High Voltage: Like a cobalt from the blue

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Cobalt stocks could be back with a bang.

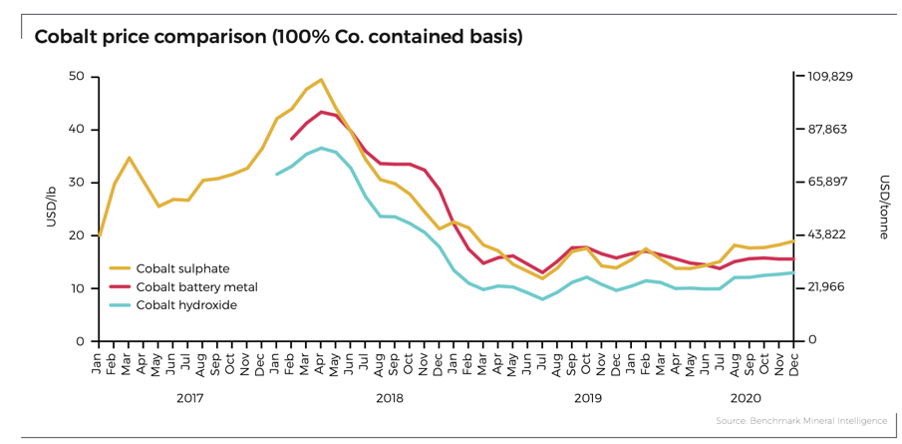

Plentiful cobalt supply in 2018 and 2019 — due in part to expansions driven by high sentiment and higher prices — caused the market to tumble, with average prices for cobalt metal reaching a low of $12.85/lb ($28,300/tonne) in July 2019, Benchmark Mineral Intelligence says.

That oversupply of the much-maligned battery metal no longer exists.

This current price recovery, albeit from a low base, is backed by real demand – not just sentiment.

Benchmark forecasts the cobalt market will fall into marginal deficit by late 2021. This gap between supply and demand will keep growing in 2022 and beyond.

“The one thing that 2021 does have that the preceding two years did not have is tight cobalt supply, particularly for the battery feedstock of choice, cobalt hydroxide,” Benchmark says in a recent note.

“Cobalt stocks have been whittled down due to the strengthening, real demand from the lithium ion battery sector due to electric vehicle (EV) sales.

“Not only is demand increasing, but the cobalt market is set to transition into undersupply imminently as demand begins to outstrip supply, due to a lack of investment in the upstream following nearly 3 years of low or falling prices.”

Exacerbating this supply deficit is the delayed transition to high nickel, low cobalt cathodes, which means cobalt demand on a per unit basis has not fallen to the levels some in the supply chain expected.

Does strong January price action so far mean prices will rally back to 2018 highs of +$US90,000/t?

Almost certainly not, Benchmark says. But the outlook for cobalt is as strong as it has been since the last price spike.

“Whilst it is too early to say this is the start of sustained higher cobalt prices in 2021, better fundamentals and therefore better times for cobalt do appear to be on the horizon,” it says.

Here’s how a basket of 105 ASX stocks with exposure to lithium, cobalt, graphite, nickel, and vanadium are performing>>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop:

| CODE | COMPANY | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | PRICE | MARKET CAP |

|---|---|---|---|---|---|---|---|

| SYA | Sayona Mining | 133 | 133 | 75 | 43 | 0.021 | $ 42,837,531.76 |

| LPD | Lepidico | 90 | 111 | 171 | 28 | 0.019 | $ 93,343,230.68 |

| VUL | Vulcan Energy | 81 | 128 | 824 | 3019 | 4.99 | $ 318,892,430.80 |

| AGY | Argosy Minerals | 56 | 69 | 123 | 56 | 0.125 | $ 122,340,256.92 |

| COB | Cobalt Blue | 56 | 124 | 180 | 93 | 0.28 | $ 60,805,461.75 |

| CXO | Core Lithium | 52 | 162 | 323 | 547 | 0.22 | $ 224,871,822.23 |

| AUZ | Australian Mines | 44 | 53 | 156 | 53 | 0.023 | $ 83,190,530.85 |

| PUR | Pursuit Minerals | 43 | 36 | 437 | 544 | 0.03 | $ 24,273,929.56 |

| BSM | Bass Metals | 43 | 25 | 67 | -17 | 0.005 | $ 20,108,378.68 |

| S2R | S2 Resources | 42 | 6 | 42 | 48 | 0.185 | $ 59,829,324.01 |

| CLA | Celsius Resources | 33 | 49 | 281 | 510 | 0.061 | $ 47,593,302.94 |

| GME | GME Resources | 32 | 14 | 69 | 30 | 0.066 | $ 34,525,749.66 |

| LTR | Liontown Resources | 31 | 37 | 324 | 443 | 0.445 | $ 822,707,370.94 |

| AVL | Australian Vanadium | 29 | 29 | 80 | 64 | 0.018 | $ 52,742,858.65 |

| GXY | Galaxy Resources | 28 | 32 | 241 | 173 | 2.85 | $ 1,446,663,347.08 |

| ASN | Anson Resources | 28 | 12 | 61 | 42 | 0.037 | $ 30,431,787.47 |

| PLS | Pilbara Minerals | 27 | 39 | 289 | 295 | 1.11 | $ 2,987,722,430.33 |

| CZN | Corazon | 25 | -17 | 25 | -35 | 0.0025 | $ 8,133,397.86 |

| EUR | European Lithium | 24 | 24 | 30 | -43 | 0.056 | $ 39,233,152.22 |

| QPM | Queensland Pacific | 24 | 11 | 193 | 173 | 0.041 | $ 37,820,350.58 |

| ARL | Ardea Resources | 23 | 11 | 85 | -7 | 0.5 | $ 63,835,291.00 |

| PLL | Piedmont Lithium | 23 | 23 | 400 | 291 | 0.45 | $ 653,631,283.26 |

| FFX | Firefinch | 22 | 38 | 69 | 197 | 0.22 | $ 179,838,667.73 |

| SBR | Sabre Resources | 22 | 10 | 267 | 450 | 0.011 | $ 19,355,231.96 |

| FGR | First Graphene | 22 | 22 | 165 | 118 | 0.305 | $ 173,602,765.05 |

| QXR | Qx Resources | 21 | 13 | -15 | -15 | 0.017 | $ 8,540,197.15 |

| ESR | Estrella Resources | 20 | -33 | 740 | 833 | 0.084 | $ 72,860,491.52 |

| GED | Golden Deeps | 20 | -14 | 20 | -50 | 0.012 | $ 10,069,973.49 |

| VRC | Volt Resources | 20 | 9 | -43 | 9 | 0.012 | $ 23,791,109.11 |

| BKT | Black Rock Mining | 20 | 35 | 105 | 154 | 0.115 | $ 78,450,659.76 |

| INF | Infinity Lithium | 19 | 28 | 111 | 212 | 0.185 | $ 59,078,396.70 |

| AML | Aeon Metals | 19 | -4 | 56 | -26 | 0.125 | $ 91,471,913.15 |

| PAN | Panoramic Resources | 19 | 23 | 119 | -30 | 0.16 | $ 358,909,950.70 |

| EMH | European Metals | 18 | 75 | 395 | 361 | 1.36 | $ 152,552,526.10 |

| RNU | Renascor Resources | 18 | 18 | 18 | 8 | 0.013 | $ 21,614,809.53 |

| JRV | Jervois Mining | 18 | 15 | 179 | 109 | 0.46 | $ 371,912,659.10 |

| AVZ | AVZ Minerals | 18 | 90 | 285 | 365 | 0.2 | $ 574,499,701.60 |

| AOU | Auroch Minerals | 17 | 13 | 227 | 183 | 0.17 | $ 44,744,898.28 |

| ADV | Ardiden | 17 | 11 | 31 | 425 | 0.021 | $ 45,004,299.56 |

| LIT | Lithium Australia | 17 | 26 | 67 | 26 | 0.077 | $ 59,419,915.20 |

| SYR | Syrah Resources | 16 | 10 | 255 | 115 | 1.12 | $ 548,650,117.85 |

| VR8 | Vanadium Resources | 16 | 29 | 44 | 20 | 0.036 | $ 13,099,710.33 |

| CLQ | Clean Teq | 16 | 9 | 123 | 18 | 0.29 | $ 235,004,459.45 |

| LPI | Lithium Power International | 16 | -7 | 50 | -2 | 0.255 | $ 80,531,253.81 |

| PRL | Province Resources | 15 | 15 | -39 | 143 | 0.015 | $ 10,065,286.74 |

| RLC | Reedy Lagoon | 14 | 23 | 60 | 433 | 0.016 | $ 7,985,474.33 |

| NIC | Nickel Mines | 14 | 24 | 108 | 102 | 1.26 | $ 3,206,662,040.03 |

| ORE | Orocobre | 14 | 23 | 95 | 71 | 5.08 | $ 1,720,217,780.00 |

| ESS | Essential Metals | 13 | 9 | -15 | -23 | 0.093 | $ 18,414,357.24 |

| AQD | Ausquest | 13 | 0 | 6 | 31 | 0.017 | $ 11,514,655.58 |

| OZL | OZ Minerals | 11 | 11 | 78 | 95 | 21.01 | $ 6,963,786,406.18 |

| CHN | Chalice Mining | 11 | 1 | 313 | 1569 | 4.34 | $ 1,557,369,317.67 |

| IGO | IGO Limited | 11 | 40 | 41 | 4 | 7.08 | $ 5,400,904,276.50 |

| TMT | Technology Metals | 11 | 7 | 89 | 188 | 0.36 | $ 55,274,814.30 |

| TLG | Talga Group | 10 | -6 | 198 | 292 | 1.79 | $ 533,939,806.26 |

| STK | Strickland Metals | 10 | -15 | 52 | 120 | 0.044 | $ 18,530,666.92 |

| BHP | BHP Group | 10 | 10 | 30 | 17 | 46.49 | $ 137,482,884,557.98 |

| BSX | Blackstone | 9 | 11 | 73 | 152 | 0.415 | $ 143,215,324.55 |

| CWX | Carawine Resources | 9 | -9 | 17 | -2 | 0.245 | $ 26,678,025.99 |

| MAN | Mandrake Resources | 8 | -6 | 229 | 513 | 0.092 | $ 29,450,170.44 |

| RFR | Rafaella Resources | 8 | 4 | 7 | -16 | 0.08 | $ 10,577,816.84 |

| MRC | Mineral Commodities | 8 | 8 | 57 | 33 | 0.4 | $ 191,621,459.82 |

| TON | Triton Minerals | 8 | -2 | -2 | 49 | 0.055 | $ 58,992,339.48 |

| BAR | Barra Resources | 8 | -10 | 40 | 27 | 0.028 | $ 18,973,026.83 |

| INR | Ioneer | 7 | 9 | 131 | 67 | 0.3 | $ 531,058,143.11 |

| JRL | Jindalee Resources | 7 | 4 | 151 | 203 | 85 | $ 34,645,573.65 |

| LKE | Lake Resources | 7 | -3 | 100 | 136 | 0.078 | $ 65,163,432.67 |

| GAL | Galileo Mining | 7 | 2 | -2 | 55 | 0.24 | $ 35,059,795.23 |

| NMT | Neometals | 5 | 32 | 100 | 74 | 0.29 | $ 160,878,623.47 |

| MIN | Mineral Resources | 5 | 13 | 75 | 133 | 39.41 | $ 7,634,426,840.48 |

| VMC | Venus Metals | 5 | -7 | -30 | 14 | 0.21 | $ 33,237,310.26 |

| AXE | Archer Materials | 5 | 1 | 19 | 248 | 0.54 | $ 127,202,148.49 |

| BUX | Buxton Resources | 5 | 0 | -18 | -34 | 0.065 | $ 9,387,824.81 |

| POS | Poseidon Nickel | 5 | 1 | 143 | 62 | 0.068 | $ 196,659,039.64 |

| MCR | Mincor Resources | 5 | 3 | 58 | 67 | 1.16 | $ 513,915,572.94 |

| DEV | Devex Resources | 4 | 2 | 109 | 220 | 0.24 | $ 69,250,190.80 |

| CTM | Centaurus Metals | 4 | 35 | 73 | 372 | 0.85 | $ 285,238,765.00 |

| CNJ | Conico | 3 | -14 | 275 | 275 | 0.03 | $ 22,693,051.23 |

| TNG | TNG | 3 | 7 | 13 | 5 | 0.093 | $ 110,312,656.82 |

| IPT | Impact Minerals | 3 | -5 | 43 | 233 | 0.02 | $ 35,577,804.52 |

| BEM | Blackearth Minerals | 2 | 5 | 15 | -6 | 0.046 | $ 6,919,066.22 |

| G88 | Golden Mile Resources | 2 | 19 | -19 | 6 | 0.057 | $ 6,766,008.04 |

| MLS | Metals Australia | 0 | 33 | 33 | 100 | 0.002 | $ 8,381,807.15 |

| GLN | Galan Lithium | 0 | 1 | 148 | 185 | 0.385 | $ 84,201,432.66 |

| EGR | Ecograf | 0 | -3 | 154 | 133 | 0.17 | $ 60,057,816.72 |

| TKL | Traka Resources | 0 | -9 | 112 | 165 | 0.021 | $ 11,648,696.56 |

| WKT | Walkabout Resources | 0 | -14 | -14 | -34 | 0.125 | $ 45,387,373.85 |

| MOH | Moho Resources | 0 | -10 | -33 | 80 | 0.09 | $ 8,431,485.21 |

| SRI | Sipa Resources | 0 | -4 | 3 | -8 | 0.065 | $ 11,380,950.27 |

| SGQ | St George Mining | 0 | -9 | -9 | -16 | 0.105 | $ 52,872,054.48 |

| RXL | Rox Resources | 0 | -2 | -41 | 96 | 0.051 | $ 104,541,251.61 |

| LEG | Legend Mining | 0 | 0 | -21 | 34 | 0.115 | $ 307,997,107.92 |

| LML | Lincoln Minerals | 0 | 0 | 60 | 60 | 0.008 | $ 4,599,869.49 |

| ATM | Aneka Tambang | 0 | 0 | 0 | 0 | 1 | $ 1,303,649.00 |

| MLX | Metals X | 0 | 44 | 59 | 84 | 0.14 | $ 127,017,249.38 |

| HNR | Hannans | 0 | -8 | 0 | -40 | 0.006 | $ 14,159,863.15 |

| GBR | Great Boulder Resources | -2 | -4 | 35 | 22 | 0.048 | $ 9,591,048.27 |

| SLZ | Sultan Resources | -2 | -14 | 19 | 271 | 0.215 | $ 15,645,237.53 |

| AZS | Azure Minerals | -3 | -38 | 359 | 237 | 0.505 | $ 161,745,003.53 |

| PSC | Prospect Resources | -3 | 14 | 90 | -8 | 0.165 | $ 56,455,363.07 |

| ARR | American Rare Earths | -5 | -16 | 394 | 460 | 0.084 | $ 27,046,573.24 |

| MNS | Magnis Energy Tech | -5 | 9 | 124 | 73 | 0.19 | $ 142,351,164.93 |

| ALY | Alchemy Resources | -11 | -16 | -18 | 49 | 0.016 | $ 12,100,382.15 |

| BOA | Boadicea Resources | -12 | -10 | 54 | 20 | 0.22 | $ 14,293,521.58 |

| PGM | Platina Resources | -13 | 7 | 17 | 182 | 0.048 | $ 19,800,238.16 |

| PNN | PepinNini Minerals | -18 | 94 | 140 | 80 | 0.32 | $ 12,935,903.16 |

SMALL CAP STANDOUTS

The cobalt price is due a big kick.

It’s stocks like Cobalt Blue, one of the last remaining pure play cobalt explorers on the ASX, who will benefit the most from improved sentiment and demand.

COB is planning pilot plant cobalt production for Q1 this year. A pilot plant is smaller version of the real thing, designed to test whether the process works in the real world.

COB says it is currently working with 15 global partners who have expressed interest in receiving cobalt samples, including big players like LG International, Mitsubishi Corporation and Sojitz Corporation.

SAYONA MINING (ASX:SYA)

US based project developer Piedmont Lithium (ASX:PLL) caught a rocket in September after announcing a deal to supply Tesla with a big chunk of its planned spodumene production for an initial five years.

Now Piedmont is looking to get bigger by becoming a strategic investor and major offtake partner in fellow US lithium play Sayona.

It will ink a +60,000tpa offtake deal based on market pricing (minimum US$500/t, maximum US$900/t), delivered to Piedmont’s planned lithium hydroxide plant in North Carolina.

Piedmont will also buy 19.9 per cent (a stake which could block any third party takeover attempt) of Sayona for ~$15m .

The cash will help advance Sayona’s flagship Authier project, the emerging Tansim project and creation of a lithium hub in Québec’s Abitibi region, including Sayona’s proposed bid for troubled lithium mine North American Lithium.

LEPIDICO (ASX:LPD)

Lepidico says it is now in confidential discussions with up to six lithium consumers and three caesium/rubidium consumers.

Lepidico has been advised by one prospective customer that its analysis of a lithium hydroxide monohydrate sample provided in 2020 should be completed in early 2021, allowing offtake discussions to advance. Offtake (purchase) deals are essential to financing a battery metals project.

Further lithium hydroxide samples will be sent to other potential customers over the coming weeks.

VULCAN ENERGY (ASX:VUL)

In 2020, the German geothermal lithium play gained ~1600 per cent to be one of the year’s best small cap performers.

Its share price has kept rising in 2021.

Its large, lithium-rich geothermal brine project in Germany can produce a “unique zero carbon lithium product”, it says.

In 2021 Vulcan plans to ink offtake agreements and complete a Definitive Feasibility Study (DFS) – an advanced look at whether a project is economic to build.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.