High Voltage: PMT’s Corvette lithium resource could be a 300Mt titan… if an ENTIRE LAKE can be drained first

Mad Max: Beyond Shelly Beach looked pretty average. (Getty Images)

- “200-300Mt resource is being considered longer term” at Patriot’s Corvette: E&P Financial Group

- Would make the Corvette one of the top 5 lithium resources in the world

- But much of the Corvette deposit sits below a large lake, which will have to be drained first

- Macquarie Equity Research names lithium stocks it believes are a buying opportunity

Our High Voltage column wraps the news driving ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, manganese, magnesium, and vanadium.

Before you take a good look at the ASX’s battery metal players’ form guide (see table further below)… there are a couple of headline acts you might want to power through first, because they certainly caught our attention…

Some intel from PMT’s Corvette

Wealth management and investment advisory group E&P Financial Group (ASX:EP1) was recently invited to attend a Patriot Battery Metals (ASX:PMT) site out at the exploration company’s world-class Corvette project in the James Bay region of Quebec, Canada.

And the financial services group, specifically analysts Adam Martin and Branco Skocic, have noted a couple of pretty eye-opening takeaways from the trip, which we’ll get to in a sec.

Just a super quick recap, on Corvette, first. If you know your lithium stocks, you’ll be aware this project is a pretty big deal in the increasingly competitive world of spodumene-rich pegmatite hunting over in Canada. It’s right in the thick of the hottest Tier 1 lithium region this year – James Bay – with seven drill rigs currently on site.

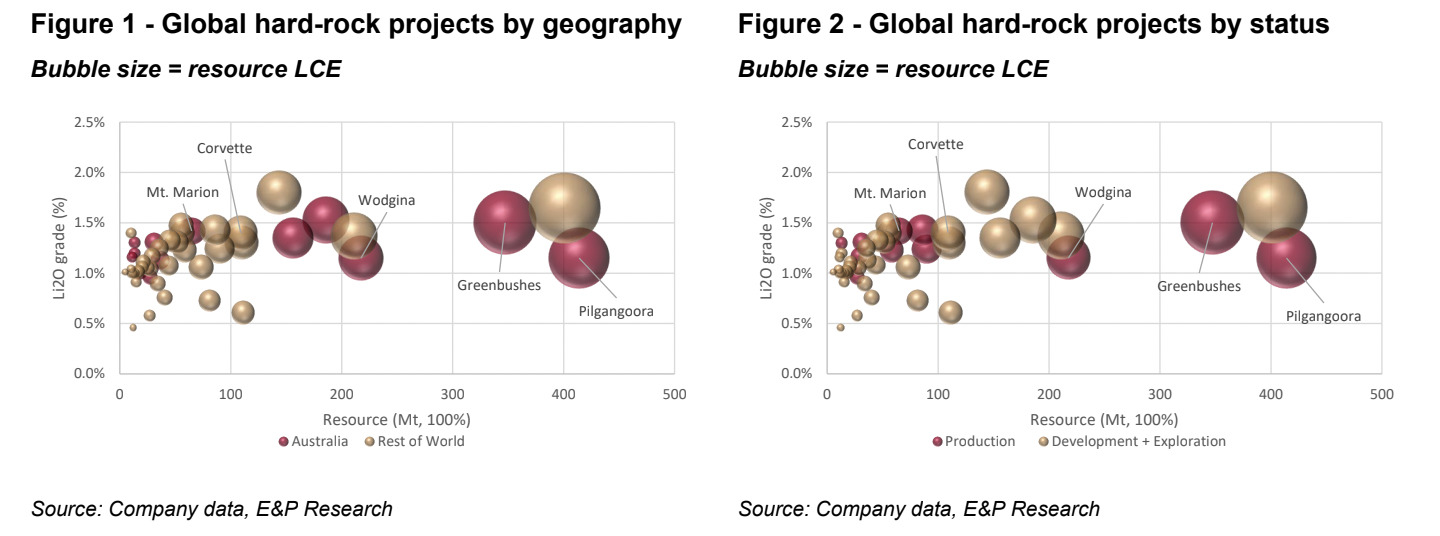

The main Corvette deposit has a resource of 109.2Mt @ 1.42% Li2O and 160 ppm Ta2O5 (at a cut-off of 0.4% Li2O).

It’s said to be the largest lithium pegmatite resource in the Americas, based on contained LCE, and one of the top 10 in the world.

PMT is currently engaged in a 30km drilling program, largely focused on what’s known as the CV13 pegmatite cluster, of which the company believes to be connected to CV5 based on similar geological traits. If CV5 and CV13 are connected, this would create a >10km long orebody, notes E&P Capital.

A maiden CV13 resource is expected to be released in Q2 next year, and PMT is fully funded for a massive 80km of drilling to prove up further resources.

Right then, some facts established, what were the E&P analysts’ two big takeaways from the PMT visit?

A massive resource that could be EVEN MASSIVE-er

“We came away with the impression that a 200-300Mt resource is being considered longer term,” wrote Martin and Skocic.

That would make the Corvette deposit one of the top 5 lithium resources in the world.

“Our conversations suggest a progressive increase in resource size over time is most likely (similar to how Pilgangoora grew across the 2015-18 timeframe).”

See the E&P graphics below for some context around where Corvette sits in the grand scheme of global spodumene deposits.

It seems PMT has potential, then, to double, maybe even close to triple the lithium resource capacity out at Corvette.

There’s just one dampener that lies in the way, though…

An entire lake will have to be drained first

Yep. Much of the Corvette deposit sits below a large lake in the region. And it’s a lake that Patriot will have to first drain if it wants to achieve its lofty resource goals.

Thanks to the wonders of modern engineering, it’s not that such a thing is not doable, the sticking point is the fact PMT will need approval to do so from the local First Nations population – the Cree.

As for the lake’s aquatic life, it won’t get much of a say in the matter.

Notes E&P:

“While Patriot is currently drilling out acreage away from the lake, draining lakes is not without precedent in this part of Canada.

“We spent time with the company understanding how the required HADD permit is obtained, what circumstances could prevent one being issued and how the company is engaging with the Cree (local native population). We came away confident that the lake could be drained providing Cree approval is obtained.”

As you might expect, Patriot has reportedly spent a lot of time engaging with the Cree and, notes E&P, “the relationship appears to be on good terms”.

“This feedback is consistent with our conversations with other investors who have suggested the Cree have been pragmatic in their dealing with other operators in the region. Pleasingly, the acreage is not a primary Cree fishing/hunting zone either.”

In other headlining lithium news: ‘buy the dip’

Macquarie Equity Research is pointing to Aussie lithium and rare earths miners as a buying opportunity for long-term investors amid dipping share market prices broadly, as noted here by Howard “@LithiumIonBull” Klein.

Macquarie says "buy the dip" in #lithium. Mr. Market overly bearish, pricing in $1,500/t spod & $18,000/t LCE. Summary highlights reference $PLL $PMT $PLS #GL1 $AKE $MIN $IGO

Table flags several names with 100% upside

Not advice. DYOR pic.twitter.com/ZQnUgDQvRi

— Howard Klein (@LithiumIonBull) September 26, 2023

And what specific ASX plays might a long-term lithium investor want to consider?

Speaking for itself, Macquarie says the $12.3bn beast Pilbara Minerals (ASX:PLS) is its “preferred producer” for long-term upside, with Patriot Battery Metals (ASX:PMT) “presenting the greatest upside on exploration in the near term”.

Other lithium hunters with strong upside valuation, believes Macquarie, include: Piedmont Lithium (ASX:PLL) (>200% potential); Allkem (ASX:AKE); Mineral Resources (ASX:MIN); Liontown Resources (ASX:LTR) and Global Lithium Resources (ASX:GL1).

As for the broader picture that this narrative fuels, and indeed vice-versa … EV sales. Macquarie notes global sales have been solid and are expected to see a boost in China in September, which it puts down to Mid-Autumn Festival and National Day. Holiday deals a-go-go?

Here’s a snapshot of ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, magnesium, manganese, and vanadium are performing lately>>>

Battery metals stocks missing from our list? Shoot a mail to [email protected].

| Code | Company | Price | % Week | % Month | % Six Month | % Year | Market Cap |

|---|---|---|---|---|---|---|---|

| 1AE | Auroraenergymetals | 0.17 | 62% | 130% | 77% | -26% | $21,492,935 |

| WCN | White Cliff Min Ltd | 0.013 | 30% | 86% | 44% | -38% | $16,341,241 |

| RXL | Rox Resources | 0.255 | 28% | 24% | -12% | -4% | $93,608,336 |

| PVT | Pivotal Metals Ltd | 0.02 | 25% | 5% | -39% | -44% | $10,892,006 |

| AKN | Auking Mining Ltd | 0.069 | 23% | 30% | 17% | -20% | $14,083,156 |

| CWX | Carawine Resources | 0.135 | 23% | 0% | 38% | 41% | $26,570,358 |

| TOR | Torque Met | 0.38 | 23% | 187% | 284% | 90% | $45,140,628 |

| EMT | Emetals Limited | 0.009 | 20% | 0% | 0% | -47% | $7,650,000 |

| ENV | Enova Mining Limited | 0.007 | 17% | -30% | -42% | -59% | $2,931,970 |

| AOA | Ausmon Resorces | 0.0035 | 17% | 17% | -30% | -56% | $3,392,513 |

| AQD | Ausquest Limited | 0.015 | 15% | 15% | -12% | -21% | $12,377,238 |

| CMX | Chemxmaterials | 0.12 | 14% | 20% | 9% | -33% | $5,307,689 |

| LPM | Lithium Plus | 0.43 | 13% | 69% | 105% | -35% | $26,395,280 |

| MOH | Moho Resources | 0.009 | 13% | -10% | -53% | -70% | $2,448,320 |

| EFE | Eastern Resources | 0.009 | 13% | -18% | -10% | -69% | $11,177,518 |

| CTN | Catalina Resources | 0.0045 | 13% | 13% | -36% | -50% | $5,573,191 |

| BUR | Burleyminerals | 0.185 | 12% | 37% | -16% | 32% | $18,739,900 |

| PUR | Pursuit Minerals | 0.01 | 11% | -17% | -50% | -29% | $29,439,714 |

| TAR | Taruga Minerals | 0.01 | 11% | -9% | -29% | -69% | $7,060,268 |

| LPI | Lithium Pwr Int Ltd | 0.26 | 11% | 6% | -9% | -54% | $157,309,390 |

| STK | Strickland Metals | 0.053 | 10% | 26% | 47% | 29% | $86,413,014 |

| CLA | Celsius Resource Ltd | 0.011 | 10% | -8% | -27% | -21% | $24,706,568 |

| DM1 | Desert Metals | 0.045 | 10% | -4% | -61% | -91% | $3,264,349 |

| AZS | Azure Minerals | 2.72 | 9% | 9% | 871% | 1295% | $1,129,997,673 |

| MQR | Marquee Resource Ltd | 0.037 | 9% | 19% | 85% | -40% | $12,236,178 |

| AX8 | Accelerate Resources | 0.025 | 9% | 4% | 14% | -34% | $9,134,442 |

| M2R | Miramar | 0.052 | 8% | 18% | 27% | -48% | $7,741,216 |

| RBX | Resource B | 0.15 | 7% | -12% | 7% | 67% | $12,816,095 |

| MHC | Manhattan Corp Ltd | 0.0075 | 7% | -17% | 36% | 0% | $23,495,838 |

| WMG | Western Mines | 0.31 | 7% | -45% | 94% | 138% | $18,771,378 |

| MMC | Mitremining | 0.265 | 6% | 4% | -4% | 47% | $10,132,302 |

| REE | Rarex Limited | 0.036 | 6% | -5% | -27% | -42% | $24,601,917 |

| TEM | Tempest Minerals | 0.0095 | 6% | -27% | -57% | -74% | $4,858,143 |

| SRI | Sipa Resources Ltd | 0.02 | 5% | -9% | -13% | -57% | $4,563,163 |

| VMS | Venture Minerals | 0.012 | 4% | -14% | -40% | -59% | $23,400,156 |

| LKE | Lake Resources | 0.1825 | 4% | -21% | -62% | -82% | $234,703,377 |

| L1M | Lightning Minerals | 0.145 | 4% | -9% | 4% | 0% | $5,307,957 |

| EVG | Evion Group NL | 0.033 | 3% | 3% | -40% | -63% | $11,070,694 |

| LIT | Lithium Australia | 0.036 | 3% | -10% | 3% | -37% | $42,776,709 |

| IG6 | Internationalgraphit | 0.195 | 3% | 5% | 11% | -48% | $16,017,860 |

| ATM | Aneka Tambang | 1.19 | 3% | 3% | 8% | 3% | $1,512,233 |

| ICL | Iceni Gold | 0.082 | 3% | -12% | -1% | -18% | $19,668,286 |

| OCN | Oceanalithiumlimited | 0.225 | 2% | -15% | -27% | -59% | $11,411,448 |

| MEI | Meteoric Resources | 0.235 | 2% | 27% | 81% | 1579% | $446,351,139 |

| EG1 | Evergreenlithium | 0.285 | 2% | 4% | 0% | 0% | $16,025,550 |

| IDA | Indiana Resources | 0.06 | 2% | 3% | 28% | -3% | $33,747,592 |

| ESS | Essential Metals Ltd | 0.47 | 1% | 15% | -3% | 4% | $125,692,035 |

| AXE | Archer Materials | 0.47 | 1% | 3% | 6% | -40% | $115,955,391 |

| JRL | Jindalee Resources | 1.745 | 1% | -3% | -26% | -26% | $94,962,189 |

| AGY | Argosy Minerals Ltd | 0.18 | 0% | -29% | -58% | -68% | $245,771,312 |

| QXR | Qx Resources Limited | 0.025 | 0% | -17% | -19% | -19% | $21,524,696 |

| HNR | Hannans Ltd | 0.008 | 0% | -20% | -20% | -62% | $21,796,838 |

| LPD | Lepidico Ltd | 0.01 | 0% | -9% | 0% | -58% | $76,383,079 |

| MRD | Mount Ridley Mines | 0.002 | 0% | 0% | -33% | -60% | $15,569,766 |

| CZN | Corazon Ltd | 0.011 | 0% | -27% | -27% | -35% | $6,771,577 |

| AVZ | AVZ Minerals Ltd | 0.78 | 0% | 0% | 0% | 0% | $2,752,409,203 |

| RLC | Reedy Lagoon Corp. | 0.006 | 0% | -14% | 3% | -59% | $3,700,102 |

| EUR | European Lithium Ltd | 0.073 | 0% | -3% | 16% | -9% | $101,779,460 |

| TKL | Traka Resources | 0.005 | 0% | -17% | -17% | -29% | $4,356,646 |

| PRL | Province Resources | 0.041 | 0% | 0% | 8% | -51% | $48,441,219 |

| VML | Vital Metals Limited | 0.01 | 0% | 0% | -41% | -73% | $53,061,498 |

| BSX | Blackstone Ltd | 0.125 | 0% | 4% | -19% | -34% | $56,842,669 |

| POS | Poseidon Nick Ltd | 0.019 | 0% | -14% | -47% | -63% | $70,455,375 |

| AVL | Aust Vanadium Ltd | 0.028 | 0% | -5% | -26% | -28% | $117,878,219 |

| FFX | Firefinch Ltd | 0.2 | 0% | 0% | 0% | 0% | $236,569,315 |

| EGR | Ecograf Limited | 0.11 | 0% | -27% | -39% | -69% | $49,785,106 |

| LML | Lincoln Minerals | 0.005 | 0% | 0% | -75% | -27% | $7,103,559 |

| 1MC | Morella Corporation | 0.006 | 0% | -8% | -14% | -76% | $36,831,934 |

| AML | Aeon Metals Ltd. | 0.016 | 0% | -16% | -27% | -43% | $17,542,410 |

| WKT | Walkabout Resources | 0.115 | 0% | 5% | 10% | -34% | $76,676,830 |

| CNJ | Conico Ltd | 0.007 | 0% | 17% | -22% | -82% | $9,420,570 |

| BOA | Boadicea Resources | 0.038 | 0% | 12% | -49% | -72% | $4,677,431 |

| MLS | Metals Australia | 0.033 | 0% | -18% | -11% | -27% | $20,593,194 |

| LSR | Lodestar Minerals | 0.006 | 0% | -20% | 20% | -14% | $12,140,384 |

| RAG | Ragnar Metals Ltd | 0.023 | 0% | 0% | 61% | -37% | $10,901,562 |

| EMC | Everest Metals Corp | 0.11 | 0% | -24% | 57% | -12% | $14,661,142 |

| WML | Woomera Mining Ltd | 0.012 | 0% | 0% | 9% | -24% | $11,474,335 |

| KOR | Korab Resources | 0.019 | 0% | -10% | 12% | -44% | $6,973,950 |

| KGD | Kula Gold Limited | 0.014 | 0% | -7% | -22% | -52% | $5,784,785 |

| ENT | Enterprise Metals | 0.004 | 0% | 0% | -50% | -67% | $3,197,884 |

| AVW | Avira Resources Ltd | 0.002 | 0% | 0% | -33% | -50% | $4,267,580 |

| MTM | MTM Critical Metals | 0.039 | 0% | -29% | -61% | -71% | $3,856,322 |

| SRZ | Stellar Resources | 0.012 | 0% | 20% | 0% | -14% | $11,065,607 |

| YAR | Yari Minerals Ltd | 0.019 | 0% | 0% | 9% | -14% | $9,164,798 |

| ODE | Odessa Minerals Ltd | 0.012 | 0% | 50% | 50% | -40% | $11,365,342 |

| FTL | Firetail Resources | 0.11 | 0% | -27% | 10% | -54% | $15,635,083 |

| CLZ | Classic Min Ltd | 0.001 | 0% | 0% | -50% | -94% | $12,046,242 |

| XTC | Xantippe Res Ltd | 0.001 | 0% | 0% | -58% | -79% | $17,528,005 |

| OD6 | Od6Metalsltd | 0.16 | 0% | -22% | -18% | -18% | $9,352,634 |

| VTM | Victory Metals Ltd | 0.19 | 0% | -14% | -16% | -7% | $15,370,935 |

| DRE | Dreadnought Resources Ltd | 0.053 | 0% | 26% | -13% | -56% | $178,044,396 |

| M24 | Mamba Exploration | 0.057 | 0% | -12% | -25% | -61% | $3,476,050 |

| KNI | Kunikolimited | 0.32 | 0% | -16% | -34% | -56% | $28,349,068 |

| PBL | Parabellumresources | 0.345 | 0% | 0% | 0% | 15% | $18,879,263 |

| EV1 | Evolutionenergy | 0.165 | 0% | -21% | -30% | -41% | $25,606,250 |

| LLL | Leolithiumlimited | 0.505 | 0% | -56% | 16% | -27% | $498,553,663 |

| TMX | Terrain Minerals | 0.005 | 0% | 0% | 0% | -38% | $5,030,575 |

| MHK | Metalhawk. | 0.1 | 0% | -13% | -5% | -49% | $9,058,666 |

| EMH | European Metals Hldg | 0.69 | -1% | -10% | 19% | -16% | $89,341,489 |

| WA1 | Wa1Resourcesltd | 5.38 | -1% | 4% | 380% | 3371% | $221,384,647 |

| MLX | Metals X Limited | 0.3075 | -1% | 10% | 12% | 18% | $281,252,481 |

| A11 | Atlantic Lithium | 0.465 | -1% | 15% | 0% | -20% | $284,692,372 |

| ABX | ABX Group Limited | 0.08 | -1% | -19% | -33% | -53% | $19,144,924 |

| SGQ | St George Min Ltd | 0.0395 | -1% | -10% | -19% | 10% | $33,016,424 |

| DVP | Develop Global Ltd | 3.1 | -1% | 14% | 6% | 25% | $615,100,067 |

| RVT | Richmond Vanadium | 0.38 | -1% | -5% | -5% | 0% | $32,758,966 |

| GBR | Greatbould Resources | 0.06 | -2% | -9% | -31% | -35% | $30,823,884 |

| GAL | Galileo Mining Ltd | 0.3 | -2% | -35% | -53% | -75% | $59,287,478 |

| QPM | Queensland Pacific | 0.059 | -2% | -12% | -46% | -59% | $113,140,403 |

| MEK | Meeka Metals Limited | 0.048 | -2% | -6% | 9% | -27% | $52,906,029 |

| ZNC | Zenith Minerals Ltd | 0.091 | -2% | 26% | -52% | -69% | $32,066,660 |

| SBR | Sabre Resources | 0.042 | -2% | -21% | 50% | -30% | $11,950,934 |

| LTR | Liontown Resources | 2.93 | -2% | 6% | 97% | 87% | $6,606,766,758 |

| S32 | South32 Limited | 3.305 | -3% | -5% | -20% | -14% | $15,136,227,604 |

| MAN | Mandrake Res Ltd | 0.038 | -3% | -3% | -16% | -3% | $22,752,877 |

| PVW | PVW Res Ltd | 0.068 | -3% | -15% | -12% | -59% | $6,695,525 |

| S2R | S2 Resources | 0.17 | -3% | -3% | 26% | 21% | $71,766,016 |

| NWC | New World Resources | 0.032 | -3% | -6% | -26% | -3% | $70,114,003 |

| AAJ | Aruma Resources Ltd | 0.032 | -3% | -16% | -44% | -48% | $6,300,528 |

| HRE | Heavy Rare Earths | 0.091 | -3% | 25% | -9% | -49% | $5,413,402 |

| LEL | Lithenergy | 0.595 | -3% | 3% | 3% | -36% | $62,321,050 |

| E25 | Element 25 Ltd | 0.445 | -3% | 2% | -26% | -52% | $100,063,954 |

| PGD | Peregrine Gold | 0.295 | -3% | 11% | -27% | -49% | $16,572,395 |

| NTU | Northern Min Ltd | 0.029 | -3% | -12% | -28% | -28% | $165,507,419 |

| TMT | Technology Metals | 0.28 | -3% | 10% | -10% | -20% | $75,014,365 |

| BKT | Black Rock Mining | 0.082 | -4% | -12% | -37% | -57% | $92,158,592 |

| A8G | Australasian Metals | 0.135 | -4% | -4% | -21% | -54% | $7,296,869 |

| FRB | Firebird Metals | 0.135 | -4% | 4% | 0% | -33% | $10,230,500 |

| GL1 | Globallith | 1.445 | -4% | -7% | 31% | -40% | $370,301,496 |

| PGM | Platina Resources | 0.026 | -4% | 13% | 44% | 8% | $16,202,689 |

| IMI | Infinitymining | 0.13 | -4% | 4% | -32% | -38% | $10,482,937 |

| LRV | Larvottoresources | 0.13 | -4% | -10% | -16% | -32% | $8,743,114 |

| WC1 | Westcobarmetals | 0.077 | -4% | 0% | -13% | -69% | $7,169,850 |

| LU7 | Lithium Universe Ltd | 0.051 | -4% | -4% | 70% | 70% | $20,591,661 |

| TVN | Tivan Limited | 0.075 | -4% | 15% | 0% | -16% | $116,237,629 |

| DTM | Dart Mining NL | 0.025 | -4% | -17% | -43% | -70% | $4,325,306 |

| SUM | Summitminerals | 0.125 | -4% | -4% | 0% | -31% | $6,671,998 |

| BC8 | Black Cat Syndicate | 0.245 | -4% | -8% | -35% | -28% | $76,689,496 |

| PLS | Pilbara Min Ltd | 4.17 | -4% | -11% | 17% | -14% | $12,510,349,234 |

| CAE | Cannindah Resources | 0.115 | -4% | -8% | -43% | -47% | $68,217,594 |

| SRL | Sunrise | 0.78 | -4% | -24% | -47% | -73% | $70,377,448 |

| RNU | Renascor Res Ltd | 0.11 | -4% | -24% | -46% | -45% | $279,334,825 |

| MIN | Mineral Resources. | 67.4 | -4% | 3% | -13% | 0% | $13,345,328,813 |

| AZI | Altamin Limited | 0.065 | -4% | -11% | -13% | -20% | $25,461,589 |

| THR | Thor Energy PLC | 0.043 | -4% | 8% | 8% | -57% | $6,848,043 |

| QEM | QEM Limited | 0.21 | -5% | 5% | 14% | 0% | $31,792,260 |

| BUX | Buxton Resources Ltd | 0.205 | -5% | 58% | 5% | 86% | $35,112,106 |

| KZR | Kalamazoo Resources | 0.1 | -5% | -9% | -29% | -50% | $16,958,376 |

| KOB | Kobaresourceslimited | 0.08 | -5% | -27% | -43% | -38% | $8,433,333 |

| ASN | Anson Resources Ltd | 0.1475 | -5% | 2% | -16% | -58% | $190,601,728 |

| DLI | Delta Lithium | 0.765 | -5% | -6% | 151% | 28% | $410,147,174 |

| TMB | Tambourahmetals | 0.19 | -5% | -19% | 118% | 19% | $15,758,667 |

| LIN | Lindian Resources | 0.2375 | -5% | -5% | 1% | -19% | $279,214,813 |

| CMO | Cosmometalslimited | 0.056 | -5% | -22% | -55% | -61% | $1,943,013 |

| BHP | BHP Group Limited | 43.43 | -5% | 1% | 0% | 14% | $223,784,861,596 |

| JMS | Jupiter Mines. | 0.185 | -5% | -10% | -14% | -8% | $382,003,251 |

| KFM | Kingfisher Mining | 0.185 | -5% | -12% | -8% | -66% | $9,937,275 |

| OMH | OM Holdings Limited | 0.4975 | -5% | -9% | -32% | -23% | $361,925,435 |

| STM | Sunstone Metals Ltd | 0.018 | -5% | -28% | -38% | -55% | $55,475,728 |

| PTR | Petratherm Ltd | 0.054 | -5% | -4% | -4% | -32% | $12,136,562 |

| GED | Golden Deeps | 0.053 | -5% | -21% | -34% | -65% | $6,238,207 |

| GRE | Greentechmetals | 0.435 | -5% | -3% | 263% | 156% | $25,185,022 |

| ARL | Ardea Resources Ltd | 0.605 | -5% | -18% | 21% | -34% | $115,823,839 |

| ASO | Aston Minerals Ltd | 0.034 | -6% | -29% | -66% | -61% | $45,917,314 |

| NVX | Novonix Limited | 0.8075 | -6% | -26% | -30% | -58% | $400,522,456 |

| IPX | Iperionx Limited | 1.44 | -6% | 37% | 100% | 56% | $277,474,537 |

| PMT | Patriotbatterymetals | 1.265 | -6% | -1% | 3% | 0% | $453,516,257 |

| OM1 | Omnia Metals Group | 0.083 | -6% | -43% | -65% | -45% | $3,782,386 |

| WR1 | Winsome Resources | 1.49 | -6% | -3% | 11% | 366% | $240,213,363 |

| ARU | Arafura Rare Earths | 0.245 | -6% | 0% | -47% | -36% | $507,207,526 |

| LEG | Legend Mining | 0.0235 | -6% | -40% | -47% | -41% | $68,255,214 |

| ILU | Iluka Resources | 7.73 | -6% | -3% | -24% | -17% | $3,348,460,655 |

| AR3 | Austrare | 0.225 | -6% | -2% | 13% | -38% | $36,229,001 |

| EMN | Euromanganese | 0.15 | -6% | -25% | -30% | -48% | $35,779,145 |

| SRN | Surefire Rescs NL | 0.015 | -6% | 0% | -35% | 7% | $24,770,452 |

| INF | Infinity Lithium | 0.085 | -7% | -7% | -10% | -53% | $39,320,328 |

| AUZ | Australian Mines Ltd | 0.014 | -7% | -26% | -53% | -81% | $9,453,513 |

| DEV | Devex Resources Ltd | 0.335 | -7% | -3% | 46% | 0% | $131,626,394 |

| PSC | Prospect Res Ltd | 0.08 | -7% | -27% | -48% | 1% | $37,443,016 |

| ADD | Adavale Resource Ltd | 0.013 | -7% | -7% | 19% | -55% | $9,859,986 |

| EVR | Ev Resources Ltd | 0.013 | -7% | -24% | 0% | -52% | $12,167,793 |

| SLZ | Sultan Resources Ltd | 0.025 | -7% | -17% | -44% | -76% | $3,408,371 |

| ETM | Energy Transition | 0.037 | -8% | -23% | -20% | -29% | $51,518,272 |

| IGO | IGO Limited | 12.15 | -8% | -6% | 2% | -17% | $9,109,931,790 |

| CTM | Centaurus Metals Ltd | 0.665 | -8% | -9% | -24% | -41% | $335,183,139 |

| IPT | Impact Minerals | 0.012 | -8% | -14% | 20% | 71% | $34,376,447 |

| RGL | Riversgold | 0.012 | -8% | -8% | -25% | -70% | $11,415,137 |

| GRL | Godolphin Resources | 0.036 | -8% | -3% | -43% | -59% | $6,092,713 |

| CY5 | Cygnus Metals Ltd | 0.18 | -8% | -14% | -18% | -14% | $53,657,888 |

| NIC | Nickel Industries | 0.7475 | -8% | 0% | -15% | -9% | $3,300,073,608 |

| LYC | Lynas Rare Earths | 6.73 | -8% | -3% | 6% | -14% | $6,265,901,851 |

| FRS | Forrestaniaresources | 0.047 | -8% | -20% | -46% | -75% | $4,406,236 |

| PAT | Patriot Lithium | 0.175 | -8% | -8% | -27% | 0% | $11,819,188 |

| NKL | Nickelxltd | 0.058 | -8% | -21% | -3% | -55% | $5,186,117 |

| NVA | Nova Minerals Ltd | 0.23 | -8% | -21% | -49% | -69% | $48,504,691 |

| LMG | Latrobe Magnesium | 0.046 | -8% | -12% | -25% | -45% | $79,461,809 |

| WC8 | Wildcat Resources | 0.395 | -8% | 18% | 1311% | 1062% | $262,918,938 |

| VHM | Vhmlimited | 0.5 | -8% | 2% | -37% | 0% | $81,463,910 |

| INR | Ioneer Ltd | 0.22 | -8% | -19% | -23% | -66% | $485,164,942 |

| ADV | Ardiden Ltd | 0.0055 | -8% | -8% | -21% | -31% | $13,441,677 |

| ALY | Alchemy Resource Ltd | 0.011 | -8% | -15% | -21% | -45% | $12,958,839 |

| KAI | Kairos Minerals Ltd | 0.022 | -8% | -8% | 21% | -35% | $57,660,068 |

| AKE | Allkem Limited | 11.61 | -8% | -16% | 14% | -22% | $7,428,913,425 |

| NC1 | Nicoresourceslimited | 0.42 | -9% | -21% | -18% | -39% | $37,368,126 |

| COB | Cobalt Blue Ltd | 0.265 | -9% | -21% | -21% | -64% | $101,353,165 |

| LLI | Loyal Lithium Ltd | 0.74 | -9% | -1% | 236% | 59% | $60,251,627 |

| EMS | Eastern Metals | 0.031 | -9% | -21% | -49% | -78% | $2,062,735 |

| LOT | Lotus Resources Ltd | 0.25 | -9% | 14% | 61% | 9% | $324,595,691 |

| FGR | First Graphene Ltd | 0.06 | -9% | -21% | -27% | -48% | $36,002,522 |

| TON | Triton Min Ltd | 0.02 | -9% | -9% | -26% | -5% | $32,788,468 |

| VR8 | Vanadium Resources | 0.06 | -9% | -6% | -14% | -37% | $32,290,570 |

| AM7 | Arcadia Minerals | 0.1 | -9% | -9% | -55% | -67% | $10,473,760 |

| BYH | Bryah Resources Ltd | 0.015 | -9% | -12% | -20% | -44% | $5,737,685 |

| KTA | Krakatoa Resources | 0.02 | -9% | -27% | -31% | -68% | $8,697,958 |

| PAM | Pan Asia Metals | 0.19 | -10% | -33% | -46% | -56% | $30,176,073 |

| CRR | Critical Resources | 0.038 | -10% | -7% | 12% | -51% | $67,539,311 |

| WIN | Widgienickellimited | 0.19 | -10% | -3% | -33% | -32% | $59,589,011 |

| MNS | Magnis Energy Tech | 0.073 | -10% | -9% | -75% | -82% | $89,962,361 |

| GSR | Greenstone Resources | 0.009 | -10% | -25% | -57% | -86% | $12,068,593 |

| HXG | Hexagon Energy | 0.009 | -10% | -10% | -25% | -44% | $4,616,243 |

| PNN | Power Minerals Ltd | 0.27 | -10% | -10% | -8% | -50% | $20,327,625 |

| SCN | Scorpion Minerals | 0.054 | -10% | -8% | -5% | -30% | $20,742,372 |

| ARR | American Rare Earths | 0.13 | -10% | -4% | -37% | -45% | $55,802,912 |

| PAN | Panoramic Resources | 0.0375 | -11% | -22% | -76% | -81% | $109,877,305 |

| VMC | Venus Metals Cor Ltd | 0.125 | -11% | 0% | 39% | 30% | $24,664,729 |

| CAI | Calidus Resources | 0.165 | -11% | -4% | -30% | -69% | $97,260,778 |

| LNR | Lanthanein Resources | 0.008 | -11% | -50% | -47% | -81% | $8,972,605 |

| LNR | Lanthanein Resources | 0.008 | -11% | -50% | -47% | -81% | $8,972,605 |

| VUL | Vulcan Energy | 2.98 | -11% | -10% | -47% | -60% | $520,156,080 |

| GLN | Galan Lithium Ltd | 0.575 | -12% | -14% | -39% | -57% | $208,639,368 |

| IXR | Ionic Rare Earths | 0.023 | -12% | 28% | -15% | -45% | $90,990,413 |

| AZL | Arizona Lithium Ltd | 0.015 | -12% | -21% | -65% | -82% | $47,920,345 |

| GT1 | Greentechnology | 0.45 | -12% | -14% | -31% | -42% | $97,969,661 |

| LRS | Latin Resources Ltd | 0.26 | -12% | -26% | 160% | 148% | $683,613,922 |

| JRV | Jervois Global Ltd | 0.037 | -12% | -23% | -69% | -93% | $97,290,745 |

| NWM | Norwest Minerals | 0.029 | -12% | -28% | 0% | -34% | $8,339,516 |

| CXO | Core Lithium | 0.3425 | -12% | -16% | -56% | -75% | $737,242,763 |

| VRC | Volt Resources Ltd | 0.007 | -13% | -22% | -33% | -73% | $29,545,679 |

| RMX | Red Mount Min Ltd | 0.0035 | -13% | -22% | -13% | -42% | $10,694,304 |

| MRR | Minrex Resources Ltd | 0.014 | -13% | 0% | -36% | -71% | $15,188,145 |

| BNR | Bulletin Res Ltd | 0.0735 | -13% | 44% | -17% | -43% | $21,725,741 |

| GSM | Golden State Mining | 0.035 | -13% | 3% | 9% | -24% | $6,688,090 |

| ASM | Ausstratmaterials | 1.56 | -13% | -9% | 25% | -37% | $255,999,987 |

| PLL | Piedmont Lithium Inc | 0.605 | -14% | -13% | -20% | -31% | $235,454,288 |

| CNB | Carnaby Resource Ltd | 0.795 | -14% | -24% | -23% | 3% | $133,533,996 |

| CDT | Castle Minerals | 0.0095 | -14% | -10% | -47% | -65% | $10,120,437 |

| PNT | Panthermetalsltd | 0.063 | -14% | 2% | -49% | -67% | $4,158,200 |

| TLG | Talga Group Ltd | 1.15 | -14% | -5% | -24% | -16% | $404,044,673 |

| GCM | Green Critical Min | 0.006 | -14% | -33% | -50% | -54% | $6,819,510 |

| BCA | Black Canyon Limited | 0.12 | -14% | -14% | -43% | -48% | $7,877,325 |

| SYA | Sayona Mining Ltd | 0.0895 | -15% | -28% | -52% | -62% | $957,276,529 |

| FG1 | Flynngold | 0.051 | -15% | -22% | -36% | -56% | $6,955,512 |

| PEK | Peak Rare Earths Ltd | 0.365 | -15% | -26% | -27% | -24% | $100,563,757 |

| PEK | Peak Rare Earths Ltd | 0.365 | -15% | -26% | -27% | -24% | $100,563,757 |

| ITM | Itech Minerals Ltd | 0.14 | -15% | -22% | -44% | -68% | $15,786,031 |

| BM8 | Battery Age Minerals | 0.275 | -15% | -27% | -23% | -45% | $23,555,025 |

| WSR | Westar Resources | 0.022 | -15% | 10% | -37% | -53% | $4,077,865 |

| G88 | Golden Mile Res Ltd | 0.032 | -16% | -14% | 100% | 0% | $10,540,464 |

| RR1 | Reach Resources Ltd | 0.016 | -16% | 14% | 300% | 129% | $47,325,760 |

| RR1 | Reach Resources Ltd | 0.016 | -16% | 14% | 300% | 129% | $47,325,760 |

| TKM | Trek Metals Ltd | 0.052 | -16% | -28% | -20% | -21% | $26,682,484 |

| SYR | Syrah Resources | 0.465 | -16% | -16% | -68% | -76% | $317,671,933 |

| SYR | Syrah Resources | 0.465 | -16% | -16% | -68% | -76% | $317,671,933 |

| ESR | Estrella Res Ltd | 0.0075 | -17% | -12% | -32% | -42% | $10,385,003 |

| MRC | Mineral Commodities | 0.038 | -17% | -24% | -41% | -55% | $26,275,326 |

| AXN | Alliance Nickel Ltd | 0.061 | -18% | -25% | -36% | -51% | $43,499,483 |

| FBM | Future Battery | 0.115 | -18% | 0% | 74% | 62% | $58,639,188 |

| DYM | Dynamicmetalslimited | 0.205 | -18% | -24% | 21% | 0% | $7,525,000 |

| CHN | Chalice Mining Ltd | 2.295 | -18% | -53% | -63% | -39% | $941,291,196 |

| BMM | Balkanminingandmin | 0.2 | -18% | -7% | -11% | -40% | $14,449,507 |

| REC | Rechargemetals | 0.2 | -18% | -11% | 82% | 14% | $21,116,895 |

| SLM | Solismineralsltd | 0.27 | -19% | -34% | 135% | 251% | $21,698,238 |

| RAS | Ragusa Minerals Ltd | 0.029 | -19% | -47% | -59% | -93% | $4,420,562 |

| ARN | Aldoro Resources | 0.09 | -22% | -33% | -55% | -59% | $13,462,374 |

| GW1 | Greenwing Resources | 0.12 | -23% | -38% | -35% | -51% | $23,523,950 |

| HAS | Hastings Tech Met | 0.745 | -23% | -23% | -69% | -82% | $95,731,322 |

| AS2 | Askarimetalslimited | 0.18 | -23% | -8% | -61% | -45% | $15,062,090 |

| NMT | Neometals Ltd | 0.3375 | -27% | -39% | -44% | -72% | $199,190,857 |

| ANX | Anax Metals Ltd | 0.037 | -33% | -43% | -40% | -44% | $17,196,157 |

| CHR | Charger Metals | 0.125 | -36% | -44% | -48% | -76% | $8,074,868 |

| VIA | Viagold Rare Earth | 0 | -100% | -100% | -100% | -100% | $166,624,808 |

| OZL | OZ Minerals | 0 | -100% | -100% | -100% | -100% | $8,918,404,433 |

| MCR | Mincor Resources NL | 0 | -100% | -100% | -100% | -100% | $751,215,521 |

| BRB | Breaker Res NL | 0 | -100% | -100% | -100% | -100% | $158,126,031 |

Who’s turning heads lately on the ASX?

This week’s big mover in the battery metals sector was NickelSearch (ASX:NIS), which spotted visual spodumene in pegmatites at the Carlingup nickel project in WA with the expert help of much bigger player Allkem (ASX:AKE).

Several gold juniors have been looking to change lanes and diversify their way into the hunt for white gold (that’d be lithium). These include a crop of Brazilian-focused operations: OzAurum Resources (ASX:OZM), Alderan Resources (ASX:AL8) and Adelong Gold (ASX:ADG).

OZM has been leading that charge, at least in terms of share price gains. However, it’s retraced a fair bit so far this week (-7% yesterday). Even still, it’s up 114% over the past 30 days.

Almost two weeks ago, this now-$11m market capped explorer broke news of its diversification into lithium with the acquisition of the Linopolis Jaime project in the State of Minas Gerais, Brazil, where it appears to be onto some juicy-looking spodumene. It’s also coming off the back of a $2.4m cap raise.

Also, as Reubs notes in the latest Eye on Lithium column, Latin Resources (ASX:LRS), Solis Minerals (ASX:SLM), Gold Mountain (ASX:GMN), Oceana Lithium (ASX:OCN) and Si6 Metals (ASX:SI6) are also all competing for lithium in Brazil.

In other news:

Near term producer Lake Resources (ASX:LKE) has wrapped up lithium carbonate testing, which is one of the steps towards a definitive feasibility study at its Kachi project in Argentina.

Olympio Metals (ASX:OLY) has flagged rock chip samples up to 7.43% Li20 at the Wells-Lacourcière prospect, part of the Cadillac project in Québec, Canada. Read about this and more, on why Olympio could be onto something big in our special report.

Anson Resources (ASX:ASN) has submitted a Plan of Operation (POO) to commence a drilling program at its Green River lithium project in Utah, USA.

And another potentially hot lithium junior to watch, says Garimpeiro columnist Barry Fitzgerald, is Bulletin Resources (ASX:BNR), which he notes has a highly anticipated drilling program pending. The project sits 12km southwest and along strike from Allkem’s (ASX:AKE) ageing Mt Cattlin mine.

It’s not just ALL about lithium, of course. (Or is it?)…

Rock chip sampling has returned multiple high grade manganese assays topping 41% from Resolution Minerals’ (ASX:RML) Carrara Range project in the NT. Our special report has more. And, more broadly on manganese, so does Barry Fitzgerald.

Castle Minerals (ASX:CDT), which produces bulk fine-flake graphite over at its Kambale project in Ghana, recently announced more multiple, wide, high-grade, near-surface intercepts.

Meanwhile, back in Bow River… Lycaon Resources (ASX:LYN) has drilled into a thick, 45.2m of nickel-copper sulphides at its Bow River prospect, “one of the best regional nickel-copper prospects in the Kimberley outside of Panoramic’s Savannah mine”. More on this… here.

At Stockhead, we tell it like it is. While NickelSearch, Latin Resources, Olympio Metals, Anson Resources, Resolution Minerals and Lyacon Resources are Stockhead advertisers at the time of writing, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.