Lake Resources MD Steve Promnitz on why the ASX lithium stock is an expert favourite

Pic: Tyler Stableford / Stone via Getty Images

Gavin Wendt is a fan. So is Guy le Page. So what makes Lake Resources (ASX:LKE) one of the best lithium stocks on the ASX?

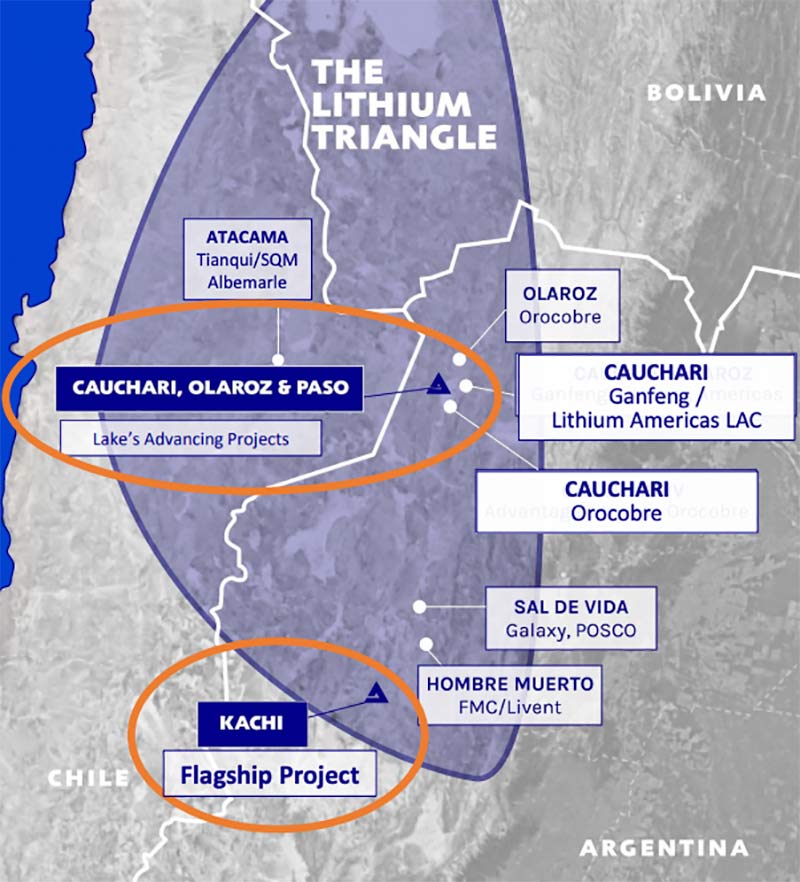

It has one of the largest tenement packages in Argentina’s Lithium Triangle, a province that produces around 50 per cent of the world’s lowest cost lithium.

Its flagship Kachi project already ranks amongst the top 10 global lithium brine resources worldwide.

But Lake’s not-so-secret weapon is an innovative direct-extraction technique, which produces cheap, high quality, environmentally friendly lithium.

That’s the trifecta.

We speak with managing director Steve Promnitz about … everything.

Lake is one of only a handful of stocks that stuck with their lithium project through the dark days. Was that an underlying belief in the project and the industry as whole?

“Three things – project, industry and the process that we are using.”

Can you tell us a bit more about that process?

“About half the world’s lithium is produced from spodumene, primarily out of WA. That concentrate primarily goes to China and made into hydroxide. The other half, 40 per cent is produced from lithium brines in Chile and Argentina.

They evaporate the brines in ponds, concentrate all the salts, and take the lithium out.

The problem with the brine producers is that you don’t get a consistent, high quality battery product.

When you put [brines] in evaporation ponds and use the power of the sun, every one of those 100 ponds is different. Different chemistry, different evaporation rates.

Back when quality wasn’t so much of an issue — when most lithium was going into ceramics and lubricants – that was fine. Now we have to do better.

That’s what the battery makers and the cathode makers are screaming for; a consistent high quality product, with production that can be scaled up to meet demand.

At the same time, EV makers over the last 15 months have been looking for better ESG outcomes, and particularly a smaller C02 footprint.

We can’t just keep doing the same old thing and expect to get a better result. That’s why we went down the path of direct lithium extraction [with partner Lilac Solutions].”

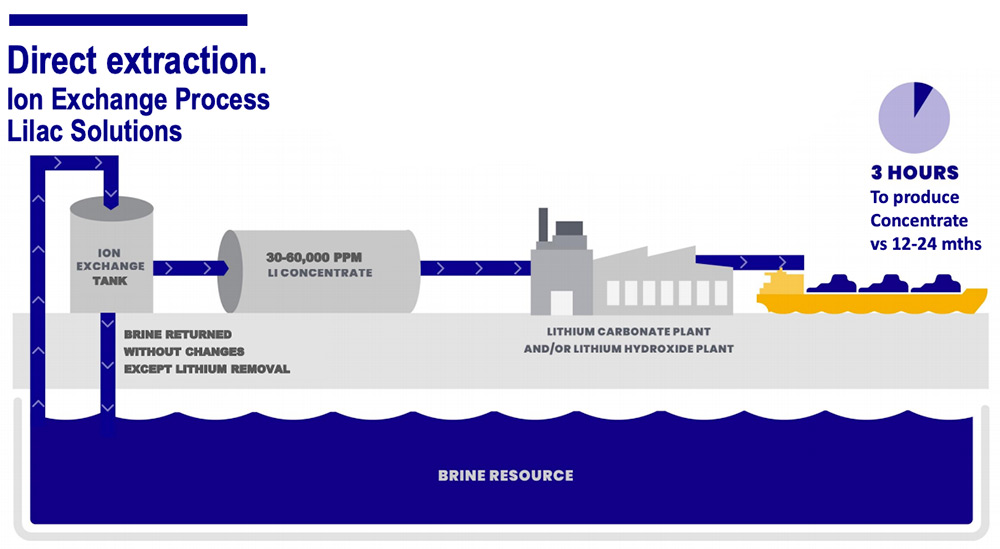

Direct Extraction – does that mean you’re pulling out the lithium and then pumping the water back into the aquifer?

“That’s exactly right. The brine [is pumped] into a tank for a couple of hours, where these little ion exchange beads latch onto all the lithium. Then you release that water – without lithium — back into the aquifer.

We aren’t heating or cooling the water, it operates at ambient temperature, so we aren’t doing anything particularly tricky. All we do is replace the evaporation ponds with these tanks, or modules.

There are a number of different methods of direct lithium extraction. We used ion exchange because it has been used in the water business for 70 years, and a good 30 plus years in mining processing. It just hasn’t been adapted for lithium space.”

So not only is this better process, but the risk is also relatively low?

“For every new technology you have to show that it works on your particular project, and you have to show that it works at scale.

We spent about 15-18 months doing benchtop work, and now we’ve had it brines running through pilot plant [smaller version of the real thing] in California for more than 12 months.

We also demonstrated that it is a very high purity product by getting it processed by a well-known third party.”

Why is your partnership with Novonix important? And why did that get such a good response from market?

“To answer the second part of your question – I don’t know.

It was interesting. For about four months you could graph Novonix and you could graph us and okay, they weren’t on the same trajectory, but they basically had the same shape for a while. I don’t really know why that was.

But look, long story short. We spoke to a few companies that could take our product and put it in a battery. It’s normally a pretty opaque process.

Normally what people like us do is send [lithium] to these battery makers, and we have no idea what the hell they do with it. They only come back to you and tell you what’s wrong.

Novonix – which tests for all the big names in the industry — took our product and put it inside a 6-2-2 battery. They came back and said ‘this doesn’t just work well — it works just as well, if not better, than the tier 1 products’.”

So, using Novonix gives you confidence that your lithium is going to go into batteries, because it already is in a battery?

“Damn straight. If anybody else questioned us and said, ‘How do I know that this works?’ We go ‘Well, look at those guys; they’re considered the benchmark in the industry’.

On the back of that we went straight to project financing, looking to raise about $400m of the $540m project capex from export credit agencies. They are quite keen to do so.

Our next step will be to have a demonstration plant on site in the latter part of this year. It would be there now, if not for COVID.”

So why haven’t big lithium producers moved to something like Direct Extraction?

“They don’t need to, yet. There was no economic reason to use this process five years ago.

If you already spent ~ $3 billion on a plant with evaporation ponds, it doesn’t go too well with your shareholders if you turn up and go ‘write it all that off, we’re going with this [process] instead’.

We do suspect that [direct extraction] is going to be the way of the future.”

Are you having conversations with EV makers and battery makers yet?

“We had some great calls with household names in the EV industry that want product like ours in their supply chains.

We aim to announce one of those [offtake partners] sometime soon.”

Can you tell us some of the headline numbers from the PFS you put out, and maybe whether you think the current DFS will improve on those numbers?

“The headline number for project value post tax is $US1.6 billion.

The operating cash flow line is $US260m a year [over 25 years], and that’s with an operating cost of $4100/t. We expect that that operating cost will probably come down a few hundred dollars a tonne.

In our PFS we used trucked gas – which is just about an expensive energy source as you can get – which will be substituted for a hybrid solar energy source. Now if we double that [PFS production] that puts us somewhere around 50,000t per annum.

You see a project value north of $US3bn, EBITDA north of $US500m a year – the thing starts to turn into a gold mine.”

Lithium demand and pricing is starting to go parabolic. Where is the industry at the moment, and how much of an expected deficit are we talking about?

“As a general rule of thumb that we’re looking at somewhere around a 10 to 12 times growth in EVs over the next 10 years.

That growth rate is legislated. Last year the EU came out with their incentives to stimulate the economy.

They said we’re going to put money towards renewables, charging stations, subsidies for electric vehicles. Various towns, cities and countries came out and said, ‘we’re going to be all electric by 2030’. ‘We’re going to be all electric by 2035’.

As of a couple of weeks ago, 208 battery megafactories would be built by 2030. For every one of those battery plants to be operating at full capacity we’re going to need about 3 million tonnes per annum of lithium carbonate equivalent. Last year we produced 300,000.

Benchmark Mineral Intelligence see the supply shortfall happening about 2025 when all reasonable [lithium] projects that are currently in development have come online. However, the market impact could come a little sooner than that.

We found out about eight weeks ago that two of the five large lithium producers went around to their key clients and said, ‘we might not be able to fill all of your orders for q3 this year’.”

That’s now it’s interesting, because I assume that car makers don’t like disruption very much. I would have thought that you’d be getting some fairly desperate conversations happening right now.

“A logical person would reach that conclusion. But when you talk to the car makers their view is that ‘I’ve signed an agreement with the battery makers to deliver batteries’.

But what if they don’t have guaranteed supply?

Let me give an example. LG Chem have got an order book of somewhere between $US60 to $US80 billion worth of batteries to enter EVs over the next 10 years. They don’t have secure agreements for lithium going into that supply, and we know that.

It beggars belief that a car maker can be investing hundreds of billions of dollars into EVs and not have secure supply chains.”

Is that pent up demand the reason why you have fast-tracked your other projects in Argentina – Cauchari, Olaroz and Paso?

“Yes. In the middle of 2020 – during the Dark Ages for lithium — we had our pre-feasibility study out for 25,500 tonnes per annum production.

We had a number of interested parties, but they would say, ‘Steve, could you stage it? if you did 10,000tpa we might take two and a half’.

Fast forward to December, when the only other peer using direct lithium extraction, TSX-listed Standard Lithium, came out with high quality, high purity lithium carbonate.

As soon as that happened my phone started ringing, we started getting emails about doubling our production and getting our Kachi project up and running. That’s why we fast tracked PFS planning for our [other] projects.”

What are some major milestones coming up for Lake?

“We have released news about increased drilling. That increased drilling will not only support the definitive feasibility study, but also move more resources into a higher category so we can support an expansion to ~50,000 tonnes per annum.

We’re also expecting a couple of announcements about who we’re working with on debt financing.

We’ve been very fortunate to see a lot of appetite for about 70% of that capital costs being debt financed through export credit agencies.

The benefit of export credit agencies is cheaper, longer term debt with a quasi-government seal of approval that makes it easy to raise equity.

We’ll probably hear some more news at some stage from Novonix, and probably announcement [ a very] close partnership arrangement between ourselves and Lilac. And probably an offtake agreement.

Pretty darn sure that we’re going to land a decent sized fish. And as we know from Piedmont (ASX:PLL), when you do that, it tends to lead to a positive market reaction.”

Okay, to summarise – what makes Lake one of the best lithium plays on the ASX?

“If you were a betting man, it would be very good bet to put money towards lithium over the next 18 months.

Any [stock] that is moving towards development and towards production should be pretty good. The guys that are in production, if they’re showing signs of expanding, or maybe improving the quality of their product, would also be a good investment.

The difference with Lake is that we’re delivering a low cost, high quality product with ESG benefits — exactly what the market wants. If we were producing right now, we’d have an $US8,000 to $10,000 margin.

It means that we know that in a beauty parade with five other new developers, a tier one off taker would probably select us because of the consistent quality product and the fact that it has an ESG benefit.

We’re seeing this across the globe. If you can reasonably demonstrate a genuine ESG benefit with data to back it up, your stock will outperform others in the same sector.”

At Stockhead, we tell it like it is. While Lake Resources is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.