Is this uranium’s renaissance or another false dawn?

Pic: Stockhead/Getty

An existing structural supply deficit in the global uranium market, aggravated by ongoing COVID-19 supply disruptions, has sent the uranium ‘spot’ price up +30 per cent year-to-date. Is this an isolated blip or the start of a more sustainable price move?

A depressed uranium market has been on the threshold of a major recovery for years but has yet to make the leap. That could be about to change.

Brandon Munro is chief executive at advanced uranium play Bannerman Resources (ASX:BMN). He is also co-chair of the World Nuclear Association’s nuclear fuel demand working group.

He believes the substantial supply disruptions from large global producers like Cameco (Canada) and Kazatomprom (Kazakhstan) in 2020 “will act as an accelerant on a fire that was already stacked with very dry kindling”.

“I say that because the fundamentals have already been demanding a uranium price correction in the absence of COVID-19 disruption,” Munro says.

“The longer the production disruptions go for, the more ‘acute’ that price discovery process will be.”

For the last couple of years, the sector has been running at a structural deficit.

Large uranium inventories – acquired a few years back when Kazakhstan was overproducing – are one of the reasons prices have stayed so low.

But those inventories are running down.

“In rough number terms, total uranium consumption around the world last year was about 180 million pounds (mlb),” Munro says.

“Of that, 135mlb was produced by mines, 25mlb was drawn out of secondary supplies, and 20mlb came from utilities drawing down these old inventories.

“In other words, the amount of uranium that has been mined in the world – even when added to secondary supply of uranium – is still less than consumed in nuclear power plants globally.

“So far, the deficit has been made up by utilities drawing down on inventories. That is a situation that can’t carry on for much longer.”

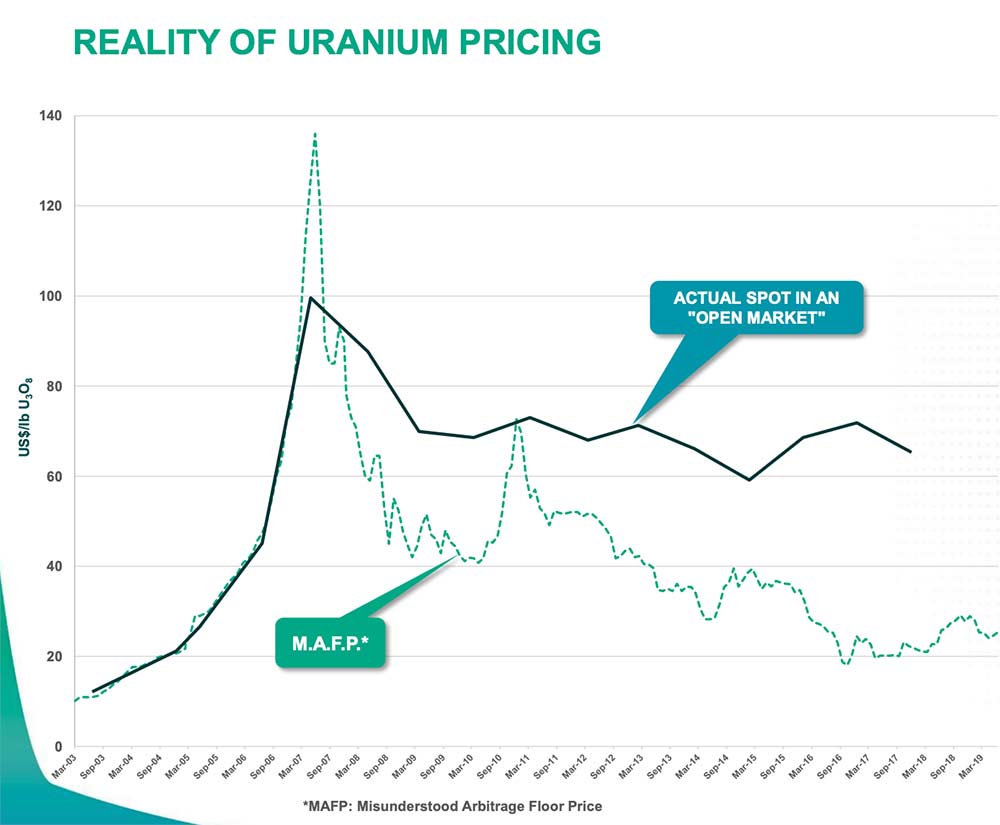

Until recently, the fundamentals show a ‘spot price’ that is consistently trading below the average cost of production for most of the world’s uranium supply.

It’s important to note that spot prices in the uranium sector aren’t an accurate reflection of privately negotiated ‘contact’ prices between producers and utilities, which represent the bulk of the market.

Fellow near-term producer Vimy Resources (ASX:VMY) calls it ‘MAFP’ – Misunderstood Arbitrage Floor Price:

Still, prices must go up substantially to encourage much-needed supply to enter the market, Munro says.

Furthermore, if the next set of long-term contracts — generally signed by utilities +3 years ahead of use — aren’t high enough to sustain production, then current production will drop off without new mines coming in to replenish lost production.

Add to this steady growth in nuclear power demand over the next +20 years.

The US still has the largest number of operable reactors in the world – 96 of 441 globally in April 2020, but countries like China are building new nuclear power plants at a much faster rate.

Globally, 164 new reactors are planned to be built or are currently under construction.

“To put China’s domestic ambitions into context, their domestic nuclear power sector could consume more uranium in 2040 than the total amount of uranium mined globally last year,” Munro says.

“2040 is ‘around the corner’ in nuclear power terms.

“That voracious Chinese appetite is going to spark tremendous potential price distortion in the uranium market, because key markets in the US, Europe, Russia, India, the Middle East and Asia will have no choice but to compete with China to power their economies.”

Which ASX players have first mover advantage?

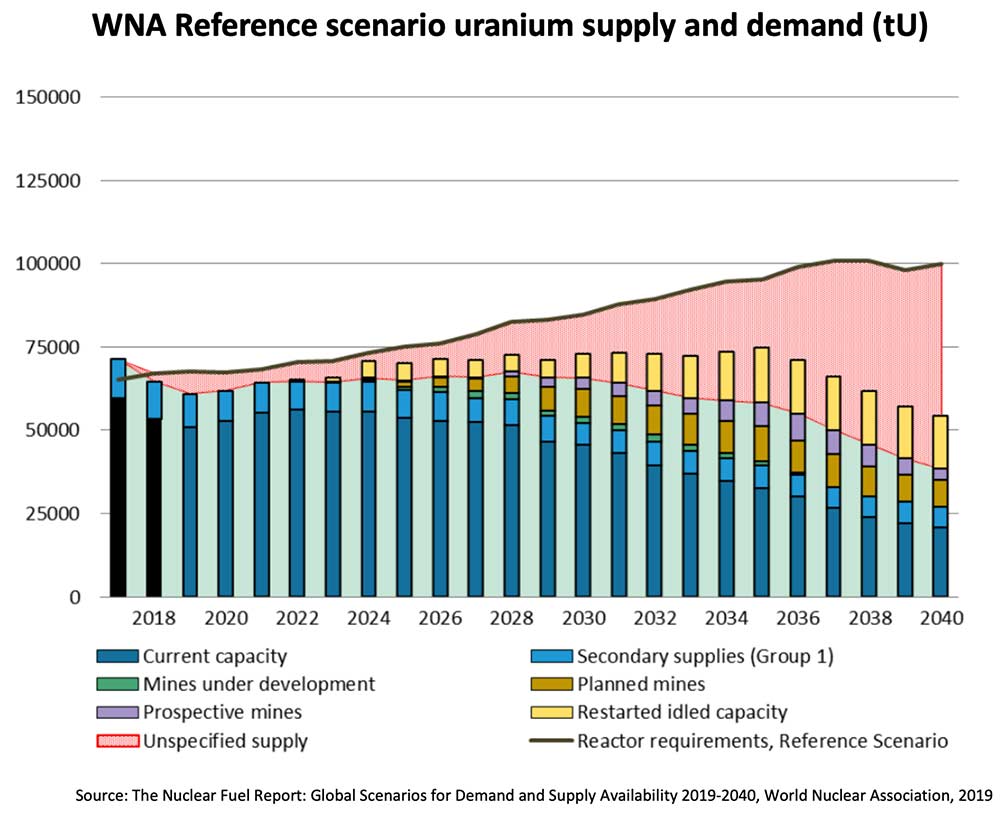

Above is the World Nuclear Association reference case for supply and demand.

We can see how current mine supply (dark blue) really starts to fall off from 2025, with depletion becoming critical in 2028.

Right now, there are only 10 deposits in the world that are either mothballed mines (4), or projects that are planned that could come online anytime soon (6).

Planned projects (brown) include Bannerman’s mammoth Etango project in Namibia, Vimy’s Mulga Rock project in Western Australia, and Boss Resources’ (ASX:BOE) Honeymoon project in South Australia. Idled projects (yellow) would include Paladin Energy’s (ASX:PDN) Langer Heinrich operation in Namibia.

Guys like Bannerman, Vimy, Paladin, and Boss have all been progressing these projects during uranium’s ‘dark days’ and are now ready to benefit.

“No matter how good your grade is, or how great your economics are, if you can’t make producible pounds into the next cycle you won’t take advantage of the likely overshoot we are going to see and your opportunity to generate ‘super profits’ is lost,” Munro says.

First mover advantage is especially important in this sector. There is one main reason for that, Munro says – permitting times.

“Uranium is a beast unto itself when it comes to winning political, community, and environmental support,” he says.

“When Cameco’s Cigar Lake [deposit] was discovered it was the most exciting, high-grade discovery of any commodity in the world.

“It still took 35 years to come into production.

“The timeframes are glacial in this sector, so having government, environmental and social permitting [in place] is crucial.”

But even if every mothballed mine comes back online and all these advanced projects are developed, there remains a big area of ‘unspecified supply’ (above in red).

No one knows where that uranium supply is going to come from.

“In the absence of a substantial and prolonged price response that can incentivise new production, we are heading towards a deep, deep structural deficit,” Munro says.

“The current nuclear power fleet provides carbon free, baseload energy for 11 per cent of global electricity requirements and represents hundreds of billions of dollars of investment.

“Given the cost of U3O8 only represents around 6 per cent of the cost of producing nuclear power, allowing reactors to run out of fuel is impossible to imagine.”

That’s why Munro believes a “suitable price response” is inevitable.

Make US uranium ‘Great Again’

Over the past 12 months, the Trump Administration has shown a strong desire to revive the domestic uranium industry to reduce its overwhelming reliance on imported uranium.

While there aren’t many surprises in the late April report from the US Nuclear Fuel Working Group (NFWG), the recommendations add momentum to an already bullish outlook for uranium. Investors have been rewarding US based companies like Peninsula Energy (ASX:PEN), and early stage explorers GTI Resources (ASX:GTR) and TNT Mines (ASX:TIN).

Utah-based GTI and TNT are up 480 per cent and 245 per cent over the past month, respectively.

GTI exec director Bruce Lane says the US Department of Energy’s first move has been to incentivise US miners and processors with a $1.5bn purchasing program over 10 years.

“This will need to be at an incentive price of at least $US60 per pound if anyone is going to get out of bed to supply into it,” he says.

The explorer is embarking on a maiden drilling program in July.

“We are drilling past producing properties with known metallurgy that are within trucking distance to the White Mesa Mill at Blanding in Utah — the only operating ore processing mill in the US,” he says.

“We think they’re very interesting especially considering the very good grades we’ve identified so far.”

TNT Mines had also inked a deal to acquire the historic high-grade East Canyon uranium and vanadium project in Dry Valley/East Canyon mining district, Utah.

TNT executive director Brett Mitchell says the US government is taking the initiative to ‘cornerstone’ the domestic nuclear power sector. Uranium projects in the US will be the obvious beneficiary.

“East Canyon is just up the road from the only conventional fully permitted and operational uranium and vanadium mill in the US [White Mesa] and located in one of the most productive uranium belts in the world,” he says.

“The mining of these types of deposits and the processing of the ore is known and understood, and there is world-class infrastructure and knowledgeable local workforce to support us.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.