Could 2020 be a stronger year for manganese stocks?

Pic: John W Banagan / Stone via Getty Images

Manganese stocks haven’t been too popular with investors in the past year, but early signs point to that being about to change in 2020.

Manganese is the fourth-most-traded metal in the world. Only aluminium, iron ore and copper are more widely used.

About 90 per cent of manganese goes into steelmaking, but it’s increasingly being used in next-generation battery and power storage applications.

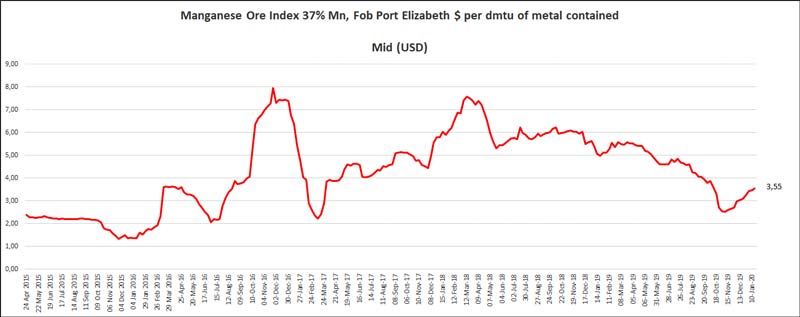

Last year wasn’t a good one for manganese, with prices slumping 30 per cent in the second half of 2019 thanks to the slowing Chinese steel market and oversupply issues.

This was largely due to the US-China trade war tensions.

But with a phase one deal between the two nations now signed and a potential phase two deal — which would remove the previously imposed tariffs — in the works, global markets are rejoicing, and China is set for a rebalancing, according to market watchers.

Over in the US traders donned hats marked “Dow 29,000” after the Dow Jones punched through the magical mark to close at 29,030 points last Wednesday.

Then on Thursday the ASX200 broke through the 7,000-point mark — a level not seen since before the GFC hit in 2007-08 — while the Small Ords climbed to 3,062 points.

So markets (and investors) are happy… for now.

Manganese is expected to be one of the beneficiaries of the easing US-China tensions, particularly thanks to China’s previously implemented stricter rebar standards.

Rebar is a reinforcing steel used in concrete. Manganese and vanadium are two of the commodities used to make stronger steel.

Angus Geddes, founder and CEO of fund manager Fat Prophets, said following relatively weak economic conditions in 2019 the world economy looks set to pick up in 2020 and extend the longest ever period of expansion – more so for emerging markets.

“China’s bumpy growth rate (also a consequence of the trade war) has been a key driver of the lacklustre performance in the worldwide economy and especially emerging markets which have been reliant on trade,” he said.

“However, the tables in our view are set to turn, with trade tensions abating, with US-Sino trade relations improving, and also as the UK reaches an amicable exit with Europe.

“This should also provide a boost to business activity, and also encourage investors to take ‘risk on’, and in the wake of low to negative interest rates.”

China, India and South Korea are three emerging markets in particular that Geddes believes will stand out this year.

“2020, looks to be a significant milestone year for China with the government pledging 10 years ago that they would double the size of the economy and average incomes,” he said.

“This will substantially influence Beijing to institute fiscal and monetary policies that ensure economic growth stays on track.”

In Australia, the prediction is the ASX200 will climb further while commodities and precious metals will also extend their gains.

The ASX producers & hopefuls

There are only a handful of ASX-listed companies in the manganese game.

Over the past 12 months over half the nine stocks on Stockhead’s watchlist lost ground, with the biggest loser being OM Holdings, which wiped off 61 per cent.

But so far in 2020 all but one have remained steady or made gains. Topping the list is manganese explorer Bryah Resources (ASX:BYH) with a 23 per cent gain so far this year.

ASX stocks with manganese exposure:

Scroll or swipe to reveal table. Click headings to sort.

| Code | Company | Price Jan 20 (Intraday) | YTD % Return | 1-Year % Return | Market Cap |

|---|---|---|---|---|---|

| BYH | BRYAH RESOURCES LTD | 0.049 | 23 | -39 | $4.9M |

| GMC | GULF MANGANESE CORP LTD | 0.007 | 20 | -25 | $31.3M |

| JMS | JUPITER MINES LTD | 0.31 | 11 | 54 | $607.3M |

| S32 | SOUTH32 LTD | 2.93 | 7 | -12 | $14.1B |

| E25 | ELEMENT 25 LTD | 0.18 | 6 | 9 | $16.6M |

| OMH | OM HOLDINGS LTD | 0.5 | 0 | -61 | $369.3M |

| PM1 | PURE MINERALS LTD | 0.016 | 0 | 0 | $7.7M |

| PMY | PACIFICO MINERALS LTD | 0.007 | -7 | 30 | $18.8M |

| EMN | EURO MANGANESE | 0.15 | 7 | -46 | $26.4M |

The largest is the $14 billion South32 (ASX:S32), which is the world’s largest producer of manganese ore with operations in Australia and Africa.

In Australia, the company’s open pit mine on the island of Groote Eylandt in the Northern Territory, which is 60 per cent owned by South32 and 40 per cent owned by Anglo American, is the largest and lowest-cost manganese ore producer in the world.

OM Holdings (ASX:OMH) is also a manganese producer and has just been given the go ahead to restart mining at its Bootu Creek mine located 110km north of Tennant Creek in the Northern Territory.

Mining was suspended in August following the death of a worker.

But between Christmas and the new year, OM said the NT government was allowing in-pit mining operations to restart in a staged manner, with each stage subject to independent review and approval.

READ: OM Holdings gets green light to restart manganese mining

The $617m Jupiter Mines (ASX:JMS) is digging up manganese at its Tshipi mine in South Africa.

Jupiter recently completed a study into the expansion of the mine that anticipates a 50 per cent increase in production to 4.5 million tonnes of manganese each year.

The company places the expansion cost at around 1.025 billion South African rand ($102.9m).

Meanwhile, Gulf Manganese (ASX:GMC) is on track to start production later this year after locking in a €52m ($83.8m) loan facility.

The company is now fully funded to complete the construction and commissioning of the first two smelters at its Kupang Smelting Hub in West Timor, Indonesia.

Managing director and CEO Hamish Bohannan told Stockhead Gulf’s goal was to be producing ferromanganese by “not later than the third quarter, but ideally slightly before that”.

“There’s seven to nine months of building and commissioning work. We will be producing metal well before the end of this year,” he said.

“We’ve been on hold now for well over six months, if not longer, following the backing out of one of our investors. So this really gets us up and going.”

Gulf will be producing ferromanganese – a ferroalloy with a high content of manganese used to deoxidize steel.

“Prior to the end of the year the low-grade ore prices were down and there was a lot of product coming out of China,” Bohannan said.

“But we’re not really in that space. We’re looking at the high-quality, high-purity, low-carbon, ferromanganese alloy for the steel industry.

“So we’re sort of a niche product in the high-quality end of the market.”

Bohannan said this meant Gulf’s product would fetch a premium price.

“We will virtually have no carbon in it at all by virtue of our very high manganese-iron ratios in the ore,” he said.

“So that will get the top price on the day. At current times it’s about $US2000 ($2907) a tonne.”

In July last year, Gulf picked up a high-grade mine via its key Indonesian and Singaporean partners.

Bohannan said the PIJ mine will account for 20-25 per cent of the company’s manganese throughput.

Gulf previously did a bunch of other deals with local miners to secure manganese ore for processing into ferromanganese. It is also looking at a few other mine acquisitions – deals it is now in a better position to progress after securing the loan facility.

On the exploration front, there is Element 25 (ASX:E25), Bryah, Pure Minerals (ASX:PM1) and Pacifico Minerals (ASX:PMY).

Bryah, Element 25 and Pure Minerals are exploring for manganese in Western Australia, while Pacifico has a cobalt, copper and manganese project in South Australia.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.