Nzuri shares could leap on ok-ish takeover offer

Mining

Mining

Advanced (but beaten down) copper and cobalt explorer Nzuri Copper (ASX:NZC) has received a $109m takeover offer — and says shareholders should accept it.

The all-cash offer from $2.5 billion Chinese company Chengtun Mining values Nzuri at 37c per share.

Nzuri told investors that the deal would “crystallise certain value” at a time when resources development projects faced “considerable funding hurdles and a range of market related and strategic risks”.

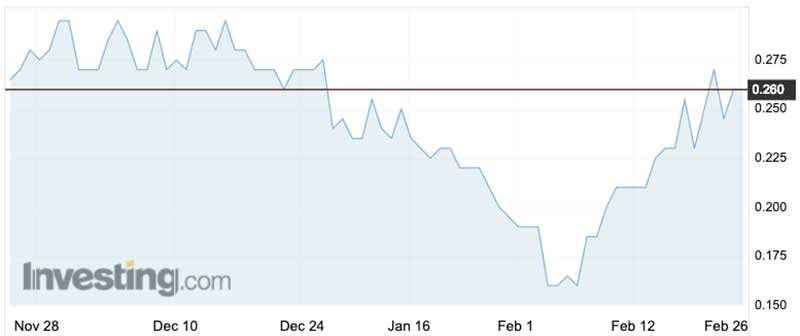

It’s 42 per cent higher than the last closing price of 26c, and a 64 per cent premium to the 3-month volume weighted average price; but it’s still well down on the 48c high reached in mid-January last year.

In the last few weeks, Nzuri’s share price has jumped from lows of 16c on no real news. Check this out:

Nzuri is developing the Kalongwe project in the Congo, which it called “the most advanced copper-cobalt development asset on the ASX”.

It says the fully permitted, ready to build project only needs about $US53.7m for the first stage of development.

“If Kalongwe was located anywhere other than the Democratic Republic of Congo it would be a genuine rock star, spinning off fat profits from its shallow orebody which has an average grade of close to 3 per cent copper and 0.3 per cent cobalt, material which is expected to cost less than $US1 per pound to produce,” Tim Treadgold wrote in December.

READ: Supply disruptions are piling up … so why are cobalt prices so depressed?

Nzuri received the current proposal from Chengtun while advancing talks to fund construction, the explorer says.

These included extensive discussions with the suitor dating back to 2017 regarding offtake, funding and “other opportunities for strategic cooperation”.

Chengtun is a major player in the Kolwezi region of the DRC.

The Chinese company is also expanding, recently completing a major new $US150m processing facility and the purchase of another copper and cobalt deposit.