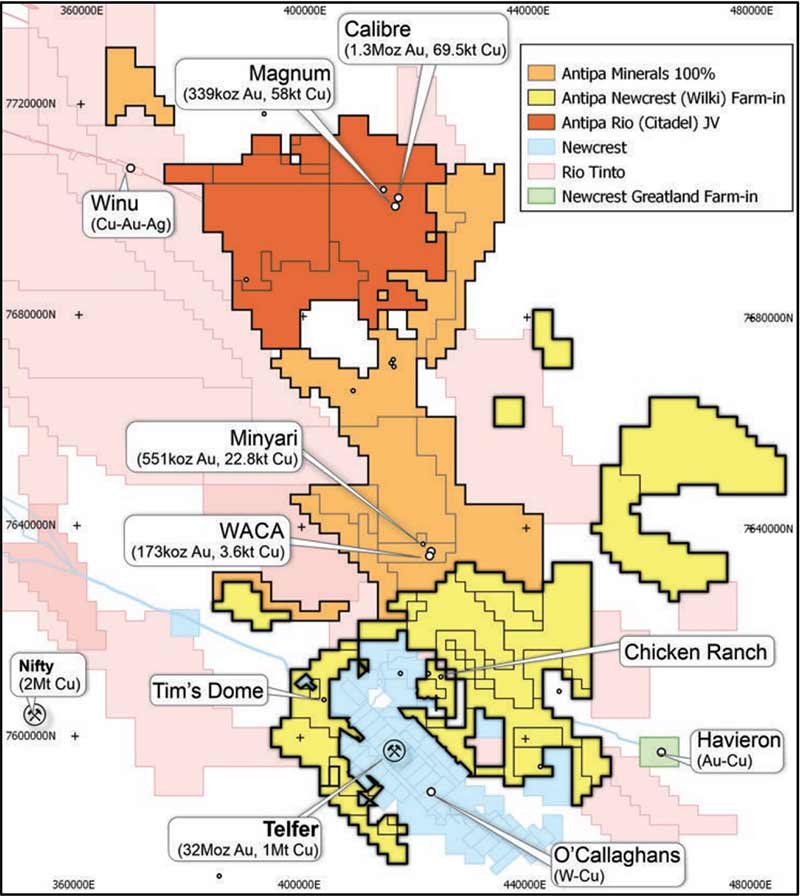

It has been building a +5000sqkm land package in the red-hot Paterson province of WA since 2011, well before the Winu and Havieron discoveries thrust it into public consciousness.

This ‘pre-emptive strike’ is paying huge dividends.

In 2015, Antipa signed a mammoth deal with major miner and subsequent Winu-finder Rio (ASX:RIO) over the Citadel project.

The deal, under which Rio can spend $60m for a 75 per cent stake in the project, is still one of the industry’s biggest between major miner and junior explorer.

In early 2020 Citadel — about 5km from Winu — had a respectable 1.6-million-ounce gold/127,000-tonne copper resource and exploration is ongoing. Rio funds all of it.

Today Antipa signed another big $60m farm-in deal with gold miner Newcrest (ASX:NCM), part owner of the nearby Havieron discovery:

This deal covers a 2,180sqkm chunk of Antipa’s remaining ground in the Paterson, now known as the Wilki project.

For the first two years Newcrest will shell out a minimum $6m on Wilki exploration to be managed by Antipa.

After that, the miner can increase its stake to 55 per cent and 75 per cent by spending $10m and $44m, respectively. That’s a total spend of $60m over the next eight years.

Newcrest will also take a 9.9 per cent stake in Antipa by subscribing for $3.9m in shares at 1.7c per share.

That’s a 54 per cent premium to the last closing price of 1.1c, which has helped launch the stock in morning trade.

This cash could go towards exploring Antipa’s remaining 1,700sqkm of wholly owned ground, including existing gold-copper resources at Minyari-WACA and its recently discovered ‘Haverion lookalike’ Reaper-Poblano-Serrano gold-copper trend.

The company was approached for extra comment.

You might be interested in