High Voltage: 2023’s ‘lithium enema’ means a healthier market by H2 2024, says Mr Lithium

Pic via Getty Images

- We can’t get enough of Joe ‘Mr Lithium’ Lowry’s insights at the moment. He’s predicting good things in 2024 after a lithium supply ‘enema’ in 2023

- Meanwhile, both he and Aussie think tank Climate Energy Finance believe reports of EV sales slowdowns aren’t entirely on the money

- ASX battery metals stocks led so far this week by: PAM and EUR

*Headline has been adjusted to reflect Joe Lowry’s statement that the so-called ‘lithium enema’ happened last year, with benefits to flow through the market in 2024. Cheers for the heads up Joe.

Right then… 2024. What’s in store? An abundance of overstocked lithium still hanging about? Or is that narrative, driven by reportedly weakened EV sales which helped keep spot prices suppressed for much of 2023, set to change? There are whispers here and there that it is.

Strategic mergers and optimistic longer term projections by various analysts certainly suggest a lithium price recovery in 2024 could be on the cards.

As you may have seen, Stockhead caught up with Joe “Mr Lithium” Lowry just before Christmas to get some of his nuanced, always forthright takes on the global lithium market.

One of the main takeaways from that, and a headlining one at that, was that Lowry expects the lithium supply/demand issues to balance out in 2024, with spot prices finally hitting their bottom by H2.

You can read about that and more here, as well as other bottoming-out punditry from various other experts in our Eye on Lithium roundup.

But in an even more detailed follow-up, the legendary lithium pundit has posted this week (on X, LinkedIn and the Global Lithium website) his annual take on the sector – “Lithium 2023 Recap and Thoughts on 2024”.

Happy New Year! Yesterday I posted my annual take on the #lithium year past – page 1 of my 5 page summary of 2023 is below. The entire document can be found on my Linked In page or https://t.co/WuSfVzGJjV $LAC $LAAC $ALB $XOM $SLI $PLS $SGML $SQM $LTHM $AKE $LTR $PMET pic.twitter.com/WeIikr0fXt

— Joe Lowry (@globallithium) January 1, 2024

We’ll delve into that further in a sec, but first, a check in on said spot pricing and further battery metal performance, courtesy of Lithium Price Bot…

Hang on, there’s not much that’s new to show yet until market data becomes available again, but it turns out the Lithium Price Bot X account was tentatively calling for a bottom just after Christmas, based on recent rebounding Li carbonate futures.

That might be a tad premature, but some positive signs there nonetheless.

Bottom? https://t.co/l4udqRWTLo

— Lithium Price Bot (@LithiumPriceBot) December 26, 2023

And look, here’s another well known lithium commentator and bullish believer, Howard Klein, who notes:

“Lots of green among producers & large developers in December – leading indicator for near-term spot price rebound? Short squeeze underway? Time will tell.”

And…

“The niche lithium industry remains nascent and immature – prone to tantrums like any adolescent. I will continue my same bet since 2015 that this irreplaceable element – the most upstream segment of the supply chain – will remain the key bottleneck across the entire EV supply chain for many, many years.”

*NEW #RKEquity #Lithium Scoreboard, December 31, 2023*

Lots of green among producers & large developers in December – leading indicator for near-term spot price rebound? short squeeze underway? Time will tell.

Lots of green too amongst the 3-year and 5-year columns – some 20,… pic.twitter.com/bZ0W6Pqw3Y

— Howard Klein (@LithiumIonBull) January 1, 2024

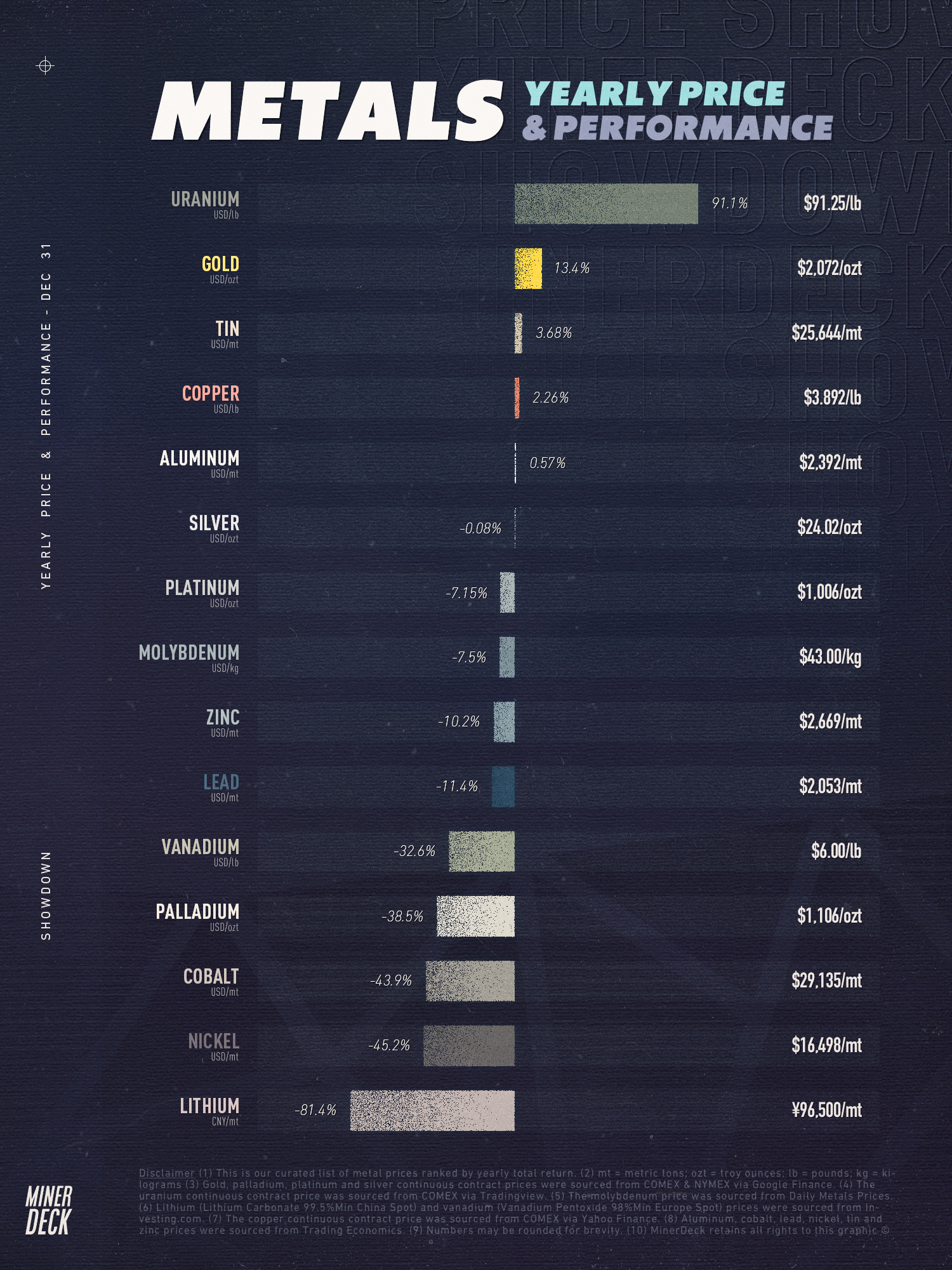

And here’s Miner Deck, bringing the reality check with the yearly price performance of lithium completely underperforming all of its metallic compadres and rivals. (Congrats, uranium sector investors, by the way. Well played.)

Buy when there’s blood in the streets? That’s certainly a hell of a lot of bleeding out.

More from Mr Lithium

Back to Joe Lowry. Why all the Lowry love lately? Well, partly because he gave up his time for us recently, but also because this columnist has certainly learned quite a lot from his analysis.

The whole thing’s worth a read, but we’ve pulled out some highlights from his annual bead on the lightest of all metals and its market performance in 2023 and outlook for 2024…

A lithium enema

“Three years ago in late December, I called 2020 the year of the ‘lithium enema’ where the lithium ion battery supply chain was ‘cleaned out’ of excess inventory. I think the same applies to 2023 although the circumstances are a bit different,” writes Lowry.

Lepidolite isn’t the only overstocked material

“From my perspective, much of the excess lithium supply in 2023 was excess production of cathode and cells in 2022 while the China market was bidding up spodumene and lithium chemicals to nose bleed levels,” Lowry continues.

“Drawing the inventories down in 2023 slowed the purchase of lithium raw material dramatically especially in the first half of the year. The steep decline in the China spot price is the natural result. I have witnessed similar cycles in the battery supply chain since the 1990s.”

Price check – bring Japan and Korea into the equation

“Many see the China spot as the only meaningful price benchmark,” writes Lowry. The fact that the main contract price markets – Japan and Korea – saw higher average prices for 2023 than 2022 should cause people to reevaluate how they think about price. Layer on the fact that in their latest quarterly earnings report the world’s largest lithium producer, Albemarle, also says their 2023 prices will be higher than 2022.”

South America is interesting

Mr Lithium notes that “despite all the buzz about Chinese lepidolite supply and hype about how fast Africa will grow, I tend to follow what is happening in South America with more interest.”

He points in particular to the LAAC & Ganfeng JV project Cauchari in Argentina, as well as Brazilian hard rock projects, such as Sigma’s, which began shipping spod this year.

And… “Probably the biggest story in South American brine was the MOU announced a few days ago between SQM and Codelco (representing the Chilean government). Should the MOU turn into executed agreements, it paves the way for increased production in the Atacama.”

The Aussie/WA scene

Regarding Gina Rinehart and Hancock Prospecting’s moves into the lithium landscape, Lowry poses the question: “Will Gina continue to dabble or begin to build a lithium empire?”

Meanwhile, on another Aussie mining titan, Mineral Resources (ASX:MIN)… “Chris Ellison has clearly stated he is making up his strategy as he goes along. It shows. I enjoy watching his moves but his desired end game isn’t clear to me. A Min Res move into brine would be an interesting statement. From my perspective, the performance of Mt. Marion & Wodgina brings Min Res lithium operational prowess into question but I wouldn’t bet against Chris Ellison and I remain a Min Res shareholder.”

Lowry says his largest WA shareholding, though, remains Pilbara Minerals (ASX:PLS):

“I look forward to seeing how they move to mid and downstream. I am hoping market conditions in 2024 lead to a dusting off of the BMX before year end but I am not predicting it.”

And others ASX stocks deemed worthy of a mention from the Global Lithium Podcast host include Liontown Resources (ASX:LTR):

“I was happy to see Liontown remain independent, was impressed by the project team when I visited Kathleen Valley and will continue to watch the build with interest.”

And Allkem (ASX:AKE), albeit not so positively…

“From my perspective the Allkem merger with Livent brings two companies that couldn’t fulfill their promise as independents into a combined entity that will struggle to show the promised synergy… Both companies have been talking a good expansion game for years with precious little to show for it.”

‘EV sky is falling’ press needs more nuance

This is something Lowry mentioned when we caught up with him recently. We can only hope he wasn’t including Stockhead in this…

“For the most part, the western press has not done a good job of understanding the lithium, battery or EV markets globally,” believes Lowry. “None of the legacy US automakers are serious players in the EV market despite their bold announcements.

“Recently both GM and Ford have made downward adjustments to their fanciful long-term plans. The mainstream press seized upon these announcements to declare a downturn in EV sales when, in fact, globally EVs sales grew from ~10.5 million units in 2022 to almost 14 million units in 2023.

“Tesla and BYD currently dominate the EV landscape. Neither GM nor Ford have a top ten selling EV globally. Negative market sentiment towards lithium stocks was exacerbated by the ‘EV sky is falling’ narrative.”

Aussie think tank agrees

And just adding to that EV sales performance take from Joe Lowry, Tim Buckley, director of Aussie think tank Climate Energy Finance, agrees.

Per a LinkedIn post referring to the biggest car market and EV car market in the world – China, which has the No. 1 EV car company by volume (BYD), he wrote:

“Mis-information on EVs is rife.

“BYD sales volumes in CY2023 were up an impressive 62.3% year-on-year (yoy) to 3.024 million. And for the month of December 2023, new energy vehicle sales were +62.2% yoy.

This is a slowdown from 98% yoy growth to 1.26 million units reported in 1HCY2023. But having nearly tripled sales in CY2022, BYD consolidated by growing only another 62% yoy for the last 12 months! Not quite a consumer led backlash to lower prices and improved quality.

“Most firms and industries, not to mention investors, would kill for a 62% yoy increase in volumes. And BYD commercial vehicle sales volumes grew 88% yoy in CY2023.”

ASX battery metals form guide:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop. (Note: figures accurate per ASX at 4pm Jan 3.)

Stocks missing from this list? Email [email protected]

| Code | Company | Price | % Week | % Month | % Year | Market Cap |

|---|---|---|---|---|---|---|

| PVW | PVW Res Ltd | 0.045 | -6% | -8% | -55% | $4,867,429 |

| A8G | Australasian Metals | 0.15 | -12% | -12% | -21% | $7,818,074 |

| INF | Infinity Lithium | 0.1 | 6% | 0% | -17% | $44,408,841 |

| LPI | Lithium Pwr Int Ltd | 0.5575 | 2% | 2% | 27% | $353,852,270 |

| PSC | Prospect Res Ltd | 0.09 | 1% | 3% | -25% | $40,773,213 |

| PAM | Pan Asia Metals | 0.2 | 60% | 33% | -51% | $26,011,601 |

| CXO | Core Lithium | 0.265 | 2% | -2% | -74% | $576,972,597 |

| LOT | Lotus Resources Ltd | 0.29 | -6% | 0% | 41% | $517,359,269 |

| AGY | Argosy Minerals Ltd | 0.1375 | 6% | -17% | -76% | $203,639,087 |

| AZS | Azure Minerals | 3.7 | -1% | -6% | 1544% | $1,697,114,428 |

| NWC | New World Resources | 0.04 | 5% | 0% | 18% | $97,545,158 |

| QXR | Qx Resources Limited | 0.024 | -4% | -20% | -43% | $26,641,868 |

| GSR | Greenstone Resources | 0.008 | 14% | -11% | -75% | $10,944,908 |

| CAE | Cannindah Resources | 0.1 | 0% | 10% | -58% | $53,183,356 |

| AZL | Arizona Lithium Ltd | 0.0295 | -8% | -24% | -52% | $110,186,126 |

| RIL | Redivium Limited | 0.005 | 0% | -38% | -74% | $16,385,129 |

| COB | Cobalt Blue Ltd | 0.2375 | 6% | -18% | -59% | $90,149,095 |

| ESS | Essential Metals Ltd | 0 | -100% | -100% | -100% | $135,278,382 |

| LPD | Lepidico Ltd | 0.0085 | 6% | 0% | -47% | $53,468,156 |

| MRD | Mount Ridley Mines | 0.002 | 0% | 33% | -60% | $15,569,766 |

| CZN | Corazon Ltd | 0.016 | 7% | -6% | -24% | $9,849,566 |

| LKE | Lake Resources | 0.13 | 4% | 0% | -84% | $192,030,035 |

| DEV | Devex Resources Ltd | 0.31 | 29% | 27% | 11% | $123,533,388 |

| INR | Ioneer Ltd | 0.1475 | 9% | 2% | -61% | $316,711,822 |

| AVZ | AVZ Minerals Ltd | 0.78 | 0% | 0% | 0% | $2,752,409,203 |

| MAN | Mandrake Res Ltd | 0.043 | -2% | 8% | 8% | $25,861,917 |

| RLC | Reedy Lagoon Corp. | 0.005 | 0% | -17% | -48% | $3,097,704 |

| GBR | Greatbould Resources | 0.064 | -3% | -3% | -29% | $39,513,356 |

| FRS | Forrestaniaresources | 0.028 | 0% | -10% | -80% | $4,610,894 |

| STK | Strickland Metals | 0.105 | 22% | -46% | 163% | $163,177,312 |

| MLX | Metals X Limited | 0.285 | 2% | 10% | -26% | $258,570,829 |

| CLA | Celsius Resource Ltd | 0.012 | -8% | -14% | -25% | $26,952,620 |

| FGR | First Graphene Ltd | 0.069 | -1% | 1% | -39% | $45,329,669 |

| HXG | Hexagon Energy | 0.012 | 0% | 33% | -29% | $6,667,907 |

| TLG | Talga Group Ltd | 0.785 | 1% | -19% | -44% | $303,803,338 |

| MNS | Magnis Energy Tech | 0.042 | 0% | -13% | -89% | $50,378,922 |

| OZL | OZ Minerals | 0 | -100% | -100% | -100% | $8,918,404,433 |

| PLL | Piedmont Lithium Inc | 0.415 | -2% | 8% | -36% | $154,407,456 |

| EUR | European Lithium Ltd | 0.11 | 53% | 51% | 49% | $153,366,309 |

| BKT | Black Rock Mining | 0.081 | 0% | -5% | -40% | $92,174,850 |

| QEM | QEM Limited | 0.2 | 3% | 5% | 11% | $30,278,342 |

| LYC | Lynas Rare Earths | 6.98 | 0% | 10% | -11% | $6,701,758,389 |

| ESR | Estrella Res Ltd | 0.006 | 20% | 0% | -57% | $10,556,231 |

| ARL | Ardea Resources Ltd | 0.475 | 1% | 7% | -33% | $95,553,204 |

| GLN | Galan Lithium Ltd | 0.705 | 28% | 15% | -34% | $258,034,764 |

| JLL | Jindalee Lithium Ltd | 0.94 | 12% | -2% | -50% | $59,280,315 |

| VUL | Vulcan Energy | 2.65 | 3% | 9% | -58% | $483,525,152 |

| SBR | Sabre Resources | 0.032 | 10% | -11% | -16% | $11,224,752 |

| CHN | Chalice Mining Ltd | 1.56 | -6% | 12% | -75% | $653,458,351 |

| VRC | Volt Resources Ltd | 0.006 | 0% | -14% | -60% | $26,845,694 |

| NMT | Neometals Ltd | 0.2 | 3% | 5% | -74% | $127,651,515 |

| AXN | Alliance Nickel Ltd | 0.043 | -2% | -22% | -53% | $31,211,103 |

| PNN | Power Minerals Ltd | 0.215 | 0% | -10% | -59% | $19,659,623 |

| IGO | IGO Limited | 8.955 | 0% | 7% | -33% | $6,891,137,098 |

| GED | Golden Deeps | 0.046 | -2% | -6% | -49% | $5,314,028 |

| ADV | Ardiden Ltd | 0.185 | 3% | 3% | -39% | $10,940,564 |

| SRI | Sipa Resources Ltd | 0.025 | 0% | 19% | -22% | $5,703,953 |

| NTU | Northern Min Ltd | 0.031 | -9% | -11% | -26% | $183,240,357 |

| AXE | Archer Materials | 0.4 | 11% | 5% | -35% | $105,761,510 |

| PGM | Platina Resources | 0.021 | 0% | -19% | 11% | $13,709,967 |

| AAJ | Aruma Resources Ltd | 0.028 | 8% | -10% | -47% | $5,316,071 |

| IXR | Ionic Rare Earths | 0.026 | 18% | 24% | -21% | $111,293,249 |

| NIC | Nickel Industries | 0.7 | 4% | -1% | -28% | $3,042,925,015 |

| EVG | Evion Group NL | 0.034 | -3% | 3% | -52% | $12,108,572 |

| CWX | Carawine Resources | 0.11 | 0% | 0% | 12% | $25,973,799 |

| PLS | Pilbara Min Ltd | 3.945 | 3% | 9% | 5% | $11,977,682,421 |

| HAS | Hastings Tech Met | 0.755 | -1% | 10% | -79% | $97,671,822 |

| BUX | Buxton Resources Ltd | 0.17 | -3% | -11% | 48% | $31,184,441 |

| ARR | American Rare Earths | 0.16 | 14% | 0% | -16% | $71,427,728 |

| SGQ | St George Min Ltd | 0.035 | 9% | 6% | -49% | $34,444,503 |

| TKL | Traka Resources | 0.003 | 0% | -5% | -52% | $2,625,988 |

| PAN | Panoramic Resources | 0.035 | 0% | 0% | -80% | $103,937,992 |

| PRL | Province Resources | 0.041 | 0% | 0% | -32% | $48,441,219 |

| IPT | Impact Minerals | 0.0115 | 15% | 5% | 64% | $34,376,447 |

| LIT | Lithium Australia | 0.031 | 3% | 7% | -31% | $36,665,750 |

| AKE | Allkem Limited | 9.83 | 0% | 16% | -13% | $6,304,350,967 |

| ARN | Aldoro Resources | 0.125 | 52% | 47% | -22% | $16,827,968 |

| JRV | Jervois Global Ltd | 0.044 | 5% | 5% | -84% | $121,613,431 |

| MCR | Mincor Resources NL | 0 | -100% | -100% | -100% | $751,215,521 |

| SYR | Syrah Resources | 0.64 | 5% | 9% | -69% | $456,230,968 |

| FBM | Future Battery | 0.072 | 0% | -1% | 36% | $37,896,675 |

| ADD | Adavale Resource Ltd | 0.008 | 14% | 0% | -58% | $5,599,414 |

| LTR | Liontown Resources | 1.6525 | 9% | 22% | 25% | $4,081,044,312 |

| CTM | Centaurus Metals Ltd | 0.535 | 15% | 14% | -52% | $262,274,545 |

| VML | Vital Metals Limited | 0.006 | 0% | -40% | -68% | $41,265,469 |

| BSX | Blackstone Ltd | 0.07 | 3% | -16% | -46% | $36,122,683 |

| POS | Poseidon Nick Ltd | 0.0125 | 4% | -22% | -69% | $44,562,417 |

| CHR | Charger Metals | 0.17 | 0% | -31% | -62% | $13,088,586 |

| AVL | Aust Vanadium Ltd | 0.021 | 5% | -9% | -16% | $99,372,136 |

| AUZ | Australian Mines Ltd | 0.009 | -10% | -36% | -83% | $9,450,493 |

| TMT | Technology Metals | 0.24 | 3% | 9% | -31% | $59,757,206 |

| RXL | Rox Resources | 0.18 | -3% | -8% | 3% | $66,483,767 |

| RNU | Renascor Res Ltd | 0.1225 | 2% | -9% | -43% | $317,425,937 |

| GL1 | Globallith | 1.135 | -2% | -11% | -38% | $304,510,400 |

| BRB | Breaker Res NL | 0 | -100% | -100% | -100% | $158,126,031 |

| ASN | Anson Resources Ltd | 0.14 | 4% | -3% | -24% | $186,432,180 |

| SYA | Sayona Mining Ltd | 0.0685 | 7% | 10% | -64% | $720,530,721 |

| FFX | Firefinch Ltd | 0.2 | 0% | 0% | 0% | $236,569,315 |

| EGR | Ecograf Limited | 0.15 | 11% | -10% | -32% | $70,374,932 |

| ATM | Aneka Tambang | 1.18 | 0% | 0% | 31% | $1,538,306 |

| TVN | Tivan Limited | 0.066 | 5% | -15% | -8% | $105,622,220 |

| ALY | Alchemy Resource Ltd | 0.0105 | 5% | 5% | -54% | $12,369,801 |

| GAL | Galileo Mining Ltd | 0.27 | 8% | -2% | -69% | $56,323,104 |

| BHP | BHP Group Limited | 49.91 | 0% | 8% | 9% | $256,174,108,835 |

| LEL | Lithenergy | 0.555 | 2% | -8% | -28% | $58,715,700 |

| MMC | Mitremining | 0.25 | -2% | -4% | -11% | $14,738,783 |

| RMX | Red Mount Min Ltd | 0.003 | 0% | -14% | -40% | $8,020,728 |

| GW1 | Greenwing Resources | 0.125 | 9% | 25% | -55% | $21,781,435 |

| AQD | Ausquest Limited | 0.011 | 0% | -8% | -35% | $9,901,791 |

| LML | Lincoln Minerals | 0.006 | 0% | -14% | -12% | $10,224,272 |

| 1MC | Morella Corporation | 0.005 | -17% | -17% | -58% | $30,893,997 |

| REE | Rarex Limited | 0.028 | 8% | 4% | -48% | $18,451,437 |

| MRC | Mineral Commodities | 0.033 | 3% | 10% | -47% | $32,487,596 |

| PUR | Pursuit Minerals | 0.008 | 7% | -6% | -50% | $23,551,771 |

| QPM | Queensland Pacific | 0.053 | 4% | -5% | -52% | $110,689,717 |

| EMH | European Metals Hldg | 0.41 | -15% | -27% | -36% | $49,903,420 |

| BMM | Balkanminingandmin | 0.105 | -19% | -22% | -68% | $8,524,862 |

| PEK | Peak Rare Earths Ltd | 0.365 | 1% | -1% | -19% | $96,639,867 |

| LEG | Legend Mining | 0.015 | -6% | -17% | -63% | $46,471,635 |

| MOH | Moho Resources | 0.01 | -9% | 5% | -52% | $5,359,412 |

| AML | Aeon Metals Ltd. | 0.01 | 11% | -9% | -63% | $10,964,006 |

| G88 | Golden Mile Res Ltd | 0.019 | 12% | -10% | -7% | $6,587,790 |

| WKT | Walkabout Resources | 0.14 | 8% | -7% | 0% | $90,620,296 |

| TON | Triton Min Ltd | 0.023 | 5% | 10% | -36% | $37,472,631 |

| AR3 | Austrare | 0.15 | 0% | -6% | -63% | $23,124,894 |

| ARU | Arafura Rare Earths | 0.17 | 6% | -13% | -63% | $385,834,498 |

| MIN | Mineral Resources. | 69.57 | 2% | 15% | -10% | $13,784,065,545 |

| VMC | Venus Metals Cor Ltd | 0.1 | -5% | -9% | 27% | $18,972,868 |

| S2R | S2 Resources | 0.155 | -14% | -16% | -9% | $70,037,989 |

| CNJ | Conico Ltd | 0.005 | 0% | 0% | -41% | $7,850,475 |

| VR8 | Vanadium Resources | 0.056 | 0% | 22% | -3% | $30,256,211 |

| PVT | Pivotal Metals Ltd | 0.024 | 9% | 41% | -45% | $16,321,339 |

| BOA | Boadicea Resources | 0.036 | 3% | 0% | -64% | $4,431,251 |

| IPX | Iperionx Limited | 1.405 | 5% | 5% | 104% | $314,016,570 |

| SLZ | Sultan Resources Ltd | 0.023 | 0% | 44% | -73% | $3,408,371 |

| NKL | Nickelxltd | 0.044 | 13% | -27% | -45% | $3,249,161 |

| NVA | Nova Minerals Ltd | 0.36 | 6% | 31% | -47% | $76,974,836 |

| MLS | Metals Australia | 0.037 | 6% | 6% | -17% | $23,713,375 |

| MQR | Marquee Resource Ltd | 0.026 | 4% | -4% | -30% | $11,161,378 |

| MRR | Minrex Resources Ltd | 0.016 | -6% | 0% | -50% | $17,357,880 |

| EVR | Ev Resources Ltd | 0.011 | 22% | 10% | -21% | $12,095,472 |

| EFE | Eastern Resources | 0.008 | 0% | -20% | -72% | $9,935,572 |

| CNB | Carnaby Resource Ltd | 0.75 | -3% | 14% | -20% | $126,205,911 |

| BNR | Bulletin Res Ltd | 0.14 | 17% | -3% | 51% | $41,105,865 |

| AX8 | Accelerate Resources | 0.04 | -7% | -20% | 74% | $23,497,172 |

| AM7 | Arcadia Minerals | 0.073 | -5% | -14% | -64% | $7,960,657 |

| AS2 | Askarimetalslimited | 0.175 | 0% | 0% | -60% | $12,051,283 |

| BYH | Bryah Resources Ltd | 0.013 | -7% | -7% | -49% | $5,636,894 |

| DTM | Dart Mining NL | 0.017 | 6% | 6% | -69% | $3,868,854 |

| EMS | Eastern Metals | 0.036 | 9% | 13% | -51% | $2,967,345 |

| FG1 | Flynngold | 0.051 | 0% | -32% | -49% | $7,577,661 |

| GSM | Golden State Mining | 0.0145 | -3% | -19% | -66% | $4,190,559 |

| IMI | Infinitymining | 0.14 | -10% | 17% | -49% | $16,625,475 |

| LRV | Larvottoresources | 0.072 | -4% | -17% | -49% | $15,299,938 |

| LSR | Lodestar Minerals | 0.004 | 0% | 0% | -20% | $6,070,192 |

| RAG | Ragnar Metals Ltd | 0.023 | -4% | 0% | 101% | $10,901,562 |

| CTN | Catalina Resources | 0.0045 | 13% | 13% | -55% | $5,573,191 |

| TMB | Tambourahmetals | 0.115 | 0% | -28% | 10% | $9,952,842 |

| TEM | Tempest Minerals | 0.008 | 0% | 0% | -65% | $4,091,068 |

| EMC | Everest Metals Corp | 0.08 | -2% | -2% | 1% | $13,062,649 |

| WML | Woomera Mining Ltd | 0.028 | 12% | 17% | 47% | $34,617,142 |

| KZR | Kalamazoo Resources | 0.125 | 19% | 4% | -40% | $20,564,337 |

| LMG | Latrobe Magnesium | 0.062 | 7% | 5% | -19% | $118,480,785 |

| KOR | Korab Resources | 0.018 | 13% | 0% | -40% | $6,606,900 |

| CMX | Chemxmaterials | 0.082 | 17% | 12% | -56% | $4,418,302 |

| NC1 | Nicoresourceslimited | 0.35 | 4% | 21% | -43% | $36,210,196 |

| GRE | Greentechmetals | 0.44 | -4% | -8% | 214% | $29,934,250 |

| CMO | Cosmometalslimited | 0.062 | 0% | 15% | -54% | $2,151,193 |

| FRB | Firebird Metals | 0.14 | -7% | -10% | -10% | $20,642,403 |

| S32 | South32 Limited | 3.39 | 5% | 10% | -15% | $15,263,601,374 |

| OMH | OM Holdings Limited | 0.495 | 10% | 8% | -29% | $367,803,264 |

| JMS | Jupiter Mines. | 0.1725 | 5% | -1% | -22% | $323,318,378 |

| E25 | Element 25 Ltd | 0.405 | 9% | -21% | -54% | $91,362,741 |

| EMN | Euromanganese | 0.098 | -2% | -25% | -72% | $23,670,457 |

| KGD | Kula Gold Limited | 0.015 | 0% | -50% | -40% | $6,290,487 |

| LRS | Latin Resources Ltd | 0.275 | 10% | 53% | 181% | $768,296,705 |

| CRR | Critical Resources | 0.02 | 5% | -13% | -53% | $35,557,006 |

| ENT | Enterprise Metals | 0.004 | 0% | 33% | -60% | $3,207,884 |

| SCN | Scorpion Minerals | 0.032 | -6% | -27% | -54% | $13,102,598 |

| GCM | Green Critical Min | 0.009 | -10% | -10% | -47% | $11,365,850 |

| ENV | Enova Mining Limited | 0.016 | -6% | 78% | 7% | $10,895,799 |

| RBX | Resource B | 0.075 | -4% | -11% | -12% | $6,201,336 |

| AKN | Auking Mining Ltd | 0.048 | 12% | -11% | -50% | $11,056,978 |

| RR1 | Reach Resources Ltd | 0.004 | 0% | -20% | -20% | $12,841,188 |

| EMT | Emetals Limited | 0.008 | 14% | 14% | -20% | $6,800,000 |

| PNT | Panthermetalsltd | 0.06 | 0% | 7% | -68% | $5,101,500 |

| WIN | Widgienickellimited | 0.087 | -11% | -17% | -74% | $25,921,220 |

| WMG | Western Mines | 0.23 | -10% | -18% | 44% | $16,891,637 |

| AVW | Avira Resources Ltd | 0.0015 | -25% | 0% | -50% | $3,200,685 |

| CAI | Calidus Resources | 0.21 | 5% | 5% | -22% | $131,531,381 |

| GT1 | Greentechnology | 0.27 | 8% | -14% | -67% | $87,244,327 |

| KAI | Kairos Minerals Ltd | 0.0145 | -3% | -9% | -31% | $36,692,771 |

| MTM | MTM Critical Metals | 0.071 | 48% | 196% | -10% | $9,148,212 |

| NWM | Norwest Minerals | 0.032 | 19% | 0% | -41% | $9,202,224 |

| PGD | Peregrine Gold | 0.265 | 10% | 2% | -31% | $15,328,676 |

| RAS | Ragusa Minerals Ltd | 0.035 | 6% | -17% | -70% | $5,133,556 |

| RGL | Riversgold | 0.012 | 0% | -25% | -60% | $12,579,599 |

| SRZ | Stellar Resources | 0.008 | 0% | 0% | -38% | $9,192,212 |

| STM | Sunstone Metals Ltd | 0.014 | 0% | -13% | -62% | $48,828,288 |

| ZNC | Zenith Minerals Ltd | 0.145 | -15% | 7% | -45% | $51,095,228 |

| WC8 | Wildcat Resources | 0.6825 | -2% | -8% | 2744% | $807,143,482 |

| ASO | Aston Minerals Ltd | 0.022 | -15% | -27% | -73% | $29,786,478 |

| THR | Thor Energy PLC | 0.03 | 3% | 7% | -50% | $5,581,090 |

| YAR | Yari Minerals Ltd | 0.011 | 22% | -21% | -35% | $5,305,936 |

| IG6 | Internationalgraphit | 0.15 | -3% | -9% | -44% | $12,903,276 |

| LPM | Lithium Plus | 0.345 | 8% | -17% | -7% | $29,665,929 |

| ODE | Odessa Minerals Ltd | 0.008 | 14% | -6% | -47% | $7,576,895 |

| KOB | Kobaresourceslimited | 0.07 | -13% | -9% | -50% | $7,379,167 |

| AZI | Altamin Limited | 0.054 | 4% | 2% | -31% | $23,546,707 |

| FTL | Firetail Resources | 0.077 | 3% | -8% | -52% | $11,465,728 |

| LNR | Lanthanein Resources | 0.011 | 0% | 83% | -48% | $14,832,837 |

| CLZ | Classic Min Ltd | 0.001 | 0% | 0% | -89% | $12,357,082 |

| NVX | Novonix Limited | 0.7225 | 10% | 5% | -51% | $361,662,761 |

| OCN | Oceanalithiumlimited | 0.115 | -4% | -4% | -67% | $6,103,798 |

| SUM | Summitminerals | 0.096 | -13% | -20% | -34% | $4,575,084 |

| DVP | Develop Global Ltd | 2.64 | -8% | -10% | -17% | $672,043,633 |

| OD6 | Od6Metalsltd | 0.14 | -3% | -18% | -58% | $7,702,169 |

| HRE | Heavy Rare Earths | 0.064 | 0% | -29% | -44% | $3,871,228 |

| LIN | Lindian Resources | 0.15 | -3% | -6% | -3% | $172,788,335 |

| PEK | Peak Rare Earths Ltd | 0.365 | 1% | -1% | -19% | $96,639,867 |

| ILU | Iluka Resources | 6.57 | -2% | -4% | -31% | $2,828,854,485 |

| ASM | Ausstratmaterials | 1.33 | 12% | -5% | -7% | $228,505,015 |

| ETM | Energy Transition | 0.039 | 3% | -13% | -37% | $53,202,272 |

| VMS | Venture Minerals | 0.008 | 14% | -27% | -65% | $15,470,091 |

| IDA | Indiana Resources | 0.08 | 25% | 36% | 45% | $46,142,780 |

| VTM | Victory Metals Ltd | 0.2 | -7% | -15% | -9% | $16,279,931 |

| M2R | Miramar | 0.021 | 0% | 11% | -72% | $3,126,260 |

| WCN | White Cliff Min Ltd | 0.0095 | 6% | -14% | -32% | $12,765,593 |

| TAR | Taruga Minerals | 0.013 | 8% | 18% | -46% | $7,766,295 |

| ABX | ABX Group Limited | 0.073 | 1% | 7% | -37% | $18,753,024 |

| MEK | Meeka Metals Limited | 0.037 | -8% | -12% | -46% | $49,388,357 |

| RR1 | Reach Resources Ltd | 0.004 | 0% | -20% | -20% | $12,841,188 |

| DRE | Dreadnought Resources Ltd | 0.029 | -6% | -9% | -72% | $100,893,116 |

| KFM | Kingfisher Mining | 0.16 | 0% | -6% | -66% | $8,862,975 |

| AOA | Ausmon Resorces | 0.003 | 0% | 0% | -57% | $3,020,998 |

| WC1 | Westcobarmetals | 0.076 | 0% | 25% | -55% | $9,180,825 |

| GRL | Godolphin Resources | 0.037 | -8% | -3% | -55% | $6,261,955 |

| DM1 | Desert Metals | 0.05 | -2% | 28% | -74% | $3,752,054 |

| PTR | Petratherm Ltd | 0.034 | 0% | -13% | -41% | $7,641,539 |

| ITM | Itech Minerals Ltd | 0.115 | -4% | -15% | -57% | $13,440,192 |

| KTA | Krakatoa Resources | 0.034 | -6% | -23% | -23% | $15,579,538 |

| M24 | Mamba Exploration | 0.047 | 15% | 52% | -68% | $2,866,217 |

| LNR | Lanthanein Resources | 0.011 | 0% | 83% | -48% | $14,832,837 |

| TKM | Trek Metals Ltd | 0.039 | -3% | -20% | -49% | $18,983,844 |

| BCA | Black Canyon Limited | 0.14 | 0% | 22% | -42% | $9,819,805 |

| CDT | Castle Minerals | 0.009 | 6% | -10% | -57% | $11,020,437 |

| DLI | Delta Lithium | 0.4625 | 2% | 3% | 0% | $326,849,945 |

| A11 | Atlantic Lithium | 0.43 | 8% | -20% | -31% | $258,473,626 |

| KNI | Kunikolimited | 0.28 | -10% | 9% | -45% | $25,068,838 |

| CY5 | Cygnus Metals Ltd | 0.115 | -8% | -18% | -70% | $34,987,097 |

| WR1 | Winsome Resources | 1.035 | 0% | -9% | -16% | $203,489,381 |

| LLI | Loyal Lithium Ltd | 0.42 | 40% | 22% | 42% | $30,399,871 |

| BC8 | Black Cat Syndicate | 0.24 | -6% | -9% | -32% | $71,384,856 |

| BUR | Burleyminerals | 0.165 | 6% | 6% | -25% | $16,713,965 |

| PBL | Parabellumresources | 0.06 | -14% | -83% | -82% | $3,987,200 |

| L1M | Lightning Minerals | 0.12 | -14% | -20% | -27% | $5,067,008 |

| WA1 | Wa1Resourcesltd | 12.13 | -2% | 44% | 770% | $543,465,666 |

| EV1 | Evolutionenergy | 0.135 | -4% | 4% | -40% | $30,677,095 |

| 1AE | Auroraenergymetals | 0.105 | 5% | 31% | -30% | $18,308,797 |

| RVT | Richmond Vanadium | 0.295 | 2% | -16% | 26% | $24,138,186 |

| PMT | Patriotbatterymetals | 1.1 | 2% | 4% | 47% | $516,920,817 |

| PAT | Patriot Lithium | 0.18 | 0% | -5% | -32% | $11,647,912 |

| BM8 | Battery Age Minerals | 0.205 | 11% | -5% | -59% | $18,273,062 |

| OM1 | Omnia Metals Group | 0.078 | 0% | 0% | -51% | $3,786,192 |

| VHM | Vhmlimited | 0.7 | -1% | 0% | 0% | $107,741,288 |

| LLL | Leolithiumlimited | 0.505 | 0% | 0% | 4% | $498,553,663 |

| SRN | Surefire Rescs NL | 0.0085 | -6% | -11% | -29% | $17,668,420 |

| SRL | Sunrise | 0.45 | 0% | -25% | -77% | $41,053,512 |

| SYR | Syrah Resources | 0.64 | 5% | 9% | -69% | $456,230,968 |

| EG1 | Evergreenlithium | 0.18 | -5% | -16% | 0% | $9,840,250 |

| WSR | Westar Resources | 0.02 | 11% | -20% | -60% | $3,707,150 |

| LU7 | Lithium Universe Ltd | 0.032 | -6% | -9% | 7% | $13,209,744 |

| MEI | Meteoric Resources | 0.2625 | 7% | 28% | 395% | $507,480,560 |

| REC | Rechargemetals | 0.1 | 9% | -9% | -26% | $10,578,438 |

| SLM | Solismineralsltd | 0.15 | -6% | -19% | 100% | $11,774,506 |

| DYM | Dynamicmetalslimited | 0.165 | 18% | 0% | 0% | $5,775,000 |

| TOR | Torque Met | 0.215 | -4% | 19% | 19% | $28,913,298 |

| ICL | Iceni Gold | 0.052 | -2% | -17% | -35% | $12,950,929 |

| TMX | Terrain Minerals | 0.005 | 0% | 25% | -17% | $6,767,139 |

| MHC | Manhattan Corp Ltd | 0.004 | 0% | 0% | -27% | $11,747,919 |

| MHK | Metalhawk. | 0.13 | 0% | -16% | -21% | $13,918,022 |

| ANX | Anax Metals Ltd | 0.029 | -3% | 4% | -45% | $13,946,611 |

| FIN | FIN Resources Ltd | 0.021 | 17% | -21% | 11% | $13,634,643 |

| LM1 | Leeuwin Metals Ltd | 0.135 | -10% | -33% | 0% | $6,442,188 |

| HAW | Hawthorn Resources | 0.093 | -6% | 12% | -19% | $31,156,452 |

| LCY | Legacy Iron Ore | 0.017 | 6% | 13% | -11% | $108,916,045 |

| RON | Roninresourcesltd | 0.18 | 3% | -18% | 9% | $6,628,502 |

| ASR | Asra Minerals Ltd | 0.007 | -13% | -7% | -65% | $11,402,970 |

| PFE | Panteraminerals | 0.052 | 0% | -13% | -53% | $6,896,373 |

What’s hot and not over the past week?

CHARGED UP

Pan Asia Metals (ASX:PAM) +60%

European Lithium (ASX:EUR) +53%

Aldoro Resources (ASX:ARN) +52%

MTM Critical Metals (ASX:MTM) +48%

LOW ON JUICE

Avira Resources (ASX:AVW) -25%

Balkan Mining and Minerals (ASX:BMM) -19%

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.