Neometals taps a cashed-up Chinese partner to help develop the Barrambie vanadium-titanium project

Mining

Mining

Neometals has already developed a major lithium mine in WA, a rare and impressive feat for a junior-listed company.

To accomplish this, it partnered with big company — with deep pockets — to help with the heavy financial lifting.

Neometals (ASX:NMT) recently sold its 13.8 per cent stake in the producing hard rock Mt Marion mine for $103m. Now, the cashed-up explorer wants to do the whole thing again at the Barrambie vanadium-titanium project.

Neometals has just entered into a memorandum of understanding (MOU) with big Chinese research organisation IMUMR to jointly develop the major WA project.

To be clear, these MOU’s are not legally binding — so when you see an MOU announcement in ALL CAPS calm down and just think of it as the ‘starting point’ for contract negotiations.

Neometals says the MOU is significant, nevertheless.

That’s because it outlines a potential pathway towards a 50:50 Barrambie joint venture, which will reduce the company’s share of development costs considerably.

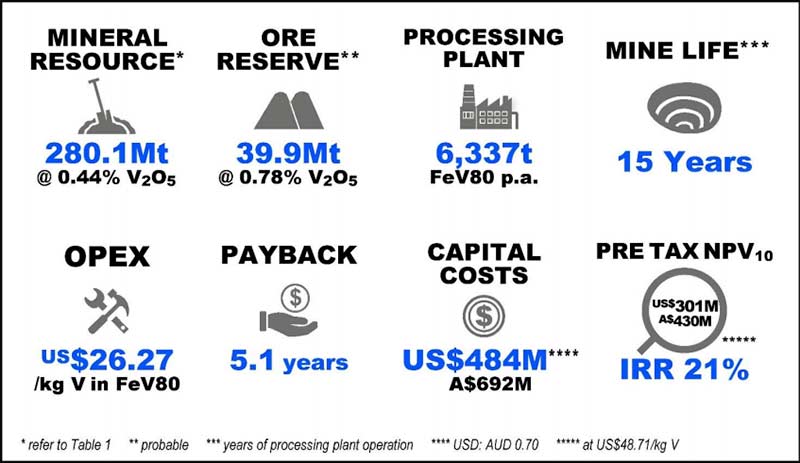

These development costs aren’t small either. A revised feasibility study released in May estimated construction costs of $692m (including a 14.3 per cent contingency) and $2.5 billion in earnings over an initial 15-year life.

(Although those numbers only included the vanadium, and not the titanium which actually makes up about 95 per cent of the contained metal at Barrambie.)

And it should also be noted that IMUMR has a Chinese national mandate – ie, government backing — that includes “development of upstream supply chains for industries of strategic relevance to China”, Neometals says.

IMUMR’s commitment bodes well for further development of the the Barrambie resource as one of the world’s richest titanium and vanadium deposits, boss Chris Reed says.

“China is the largest producer of titanium and vanadium chemical products in the world, with applications spanning titanium pigment, aerospace alloys and energy storage applications,” he says.

“Chemical producers need secure long-term sources of upstream feed sources with credentialed partners to undertake mining and beneficiation in first world jurisdictions.”

It is anticipated that joint test work and engineering studies will take approximately 18 months, leading to joint venture final investment decision around mid-2021.

READ MORE about Neometals:

Cashed up Neometals takes vanadium strategy to the next level

Neometals is poised to develop India’s first lithium chemical project

Aussie company Neometals is building a battery recycling plant… in Canada