Micros with Majors: Which ASX juniors are teaming up with mining majors for gold and critical mineral treasures?

Micros with Majors is Stockhead’s new column which profiles and looks at the stories behind microcap ASX companies in partnerships with some of Australia’s, and the world’s, leading organisations.

In the mining exploration world, the probability of running into obstacles far exceeds the chances of striking it rich.

Discovering a valuable resource can take years of work and even the most promising sites can yield unremarkable results and turn out to be unproductive.

For ASX juniors looking to make a discovery, it makes sense to bring in quality partners who can provide significant capital and lead exploration programs in new frontiers to test new ideas.

This also allows microcap explorers to avoid market volatility, relieving them from the pressures of having to raise funds.

JV deals see $200m injection over last 12 months

Across the ASX junior mining space, more than $200m has been invested in joint venture deals over the last 12 months with a significant portion of those funds injected into ~10,000km2 of exploration ground in NSW’s prolific Lachlan Fold Belt (LFB).

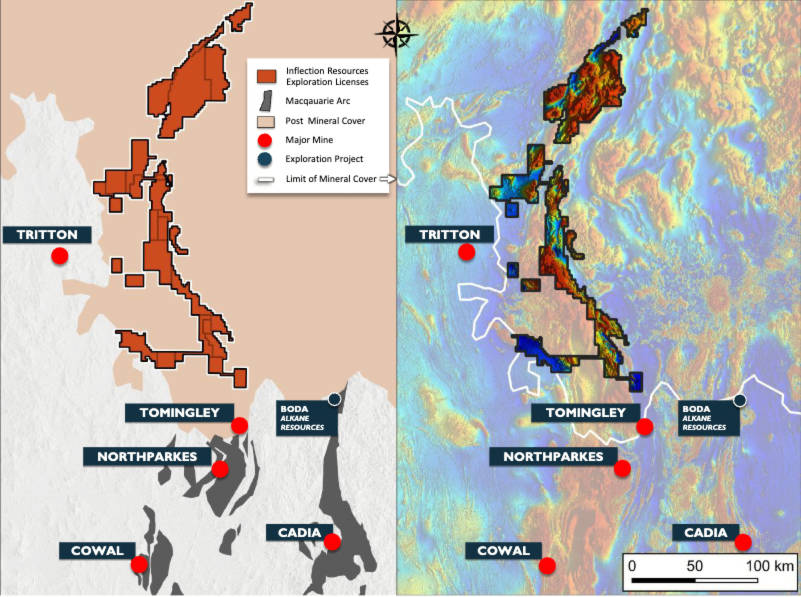

The first of these deals was the multi-year earn-in agreement entered into by Anglogold Ashanti in February 2023 across a group of copper-gold projects owned by Canada’s Inflection Resources within the northern extension of Macquarie Arc, part of the LFB.

AngloGold is sole funding up to $10m on a wide range of different intrusive related exploration targets within a 36-month period.

In return for spending a cumulative $145m and delivering pre-feasibility studies, the company could earn up to a 75% interest in five projects individually.

Shortly thereafter, Legacy Minerals (ASX:LGM) entered into a $15m farm-in and JV agreement with US gold behemoth Newmont Corporation in April 2023 at the large, epithermal Bauloora project in April 2023, also within the LFB.

Nine months later LGM had formed its second mega deal, this time involving the $6m farm-out agreement with S2 Resources (ASX:S2R) at the highly prospective Glenlogan copper gold project.

Glenlogan is less than 50km from the giant Cadia Valley porphyry complex and was last explored by Rio Tinto in 1996.

Historical data captured from that period shows the potential of a buried, Cadia-style, copper-gold porphyry target that may be amenable to bulk mining techniques.

Picking the right partner

In an interview with Stockhead, LGM managing director Chris Byrne says joint ventures are a bit like a marriage.

“You’re picking the right partner that aligns with your values and what you see in the project.

“For us, signing on with a major like Newmont – who have only done two transactions in Australia in the last three years – gives us credibility,” he says.

“It gives us confidence in the geological upside that we’ve seen in our own projects, and the second aspect is obviously the funding component.

“It means our projects get financed, it’s non-dilutionary and from that perspective there’s a lot of value our shareholders get from the joint venture as our projects are essentially being carried through to commercial production.”

But what are the benefits for the bigger companies?

Turns out it could well be the exposure to the discovery making process itself.

“It’s well known that majors aren’t that successful in making discoveries, in fact, if you look at the discovery rates, most of them are made by juniors,” Byrne says.

“For companies like Newmont, they get exposure to a new geological region that they weren’t in before.

“In most cases, what these majors are looking for are discoveries where some of the heavy lifting has already been done, for instance where the junior has gone out and secured access, secured the tenement and the only thing left is the large amount of funding required to drill it, which is what they can bring to the table.”

JV deals in 2024

Magmatic Resources’ (ASX:MAG) $14m farm-in and joint venture agreement with FMG Resources, a wholly owned subsidiary of mining giant Fortescue (ASX:FMG), to explore the Myall copper-gold project in NSW is a more recent example.

Fortescue has also agreed to become a 19.9% cornerstone investor, enabling MAG to simultaneously advance its other two projects at Wellingtown North and Parkes, strategically located near Alkane.

Just last week, Kincora Copper (ASX:KCC) locked in AngloGold Ashanti for its Northern Junee-Narromine Belt (NJNB) copper-gold project in a deal that sees the multi-billion dollar miner earn up to an 80% stake by spending up to $50m.

Regional geophysics strongly indicates that Kincora’s Nyngan and Nevertire licenses host two of the very few remaining, almost untested, volcano-intrusive complexes of Macquarie Arc.

On the lithium front, Lord Resources (ASX:LRD) entered into a binding farm-in agreement with Mineral Resources (ASX:MIN) on the Horse Rocks Lithium Project in WA, just 80km from the operating Mt Marion mine in March.

Horse Rocks is also close to MinRes’ recently acquired Bald Hill lithium mine and processing plant and Liontown Resources’ (ASX:LTR) undeveloped Buldania project, a clear indicator the project is within potential “world-class” lithium territory.

MinRes is set to spend $1 million during the initial farm-in period to acquire 40% of the project, with further farm-in stages allowing the miner to increase its stake to 85%.

Speaking with Stockhead, LRD exploration manager Georgina Clark says the deal allows the junior to direct its fund towards exploring other projects including the Jingjing Lithium Project northeast of Norseman.

“Since we listed on the ASX in April 2022, there has been continuous conversations with MinRes about the Horse Rocks Project,” she says.

“MinRes have been able to provide in-depth knowledge of the lithium in the region, which is extremely valuable but while there is a collaboration on ideas and strategy, we remain the manager and operator of the project.”

Recent strategic partnerships

At the end of last year, Raiden Resources (ASX:RDN) joined into a strategic partnership with Canadian miner First Quantum Minerals over the Mt Sholl nickel-copper-PGE project in WA’s Pilbara region.

While undoubtedly prospective for lithium given the success at neighbouring projects, Mt Sholl is also highly prospective for nickel-copper-PGE being just 10km from the historical Radio Hill mine.

Mt Sholl currently has a resource of 23.4Mt grading 0.6% nickel equivalent containing 83,000t of nickel, 83,700t copper and 233,644oz of palladium-platinum-gold that remains open along strike and at depth across all four deposits.

That was enough to lure the Australian arm of First Quantum Minerals who signed a memorandum of understanding with RDN in relation to a strategic partnership.

Under the agreement, First Quantum Minerals Australia will spend at least $1.5 million on exploration – including at least 3,000m of drilling – during the 12-month exclusive due diligence phase.

Other interesting deals

Sultan Resources (ASX:SLZ) continues to make significant strides in exploration at its Calesi magmatic nickel prospect in WA’s Wheatbelt region, which falls under the exploration licence E70/5082, subject to an option and farm-in agreement with Rio Tinto Exploration (RTX), a subsidiary of Rio Tinto (ASX:RIO).

RTX has exercised its option to earn an 80% interest in the exploration licence by fully funding the $2 million exploration commitment within a five-year timeframe.

This strategic partnership positions Sultan Resources for shared success and leverages the expertise and financial backing of a major player in the industry.

Over in Queensland, Strategic Energy Resources (ASX:SER) rounded out its first field season at the Canobie project with joint venture partner FMG Resources, a wholly owned subsidiary of Fortescue (ASX:FMG).

Canobie sits within the same geological domain as Evolution Mining’s (ASX:EVN) Ernest Henry operation to the south, as well as the Mount Margaret, Eloise and Roseby copper-gold deposits and is one of largest copper reserves in the world.

SER plans to uncover an Ernest Henry 2.0 at the project, where exploration is focused on targeting both Iron Oxide Copper-Gold (IOCG) and nickel-copper sulphide mineralisation.

Additional geophysical surveys are scheduled to begin in the second quarter of 2024, which will be used to rank drill targets prior to the completion of a second year of drill testing.

At Stockhead we tell it like is is. While Legacy Minerals, Lord Resources, Raiden Resources, Sultan Resources, and Strategic Energy Resources are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.