High Voltage: Is it almost time to get excited about cobalt again?

Pic: John W Banagan / Stone via Getty Images

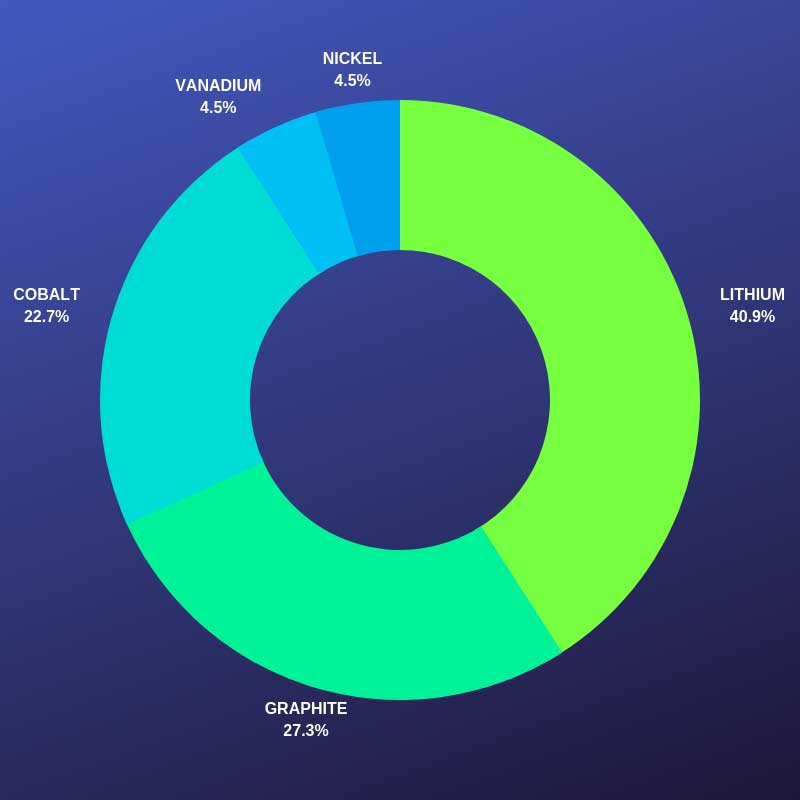

Each week our High Voltage column wraps all the news driving ASX battery metals stocks with exposure to lithium, cobalt, graphite, manganese and vanadium.

INDUSTRY FOCUS

In early 2018, cobalt prices were peaking above $US90,000/t and countless explorers were jumping on the bandwagon.

Then prices started falling and everyone realised they had jumped the gun instead. The once-lauded battery metal quickly became a pariah.

Cobalt prices remained in the doldrums until August 2019, when multi commodity giant Glencore announced plans to mothball the globally significant Mutanda mine in the DRC from the end of 2019.

This will take a huge chunk of production out of the existing market, and so cobalt prices have been recovering at decent clip.

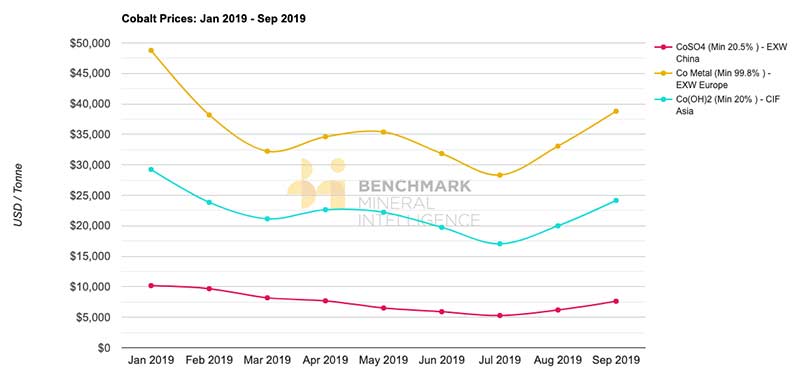

Cobalt hydroxide, sulphate and metal prices rose 20.9 per cent, 23.2 per cent and 17.3 per cent respectively in September, according to price reporting agency Benchmark Mineral Intelligence. This follows some big gains in August.

But is this just another dead cat bounce? Recent cobalt price increases in April and May ran out of steam quickly, but Benchmark’s Caspar Rawles says this time is different.

“With current market dynamics it is expected that prices will be more resistant to decreases as producers are more confident of a tighter market balance moving into 2020, driven primarily by the Mutanda closure,” he says.

We bet there’s a bunch of cobalt-exposed small caps (and their investors) watching this pricing action very closely.

Because, in the background, cobalt demand forecasts have remained pretty positive. Benchmark forecasts that battery makers will need 152,000t of the stuff by 2024 — up from just 75,000t in 2019.

READ: Benchmark forecasts stronger cobalt prices going into 2020

SMALL CAP SPOTLIGHT

More than $80bn was wiped off the market last week, and it shows. The small end of the resources market did poorly, unless you were a gold explorer; then you probably did ok.

Still, we found some battery metals were beacons of hope amongst all the doom and gloom.

Here’s where all this weeks’ winners came from:

Nzuri Copper (ASX:NZC) +17 %

Advanced copper-cobalt play Nzuri updated the market on its ongoing (and very drawn out) takeover process by Chinese firm Chengtun Mining.

The $109m all-cash offer, first announced in February, values Nzuri at 37c per share.

Last week it ticked another box in this process, which was enough to send the stock up 17 per cent.

Neometals (ASX:NMT) +11%

Neometals has already developed a major lithium mine in WA, a rare and impressive feat for a junior-listed company.

To accomplish this, it partnered with big company — with deep pockets — to help with the heavy financial lifting.

Now, the cashed-up explorer wants to do the whole thing again at the Barrambie vanadium-titanium project.

Neometals has just entered into a memorandum of understanding (MOU) with big Chinese research organisation IMUMR to jointly develop the major +$600m WA project.

IMUMR’s commitment bodes well for further development of Barrambie, boss Chris Reed says. Joint test work and engineering studies will take approximately 18 months, leading to JV final investment decision around mid-2021.

Here’s a table of ASX battery metal stocks with exposure to lithium, cobalt, graphite, manganese and vanadium>>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop:

| Code | Name | 1 Week Total Return % | 1 Year Total Return % | Share Price [intraday Monday] | Market Cap |

|---|---|---|---|---|---|

| GBE | GLOBE METALS AND MINING | 40 | 62 | 0.021 | $ 8,852,525.00 |

| ADV | ARDIDEN | 33 | -50 | 0.004 | $ 6,762,081.00 |

| PSC | PROSPECT RESOURCES | 29 | -58 | 0.135 | $ 30,673,728.00 |

| KTA | KRAKATOA RESOURCES | 24 | 3 | 0.031 | $ 4,200,000.00 |

| CZN | CORAZON MINING | 20 | -57 | 0.003 | $ 6,115,082.00 |

| HIP | HIPO RESOURCES | 17 | -26 | 0.014 | $ 5,411,146.50 |

| NZC | NZURI COPPER | 17 | 2 | 0.315 | $ 91,730,704.00 |

| CHK | COHIBA MINERALS | 15 | 114 | 0.015 | $ 10,633,828.00 |

| BSM | BASS METALS | 14 | -67 | 0.008 | $ 22,478,996.00 |

| NMT | NEOMETALS | 11 | -16 | 0.2 | $ 103,443,264.00 |

| VRC | VOLT RESOURCES | 10 | -48 | 0.011 | $ 16,054,073.00 |

| VML | VITAL METALS | 10 | 57 | 0.011 | $ 17,426,112.00 |

| TLG | TALGA RESOURCES | 8 | 2 | 0.455 | $ 95,527,272.00 |

| WKT | WALKABOUT RESOURCES | 8 | 124 | 0.28 | $ 85,565,384.00 |

| TON | TRITON MINERALS | 5 | -15 | 0.04 | $ 37,085,528.00 |

| LIT | LITHIUM AUSTRALIA | 4 | -55 | 0.047 | $ 24,576,504.00 |

| ASN | ANSON RESOURCES | 3 | -60 | 0.038 | $ 23,398,510.00 |

| MZN | MARINDI METALS | 3 | -77 | 0.082 | $ 6,555,478.00 |

| DGR | DGR GLOBAL | 3 | -43 | 0.082 | $ 49,054,552.00 |

| SRK | STRIKE RESOURCES | 2 | -8 | 0.046 | $ 7,688,176.50 |

| SEI | SPECIALITY METALS INTERNATIONAL | 2 | 220 | 0.05 | $ 46,188,292.00 |

| BEM | BLACKEARTH MINERALS | 2 | -64 | 0.05 | $ 5,682,776.00 |

| MCT | METALICITY | 0 | -65 | 0.006 | $ 3,866,334.75 |

| RLC | REEDY LAGOON | 0 | -60 | 0.004 | $ 1,609,086.88 |

| BDI | BLINA MINERALS | 0 | 0 | 0.001 | $ 5,454,882.50 |

| SUH | SOUTHERN HEMISPHERE MINING | 0 | -63 | 0.024 | $ 2,123,267.25 |

| SI6 | SIX SIGMA METALS | 0 | -50 | 0.004 | $ 2,580,012.50 |

| TAR | TARUGA MINERALS | 0 | -58 | 0.03 | $ 4,235,017.00 |

| BUX | BUXTON RESOURCES | 0 | -37 | 0.095 | $ 12,789,211.00 |

| AMD | ARROW MINERALS | 0 | -50 | 0.009 | $ 7,597,246.50 |

| HXG | HEXAGON RESOURCES | 0 | -58 | 0.059 | $ 17,215,220.00 |

| POW | PROTEAN ENERGY | 0 | -75 | 0.006 | $ 1,868,623.50 |

| LML | LINCOLN MINERALS | 0 | -40 | 0.006 | $ 3,449,902.00 |

| SBR | SABRE RESOURCES | 0 | -73 | 0.003 | $ 1,426,151.00 |

| LCD | LATITUDE CONSOLIDATED | 0 | -33 | 0.014 | $ 3,852,506.00 |

| ANW | AUS TIN MINING | 0 | -87 | 0.003 | $ 7,093,489.00 |

| MRR | MINREX RESOURCES | 0 | -67 | 0.01 | $ 958,777.25 |

| PUR | PURSUIT MINERALS | 0 | -80 | 0.01 | $ 3,053,697.75 |

| PSM | PENINSULA MINES | 0 | -67 | 0.002 | $ 2,033,744.13 |

| EUC | EUROPEAN COBALT | 0 | -34 | 0.033 | $ 25,136,012.00 |

| KAI | KAIROS MINERALS | 0 | -58 | 0.014 | $ 11,931,820.00 |

| PM1 | PURE MINERALS | 0 | 42 | 0.017 | $ 7,539,335.50 |

| AZI | ALTA ZINC | 0 | -22 | 0.005 | $ 9,149,422.00 |

| FEL | FE | 0 | -6 | 0.015 | $ 7,330,524.50 |

| MLS | METALS AUSTRALIA | 0 | -50 | 0.002 | $ 5,914,395.50 |

| PNN | PEPINNINI LITHIUM | 0 | -63 | 0.003 | $ 3,714,035.25 |

| CFE | CAPE LAMBERT RESOURCES | 0 | -77 | 0.005 | $ 5,392,369.50 |

| ARE | ARGONAUT RESOURCES | 0 | -77 | 0.005 | $ 7,771,903.00 |

| MTB | MOUNT BURGESS MINING | 0 | -33 | 0.004 | $ 2,080,517.63 |

| KDR | KIDMAN RESOURCES | 0 | 88 | 1.9 | $ 776,185,280.00 |

| GPP | GREENPOWER ENERGY | 0 | -71 | 0.001 | $ 2,302,245.25 |

| RIE | RIEDEL RESOURCES | 0 | -67 | 0.01 | $ 4,180,697.00 |

| 4CE | FORCE COMMODITIES | 0 | -45 | 0.018 | $ 9,137,786.00 |

| AYR | ALLOY RESOURCES | 0 | -38 | 0.0025 | $ 4,233,194.00 |

| ZNC | ZENITH MINERALS | 0 | -31 | 0.063 | $ 13,426,226.00 |

| LPD | LEPIDICO | 0 | -19 | 0.016 | $ 70,378,696.00 |

| CGM | COUGAR METALS | 0 | -75 | 0.001 | $ 1,176,583.25 |

| SVD | SCANDIVANADIUM | 0 | -64 | 0.009 | $ 3,166,795.00 |

| CLA | CELSIUS RESOURCES | 0 | -87 | 0.017 | $ 12,872,707.00 |

| BAT | BATTERY MINERALS | 0 | -69 | 0.009 | $ 11,862,824.00 |

| KOR | KORAB RESOURCES | 0 | -32 | 0.021 | $ 6,978,388.50 |

| LI3 | LITHIUM CONSOLIDATED | 0 | -37 | 0.05 | $ 6,202,809.50 |

| CNJ | CONICO | 0 | -69 | 0.008 | $ 3,459,584.00 |

| JRL | JINDALEE RESOURCES | 0 | -17 | 0.22 | $ 8,468,736.00 |

| GME | GME RESOURCES | 0 | -40 | 0.06 | $ 30,374,576.00 |

| MIN | MINERAL RESOURCES | 0 | -16 | 13.2 | $ 2,458,448,384.00 |

| TNG | TNG | -1 | -23 | 0.084 | $ 95,586,336.00 |

| POS | POSEIDON NICKEL | -2 | -4 | 0.052 | $ 137,420,496.00 |

| CAZ | CAZALY RESOURCES | -2 | 50 | 0.045 | $ 15,228,984.00 |

| PLL | PIEDMONT LITHIUM | -2 | -40 | 0.09 | $ 73,384,232.00 |

| CHN | CHALICE GOLD MINES | -2 | 85 | 0.215 | $ 58,924,648.00 |

| JRV | JERVOIS MINING | -2 | -23 | 0.215 | $ 137,951,024.00 |

| E25 | ELEMENT 25 | -2 | 11 | 0.2 | $ 17,002,846.00 |

| VMC | VENUS METALS | -3 | -1 | 0.18 | $ 20,269,330.00 |

| MNS | MAGNIS ENERGY TECHNOLOGIES | -3 | -46 | 0.18 | $ 106,948,800.00 |

| AGY | ARGOSY MINERALS | -3 | -71 | 0.072 | $ 73,116,152.00 |

| GPX | GRAPHEX MINING | -3 | -38 | 0.17 | $ 17,612,912.00 |

| SYR | SYRAH RESOURCES | -3 | -77 | 0.49 | $ 202,553,456.00 |

| LTR | LIONTOWN RESOURCES | -3 | 268 | 0.095 | $ 162,190,576.00 |

| BKT | BLACK ROCK MINING | -3 | 76 | 0.06 | $ 37,353,052.00 |

| PAN | PANORAMIC RESOURCES | -3 | -46 | 0.295 | $ 196,270,720.00 |

| BSX | BLACKSTONE MINERALS | -3 | 7 | 0.145 | $ 27,688,446.00 |

| GED | GOLDEN DEEPS | -3 | -38 | 0.028 | $ 6,145,822.50 |

| EMH | EUROPEAN METALS | -3 | -29 | 0.28 | $ 40,718,400.00 |

| MZZ | MATADOR MINING | -4 | -12 | 0.265 | $ 25,157,996.00 |

| HRZ | HORIZON MINERALS | -4 | -16 | 0.13 | $ 55,636,776.00 |

| JMS | JUPITER MINES | -4 | 19 | 0.375 | $ 724,826,688.00 |

| HAV | HAVILAH RESOURCES | -4 | -40 | 0.12 | $ 27,281,132.00 |

| SVM | SOVEREIGN METALS | -4 | 1 | 0.093 | $ 34,131,000.00 |

| AUZ | AUSTRALIAN MINES | -4 | -48 | 0.023 | $ 79,229,080.00 |

| CRL | COMET RESOURCES | -4 | -28 | 0.023 | $ 6,660,000.00 |

| LKE | LAKE RESOURCES | -5 | -55 | 0.041 | $ 20,942,300.00 |

| FGR | FIRST GRAPHENE | -5 | 33 | 0.2 | $ 97,316,848.00 |

| AXE | ARCHER EXPLORATION | -5 | 70 | 0.1475 | $ 28,578,308.00 |

| CXO | CORE LITHIUM | -5 | -14 | 0.039 | $ 30,770,792.00 |

| NXE | NEW ENERGY MINERALS | -5 | -79 | 0.019 | $ 2,905,013.50 |

| BOA | BOADICEA RESOURCES | -5 | 94 | 0.19 | $ 10,563,192.00 |

| MEI | METEORIC RESOURCES | -5 | 229 | 0.056 | $ 52,238,912.00 |

| MLL | MALI LITHIUM | -5 | -72 | 0.074 | $ 20,168,896.00 |

| TMT | TECHNOLOGY METALS AUSTRALIA | -5 | -65 | 0.175 | $ 15,321,979.00 |

| AJM | ALTURA MINING | -6 | -74 | 0.068 | $ 148,829,600.00 |

| ORE | OROCOBRE | -6 | -45 | 2.44 | $ 651,578,432.00 |

| BPL | BROKEN HILL PROSPECTING | -6 | -55 | 0.03 | $ 3,844,968.50 |

| CLQ | CLEAN TEQ | -6 | -49 | 0.29 | $ 212,741,152.00 |

| RNU | RENASCOR RESOURCES | -7 | -22 | 0.014 | $ 16,147,941.00 |

| CUL | CULLEN RESOURCES | -7 | -33 | 0.014 | $ 2,372,507.50 |

| INF | INFINITY LITHIUM | -7 | 6 | 0.07 | $ 14,811,977.00 |

| OMH | OM HOLDINGS | -8 | -73 | 0.43 | $ 339,766,720.00 |

| WCN | WHITE CLIFF MINERALS | -8 | -66 | 0.006 | $ 2,822,099.25 |

| MLM | METALLICA MINERALS | -8 | -65 | 0.012 | $ 3,888,569.00 |

| NWC | NEW WORLD COBALT | -8 | -56 | 0.022 | $ 19,313,308.00 |

| AVL | AUSTRALIAN VANADIUM | -8 | -76 | 0.011 | $ 28,020,524.00 |

| AVZ | AVZ MINERALS | -9 | -55 | 0.043 | $ 99,078,384.00 |

| MQR | MARQUEE RESOURCES | -9 | -50 | 0.075 | $ 4,770,757.50 |

| ARL | ARDEA RESOURCES | -9 | -24 | 0.51 | $ 58,391,764.00 |

| BAR | BARRA RESOURCES | -9 | -50 | 0.02 | $ 10,777,815.00 |

| TKL | TRAKA RESOURCES | -9 | -71 | 0.01 | $ 4,004,629.50 |

| N27 | NORTHERN COBALT | -9 | -75 | 0.03 | $ 2,046,304.00 |

| COB | COBALT BLUE | -10 | -55 | 0.14 | $ 21,735,866.00 |

| AML | AEON METALS | -10 | -62 | 0.135 | $ 94,369,760.00 |

| THR | THOR MINING | -10 | -63 | 0.009 | $ 8,216,468.50 |

| SYA | SAYONA MINING | -10 | -73 | 0.009 | $ 16,648,177.00 |

| CZR | COZIRON RESOURCES | -10 | -40 | 0.009 | $ 18,747,462.00 |

| PIO | PIONEER RESOURCES | -10 | -5 | 0.018 | $ 27,157,658.00 |

| HNR | HANNANS | -10 | -25 | 0.009 | $ 19,879,546.00 |

| VR8 | VANADIUM RESOURCES | -10 | -66 | 0.043 | $ 15,141,480.00 |

| PLS | PILBARA MINERALS | -11 | -66 | 0.29 | $ 572,374,208.00 |

| GLN | GALAN LITHIUM | -11 | -39 | 0.185 | $ 26,684,610.00 |

| AEE | AURA ENERGY | -11 | -60 | 0.008 | $ 11,708,144.00 |

| MTC | METALSTECH | -11 | -76 | 0.016 | $ 1,754,308.25 |

| KNL | KIBARAN RESOURCES | -11 | -60 | 0.08 | $ 23,409,678.00 |

| LPI | LITHIUM POWER INTERNATIONAL | -12 | 5 | 0.29 | $ 78,754,168.00 |

| INR | IONEER | -13 | -38 | 0.175 | $ 272,871,936.00 |

| GXY | GALAXY RESOURCES | -13 | -65 | 0.94 | $ 405,384,544.00 |

| IDA | INDIANA RESOURCES | -13 | -48 | 0.026 | $ 3,848,382.00 |

| KSN | KINGSTON RESOURCES | -14 | -13 | 0.019 | $ 35,318,412.00 |

| PGM | PLATINA RESOURCES | -14 | -67 | 0.025 | $ 6,603,156.00 |

| IEC | INTRA ENERGY | -14 | -54 | 0.006 | $ 2,326,344.25 |

| RMX | RED MOUNTAIN MINING | -14 | -14 | 0.006 | $ 4,235,184.00 |

| SO4 | SALT LAKE POTASH | -16 | 47 | 0.75 | $ 207,349,456.00 |

| MTH | MITHRIL RESOURCES | -17 | -40 | 0.005 | $ 2,451,946.00 |

| NVA | NOVA MINERALS | -18 | 48 | 0.037 | $ 35,417,296.00 |

| DHR | DARK HORSE RESOURCES | -20 | -50 | 0.004 | $ 9,153,361.00 |

| HWK | HAWKSTONE MINING | -20 | -54 | 0.012 | $ 8,974,134.00 |

| BYH | BRYAH RESOURCES | -20 | -33 | 0.06 | $ 4,784,288.00 |

| SRN | SUREFIRE RESOURCES | -21 | 22 | 0.011 | $ 7,537,843.50 |

| WML | WOOMERA MINING | -23 | -76 | 0.017 | $ 2,282,963.50 |

| DTM | DART MINING | -25 | -14 | 0.006 | $ 6,104,257.00 |

| LRS | LATIN RESOURCES | -33 | -91 | 0.012 | $ 2,802,584.25 |

| Code | Name | 1 Week Total Return % | 1 Year Total Return % | Share Price [intraday Monday] | Market Cap |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.