High Voltage: Is Nigeria the world’s new lithium hotspot?

Nigeria is emerging as a lithium hotspot comparable to Brazil’s Lithium Valley. Pic: Getty Images

- Nigerian lithium adventure places Chariot in pole position to supply Chinese battery customers

- Its new African operations have already sold artisanal pegmatite products to the Middle Kingdom

- Projects in Kwara and Oyo States similar geologically to giant deposits in Brazil’s Lithium Valley

Our High Voltage column wraps all the news driving ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, and vanadium.

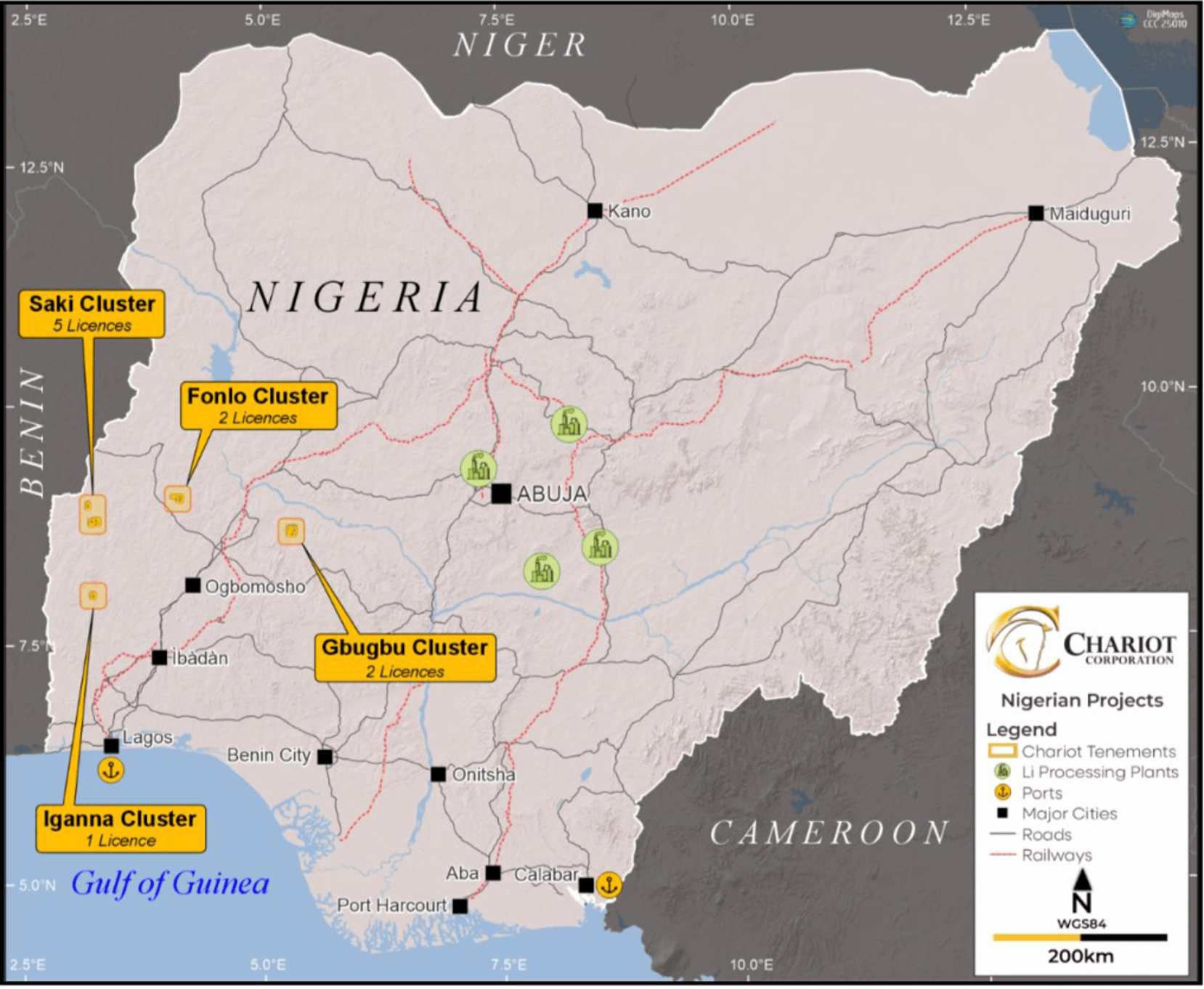

Last week, Chariot Corporation (ASX:CC9) announced its plans to acquire a majority stake in a Nigerian hard-rock lithium portfolio, a move set to propel the company to the forefront of a new lithium hotspot.

Nigeria is emerging as one of the continent’s fastest-growing lithium regions, with this highly prospective hard-rock lithium portfolio, covering 254km2 across the Oyo and Kwara states.

It consists of four projects, Fonlo, Gbugbu, Iganna and Saki, and includes eight Exploration Licences (ELs) and two Small-Scale Mining Leases (SSMLs).

What’s really interesting about the projects is 1) they have already been in production via artisanal miners, despite never being drilled and 2) their geological similarity to Brazil’s Lithium Valley.

The projects have been historically and are currently being mined for tin and columbite-tantalite and semi-precious gemstones, indicating the potential for lithium-rich LCT pegmatite systems.

Rock chip sampling has previously returned up to 6.59% Li2O.

Nigeria, Africa’s most populous country and already a major energy player as the largest oil producer in Africa, has been overlooked by TSX and ASX explorers for places like Brazil, despite the geological comparison.

CC9 managing director Shanthar Pathmanathan compared their potential to Sigma Lithium’s Grota do Cirilo project or Pilbara Minerals’ (ASX:PLS) Salinas project – both in Brazil.

“Instead of one asset, like Sigma was, we’ve got four projects that individually could be as big as Pilbara or Sigma,” he said.

“It could be a Pilbara, that could be a Liontown.

“At surface these are multi-kilometre strike systems, so as big as anything we’ve seen in WA and Brazil.”

In country knowledge the key

Pathmanathan said the deal came down to geologist Michael Cronwright, who had previously worked for the government in mapping the projects.

“Michael is an African lithium specialist and he is competent person for a whole bunch of African lithium names, and he worked on the NIMET mapping project in Nigeria,” he said.

“The main geo at Continental Lithium also worked on that project and that’s how these orebodies were found, by the government sponsored program.”

The company will acquire 66.7% in the assets via a joint venture with Continental– which will hold the remaining 33.3% – with CC9 funding a minimum of US$10m in exploration.

Entering the Africa-China supply corridor

The plan at the projects is to start producing on a small scale.

“Already we’ve gotten calls from various groups that promoted AVZ, we’ve gotten calls from Chinese parties who want deals on offtake and they want to fund modern small-scale development,” Pathmanathan said.

“China is prioritising African supply. Australia is not viewed as strongly any more by the Chinese, South America has some political issues evolving, and then Africa has got very little political resistance, very little ESG constraints and less red tape.

“It’s permitting friendly.”

Not to mention, African production has grown 500% in the last three years when lithium prices have crashed 90%.

“That is pretty startling because normally when markets fall people shut down, but what’s happened is the Chinese customers have gone to Africa and they’re paying a premium for African ore to support artisanal and small scale mining,” Pathmanathan said.

“That 500% increase in the last two years – in contrast to the shutting down of plants in WA and the shutting down of expansion plans in South America – tells me there’s a two track system and China is the biggest market in the world. It’s going to be the inside lane.”

Battery Metals Winners and Losers

Here’s how a basket of ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, magnesium, manganese and vanadium is performing >>>

Code Company Price % Week % Month % Six Month % Year Market Cap ARR American Rare Earths 0.475 94% 83% 79% 67% $220,729,135 ASN Anson Resources Ltd 0.093 72% 98% 37% -38% $133,126,708 SRL Sunrise 1.45 65% 193% 368% 176% $172,949,259 AR3 Austrare 0.088 63% 66% -2% 1% $18,654,888 REE Rarex Limited 0.027 59% 35% 200% 80% $24,844,429 KNG Kingsland Minerals 0.12 52% 46% -8% -43% $10,521,332 LSR Lodestar Minerals 0.015 50% 150% 0% -25% $6,361,448 ENT Enterprise Metals 0.003 50% 20% 0% 0% $4,113,952 AKN Auking Mining Ltd 0.006 50% -25% 71% -70% $3,440,582 GCM Green Critical Min 0.032 45% 78% 60% 967% $68,767,742 MTM MTM Critical Metals 0.855 40% 58% 217% 2343% $451,102,427 BCA Black Canyon Limited 0.24 37% 182% 264% 182% $29,819,660 BMM Bayanminingandmin 0.065 35% 91% 35% -24% $6,795,057 MEI Meteoric Resources 0.155 35% 24% 74% 11% $373,978,045 BYH Bryah Resources Ltd 0.008 33% -33% 100% 100% $7,759,628 TOR Torque Met 0.19 33% 46% 273% 46% $94,783,886 FRS Forrestaniaresources 0.125 32% 79% 1036% 268% $43,543,140 ILU Iluka Resources 5.01 28% 32% -6% -26% $2,096,750,819 EVG Evion Group NL 0.023 28% 39% -12% 0% $10,003,159 PVW PVW Res Ltd 0.014 27% 0% 0% -52% $2,784,667 VTM Victory Metals Ltd 1.1 27% 32% 189% 224% $132,353,155 NTU Northern Min Ltd 0.035 25% 13% 75% 6% $275,786,142 EGR Ecograf Limited 0.325 25% 8% 269% 183% $163,523,455 MOH Moho Resources 0.005 25% 25% 25% 0% $3,727,070 TON Triton Min Ltd 0.005 25% 0% -38% -55% $7,841,944 CRR Critical Resources 0.005 25% 43% 0% -38% $13,850,427 NWM Norwest Minerals 0.015 25% 7% 9% -45% $13,557,020 RGL Riversgold 0.005 25% 11% 67% -29% $6,734,850 TMX Terrain Minerals 0.0025 25% 0% -50% -29% $6,329,536 BM8 Battery Age Minerals 0.064 23% 25% -36% -54% $9,108,109 IPX Iperionx Limited 5.29 23% 15% 20% 135% $1,647,628,448 NH3 Nh3Cleanenergyltd 0.056 22% 81% 211% 331% $38,185,332 GT1 Greentechnology 0.028 22% 27% -58% -61% $11,879,251 ASM Ausstratmaterials 0.675 22% 9% 34% -15% $129,658,588 ASL Andean Silver 1.385 21% 26% 33% 39% $219,901,651 DEV Devex Resources Ltd 0.083 20% 4% -3% -71% $38,427,088 FRB Firebird Metals 0.12 20% 54% 20% -17% $15,659,754 LEG Legend Mining 0.0095 19% 36% -5% -14% $26,230,295 LYC Lynas Rare Earths 9.755 18% 5% 38% 55% $9,363,823,189 SRI Sipa Resources Ltd 0.02 18% 33% 43% 18% $8,327,966 AXE Archer Materials 0.31 17% 15% -25% 11% $76,454,104 LML Lincoln Minerals 0.007 17% 56% 17% 17% $14,717,988 LU7 Lithium Universe Ltd 0.007 17% 17% -13% -53% $6,551,857 NVX Novonix Limited 0.46 16% 12% -30% -31% $302,194,648 CDT Castle Minerals 0.08 16% -9% 33% -33% $8,120,670 M24 Mamba Exploration 0.015 15% 7% 0% 15% $4,722,650 KM1 Kalimetalslimited 0.099 15% 32% -14% -52% $8,698,983 DM1 Desert Metals 0.023 15% 5% -12% -21% $9,288,018 GSM Golden State Mining 0.008 14% 7% 0% -27% $2,234,965 A11 Atlantic Lithium 0.16 14% -3% -37% -57% $103,972,097 EUR European Lithium Ltd 0.082 14% 86% 6% 55% $106,943,428 ARU Arafura Rare Earths 0.21 14% 17% 56% 14% $529,830,669 INR Ioneer Ltd 0.1125 13% 2% -30% -22% $275,963,714 LMG Latrobe Magnesium 0.009 13% 0% -47% -79% $21,012,720 FTL Firetail Resources 0.085 12% 15% 13% 16% $32,682,406 SYA Sayona Mining Ltd 0.019 12% 27% -21% -42% $219,322,624 AZI Altamin Limited 0.019 12% -21% -14% -42% $10,915,555 MIN Mineral Resources. 27.4 11% 17% -24% -52% $5,384,609,750 QXR Qx Resources Limited 0.005 11% 67% 67% -17% $6,551,644 IXR Ionic Rare Earths 0.02 11% 122% 186% 82% $96,608,406 PVT Pivotal Metals Ltd 0.01 11% 67% 11% -55% $9,072,259 EVR Ev Resources Ltd 0.01 11% 67% 400% 118% $22,275,033 RBX Resource B 0.03 11% 20% -19% -21% $3,455,535 HRE Heavy Rare Earths 0.05 11% 22% 61% 79% $11,025,796 WC1 Westcobarmetals 0.02 11% -5% -9% -35% $3,750,831 LRV Larvottoresources 0.785 11% 22% 15% 648% $327,870,466 SYR Syrah Resources 0.2925 10% 10% 22% -6% $307,462,220 SYR Syrah Resources 0.2925 10% 10% 22% -6% $307,462,220 PTR Petratherm Ltd 0.375 10% 29% 0% 1605% $128,247,465 PLL Piedmont Lithium Inc 0.11 10% 18% -21% -35% $57,350,216 LIT Livium Ltd 0.011 10% 22% -31% -51% $16,909,071 ALY Alchemy Resource Ltd 0.0055 10% 10% -21% -31% $5,890,381 DRE Dreadnought Resources Ltd 0.011 10% -15% 0% -50% $55,874,500 ICL Iceni Gold 0.068 10% -4% -14% -9% $24,031,097 WA1 Wa1Resourcesltd 17.67 9% 27% 33% 8% $1,216,227,155 HAS Hastings Tech Met 0.3 9% 3% -10% -18% $58,088,490 VMC Venus Metals Cor Ltd 0.12 9% 4% 60% 62% $23,535,442 QPM QPM Energy Limited 0.037 9% 0% -45% 12% $102,523,345 FBM Future Battery 0.025 9% 56% 14% -14% $18,848,509 OMH OM Holdings Limited 0.32 8% 7% -11% -26% $249,033,460 OD6 Od6Metalsltd 0.027 8% 4% -63% -49% $4,332,635 WR1 Winsome Resources 0.205 8% 46% -53% -71% $48,793,690 JLL Jindalee Lithium Ltd 0.42 8% 8% 91% 33% $33,545,755 KGD Kula Gold Limited 0.007 8% -13% 56% -33% $6,448,776 LTR Liontown Resources 0.8075 8% 21% 39% -15% $2,004,259,109 ESR Estrella Res Ltd 0.043 8% -7% 79% 975% $88,234,145 JMS Jupiter Mines. 0.22 7% 13% 57% -19% $431,429,187 GW1 Greenwing Resources 0.03 7% 15% -32% -40% $8,564,078 STM Sunstone Metals Ltd 0.015 7% 0% 131% 50% $92,030,980 WCN White Cliff Min Ltd 0.0225 7% 13% 13% 50% $53,094,495 RNU Renascor Res Ltd 0.061 7% -10% 3% -35% $155,132,416 MLX Metals X Limited 0.6575 7% 17% 49% 32% $607,178,204 EFE Eastern Resources 0.032 7% 7% 14% -20% $4,034,878 GAL Galileo Mining Ltd 0.165 6% 43% 0% -11% $31,619,988 PMT Patriotbatterymetals 0.335 6% 29% -17% -37% $179,351,426 CRI Criticaltd 0.017 6% -6% 31% -11% $45,869,097 IG6 Internationalgraphit 0.052 6% -9% -13% -37% $9,484,358 TVN Tivan Limited 0.089 6% -5% -32% 59% $176,827,231 DYM Dynamicmetalslimited 0.27 6% -5% -7% 108% $13,252,772 S2R S2 Resources 0.073 6% 1% -12% -27% $36,995,653 SCN Scorpion Minerals 0.019 6% -5% 12% 6% $9,957,068 IGO IGO Limited 4.63 5% 10% -10% -22% $3,581,876,755 CNB Carnaby Resource Ltd 0.4475 5% 28% 30% -12% $102,774,987 MAN Mandrake Res Ltd 0.02 5% 5% -9% -31% $12,545,198 RAG Ragnar Metals Ltd 0.02 5% -9% 0% 5% $9,953,706 PEK Peak Rare Earths Ltd 0.31 5% 13% 195% 102% $133,466,467 PEK Peak Rare Earths Ltd 0.31 5% 13% 195% 102% $133,466,467 MHC Manhattan Corp Ltd 0.021 5% -9% -22% -37% $4,932,877 TMB Tambourahmetals 0.022 5% 0% -12% -55% $3,474,997 CY5 Cygnus Metals Ltd 0.09 5% 0% -31% 58% $95,693,596 GED Golden Deeps 0.023 5% 0% -4% -32% $3,719,640 NIC Nickel Industries 0.7475 5% 7% -12% -12% $3,212,292,548 CHN Chalice Mining Ltd 1.7875 4% 16% 50% 48% $702,193,352 ETM Energy Transition 0.051 4% 9% -40% 168% $79,121,843 BHP BHP Group Limited 39.36 4% 5% -2% -9% $198,522,056,311 BC8 Black Cat Syndicate 0.805 4% -8% 10% 124% $576,650,741 LM1 Leeuwin Metals Ltd 0.135 4% -4% 23% 129% $14,112,894 KZR Kalamazoo Resources 0.092 3% 10% 16% 37% $20,184,204 GBR Greatbould Resources 0.063 3% -16% 37% 13% $62,669,316 ADV Ardiden Ltd 0.16 3% 10% 14% 19% $9,690,213 EMN Euromanganese 0.175 3% -10% 6% -50% $9,690,643 AXN Alliance Nickel Ltd 0.037 3% 16% 23% 0% $24,678,547 GL1 Globallith 0.185 3% 28% 3% -31% $52,346,425 PSC Prospect Res Ltd 0.19 3% 36% 104% 36% $129,608,628 RXL Rox Resources 0.2975 3% 1% 32% 98% $223,961,485 LLM Loyal Metals Ltd 0.22 2% 69% 122% 63% $21,657,609 NWC New World Resources 0.0665 2% 28% 233% 102% $232,359,277 NC1 Nicoresourceslimited 0.09 2% -6% -4% -38% $11,110,552 CHR Charger Metals 0.051 2% 24% -11% -17% $3,948,433 1AE Auroraenergymetals 0.051 2% -15% -18% -43% $9,132,251 GRE Greentechmetals 0.052 2% 30% -26% -64% $5,669,757 AQD Ausquest Limited 0.055 2% 0% 588% 416% $75,160,766 CTM Centaurus Metals Ltd 0.345 1% -5% -5% -14% $173,845,425 ARN Aldoro Resources 0.37 1% 12% 42% 320% $66,933,389 KNI Kunikolimited 0.096 1% -26% -45% -54% $8,170,881 A8G Australasian Metals 0.067 0% -1% -16% -4% $3,878,612 RIL Redivium Limited 0.004 0% 0% 0% 33% $13,609,422 LPD Lepidico Ltd 0.002 0% 0% 0% 0% $17,178,371 MRD Mount Ridley Mines 0.0025 0% 25% -17% -75% $1,946,223 CZN Corazon Ltd 0.002 0% -20% 0% -60% $2,369,145 LKE Lake Resources 0.032 0% 10% -26% -14% $57,700,793 RLC Reedy Lagoon Corp. 0.002 0% 0% 0% -33% $1,553,413 CLA Celsius Resource Ltd 0.007 0% 0% -36% -50% $21,948,419 TLG Talga Group Ltd 0.41 0% -13% -2% -22% $181,984,302 MNS Magnis Energy Tech 0.042 0% 0% 0% 0% $50,378,922 GLN Galan Lithium Ltd 0.135 0% 41% 4% -13% $130,133,327 VRC Volt Resources Ltd 0.004 0% 0% 33% -20% $18,739,398 PGM Platina Resources 0.021 0% 0% 5% -25% $14,333,148 TKL Traka Resources 0.001 0% -50% -50% -33% $2,125,790 IPT Impact Minerals 0.007 0% 27% -33% -52% $25,956,645 AVL Aust Vanadium Ltd 0.009 0% 0% -40% -47% $77,711,923 LEL Lithenergy 0.37 0% 0% 0% -1% $41,440,581 1MC Morella Corporation 0.016 0% -6% -36% -67% $5,894,864 MRC Mineral Commodities 0.026 0% 0% 0% 0% $25,596,288 WKT Walkabout Resources 0.095 0% 0% 0% -10% $63,769,838 CNJ Conico Ltd 0.007 0% 0% -13% -30% $1,905,020 SLZ Sultan Resources Ltd 0.006 0% 20% -14% -25% $925,880 SMX Strata Minerals 0.012 0% 0% -63% -50% $2,938,226 MLS Metals Australia 0.017 0% 0% -29% -11% $12,388,232 MQR Marquee Resource Ltd 0.009 0% -18% -36% -10% $5,024,723 MRR Minrex Resources Ltd 0.008 0% -20% 0% -27% $8,678,940 BNR Bulletin Res Ltd 0.061 0% 5% 61% 33% $17,910,413 AS2 Askarimetalslimited 0.008 0% 33% -27% -82% $3,233,365 DTM Dart Mining NL 0.003 0% -14% -70% -83% $3,594,167 EMS Eastern Metals 0.01 0% 0% -33% -64% $1,394,262 IMI Infinitymining 0.01 0% 25% -9% -50% $3,807,142 CTN Catalina Resources 0.004 0% 0% 7% 42% $9,704,076 OB1 Orbminco Limited 0.001 0% 0% -40% -60% $3,402,568 KOR Korab Resources 0.008 0% 0% 0% 0% $2,936,400 CMX Chemxmaterials 0.026 0% 0% 0% -42% $3,354,580 E25 Element 25 Ltd 0.23 0% 18% -10% 5% $52,580,852 RR1 Reach Resources Ltd 0.008 0% 7% 14% -47% $6,995,451 EMT Emetals Limited 0.003 0% 0% -25% -40% $2,550,000 PNT Panthermetalsltd 0.011 0% -21% 38% -56% $3,309,950 AVW Avira Resources Ltd 0.007 0% 0% -65% -65% $1,610,000 RAS Ragusa Minerals Ltd 0.014 0% -7% 8% -13% $2,672,982 ZNC Zenith Minerals Ltd 0.034 0% 10% -3% -29% $18,001,487 LPM Lithium Plus 0.06 0% -6% -27% -60% $7,970,400 ODE Odessa Minerals Ltd 0.006 0% 20% -8% 100% $9,597,195 LNR Lanthanein Resources 0.001 0% 33% -56% -67% $2,810,182 CLZ Classic Min Ltd 0.001 0% 0% 0% 0% $3,017,699 M2R Miramar 0.004 0% 33% 0% -50% $4,485,705 TAR Taruga Minerals 0.008 0% -11% -20% -11% $5,710,032 ABX ABX Group Limited 0.038 0% -5% -5% -25% $9,823,379 RR1 Reach Resources Ltd 0.008 0% 7% 14% -47% $6,995,451 AOA Ausmon Resorces 0.002 0% 0% 0% -33% $2,622,427 GRL Godolphin Resources 0.011 0% 22% -15% -31% $4,937,606 KTA Krakatoa Resources 0.011 0% -8% 22% -21% $8,526,474 LNR Lanthanein Resources 0.001 0% 33% -56% -67% $2,810,182 L1M Lightning Minerals 0.04 0% -26% -39% -39% $4,634,275 EV1 Evolutionenergy 0.015 0% 7% -29% -44% $5,802,408 VHM Vhmlimited 0.19 0% -17% -49% -61% $48,178,291 LLL Leolithiumlimited 0.332997 0% 0% 0% 0% $401,204,047 SRN Surefire Rescs NL 0.002 0% 0% -40% -63% $6,457,219 WSR Westar Resources 0.005 0% 0% -44% -38% $1,993,624 REC Rechargemetals 0.012 0% -29% -40% -60% $3,083,880 SLM Solismineralsltd 0.083 0% -9% 22% -50% $11,709,655 ANX Anax Metals Ltd 0.007 0% 0% -42% -72% $6,179,653 FIN FIN Resources Ltd 0.003 0% -40% -25% -57% $2,084,665 ASR Asra Minerals Ltd 0.002 0% 0% -33% -64% $8,000,396 PLS Pilbara Min Ltd 1.49 -1% 14% -36% -50% $4,971,701,859 IDA Indiana Resources 0.085 -1% 10% 35% 83% $54,953,625 LOT Lotus Resources Ltd 0.1725 -1% -1% -22% -50% $414,724,976 WC8 Wildcat Resources 0.1625 -2% 25% -34% -39% $233,899,477 OCN Oceanalithiumlimited 0.061 -2% -8% 126% 77% $10,459,689 FLG Flagship Min Ltd 0.058 -2% 18% 41% -37% $13,420,603 PNN Power Minerals Ltd 0.058 -2% -3% -36% -59% $8,373,425 ATM Aneka Tambang 1.105 -2% 33% 24% 3% $1,440,532 MEK Meeka Metals Limited 0.1375 -2% -21% 25% 220% $408,198,724 COB Cobalt Blue Ltd 0.054 -2% -8% -18% -38% $24,021,298 CWX Carawine Resources 0.095 -2% 1% -5% 10% $22,431,918 KFM Kingfisher Mining 0.047 -2% 4% 15% -28% $2,524,605 LIN Lindian Resources 0.088 -2% -27% -10% -27% $101,217,735 BSX Blackstone Ltd 0.07 -3% -24% 169% 43% $122,888,335 QEM QEM Limited 0.034 -3% -15% -46% -72% $8,037,612 EMH European Metals Hldg 0.155 -3% -18% 7% -43% $33,191,153 ITM Itech Minerals Ltd 0.03 -3% 0% -47% -70% $5,125,062 STK Strickland Metals 0.145 -3% 4% 84% 49% $328,042,171 ARL Ardea Resources Ltd 0.425 -3% 6% 29% -15% $89,425,489 EMC Everest Metals Corp 0.135 -4% -7% 0% 4% $30,257,719 PAT Patriot Resourcesltd 0.054 -4% -10% 8% 13% $8,416,145 MHK Metalhawk. 0.405 -4% -17% 29% 664% $51,207,914 RVT Richmond Vanadium 0.074 -4% -38% -60% -75% $16,429,883 WMG Western Mines 0.24 -4% 60% 78% -11% $23,229,203 CAE Cannindah Resources 0.022 -4% -21% -44% -61% $16,017,759 VML Vital Metals Limited 0.105 -5% 5% 5% -40% $11,789,927 DVP Develop Global Ltd 4.59 -5% -1% 97% 124% $1,536,868,953 S32 South32 Limited 2.88 -5% -4% -17% -19% $12,970,469,148 VR8 Vanadium Resources 0.02 -5% 43% -29% -62% $12,414,421 CMO Cosmometalslimited 0.02 -5% 18% 34% -56% $7,409,119 BOA BOA Resources Ltd 0.018 -5% -10% -10% -28% $2,220,351 SRZ Stellar Resources 0.018 -5% 9% 38% -22% $37,435,510 HAW Hawthorn Resources 0.054 -5% -2% 17% -10% $18,090,843 PUR Pursuit Minerals 0.071 -5% 92% -18% -65% $7,280,579 SGQ St George Min Ltd 0.035 -5% 30% 25% 13% $90,875,963 RMX Red Mount Min Ltd 0.0085 -6% -6% -6% -15% $4,872,855 KOB Kobaresourceslimited 0.032 -6% -14% -55% -78% $6,000,691 BUX Buxton Resources Ltd 0.045 -6% 18% 18% -42% $16,087,276 FG1 Flynngold 0.03 -6% -12% 11% 20% $11,739,494 SUM Summitminerals 0.042 -7% 31% -71% -83% $3,808,771 CXO Core Lithium 0.1025 -7% 10% 15% -7% $235,731,710 BUR Burleyminerals 0.041 -7% -2% -48% -67% $7,550,860 FGR First Graphene Ltd 0.026 -7% -4% -56% -51% $20,966,780 BKT Black Rock Mining 0.026 -7% -7% -28% -58% $38,296,690 PGD Peregrine Gold 0.18 -8% 3% 33% -5% $15,272,593 NVA Nova Minerals Ltd 0.26 -9% -28% -26% 24% $75,904,393 NMT Neometals Ltd 0.07 -9% -7% -11% -13% $52,320,906 YAR Yari Minerals Ltd 0.01 -9% -23% 233% 233% $5,547,115 WIN WIN Metals 0.019 -10% -5% 6% -14% $11,001,168 RON Roninresourcesltd 0.14 -10% -15% -32% -7% $5,652,501 SBR Sabre Resources 0.009 -10% 13% 29% -36% $3,944,619 THR Thor Energy PLC 0.009 -10% -10% -18% -50% $6,397,109 LCY Legacy Iron Ore 0.009 -10% -10% 13% -33% $97,620,426 VUL Vulcan Energy 3.57 -11% -6% -40% -20% $776,288,717 AX8 Accelerate Resources 0.008 -11% 14% 14% -64% $6,946,104 INF Infinity Lithium 0.015 -12% 0% -46% -74% $7,088,881 AAJ Aruma Resources Ltd 0.007 -13% -30% -22% -42% $2,623,524 AUZ Australian Mines Ltd 0.007 -13% -22% -42% -30% $12,832,591 EG1 Evergreenlithium 0.028 -13% -7% -62% -52% $6,116,959 DLI Delta Lithium 0.155 -14% -16% -18% -31% $111,063,978 TKM Trek Metals Ltd 0.086 -14% 15% 291% 153% $50,108,345 AZL Arizona Lithium Ltd 0.006 -14% 20% -45% -68% $36,892,201 OM1 Omnia Metals Group 0.012 -14% 9% -85% -85% $2,605,100 PBL Parabellumresources 0.047 -15% 4% -15% 18% $3,177,300 TEM Tempest Minerals 0.005 -17% 43% 0% -33% $5,508,975 KAI Kairos Minerals Ltd 0.025 -17% -19% 108% 178% $78,927,366 G88 Golden Mile Res Ltd 0.009 -18% -31% 0% -18% $4,898,231 ENV Enova Mining Limited 0.0065 -19% -7% 30% -35% $8,745,600 AM7 Arcadia Minerals 0.021 -19% 40% -13% -40% $2,465,052 AGY Argosy Minerals Ltd 0.024 -20% 60% -17% -71% $36,862,102 PFE Pantera Lithium 0.018 -25% 33% 9% -43% $8,764,998 ADD Adavale Resource Ltd 0.021 -32% -30% -48% -74% $3,655,626 PRL Province Resources 0 -100% -100% -100% -100% $0 JRV Jervois Global Ltd 0 -100% -100% -100% -100% $29,730,402 POS Poseidon Nick Ltd 0 -100% -100% -100% -100% $23,380,727 AML Aeon Metals Ltd. 0 -100% -100% -100% -100% $5,482,003 LRS Latin Resources Ltd 0 -100% -100% -100% -100% $477,661,711 CAI Calidus Resources 0 -100% -100% -100% -100% $93,678,206 ASO Aston Minerals Ltd 0 -100% -100% -100% -100% $28,491,414 LTM Arcadium Lithium PLC 0 -100% -100% -100% -100% $1,994,929,982 Code Company Price % Week % Month % Six Month % Year Market Cap

Weekly Small Cap Standouts

Anson Resources (ASX:ASN)

The company, via subsidiary Blackstone Minerals, is continuing its ‘polishing’ program of the highly purified lithium chloride eluate (LiCl) produced at the Green River Lithium Project, in Utah, USA, using the Koch Technology Services (KTS) Direct Lithium Extraction (DLE) pilot plant.

Polishing is the first step in downstream processing which further removes minor contaminants remaining in the LiCl after the DLE process – and prior to the final steps of evaporation and carbonation.

With the majority of the contaminants then removed in the DLE process, the effectiveness of the polishing can directly impact the final grade and thus the capex and opex of a lithium carbonate plant.

Already the company has shipped two tonnes of lithium-rich Green River brine has been shipped to POSCO in South Korea as part of due diligence for a planned demonstration plant.

POSCO will then prepare initial engineering design and cost estimates to determine whether to invest in the demonstration plant at the project.

Anson expects this demonstration plant will operate on a continuous process basis to closely resemble that of the anticipated future commercial plant as well as generating significant quantities of lithium carbonate product.

Auking Mining (ASX:AKN)

The company has commenced exploration at its Myoff Creek Niobium/REE project in Canada, which hosts near-surface carbonatite mineralisation.

Notable high grade historical intercepts include 0.93% niobium (Nb) and 2.06% total rare earth oxides (TREO).

MD Paul Williams said the project has been the subject of exploration activities over the past 40 years.

“Previous exploration activities (including drilling programs) have identified a 1.4km by 0.4km area of near-surface Nb-REE bearing carbonatite hosted mineralisation,” he said.

“The planned helicopter-based survey will be used by AuKing to test the potential extent of the carbonatite mineralisation across the entire Myoff Creek tenure area.

“The results of this aerial survey will then determine the nature of future exploration (including drilling) in the area.”

Bayan Mining and Minerals (ASX:BMM)

BMM is also on the hunt for rare earths, but a little closer to the latest news coming out of the US.

Pentagon-backed rare earths miner MP Materials has signed a US$500m deal for the supply of rare earth magnets with Apple, guaranteeing the Cupertino-based tech giant a flow of supply free from China, the world’s largest producer.

And it’s bringing a cavalcade of ASX rare earths stocks along for the ride, including BMM which is literally on the doorstep of MP’s Mountain Pass mine in California, the only producing rare earths operation in the US.

The company’s Desert Star asset is just 4.5kms from Mountain Pass,

Initial fieldwork is now underway, thanks to the results of satellite imagery which has identified both rare earth and gold mineralisation indicators.

“[This] strengthens our belief in Desert Star’s dual commodity potential,” executive director Fadi Diab said.

“The proximity to world-class deposits, including the Mountain Pass REE mine and the Colosseum gold mine, adds a layer of strategic value to the project.

“With fieldwork set to commence shortly, we are confident that we’re well positioned to advance toward drill-ready targets and unlock substantial value for our shareholders.”

Victory Metals (ASX:VTM)

VTM owns the North Stanmore project in WA’s Gascoyne region, which promises to deliver critical metals including heavy and light rare earths, gallium, scandium and hafnium for the defence, semiconductor, auto and energy sectors.

The company has already received a letter of intent for a US$190m funding package from the US Export-Import Bank and this week announced it had secured System for Award Management approval – a critical prerequisite for engaging directly with U.S. federal agencies, including the Department of Defence (DoD) and the Export-Import Bank of the United States (EXIM Bank).

VTM CEO and executive director Brendan Clark said it confirms the company’s legitimacy, compliance, and strategic alignment with allied supply chain priorities.

“This validation opens the door to long term partnerships with the world’s most powerful institutions,” he said.

“It positions Victory as a credible, secure, and ready supplier of the rare earths and critical minerals that underpin defence, energy, and future technologies.”

At Stockhead, we tell it like it is. While Chariot Corporation, Anson Resources and Victory Metals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.