Moho makes shrewd investment in WA nickel play St George

Pic: John W Banagan / Stone via Getty Images

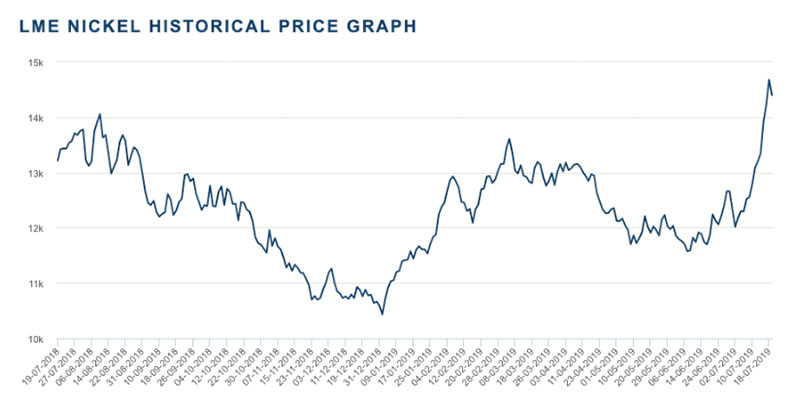

Special Report: Moho Resources makes a savvy investment in fellow explorer St George Mining as nickel prices surge to 12-month highs.

Strong demand means nickel has been one of this year’s best performers so far, but a recent nickel export ban from Indonesia really added fuel to the fire.

In an intelligent move, Moho (ASX:MOH) will tip in $500,000 as part of St George Mining’s (ASX:SGQ) latest $3m placement to give it a 1.37 per cent interest in the advanced WA explorer.

Investing in a fellow explorer with great potential is an effective use of unused funds, Moho says.

St George’s exciting Mt Alexander discovery is near some of the world’s best nickel mines, including Mt Keith, Cosmos and Perseverance.

So far, high-grade nickel and copper sulphides have been intersected across a 4.5km strike of the so-called ‘Cathedrals Belt’ at Mt Alexander.

“St George is undertaking some exciting exploration at Mt Alexander in WA and participating in this placement gives Moho exposure to a company poised to grow the scale of its high-grade nickel-copper discovery,” Moho managing director Shane Sadleir says.

Moho also has a nickel project in a pretty sweet spot with their Silver Swan North Project which surrounds Poseidon Nickel’s (ASX:POS) Silver Swan and Black Swan mines and 2.2mtpa processing plant , near Kalgoorlie in WA.

Moho will be drilling promising targets with coincident gravity and nickel-in-soil anomalies at the Silver Swan North project in early August.

The project has the potential to be an early cash generator for Moho if it yields a promising discovery.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebookor Twitter

This story was developed in collaboration with Moho Resources, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.