Major Upgrade: Anson announces 45pc jump in Paradox lithium resource

The update includes a 45% increase in the LCE and 44% increase in the bromine resource at Paradox. Pic: via Getty Images.

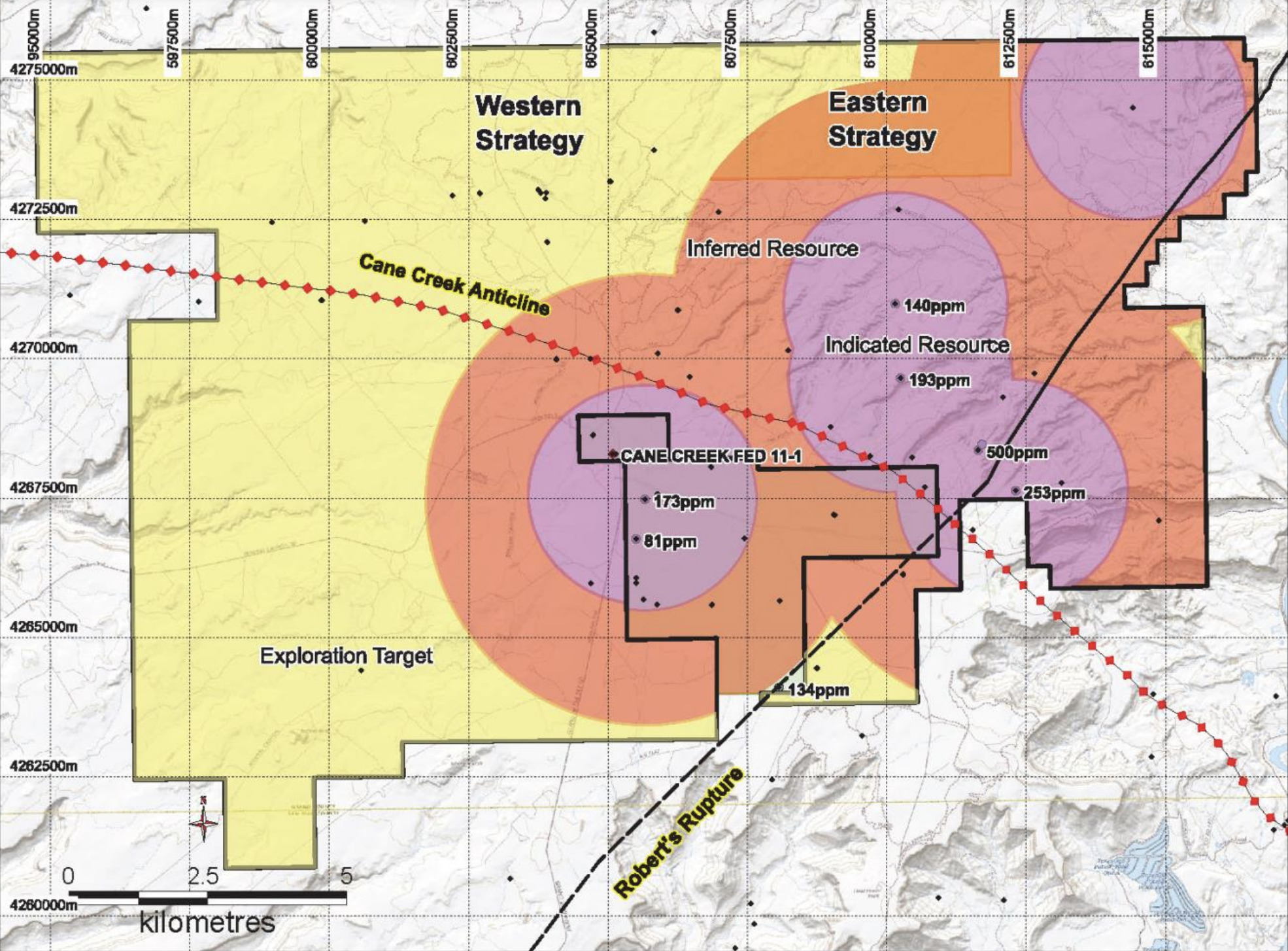

- ASN updates Paradox resource to 1.5Mt LCE and 7.61Mt bromine after acquiring the adjacent Green Energy project

- Resource updated without drilling as the Green Energy project hosts historic O&G wells with recorded lithium values

- Company plans to develop a direct-lithium-extraction operation for Paradox

- Potential for substantial further Mineral Resource expansion with planned Western Strategy drilling at the Paradox Project

Anson Resources has upgraded the resource at its Paradox lithium project in Utah by a huge 45% to 1.5Mt of Lithium Carbonate Equivalent (LCE) and 7.61Mt of bromine.

This includes a 6% increase in the indicated resource to 366,737 LCE and 1.91Mt bromine and a 117% increase in the inferred resource to 1.14Mt LCE and 5.7Mt bromine.

The update comes thanks to the company’s successful acquisition of the Green Energy project adjacent to Paradox.

The project hosts 18 historic oil and gas wells – three of which have recorded lithium values – which enabled Anson Resources (ASX:ASN) to deliver this resource increase without the need for further drilling.

Building a world-class resource inventory

This update represents a major step-change increase in Anson’s resource inventory at its Paradox Basin lithium assets, and a significant milestone in the development pathway of the Paradox project.

“The acquisition of the Green Energy project from Legacy and the corresponding increase in the JORC Resource estimate is a milestone achievement for Anson,” executive chairman and CEO Bruce Richardson said.

“The discovery and development of this world class resource in the United State of America at this point in time is significant and a credit to the whole Anson team and in particular its geologist and consultants.

“This increase in resource has been achieved without needing to re-enter a well and incur the related expenditure.

“The company is working vigorously to bring the Paradox lithium project into production and will continue to provide updates to the market as the project develops.”

Economic extraction potential

Three factors; high pressure, porosity (both horizontal and vertical) and shallow depth are key attributes of the Paradox lithium project and are not present anywhere else in the area.

In combination, they provide strong indicators of low extraction costs and beneficial ESG outcomes.

The high flow rates from the four tested wells to date also confirms this theory.

Also, at Anson’s nearby Green River Lithium Project located 50kms to the northwest, indications are that brine may flow to the surface naturally. This offers the potential to reduce operating costs as it eliminates the need for mechanical pumping to extract brines from depth.

The plan is to develop the Paradox and Green River projects into significant Direct Lithium Extraction (DLE), lithium producing operations.

DLE is nothing new – it’s been used in water treatment for decades – but its use to extract lithium from brines is just now coming into its own.

DLE tech promises to produce cheaper, higher quality, and more environmentally friendly lithium than incumbent processes and could be used literally anywhere there’s an oil & gas wells – and there’s a lot of those in America.

Further resource expansion on the cards

Anson plans to commence a resource definition drilling campaign at Green River in the near-term and is confident of the project’s potential to deliver additional resources to its Paradox Basin lithium resource inventory.

At the Paradox project, future drilling of the “Western Strategy” – which includes drilling the Mineral Canyon and Sunburst wells to sample the thick Mississippian units, and the Pennsylvanian clastic horizon to deliver additional data for a resource upgrade – could significantly increase the brine tonnages based on the thicknesses of those units, as determined from historical oil exploration drilling in the area.

In addition, the Big Flat Unit 2 well, within the acquired Green Energy project, has a known historical value of 173ppm lithium for the Clastic Zone 31 horizon.

The re-entry of this well, if successful, would further increase the brine tonnage based on similar thicknesses which would support either an extension of the life of mine or a possible production increase.

An internal review considering these options and whether to continue with further drilling programs in the immediate future to increase the resource estimate is currently under way.

This article was developed in collaboration with Anson Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.