Resources Top 5: ASX uranium stocks are heating up

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Here’s your top ASX small cap resources winners in morning trade Monday, December 7.

A uranium boom is well overdue, if you believe the experts.

On Friday, a Senate Committee in the US – the world’s nuclear powerhouse — gave it a kick along, approving a bill advancing the creation of a US national strategic uranium reserve.

Uranium from companies owned, controlled, or subject to jurisdictions in Russia or China cannot participate.

Which is good news for our cabal of ASX-listed companies.

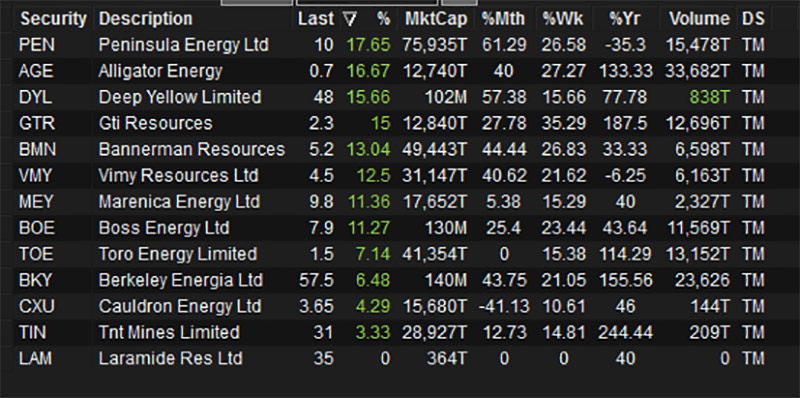

It’s green almost across the board in morning trade Monday:

US based Peninsula Energy (ASX:PEN) – which is up almost 20 per cent in early trade – reckons it will be just six months to production once it presses the button on the restart of its Lance project.

Aussie uranium explorer Alligator Energy (ASX:AGE) has high grade resources in the Northern Territory and South Australia; it acquired the latter in October.

Other uranium companies flying today include Africa-focused Paladin Energy (ASX:PDN), Lotus Resources (ASX:LOT) and Bannerman Resources (ASX:BAN) – companies that can ostensibly get into production quickly once prices improve to a certain level.

Paladin is a former producer at the Langer Heinrich mine in Namibia, which has been on care and maintenance but is ready to relaunch.

The company’s timetable envisages a restart of production by mid next year, with a fairly modest capital outlay of around $80m.

Lotus’ Kayelekera project in Malawi – purchased from Paladin in March – will cost just $US50m to get up and running, the company says.

Bannerman’s Etango-8 project in Namibia has been ‘reimagined’ as smaller scale mine initially, but with the ability to ramp up production as demand improves.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.