Manganese has been on a tear and this junior’s DSO plans just received a shot in the arm

Image: Getty Images

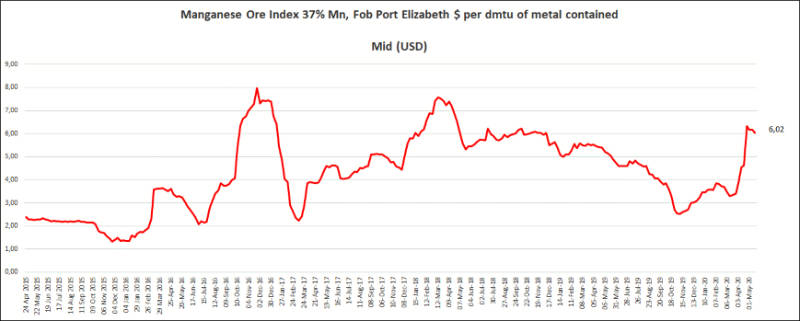

This year is looking increasingly like a good one for manganese plays with prices rising 50 per cent since the middle of March to $US6.02 ($9.17) per dry metric tonne unit, or about 10kg.

While prices had softened due to the COVID-19 pandemic after a steady recovery earlier this year, a subsequent national lockdown in South Africa — the largest producer of manganese globally — sent the metal flying.

Manganese explorer Bryah Resources (ASX:BYH) is well placed to capitalise on this growth in pricing with its latest exploration providing support for its near-term direct shipping ore production strategy.

Recent reverse circulation drilling at the Black Hill prospect has intersected direct shipping grades (above 30 per cent), with top results of 4m at 32.7 per cent manganese including 1m at 41.9 per cent manganese from surface and 6m at 30 per cent manganese from 1m that includes a 1m interval grading 47.9 per cent manganese from 4m.

Bryah says the results support a fast track strategy to produce manganese, leveraging the existing mining lease and new higher-grade prospects.

This has certainly caught the attention of investors, who have sent shares in the company jumping more than 40 per cent this morning to 6c.

Drilling has also uncovered a new shallow high-grade discovery at the Brumby Creek prospect, with assays returning 12m at 24.7 per cent manganese from 11m and 10m at 31.1 per cent manganese from 29m within the same hole and 17m at 26.5 per cent manganese from 7m.

The company noted that mineralisation at Brumby Creek remained open down dip and along strike.

Adding value, the drilling was fully funded by partner OM Holdings (ASX:OMH) under the Bryah Basin joint venture agreement.

Further results are expected from the Mount Labouchere prospect and Horseshoe South mine next week.

“We are very encouraged with the latest drilling results, in particular the new high-grade manganese zone discovered under shallow cover at the Brumby Creek prospect,” managing director Neil Marston said.

“These grades and thicknesses of mineralisation demonstrate that the manganiferous Horseshoe Range, most of which is under our joint venture’s tenure, has the potential to host significant tonnages of shallow high-grade manganese.

“Manganese ore prices have recovered significantly recently, which augurs well for us as we develop a pathway to production.”

Of its small cap peers, shares in Gulf Manganese Corporation (ASX:GMC) have been in suspension since mid-February as the spread of COVID-19 has prevented the completion of its €52m ($86.7m) finance facility.

The funding would have allowed the company to complete the construction and commissioning of the first two smelters at its Kupang Smelting Hub in West Timor, Indonesia.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.