Monsters of Rock: Good news continues to flow if you’re in lithium

Pic: Joe Raedle/Getty Images North America via Getty Images.

The news continues to get brighter for lithium producers and up and comers trying to ride the same wave.

Benchmark Mineral Intelligence data from November shows spodumene prices continued to climb, rising 17.3% month on month in November to an average of US$1525/t FOB Australia.

That’s 301.3% up in just 12 months and more than 290% higher year on year.

Prices are so far beyond levels of just a year ago (in around the US$400/t mark) that US$1250/t is now the low point of recorded sales, which ranged as high as US$1800/t.

Starving battery manufacturers are paying as much as US$32,000/t to get their hands on uncontracted lithium hydroxide chemicals, with prices up 5.4% MoM and 92.1% YoY to US$19,500/t FOB North America and prices in China averaging $30,300/t, up 2.1%.

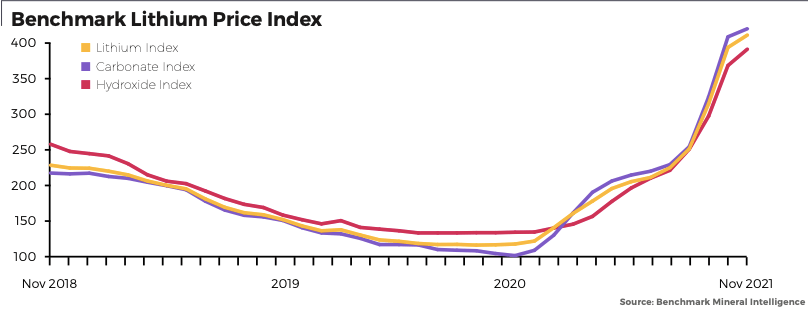

The inflection on these index charts is so hectic it looks like a goddamn cobra about to strike.

On a weighted average basis hydroxide prices were up 6.2% to US$25,894/t, while carbonate prices are up 2.8% to US$23,798/t.

BMI analyst George Miller said the supply-demand situation left producers very much in control during contracting season.

“Activity in the domestic Chinese lithium chemical market picked back up in the latter half of November, as buyers looked to restock inventories ahead of the Spring Festival. The increased demand drove upward price pressure as trading gained pace following a quiet period at the end of October and during early November,” he said.

“Outside of China, prices also continued to rise during the ongoing contracting season, as buyers became increasingly willing to accept higher prices to secure any available lithium supply towards the end of 2021 and into 2022.

“Furthermore, producers sought to introduce more regular pricing breaks in contract structures given the potential upside on the back of supply deficit expectations, lifting the bottom end of prices as contracts begun to be revised higher amidst ongoing negotiations.

“The upper end of the range of recorded prices also ticked upwards, with lower volume spot transactions shifting towards Chinese domestic prices in response to very limited availability.

“As such, the Benchmark Lithium Price Index rose by 4.4% m-o-m in November, which alongside rising demand, was driven by expectations of a widening supply deficit into the New Year and continued international demand growth in Q4 2021. High prices and robust demand gave way to a stream of investments into the lithium value chain in November, in particular, Chinese incumbents striking deals with western companies in pursuit of supply expansions.”

China, which is increasing its production of lithium-iron-phosphate battery chemistries, has imported almost 70,000t of lithium carbonate this year, 80.8% up on the same period in 2020, while European demand for EVs remains high.

Sales were up 91.1% year on year to 180,000 units.

Lithium mid-tiers rule the roost

With that in mind it was lithium project developers that dominated the gains in the materials sector today.

AVZ Minerals (ASX:AVZ), owner of the giant Manono project in the DRC was up 14.16% after a big feature Q & A in Stockhead’s morning newsletter, while Vulcan Energy (ASX:VUL) rose 6.23% and Ioneer (ASX:INR) climbed 7.83%.

Among the large caps oil and gas stocks Woodside and Santos were up after Oil Search shareholders approved their mega merger with the latter to create a $23 billion energy major.

Lithium stocks share price today:

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.