It’s not all about lithium – here’s why manganese is the ultimate battery metals quiet achiever

Pic: Getty Images

As the demand for lithium-ion batteries swells, so too does the demand for lesser-known raw materials, like manganese, a key stabilising component in the cathodes of nickel-manganese-cobalt (NMC) lithium-ion batteries used in electric vehicles.

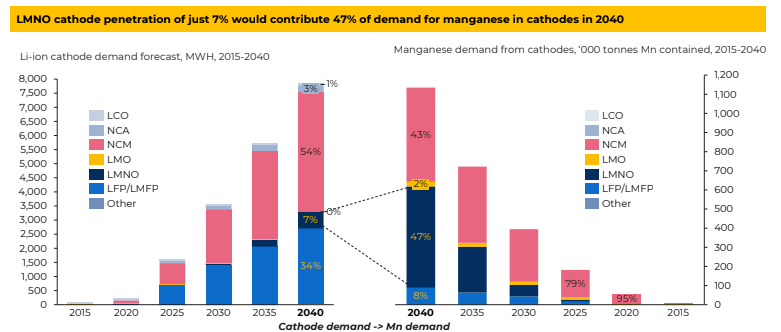

An afterthought in global commodity markets for the last few decades, almost half of today’s lithium-ion batteries include manganese, and CPM’s projections have that figure jumping above 60% by 2030.

With its ability to increase energy density, equating to longer driving range in the case of electric vehicles, and the added benefit of combustibility reduction, manganese is fast emerging as a vital material to the future of the EV industry and automakers are cashing in.

Volkswagen surprised the industry in 2021 when it announced its intention to incorporate high-manganese cathodes into its future mainstream cathode chemistry.

This represented the first large-scale commitment to manganese-based cathode chemistries by an automaker and sparked a flurry of developments to follow, including Tesla’s Master Plan 3, which revealed that production of nickel and manganese cathodes are already underway for a portion of future vehicles.

But it’s the latest advancement which might have the biggest impact, with researchers discovering that including manganese into an upgraded version of lithium-iron-phosphate batteries (currently the dominant battery chemistry in China) can deliver a range up to 1,000km for a single charge, double the current standard.

Chinese manufacturer Gotion High-tech – a supplier to Volkswagen – said its manganese doped L600 LMFP Astroinno has already passed safety tests, boasting a life cycle of 4,000 charge-discharge cycles and a potential lifetime range of 4 million km.

LFMP: the ‘M’ is for manganese

This ‘third wave’ of battery technology development, called lithium-manganese-iron-phosphate (LMFP), has Element 25 (ASX:E25) managing director Justin Brown feeling particularly excited.

The company recently signed a supply deal with General Motors for 32,500tpa manganese sulphate over a seven-year period, meaning along with its agreement with Stellantis, customers for 65% of its first phase of production from a battery plant its building in Louisiana have been accounted for.

“What we’re seeing is the shift away from cobalt, which has meant that the proportion of nickel has been increasing, however nickel has become problematic because all significant nickel supply comes from laterite processing in Indonesia, which is energy intensive and an environmentally destructive process,” he explained.

“Manganese is now the go-to metal and while the transition isn’t going to happen overnight, I’m told by the OEMs that the factories they are building now will be able to switch across to high manganese cathode materials without any significant re-tooling.

“It has become a really important part of their planning and over the next two years, when we get into production, I think you’re going to see a completely new landscape.”

E25 owns and operates the Butcherbird manganese project, host to Australia’s biggest onshore manganese resource at >260Mt, which will provide supply to the Louisiana facility.

Brown said discussions are underway to bring on a third offtake partner before the end of the year and plans are in the works to set up processing plants in Australia as the battery industry develops.

Explosion in manganese demand set for 2028

Firebird Metals (ASX:FRB) is another ASX-lister making moves in the space.

The company owns the Oakover manganese operation in Western Australia, where it recently delivered an 80% increase in Indicated Resources from 58.7Mt to 105.Mt, using a 7% manganese cut off.

In an interview with Stockhead, managing director Peter Allen said while signs of a looming supply shortage are already beginning to show in the high-purity manganese market, the situation will really start to heat up in 2028, about the same time Firebird plans to bring Oakover into production.

“My CFO and I were recently in China visiting different sulphate plants, and the excitement over there about LFMP batteries overtaking LFP is really phenomenal,” he said.

“In China, it is going to become the cathode of choice – these cathodes are already starting to be deployed in electric vehicles but explosion in demand is really going to take off over the next few years.”

Element 25 and Firebird Metals share prices today:

Which other ASX stocks have manganese?

EURO MANGANESE (ASX:EMN)

This $74.49m market cap company is in the process of developing its Chvaletice project in the Czech Republic, which is a unique waste-to-value recycling and remediation opportunity involving reprocessing old tailings from a decommissioned mine.

Its most recent milestone includes awarding Woods Australia as its Engineering, Procurement, and Construction Management (EPCM) partner ahead of the construction permit delivery, expected at the end of Q2.

The Chvaletice Project is the only sizable resource of manganese in Europe, positioning the company to provide battery supply chains with critical raw materials to support the global shift to a circular, low-carbon economy.

MAKO GOLD (ASX:MKG)

Mako is hoping for a big payoff with the start of drilling on two parallel 7km-long manganese units at its Korhogo project that had delivered up to 33% manganese in rock chip sampling.

The company plans to drill holes at or near recent rock chip sampling locations to leverage the success of the earlier exploration, which saw all 22 rock chips return significant manganese values averaging about 22%.

With manganese seeing increasing use in the manufacture of batteries for electric vehicles, a major find at Korhogo will open up significant opportunities.

BRYAH RESOURCES (ASX:BYH)

Manganese drilling results at Bryah’s 49% owned Bryah Basin project returned excellent grades in early May with stand-out intersections including 7m at 26.4% manganese and 7m at 23% manganese as well as 4m at 27.3% manganese.

Bryah (49%) and OM Manganese (51%) have a Joint Venture (JV) to undertake exploration to test targets in Western Australia’s Brumby Creek area, with a view to commencing manganese production.

These results support a substantial manganese resource while geological modelling indicates good continuity showing the prospect is open in multiple directions.

PANTERA MINERALS (ASX:PFE)

Explorer Pantera Minerals owns the highly prospective Weelarrana manganese project, which sits on the same manganiferous shales known to host economic mineralisation at E25’s Butcherbird and FRB’s Hill 616 projects.

Assay results from phase-2 drilling at Weelarrana confirmed widespread manganese mineralisation up to 1m at 22.6% with similar thickness and grade to results reported from drilling in November 2022.

Pantera’s next program of works involves further mapping and rock chip sampling of the channel iron mineralisation as well as planning additional heritage survey work.

CONICO (ASX:CNJ)

Latest phase-1 drilling results continue to highlight the potential of Conico’s Mt Thirsty nickel-cobalt-manganese-scandium project near Norseman in Western Australia.

Most of these results were returned outside the current mineral resource estimate and present an opportunity for further resource growth as well as potential mine life extensions with hits such as 6m at 0.85% manganese, 26m at 1.06% manganese, and 13m at 1.36% manganese.

Metallurgical studies are progressing and will feed into the scoping study, currently underway, expected for completion shortly.

Manganese stocks share prices today:

At Stockhead we tell it like it is. While Pantera Minerals, Mako Gold, and Conico are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.