Guy on Rocks: Could palladium be getting ready to punch through $US3,000?

Experts

Experts

Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week.

Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

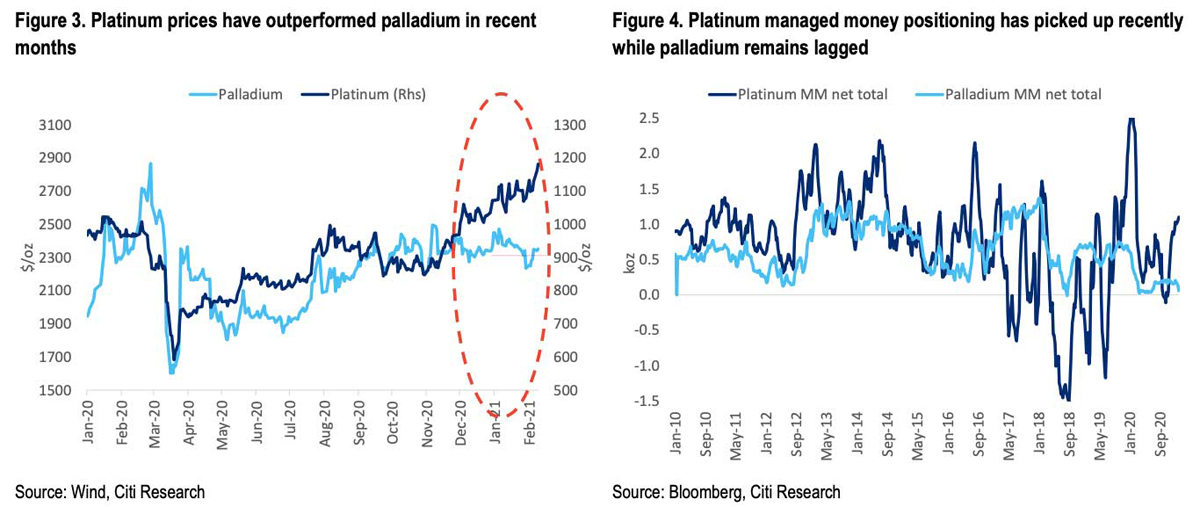

Looks like Palladium (figure 1 and 2) is getting set to test $US3,000 ($3,866) an ounce sometime this year on the back of a large projected deficit (1 million ounces, according to Citibank, over the next two years) spurred on by automotive spending.

This is all in spite of efforts to substitute platinum (we note similar efforts to reduce cobalt content of batteries has also been problematic). Platinum (figure 1 and 2) is also likely to follow suit on the back of investment demand and speculation around palladium substitution.

It’s a little hard to predict price action here in light of a surplus and will no doubt be tied in part to investment demand.

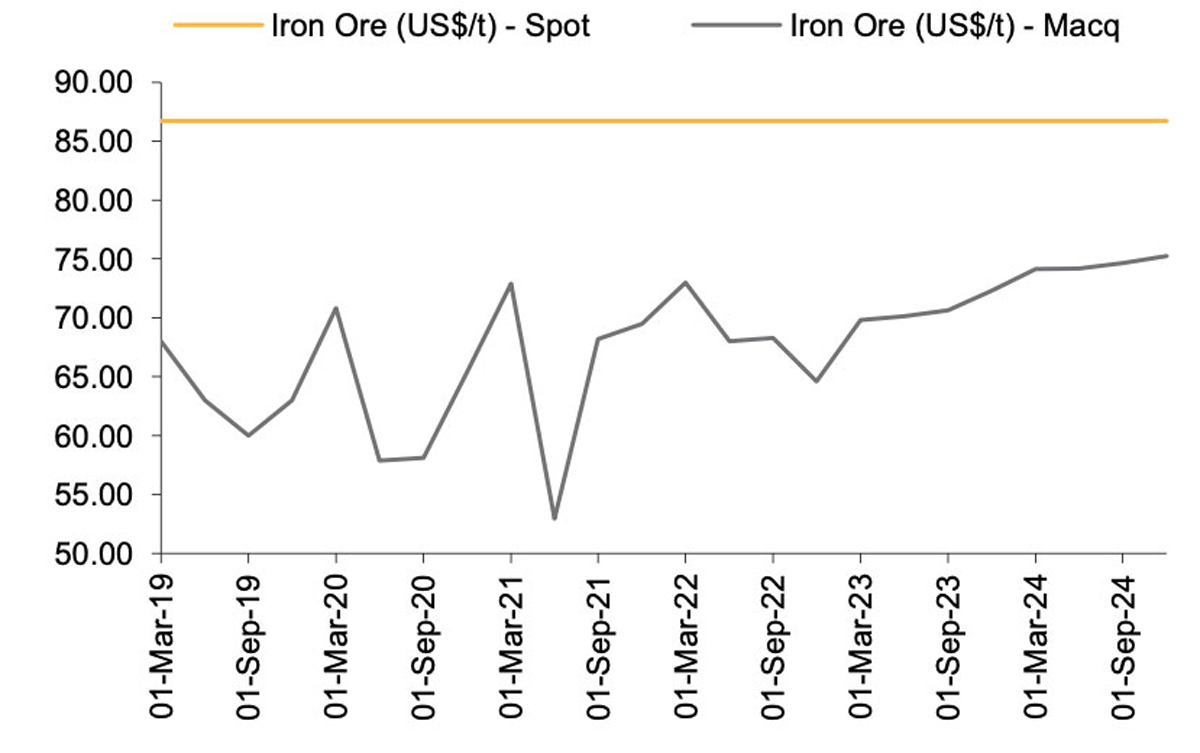

Also interesting to note, and not surprisingly, that iron ore forecasts from the major banks/brokers going out to 2022 all appear to be well above $US100/tonne (62 per cent fines). This is in stark contrast with Macquarie Bank’s projections this time two years ago (figure 3), which turned out to be $US80/tonne lower at around $US70/tonne compared to current spot prices in the range of $US150/tonne.

With all the sophisticated modelling tools it shows that commodity forecasting is indeed a dark art. In their defence, other forecasters were not dissimilar.

There’s still plenty of speculation around iron ore breaking through $US170, which will continue to place pressure on Chinese steel margins. Cyclones in Port Headland saw a reduction in shipping volumes by 16 per cent week on week compared to Vale, which witnessed a 45 per cent decline in shipping volumes over the same period.

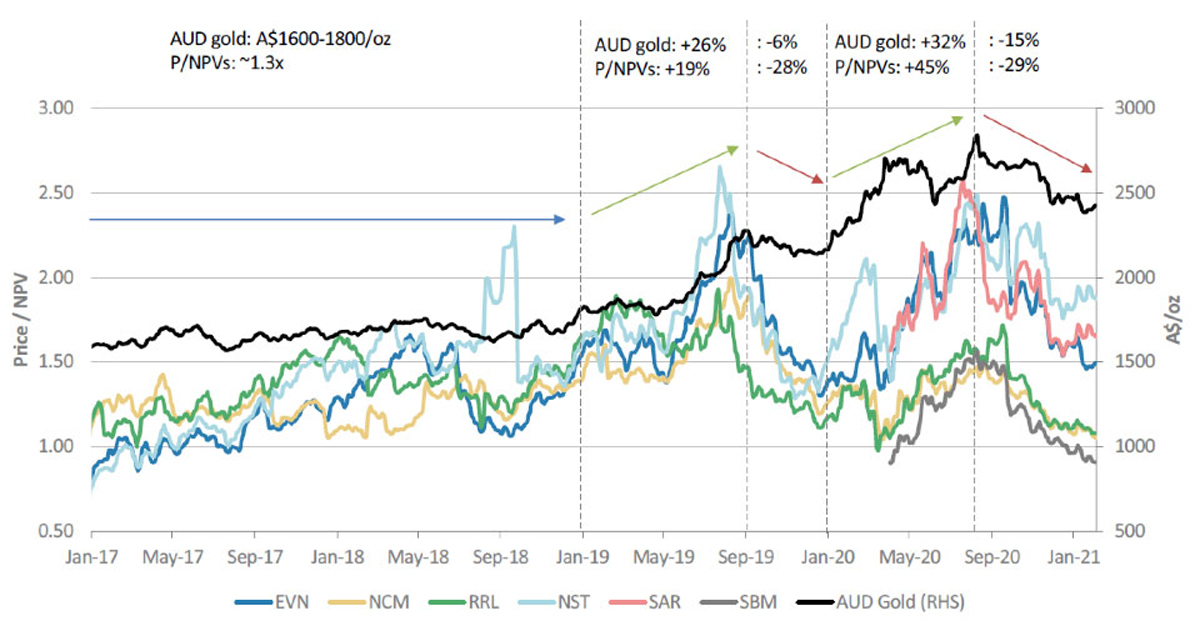

Gold has strengthened over the last week or so in the wake of a weakening dollar, global uncertainty and negative real interest rates.

Gold valuations were stretched over 1Q 2021 as our gold index (ASX:XGU) shows (figure 4), however a 15 per cent correction in the gold price has seen a 30 per cent correction in the valuations of ASX-listed gold producers (figure 5), which has had a knock-on effect on the junior end.

Gold producers are trading at 1.3x net present value — a similar level to the previous period of “flat” gold markets.

So, what does also this mean? There is scope for share prices to lift on the back of rising gold prices in CY2021.

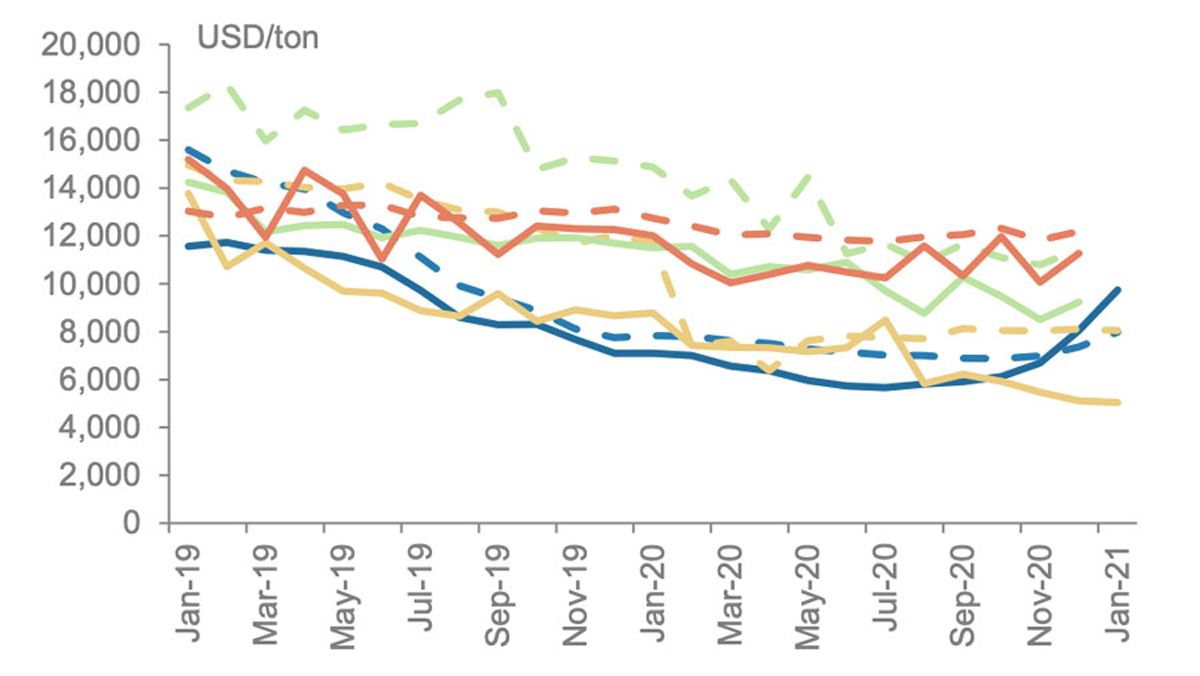

The resurgence in lithium prices (figure 6) has caught many of us by surprise, with lithium carbonate China/spot prices now back over $US10,000/tonne compared to marginal costs of around $US7,000/tonne.

Prices are also firming in Japan and Korea. Based on the tightness of supply, it looks like further near-term increases will likely be buoyed by EV demand and an uplift across commodity prices.

GWR Group (ASX:GWR) (figure 7) has joined the ranks of iron ore producers after loading 50,000 tonnes of high-grade lump at the Port of Geraldton site 88 for delivery to offtake partner Pacific Minerals from its Wiluna West iron ore project.

GWR will now look to secure offtake for stage 2, comprising 20 million tonnes of iron ore resources.

Challenger Exploration (ASX:CEL) (figure 8) announced some very broad intersections this week from its Hualilan gold project, including 227m (from 139m down hole) at 1 gram per tonne (g/t) gold equivalent (0.80g/t gold, 2.7g/t silver, 0.2 per cent zinc).

The company has enjoyed a 70 per cent share price rise since the start of the year. There’s more to come, I would think, if Challenger can back it up with more announcements like this.

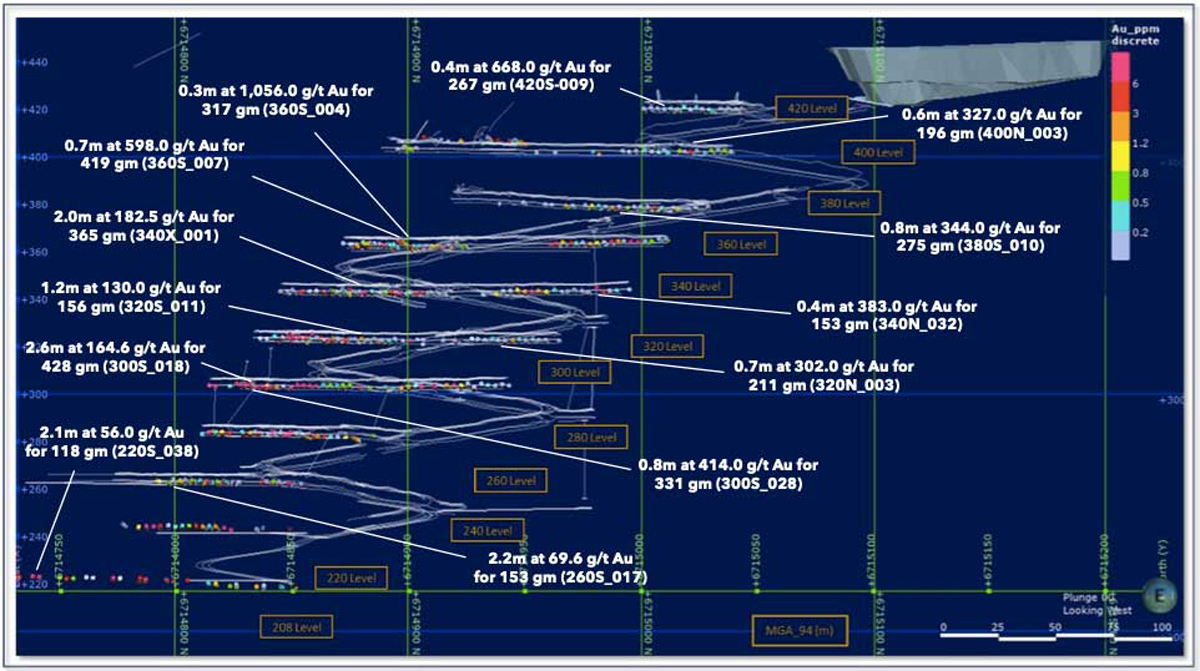

Viking Mines (ASX:VKA) (figure 9) is preparing to start diamond drilling at its recently acquired First Hit project (50km north of Kalgoorlie, situated just off the prolific Ida and Zuleika shear zone) after publishing old face sample assays from underground workings.

These workings revealed numerous eyewatering gold high-grade gold values, including 0.4m at 668g/t and 0.6m at 337g/t.

The February 11 announcement is worth a read and also checking the pockets of the drillers and field team as they are leaving the site after an honest day’s work when the drill bit starts turning.

A number of ASX-listed juniors have benefited from the lithium rise, with the likes of Northern Territory spodumene lithium developer Core Lithium (ASX:CXO) up from March 2020 lows of 1.4c to recently touch 40c (27/1/2021).

AVZ Minerals (ASX:AVZ), which is developing the Manono lithium and tin project in the DRC ($US1bn post tax NPV10 based on JORC proven resources of 44 million tonnes at 1.65 per cent lithium and 700 parts per million tin) has risen from 5.2c to 23c over the last 12 months.

This brings me to the gravity defying Lake Resources (ASX:LKE) (figure 11), which has a similar share price trajectory to other juniors in the sector.

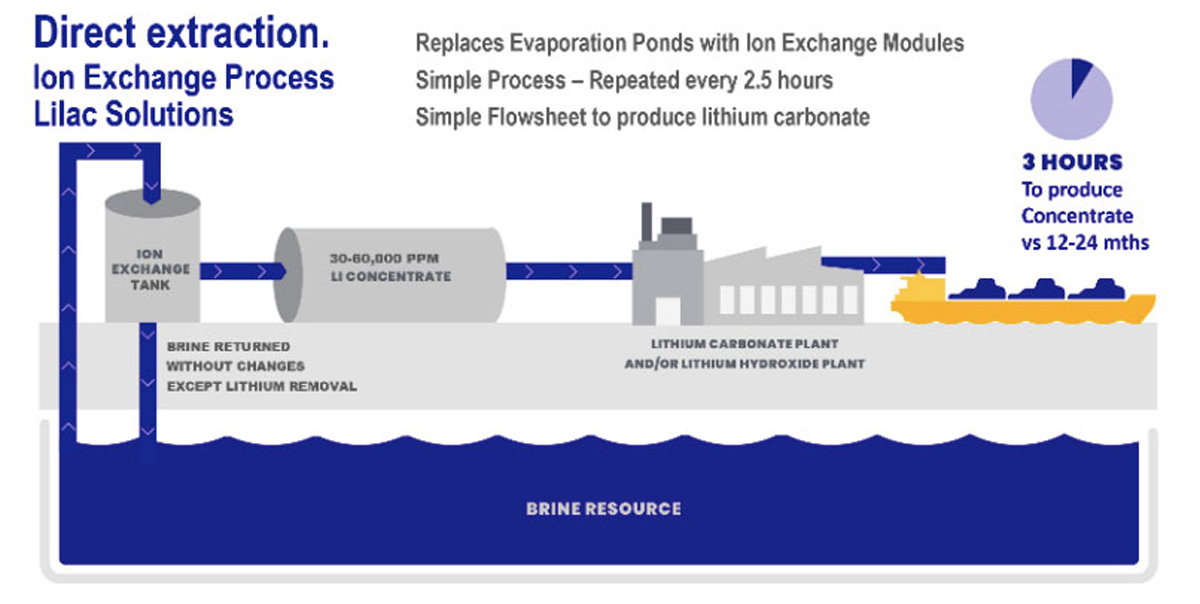

The company is proposing a revolutionary direct extraction technology to recover high-purity lithium products from its Kachi project, (JORC resources of 4.4 million tonnes of lithium carbonate equivalent), as well as three other lithium brine projects in Argentina.

I have a preference for brine over spodumene projects, and LKE is situated in a prime location within the Lithium Triangle, adjacent to five major lithium producers (40 per cent of global lithium is production).

Pilot studies are underway on direct lithium extraction processing (DLE) at Lilac Solutions’ pilot plant (Hazen Research) in the US, targeting battery grade 99.97 per cent lithium carbonate (figure 12).

A bankable feasibility study is in full swing and I am optimistic that the prefeasibility study numbers (25-year mine life, capex of $US544m, post tax NPV8 of $US748m at an internal rate of return of 22 per cent and EBITDA of $US155m in year one of operation) will be exceeded.

At a market capitalisation of around $300m the stock isn’t cheap, but it has the momentum of the “second wave” of lithium interest. It has found itself in the right place at the right time with a potentially superior processing technology that could propel the company into the lowest cost quartile of lithium carbonate producers.

There is still risk associated with brining new technology online, however with scalability of tanks not a major issue, I am cautiously optimistic on this one.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.