Indonickel is setting sail for the battery market, but even that may not be enough for the growing EV sector

Pic: Getty

We need a whole lot more nickel than we currently mine to fill the order books of the world’s electric carmakers.

That has brought Indonesia, previously seen as a class 2 nickel-only sort of jurisdiction, into play as an EV metals hub.

While Indonesia’s unfathomably fast growing nickel pig iron producers – including Australia’s own Nickel Mines (ASX:NIC) – have cornered the stainless steel supply market, it was long thought there were too many challenges for them to compete with the Aussies and other nickel sulphide producers in the battery space.

Last week Morowali port saw off its first shipment of more than 9500t of nickel and cobalt hydroxide products from Huayou Cobalt’s operations in the South East Asian nation, headed straight for China’s Ningbo port.

Following from Tsingshan’s successful delivery last year of battery grade nickel matte from its operations in Indonesia, Benchmark Minerals Intelligence forecasts the supply of mixed hydroxide products for batteries will grow five-fold this year.

That sort of growth seems large in year on year terms, but when you consider demand for the NCM style batteries which have high nickel chemistries will rise 42% this year on rising EV sales, it’s easy to understand why it’s happening.

Will this hit nickel prices?

Demand for nickel in batteries has risen sharply in recent years and provided upside to nickel prices subdued by the rise in cheap class 2 supply from Indonesia five or so years ago.

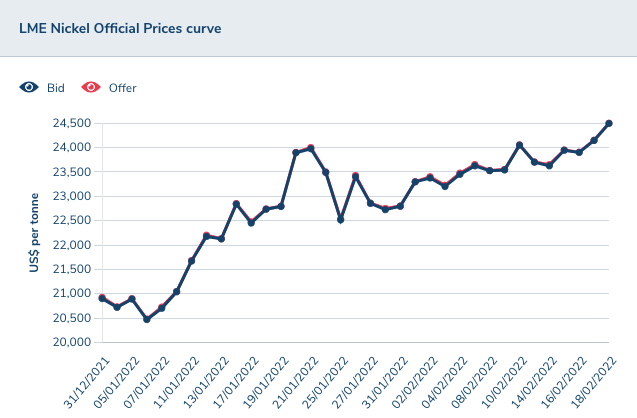

They are now up around the US$24,500/t mark, with the world’s primary metal storage warehouse the London Metal Exchange holding just 83,000t in stock last Friday, levels verging on critically low.

It was previously assumed the 300,000tpa and growing battery market, around 12% of global nickel demand in 2021, would lean heavily on class 1 nickel sulphides converted into nickel sulphate chemicals for battery nickel supply.

Indonesia’s move into the space threatens to put the cat among the pigeons so to speak, with BMI saying it is “expected to alleviate the rising demand for nickel in electric vehicle batteries.”

It is hardly a new product for battery supply either. Australian nickel laterite mines like Glencore’s Murrin Murrin and First Quantum’s Ravensthorpe have delivered a similar product for years.

However, the Australian mines took years to hit nameplate capacity and, in Ravensthorpe’s case, are struggling to breakeven even at today’s strong pricing levels.

If Chinese miners in Indonesia have one ace up their sleeve, it is that they will sit a lot lower on the cost curve and have ready made supply chains.

Will rising Indonickel supply have a dulling effect on effervescent price rises so far in 2022?

It is hard to say. Experts maintain the reality is nickel laterites will be required to service the battery nickel market. Indonesia is the world’s only true growth market, and as much as 1Mt of new nickel could be needed by 2030 to fill rising EV orders from carmakers like Tesla and VW.

Renowned nickel expert Jim Lennon, Macquarie Bank’s head consultant in the area, told Stockhead last month the most nickel sulphide supply and smelting capacity is likely to rise is around 200,000t.

Some in the industry believe premiums or demand preferences could come for nickel sulphides for two reasons. Primarily, they want a non-Chinese supply chain, but there are also doubts over the ESG oversight of Indonesian mines when it comes to carbon emissions and pollution.

The threat of war between Russia and Ukraine and potential sanctions against Russia have always raised prospects of more nickel supply issues. Russia’s Norilsk is the world’s top nickel sulphide producer.

Any nickel news yesterday?

Azure Minerals (ASX:AZS), which notably has the backing of billionaire prospector and human metal detector Mark Creasy, says resource drilling is done at its Andover nickel-copper project in WA’s north.

Like the end of an exam the pens are down, the test is over and now we wait patiently for our results to come back.

Owned in a 60-40 JV with Creasy Group, the Andover project south of Roebourne has been subject to more than 40,000m of diamond drilling since Azure took it on in mid 2020.

Results from the final drill assays ahead of the resource announcement later this quarter included 3.7m at 2.73% Ni, 0.42% Cu & 0.12% Co from 258.1m in infill drilling on the western side of the Andover deposit and 17.9m at 1.57% Ni, 0.79% Cu & 0.08% Co from 266.8m in extensional drilling.

Speaking of Creasy, who famously pegged swathes of the Fraser Range where the Nova-Bollinger nickel mine was discovered while fossicking for wreckage from the Skylab crash near Esperance, also has a big stake in Galileo Mining (ASX:GAL).

Run by former Creasy lieutenant Brad Underwood, Galileo is searching for nickel out on the range where EM conductors have been identified and the explorer hit anomalous low grade nickel a couple years ago.

Galileo is planning to put around 1000m of RC drilling into the Empire Rose prospect 30km south of Nova at the bottom end of the Fraser Range, with a campaign due to start this month.

“We are looking forward to the start of our first drill campaign of the year and anticipate having preliminary geological results approximately two weeks after the commencement of drilling,” Underwood said.

“A market update will be provided at that time and full assay results are expected to be returned from the laboratory in April/May 2022.”

Adavale Resources (ASX:ADD) meanwhile has announced that it has closed an arrangement that will give it exclusive rights to explore the Luhuma project adjacent to its Kabanga Jirani nickel project in Tanzania.

The farm in deal will add 99km2 to Adavale’s tenement package in Tanzania, taking its total exploration ground in the African nation to 1243km2.

It comes shortly after BHP (ASX:BHP) announced a deal to take a stake in the large-scale Kabanga nickel project nearby, owned by Kabanga Nickel, in a US$50m initial investment.

Ironically, BHP already drilled holes into the Luhuma project when it was exploring on its own in Tanzania in the 1990s.

“Adavale considers the scale of the opportunity we are looking to realise for the Company on our licences justify the current level of planning and preparation for drilling and will give Adavale the best chance of a significant discovery,” exec director David Riekie said.

“We now are looking forward to exploration success, building on these important workstreams as part of our planned activities for 2022.

“Adavale like many others have welcomed the re-emergence of BHP in Tanzania taking a strategic stake in our neighbour, having been the early mover in the exploration of the region some decades ago.”

Nickel explorers share price today:

At Stockhead, we tell it like it is. While Adavale Resources and Azure Minerals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.