Lithium: Investors are rewarding the best development stories even as prices tumble

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Lithium is not the coolest kid in the playground right now. Still, there’s a hardy group of advanced explorers plugging away at project milestones ahead of that looming mid-2020s supply deficit.

And the best stories are still getting rewarded, even as lithium prices continue to hit the skids.

Galan Lithium (ASX:GLN), AVZ Minerals (ASX:AVZ) and Vulcan Energy (ASX:VUL), for example, are currently up 81 per cent, 64 per cent, and 56 per cent respectively since the start of the year.

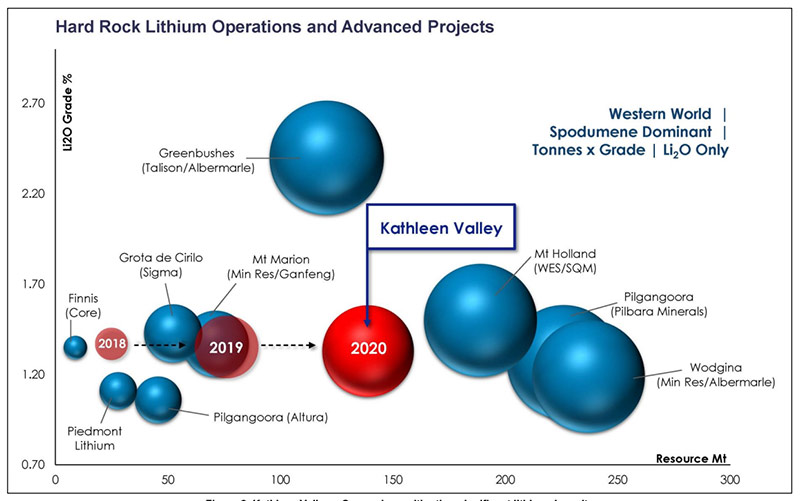

Today, WA-based Liontown Resources (ASX:LTR) increased the size of its Kathleen Valley project resource by 86 per cent to 4.5 million tonnes of lithium carbonate equivalent (LCE) and 43 million pounds of tantalum.

But this is just an interim number, announced because Liontown realised that a previous exploration target would be “materially exceeded”.

In-fill drilling and drilling to define the margins of this “octopus-like” mineralised system will continue until the end of the month.

This data will be used to prepare the proper resource, Liontown says, which will underpin a project definitive feasibility study (DFS).

Kathleen Valley is one of the few new, significant lithium projects of scale currently being progressed towards development in Australia over the next two-three years, says Liontown managing director David Richards.

“Importantly, this is not the end of the story in terms of the growth of this deposit,” he says.

“Based on the success of our drilling, we are increasingly confident that the DFS will encapsulate both a high-grade underground mine in parallel with an open pit, establishing the foundations for a new long-life, high-quality Australia lithium-tantalum mining operation.”

Liontown – which is up 16 per cent year to date – moved 6 per cent higher on today’s news.

READ: Tim Goyder and the secret behind his magical small cap ‘four-peat’

Fellow hard rock play Mali Lithium (ASX:MLL) is also enjoying drilling success at the advanced Goulamina project in southern Mali.

The company, which is also at the DFS stage, continues to unearth high-grade lithium outside the existing resource shell.

This supports the company’s belief that “substantial resource upside exists”, managing director Chris Evans says.

“The discovery of spodumene-bearing wide pegmatite intersections at the Bara prospect also highlights the prospectivity of our tenement package,” he says.

“We look forward to reporting the results in full to the market once assays are received and incorporating other positive results from recent drilling in the pending resource and reserve updates.”

Mali – which is up 9 per cent since the start of the year – nudged higher to 8.5c per share in morning trade.

READ: Chris Evans on pitfalls, project development and that 100m tonne Mali resource

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.