MTM rakes in $7m to consolidate its entry into red-hot West Arunta niobium-REE mineral province

Mining

Mining

Special Report: MTM Critical Minerals has rattled the tin for up to $7 million to kick off exploration right next door to WA1’s exciting niobium-REE discovery in the emerging West Arunta region.

MTM Critical Minerals (ASX: MTM) became the latest company to enter the remote, underexplored region on the West Australian side of the border with the Northern Territory last month when it acquired private firm Flash Metals via a binding purchase and sale agreement.

Some $60 million has been pumped into the West Arunta region over the last two years by the likes of WA1 Resources (ASX: WA1), Encounter Resources (ASX: ENR) and another relative newcomer in CGN Resources (ASX: CGR). Even major Rio Tinto (ASX: RIO) is active in the district via its JV with Tali Resources.

WA1 is now capped at more than $700 million on the back of reporting juicy exploration hits such as 13m @ 5% Nb2O5 and 24m @ 2.4% Nb2O5.

From its acquisition of Flash, MTM has picked up three granted exploration licences collectively covering ~140km2 and located immediately adjacent to tenements held by WA1 and ENR where confirmed niobium-REE mineralised carbonatite discoveries have been made.

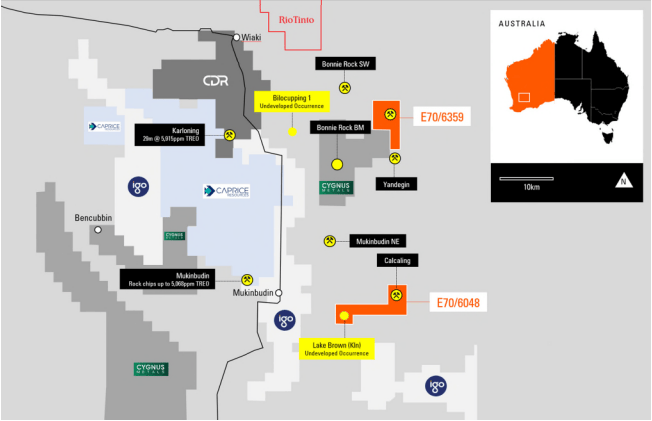

MTM also grabbed hold of the Mukinbudin niobium-REE project, about 250km north-east of Perth, as part of the Flash acquisition, as well as an option to exclusively negotiate the rights to the company’s Flash Joule Heating (FJH) early-stage processing technology developed by Rice University in Houston, USA.

FJH was developed by the founder of the prolific public semiconductor IP technology company Weebit Nano (ASX: WBT), also capped at over $700 million.

MTM today emerged from a trading halt with plans to raise $5 million via a two-tranche placement at 8c/share with a one-for-two free attaching option exercisable at 25c by the 26 November 2024 expiry date.

A complementary non-renounceable entitlement offer raising ~$2 million will also be offered to existing shareholders on the same terms as the placement.

Heavily oversubscribed by new and existing professional and sophisticated investors and institutions, the placement was run at a 3% discount to the 12-day VWAP, being the period of time elapsing since the acquisition of Flash was announced on 19 December. It also equates to a 38% discount to MTM’s last closing price before entering a trading halt on Wednesday.

MTM’s share price has surged more than 525% over the past month, promoting an ASX query for higher than usual volumes being traded.

“We are very pleased with the strong level of demand for the placement which has validated our recent announcement of the acquisition of Flash Metals,” MTM managing director Lachlan Reynolds said.

“The excess demand from the placement will ensure that any shortfall from the rights issue will be allocated.”

Sandton Capital Advisory and State One Equities acted as lead managers to the placement.

Proceeds from the capital raise will be directed to upcoming exploration work on the company’s newly acquired ground in the West Arunta and at Mukinbudin, as well as its existing niobium-REE assets at East Laverton and Pomme in Canada.

Historical reports indicate niobium and REE minerals are associated with the pegmatites identified on the two exploration licences which comprise the Mukinbudin project in WA’s South West Mineral Field.

MTM’s West Arunta project is located about 130km west of the WA/Northern Territory border within the Gibson Desert.

Funds will also be used to finalise licencing agreements for the FJH technology with Rice University, as well as development, engineering and commercialisation of the technology.

This article was developed in collaboration with MTM Critical Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.