How GTI Resources got its pieces in all the right places

Pic: Tyler Stableford / Stone via Getty Images

Special Report: GTI Resources had a double dose of good news the day it announced it had dropped the first reverse circulation drill hole into its Niagara gold project in the Eastern Goldfields this week.

Developments at the project in the Kookynie region of Western Australia have taken much of GTI Resources’ (ASX:GTR) attention in 2020.

Located in the right postcode on the Norseman-Wiluna belt, Niagara seems to be the sort of gold project that those in search of gold projects are looking for – highly prospective with numerous historical workings scattered throughout, but largely untested to modern standards.

The newsflow from Niagara over the last six-to-nine months has been ongoing and positive – here’s a brief rundown.

Aeromagnetic surveying kicked off in July, buoyed by spectacular hits from neighbours Metalicity and Nex Metals at their JV Kookynie project 4km to the north.

GTI’s rights to explore the area were extended to 2025 that same month, and in August it picked up an additional three prospecting licences to further its landholding.

Aeromagnetic results then arrived, allowing GTI to define and map potential north-trending structures which would ultimately lead it to a 1000-hole field sampling program.

Five new gold targets were identified in this program, and aircore drill rigs were brought in which intersected encouraging quartz vein structures.

This testing would ultimately confirm gold anomalies, with assays returning a peak result of 2.78 grams per tonne gold and suggestions of a potential relationship between low-grade bismuth, tungsten and tellurium on the project.

The culmination of all this work, the RC rigs are now on the ground at Niagara.

“Obviously this drill program is our main activity for the year,” GTI executive director Bruce Lane told Stockhead.

“That sets us up for hopefully some good news in the early part of next year. We’re hopeful of some more granted tenements, and then if things go well an expansion of exploration activities there at Kookynie.”

Important developments. But as a multi-commodity play, some news out of the United States over the weekend further bolstered GTI’s day.

Maximum power

The news was of course the bipartisan passage by the US Senate Committee on Environment and Public Works of a uranium reserve bill which advances a federal initiative to establish a US national strategic uranium reserve.

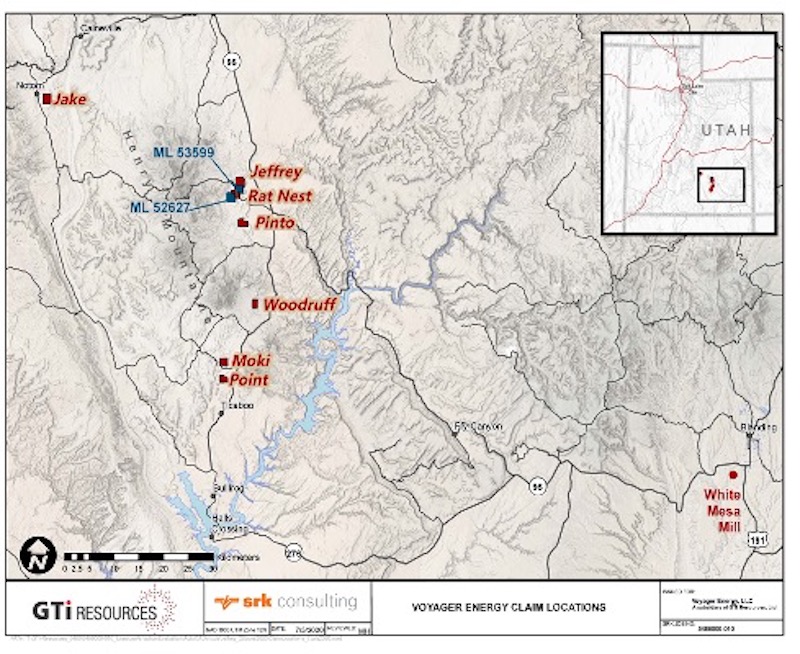

It just so happens that GTI’s other project is the Henry Mountains uranium and vanadium project in Utah – part of the Colorado Plateau uranium province which has historically provided the most important uranium resources in the United States.

The government plan for a uranium reserve is expected to pump significant cashflow – said to be in the order of US$1.5 billion (US$150 million per annum for 10 years) – into a domestic market, for so long stagnant, in exchange for yellowcake.

In the Henry Mountains, GTI is sitting on territory highly prospective for near-surface uranium and vanadium mineralisation with access to extensive historical data.

In October, GTI announced plans to acquire further ground in the region which would connect its Jeffrey and Rats Nest claim groups across a 5.5km contiguous interpreted mineralised trend.

Lane said that waiting for settlement of the acquisition of new land had meant newsflow from Utah was less than that for WA for parts of 2020.

“There’s been a natural hiatus because we acquired that very significant land package from Anfield Energy which joined up the strike between two of our most prospective pieces of ground,” he said.

GTI is currently refining the exploration program for its new uranium territory, in anticipation of permitting with a goal of kicking off exploration in the new year.

Lane said the developments out of the US Senate represented huge news for aspiring uranium producers in the states – committing funds to the commodity while highlighting a positive shifting sentiment around a commodity which has for so long been severely in doldrums.

“Uranium mining and processing in the states has all-but died – it’s really been obliterated,” he said.

“But these latest developments are extremely positive, and the sentiment around uranium is improving at the moment.

“There’s been shutdowns at Cigar Lake, McArthur River, [Kazakhstani uranium producer] Kazatomprom has pulled back production to 20% of output and ERA’s Ranger uranium mine in Australia is closing in about a month’s time by the end of January 2021.

“There’s been a very significant and obvious tightening of supply against a backdrop of very obvious growing demand. That can’t go on forever without a uranium price response, otherwise there will be no uranium because there’s no incentive to produce it.

“Nuclear power makes up 50% of US domestic green energy supply – we think the US understands that there’s a real strategic need for them to have their own uranium supply and not rely on Kazakhstan and the like.

“We think the future is very bright for the uranium mining and processing industry, particularly in the US, it really is just a matter of time.”

Around the time it hopes to kick off exploration on its newly acquired uranium ground in Utah in February, GTI expects to receive assays from the gold drilling now underway at Niagara.

If this week’s developments are anything to go by, there could well be plenty more big news days on the horizon as GTI heads into the new year.

This article was developed in collaboration with GTI Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.