Resources Top 5: For its first Oz investment, this Hong Kong group sunk $10m into a NSW gold junior worth… $7m

Pic via Getty Images

- Australian Gold and Copper pulls in more than $10m of funding from HK mining investment firm Delin

- Fellow goldie juniors Austral and Astral are also shining on the bourse

Here are the biggest small cap resources winners in early trade, Thursday September 21.

Australian Gold and Copper (ASX:AGC)

This NSW-exploring junior is up on some big investment news this morning.

It’s receiving what it describes as a “transformational” $10.1 million strategic capital investment from the Hong Kong-based Delin Mining Group Cooperation.

Never heard of Delin? It’s apparently its first investment in Australia as it plans to build an extensive mining portfolio.

What matters for AGC shareholders, though, is that this sizeable chunk of non-gold-backed fiat will allow AGC to kick on hard with the exploration of its portfolio, including five drill ready targets at the company’s South Cobar gold project.

AGC notes that the placement of 122,222,222 shares at $0.082636 per share “represents a significant premium above yesterday’s closing price of $0.057.” The current AGC share price is $0.082.

Following completion of the placement, subject to shareholder approval, Delin will hold 55% of the issued share capital of AGC.

AGC chairman David Richardson said:

“In the current climate where the cost of capital is high, this investment represents exceptional value for all our shareholders.

“The significant premium to market price is clear evidence of the attractiveness of the drill ready targets in our South Cobar project.”

AGC share price

Austral Gold (ASX:AGD)

(Up on no news)

Gold and silver miner AGD is up about 24% at the time of writing on nothing fresh that we can see landing today… but it did recently (Sep 15) obtain itself a new unsecured short-term loan of up to US$3 million from Inversiones Financieras del Sur S.A, the company’s largest shareholder.

The loan agreement is for six months with an interest rate of 9% per annum and it will be used for “working capital”.

Watch the video below to see the highlights from our Half Year Report! pic.twitter.com/N10ZPVk49h

— Austral Gold Limited (@AustralGold) September 12, 2023

Austral Gold, dual-listed on the ASX and the Toronto Stock Exchange (TSXV), also released a positive half-yearly report recently, noting a gross profit of 12.4% among other positive data.

The company made headlines about this time last year when armed bandits absconded with ~500oz of gold from AGD’s Guanaco and Amancaya mine complex operation in Chile.

AGD share price

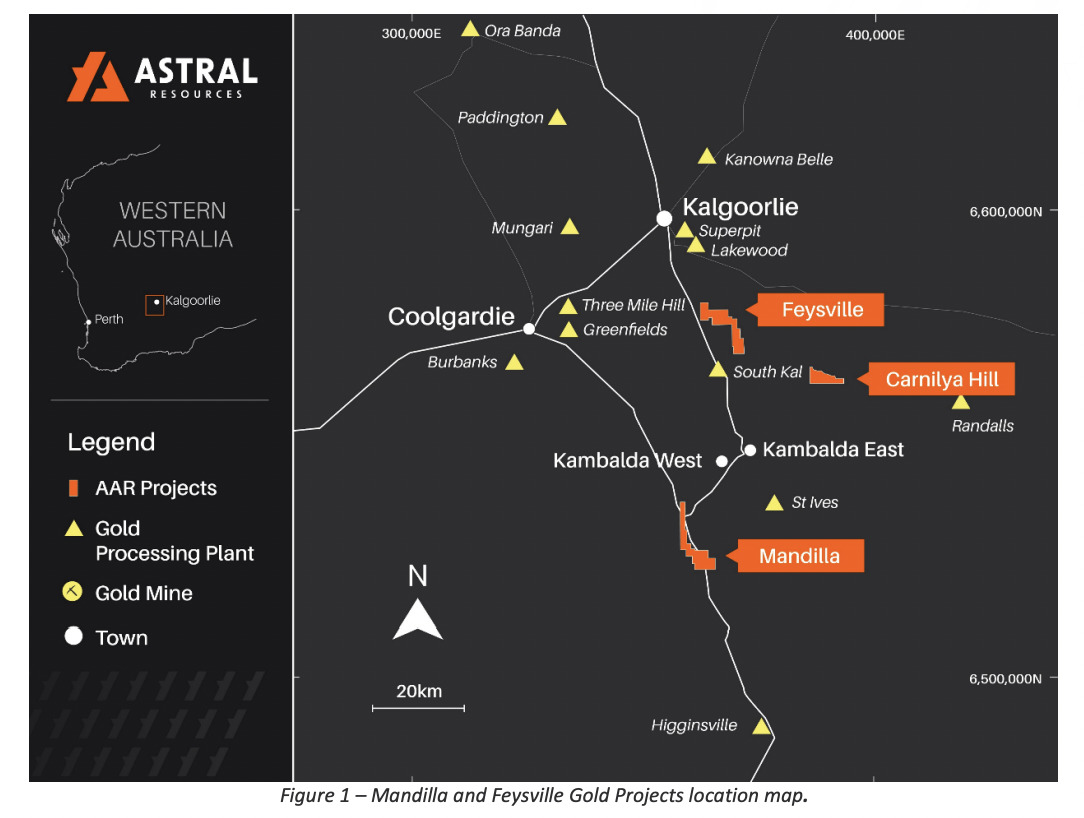

Astral Resources (ASX:AAR)

Looks like we’re working our way through the ‘A’s so far today.

Astral Resources, another gold-exploring junior, is up double digits on the back of positive scoping study learnings pertaining to its Mandilla gold project in WA’s Widgiemooltha greenstone belt near Kalgoorlie.

Mandilla is one of the largest undeveloped free-milling open pit gold development projects in the region.

The study reveals that a 2.5Mtpa (million tonnes per annum) carbon in leach (CIL) processing plant and associated infrastructure will be the optimal commercialisation strategy for the mine.

It also projects an average annual gold production target of 100,000 ounces at an average feed grade of 1.30g/t gold over the first 7.4-year period, gradually reducing to a projected 41,000 ounces at 0.50g/t gold when treating lower grade stockpiles over a remaining 3.4 years.

Astral estimates that $191 million will be needed for pre-production capital and operating costs.

Additionally, the study has generated some “compelling financials” for Mandilla, using a $2,750/oz gold price assumption – which is conservative. These include:

• A pre-tax internal rate of return of 73%

• A net present value of $442 million based on a discounted rate of 8%

AAR share price

Castle Minerals (ASX:CDT)

Castle continues its recent good form.

The explorer, which is producing bulk fine-flake graphite over at its Kambale project in Ghana, has announced more multiple, wide, high-grade, near-surface intercepts.

And these have been obtained through another 21 holes in the company’s recent 43-hole RC drilling campaign.

The mineralisation extends continuously for 2.5km north-south and to over 120m below surface with “excellent grade continuity”, reports Castle, and it adds further to the company’s existing impressive intercepts from a total of 21,367m worth of drilling.

Castle MD Stephen Stone extrapolated:

“The results from the final 21 holes of the recently completed 43-hole, 5,335m RC drilling programme at the Kambale Graphite Project provide additional support to our expectation of a material increase in contained graphite in what is an already robust 15.6Mt Mineral Resource Estimate grading 9.0% TGC and containing 1.41Mt of graphite.”

The company will be releasing its Mineral Resource Estimate update soon.

$CDT MD, Steve Stone, says that it’s Kambale #Graphite Project just gets better and better with recent results of a whopping 86m @ 8.2% TGC and 53m @ 11.5% THC and he is now looking forward to delivering a resource update in coming weeks.

🔗 https://t.co/sjIbNM5cn6 pic.twitter.com/0J5kAtu1Zx

— Castle Minerals Limited (@Castle_Minerals) September 21, 2023

CDT share price

Native Mineral Resources (ASX:NMR)

(Up on no news)

No fresh news overnight or this morning from NMR, but this, from the other day (Sep 19) is well worth a mention here.

ICYMI: Spodumene Bearing Pegmatites Visually Confirmed at High-Grade Lithium Project

Field trip to McLaughlin Lake involving mapping & ground-based sampling identified multiple pegmatite dykes at highly prospective McLaughlin Lake Lithium Projecthttps://t.co/e61H6cE37H $NMR pic.twitter.com/GuheU8i3DY

— Native Mineral Resources (@NM_Resources) September 19, 2023

A geological field trip at the company’s highly prospective McLaughlin Lake lithium project in Canada’s Manitoba region has revealed multiple pegmatite dykes up to 5m wide over a 5km trend.

Some 29 samples of multiple dykes have been collected from both the McLaughlin Lake and Magill Lake areas and assays are expected in 3-4 weeks.

NMR’s managing director Blake Cannavo said:

“The information gathered by our team so far is hugely encouraging. Initial observations from mapping and sampling completed across key targets has confirmed NMR’s belief that McLaughlin Lake has the potential to be an exciting Lithium-cesium-tantalum (LCT) pegmatite deposit.”

NMR share price

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.