High Voltage: Flaccid cobalt prices are on the rise again

Pic: Via Getty

- Battery metals prices had weaker month in August, with only nickel sulphate (~2%) eking out gains

- Former top White House official John Podesta to oversee rollout of ~$US369bn of climate and clean energy spending

- Weekly ASX standouts: Kingfisher, Emetals, White Cliff, Koba, Reach

Our High Voltage column wraps all the news driving ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, manganese, magnesium, and vanadium.

Limp battery metals prices start rising again late August

Battery metals assessed by Benchmark Minerals intelligence had a weaker month in August, with only nickel sulphate (~2%) prices eking out gains.

The other indexes – lithium, cobalt, and graphite – fell 0.5%, 15.1% and 2.2% respectively month on month.

Its ain’t all bad though, with prices gaining some positive impetus though the second half of the month.

“Lithium chemicals pricing on the Chinese domestic market gained upward momentum in the second half of August, following relative stability in the first half of the month, under accelerating demand from downstream consumers, as well as near-term impact on supply from converters in Sichuan Province under a regional power shutdown,” Benchmark says.

A despite suffering a 15.1% fall, all cobalt grades assessed by Benchmark saw upwards momentum late in the month.

“Prices trended to the top end of the range in late August, primarily due to an uptick in demand and therefore market activity, generated by both concerns of supply shortage due to strikes at Glencore’s Nikkelverk and market participants returning from the traditional summer break,” it says.

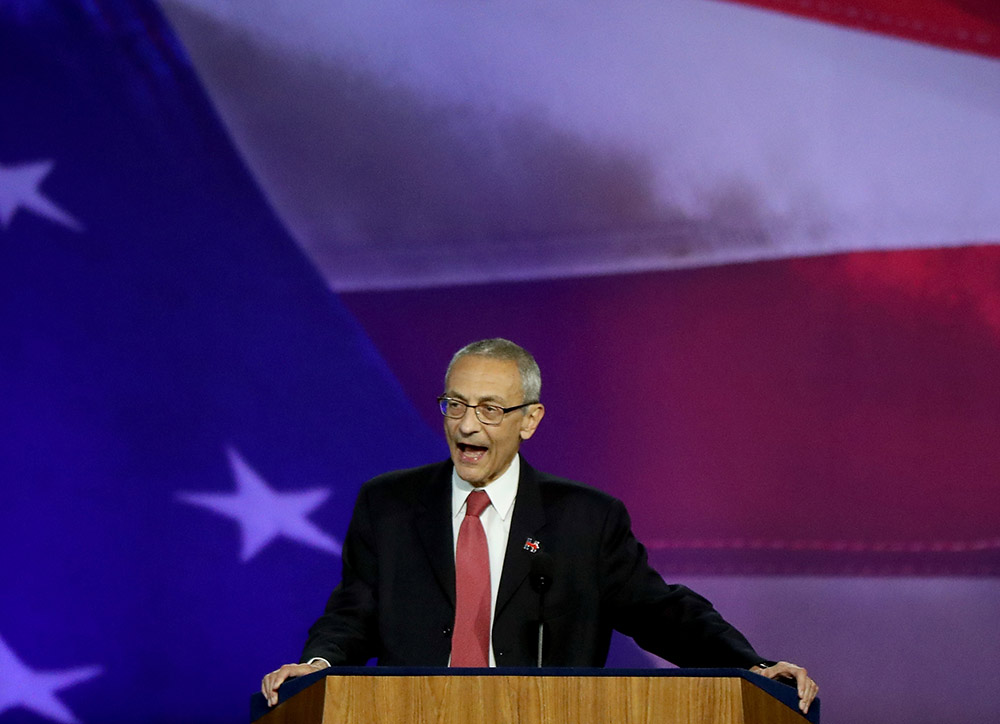

Who’s in charge of $US369bn in US clean energy spending? This guy

President Joe Biden has named former top White House official John Podesta to oversee the rollout of an estimated $US369bn of climate and clean energy spending, Argus says.

$US369 billion dollars.

Podesta coordinated climate and energy policy under former president Barack Obama, back when Biden was serving as US vice president.

Podesta will influence policies guiding all these billions in funding for wind, solar, biofuels, carbon capture, clean hydrogen, electric vehicles and energy efficiency.

Battery Metals Winners and Losers

Here’s how a basket of ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, magnesium, manganese, and vanadium is performing>>>

Battery metals stocks missing from our list? Shoot a mail to [email protected].

| CODE | COMPANY | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | PRICE | MARKET CAP |

|---|---|---|---|---|---|---|---|

| KFM | Kingfisher Mining | 98% | 128% | 143% | 215% | 0.535 | $18,149,850.53 |

| EMT | Emetals Limited | 91% | 75% | 24% | 5% | 0.021 | $13,600,000.00 |

| WCN | White Cliff Min | 63% | 126% | 0% | 73% | 0.026 | $15,032,877.33 |

| KOB | Kobaresourceslimited | 42% | 13% | 0% | 0% | 0.17 | $11,050,000.00 |

| RR1 | Reach Resources | 33% | 33% | -25% | 0% | 0.006 | $11,460,303.83 |

| INF | Infinity Lithium | 23% | 36% | 23% | 104% | 0.19 | $76,777,417.21 |

| EGR | Ecograf Limited | 22% | 9% | -24% | -46% | 0.44 | $168,875,047.13 |

| MOH | Moho Resources | 22% | 22% | -25% | -46% | 0.033 | $5,814,541.74 |

| WML | Woomera Mining | 21% | 6% | 0% | -18% | 0.017 | $10,989,329.06 |

| VRC | Volt Resources | 21% | 28% | 92% | -38% | 0.023 | $73,054,603.09 |

| ESS | Essential Metals | 21% | 0% | 40% | 139% | 0.49 | $115,079,332.28 |

| MRD | Mount Ridley Mines | 20% | 20% | -37% | 50% | 0.006 | $35,249,825.65 |

| NWM | Norwest Minerals | 20% | 33% | 7% | -19% | 0.06 | $11,378,265.38 |

| SUM | Summitminerals | 19% | 27% | 0% | 0% | 0.19 | $4,821,872.25 |

| AZI | Altamin Limited | 17% | 6% | 40% | 23% | 0.095 | $37,213,091.44 |

| ADD | Adavale Resource | 17% | 52% | 3% | -39% | 0.035 | $15,308,054.93 |

| MLX | Metals X Limited | 15% | -6% | -53% | -5% | 0.3 | $254,034,498.76 |

| ARU | Arafura Resource | 15% | 24% | 70% | 100% | 0.34 | $586,354,332.10 |

| PNN | Power Minerals | 15% | 7% | 32% | 77% | 0.54 | $30,165,953.79 |

| AGY | Argosy Minerals | 15% | 9% | 33% | 130% | 0.425 | $553,170,767.94 |

| SRI | Sipa Resources | 15% | 4% | -13% | -23% | 0.047 | $9,636,165.74 |

| LOT | Lotus Resources | 14% | 19% | 8% | 19% | 0.28 | $289,937,103.84 |

| RBX | Resource B | 14% | 0% | -38% | -29% | 0.12 | $4,712,297.16 |

| TSC | Twenty Seven Co. | 14% | -5% | -37% | -5% | 0.002 | $5,321,627.81 |

| LPI | Lithium Pwr Int | 14% | 7% | 2% | 128% | 0.65 | $209,486,908.80 |

| TEM | Tempest Minerals | 14% | -13% | 78% | 119% | 0.041 | $19,685,880.86 |

| LNR | Lanthanein Resources | 14% | 176% | 123% | 205% | 0.058 | $53,918,231.92 |

| CZL | Cons Zinc | 14% | 2% | -11% | -17% | 0.025 | $9,296,587.51 |

| PLS | Pilbara Min | 13% | 38% | 40% | 75% | 3.96 | $11,031,205,666.90 |

| LKE | Lake Resources | 13% | 30% | 22% | 110% | 1.205 | $1,528,971,079.90 |

| RXL | Rox Resources | 13% | -9% | -35% | -38% | 0.265 | $47,303,465.16 |

| SRL | Sunrise | 13% | 0% | 61% | 65% | 3.04 | $271,974,794.58 |

| AOA | Ausmon Resorces | 13% | 64% | 29% | 29% | 0.009 | $6,858,314.74 |

| MNS | Magnis Energy Tech | 12% | 35% | 16% | 37% | 0.5 | $494,869,056.33 |

| GL1 | Globallith | 12% | 20% | 16% | 378% | 1.89 | $268,200,052.64 |

| LPD | Lepidico | 11% | 3% | -6% | 11% | 0.03 | $182,201,354.52 |

| RFR | Rafaella Resources | 11% | 25% | -47% | -66% | 0.03 | $8,424,715.47 |

| THR | Thor Mining PLC | 11% | 0% | -29% | -33% | 0.01 | $10,755,643.90 |

| NMT | Neometals | 11% | 7% | -7% | 92% | 1.385 | $723,573,925.48 |

| CXO | Core Lithium | 11% | 16% | 57% | 333% | 1.495 | $2,362,585,684.16 |

| ARN | Aldoro Resources | 10% | 35% | -25% | -48% | 0.27 | $24,398,892.67 |

| TNG | TNG Limited | 10% | 20% | 83% | 35% | 0.115 | $138,841,822.20 |

| GW1 | Greenwing Resources | 9% | 16% | 2% | -6% | 0.29 | $35,741,731.21 |

| KGD | Kula Gold Limited | 9% | -13% | -44% | -50% | 0.024 | $4,949,039.54 |

| QEM | QEM Limited | 9% | 14% | 45% | 55% | 0.24 | $30,022,458.48 |

| RGL | Riversgold | 9% | 20% | 47% | 24% | 0.036 | $26,356,457.82 |

| VMC | Venus Metals Cor | 9% | -5% | 0% | 9% | 0.18 | $27,213,376.11 |

| HAS | Hastings Tech Met | 9% | 28% | -5% | 20% | 5.42 | $549,851,547.50 |

| GME | GME Resources | 9% | 19% | 112% | 119% | 0.125 | $75,050,127.25 |

| VR8 | Vanadium Resources | 8% | 10% | 3% | 33% | 0.077 | $36,460,452.80 |

| WR1 | Winsome Resources | 8% | 2% | -27% | 0% | 0.26 | $35,805,208.41 |

| AXE | Archer Materials | 8% | -6% | -19% | -53% | 0.79 | $181,381,061.11 |

| DEV | Devex Resources | 8% | 33% | 3% | 36% | 0.4 | $143,820,646.40 |

| BNR | Bulletin Res | 8% | 27% | -7% | 122% | 0.14 | $39,499,798.50 |

| TON | Triton Min | 8% | -3% | -3% | -18% | 0.028 | $35,245,956.96 |

| SRZ | Stellar Resources | 7% | -12% | -42% | -42% | 0.015 | $15,443,162.02 |

| LTR | Liontown Resources | 7% | 17% | 14% | 98% | 1.765 | $3,668,047,034.50 |

| MTM | Mtmongerresources | 7% | 48% | -6% | -23% | 0.155 | $5,251,404.62 |

| RLC | Reedy Lagoon Corp. | 7% | 0% | -36% | -20% | 0.016 | $8,918,830.59 |

| CHR | Charger Metals | 6% | -2% | -27% | -12% | 0.495 | $15,801,801.98 |

| SHH | Shree Minerals | 6% | 6% | -50% | -29% | 0.0085 | $11,146,382.03 |

| TMT | Technology Metals | 6% | -5% | -3% | -20% | 0.35 | $74,487,717.74 |

| PVW | PVW Res | 6% | -4% | -51% | 53% | 0.275 | $25,581,015.63 |

| CHN | Chalice Mining | 6% | -9% | -42% | -33% | 4.37 | $1,674,522,513.30 |

| PEK | Peak Rare Earths | 5% | -18% | -31% | -47% | 0.49 | $99,527,297.76 |

| ASN | Anson Resources | 5% | 122% | 140% | 200% | 0.3 | $293,000,263.50 |

| GLN | Galan Lithium | 5% | -9% | -10% | 13% | 1.235 | $357,869,610.18 |

| ALY | Alchemy Resource | 5% | 31% | 62% | 53% | 0.021 | $20,967,629.25 |

| CZN | Corazon | 5% | 17% | -35% | -42% | 0.021 | $10,985,950.03 |

| GBR | Greatbould Resources | 5% | 9% | -28% | -34% | 0.105 | $42,287,217.30 |

| NVA | Nova Minerals | 5% | 2% | 53% | -30% | 0.905 | $167,588,125.05 |

| LRS | Latin Resources | 5% | 53% | 195% | 167% | 0.115 | $204,802,763.97 |

| FGR | First Graphene | 4% | -7% | -24% | -39% | 0.125 | $74,836,447.53 |

| 1MC | Morella Corporation | 4% | 39% | 4% | -60% | 0.025 | $144,141,144.65 |

| CTM | Centaurus Metals | 4% | 13% | -14% | 10% | 1.11 | $474,087,963.03 |

| BYH | Bryah Resources | 4% | -10% | -42% | -44% | 0.028 | $7,819,097.27 |

| KAI | Kairos Minerals | 4% | -7% | 27% | -3% | 0.028 | $54,994,617.75 |

| KOR | Korab Resources | 4% | 40% | -38% | 65% | 0.028 | $11,011,500.00 |

| AZL | Arizona Lithium | 4% | 5% | -39% | 98% | 0.085 | $195,203,970.44 |

| AS2 | Askarimetalslimited | 3% | -1% | -9% | 70% | 0.34 | $14,422,166.40 |

| G88 | Golden Mile Res | 3% | 25% | -41% | -35% | 0.035 | $6,926,908.88 |

| MCR | Mincor Resources NL | 3% | 9% | -6% | 46% | 2.1 | $1,025,128,167.00 |

| AUZ | Australian Mines | 3% | 16% | -53% | -66% | 0.08 | $37,497,107.28 |

| EUR | European Lithium | 2% | -6% | -17% | -8% | 0.083 | $113,419,373.18 |

| SCN | Scorpion Minerals | 2% | 32% | 17% | 22% | 0.083 | $26,214,664.17 |

| VUL | Vulcan Energy | 2% | 0% | -12% | -43% | 7.97 | $1,097,948,405.66 |

| MAN | Mandrake Res | 2% | -12% | -9% | -28% | 0.043 | $23,517,996.48 |

| IGO | IGO Limited | 2% | 12% | 6% | 32% | 12.96 | $9,632,446,581.36 |

| ARR | American Rare Earths | 2% | -27% | -43% | 31% | 0.23 | $102,207,583.77 |

| GT1 | Greentechnology | 2% | 3% | -11% | 0% | 0.72 | $130,121,678.67 |

| AM7 | Arcadia Minerals | 2% | 93% | 18% | 24% | 0.26 | $12,141,451.92 |

| AKE | Allkem Limited | 2% | 19% | 41% | 44% | 14.06 | $8,595,630,999.28 |

| SYA | Sayona Mining | 2% | 29% | 108% | 75% | 0.27 | $2,116,189,713.96 |

| WIN | Widgienickellimited | 2% | -19% | -20% | 0% | 0.285 | $70,056,000.00 |

| ZNC | Zenith Minerals | 2% | 5% | -9% | 37% | 0.315 | $101,704,872.31 |

| E25 | Element 25 | 2% | 2% | -33% | -70% | 0.675 | $95,443,980.63 |

| COB | Cobalt Blue | 1% | 1% | 48% | 188% | 0.805 | $250,937,056.12 |

| S32 | South32 Limited | 1% | 8% | -20% | 26% | 4.14 | $19,207,991,073.60 |

| INR | Ioneer | 1% | -2% | 21% | 6% | 0.635 | $1,290,352,456.74 |

| IG6 | Internationalgraphit | 1% | 17% | 0% | 0% | 0.3325 | $27,705,956.72 |

| TLG | Talga Group | 1% | -2% | -2% | -1% | 1.4 | $407,140,982.87 |

| OZL | OZ Minerals | 1% | 37% | -2% | 7% | 26 | $8,582,862,799.96 |

| AML | Aeon Metals . | 0% | 7% | -40% | -47% | 0.03 | $30,616,061.64 |

| ATM | Aneka Tambang | 0% | 0% | 4% | 15% | 1.15 | $1,499,196.35 |

| AVW | Avira Resources | 0% | 0% | -20% | -20% | 0.004 | $8,475,160.00 |

| AVZ | AVZ Minerals | 0% | 0% | -15% | 179% | 0.78 | $2,752,409,203.44 |

| BSX | Blackstone | 0% | -11% | -58% | -58% | 0.195 | $89,912,792.75 |

| CWX | Carawine Resources | 0% | -9% | -53% | -52% | 0.1 | $13,783,434.70 |

| CMX | Chemxmaterials | 0% | 25% | 6% | 0% | 0.19 | $8,201,572.05 |

| ENV | Enova Mining Limited | 0% | 0% | -20% | -33% | 0.016 | $5,875,440.99 |

| FFX | Firefinch | 0% | 0% | -17% | -5% | 0.2 | $236,248,644.20 |

| FRS | Forrestaniaresources | 0% | 25% | -55% | 0% | 0.175 | $6,505,454.28 |

| GED | Golden Deeps | 0% | 36% | 50% | 36% | 0.015 | $18,483,627.42 |

| HNR | Hannans | 0% | 0% | -36% | 204% | 0.021 | $54,731,701.00 |

| HXG | Hexagon Energy | 0% | -6% | -72% | -78% | 0.016 | $8,206,654.42 |

| IPT | Impact Minerals | 0% | 0% | -37% | -37% | 0.008 | $18,610,279.17 |

| IMI | Infinitymining | 0% | 54% | 18% | 0% | 0.2 | $11,787,500.00 |

| JMS | Jupiter Mines. | 0% | -3% | -17% | -22% | 0.195 | $391,798,206.60 |

| LMG | Latrobe Magnesium | 0% | -8% | -10% | 315% | 0.083 | $130,476,955.82 |

| LML | Lincoln Minerals | 0% | 0% | 0% | 0% | 0.008 | $4,599,869.49 |

| LSR | Lodestar Minerals | 0% | -13% | -46% | -22% | 0.007 | $12,169,061.44 |

| NKL | Nickelx | 0% | 6% | -7% | -41% | 0.135 | $8,383,500.00 |

| PLL | Piedmont Lithium Inc | 0% | 31% | 8% | 4% | 0.865 | $453,710,888.00 |

| POS | Poseidon Nick | 0% | -7% | -43% | -57% | 0.052 | $159,325,895.35 |

| PSC | Prospect Res | 0% | -25% | 132% | 468% | 0.097 | $43,452,389.43 |

| QPM | Queensland Pacific | 0% | -3% | -3% | -29% | 0.145 | $226,723,904.00 |

| REE | Rarex Limited | 0% | -5% | -44% | -49% | 0.059 | $33,625,665.74 |

| S2R | S2 Resources | 0% | 0% | -22% | 17% | 0.14 | $49,892,479.70 |

| SGQ | St George Min | 0% | -13% | -38% | -62% | 0.026 | $16,800,427.39 |

| STM | Sunstone Metals | 0% | -4% | -45% | 65% | 0.043 | $116,840,088.86 |

| TKL | Traka Resources | 0% | 0% | -36% | -50% | 0.007 | $4,821,421.93 |

| VIA | Viagold Rare Earth | 0% | 0% | 0% | 4662% | 2 | $166,624,808.00 |

| WKT | Walkabout Resources | 0% | 0% | -14% | -7% | 0.173011 | $78,248,343.26 |

| WMG | Western Mines | 0% | -13% | -18% | -26% | 0.14 | $5,128,550.00 |

| JRV | Jervois Global | -1% | 20% | -30% | 2% | 0.51 | $767,474,235.31 |

| NTU | Northern Min | -1% | 0% | -18% | -11% | 0.041 | $199,280,143.26 |

| MRC | Mineral Commodities | -1% | -12% | -37% | -49% | 0.079 | $43,374,741.35 |

| DVP | Develop Global | -1% | -12% | -34% | -27% | 2.27 | $365,947,769.17 |

| EMH | European Metals Hldg | -1% | -9% | -40% | -53% | 0.72 | $86,211,701.28 |

| KTA | Krakatoa Resources | -2% | 27% | 55% | -7% | 0.062 | $20,682,595.02 |

| SYR | Syrah Resources | -2% | 15% | 28% | 25% | 1.685 | $1,098,952,206.76 |

| STK | Strickland Metals | -2% | -9% | -13% | 36% | 0.053 | $67,898,350.05 |

| LEL | Lithenergy | -2% | -3% | 5% | 57% | 0.96 | $43,795,500.00 |

| LRV | Larvottoresources | -2% | 0% | 22% | 0% | 0.225 | $9,344,812.50 |

| AVL | Aust Vanadium | -2% | -2% | 13% | 95% | 0.043 | $170,450,391.71 |

| CRR | Critical Resources | -2% | -9% | -45% | 75% | 0.042 | $61,008,624.80 |

| LEG | Legend Mining | -3% | -26% | -43% | -51% | 0.037 | $101,940,021.68 |

| AX8 | Accelerate Resources | -3% | -3% | -22% | -13% | 0.035 | $10,277,438.16 |

| AAJ | Aruma Resources | -3% | -4% | -24% | -24% | 0.065 | $10,516,420.70 |

| AOU | Auroch Minerals | -3% | 5% | -42% | -65% | 0.064 | $24,122,266.94 |

| CMO | Cosmometalslimited | -3% | 7% | -6% | 0% | 0.145 | $3,698,950.00 |

| EFE | Eastern Resources | -3% | 4% | -41% | 123% | 0.029 | $29,195,190.30 |

| EVR | Ev Resources | -3% | 0% | -44% | -3% | 0.029 | $25,001,569.92 |

| QXR | Qx Resources Limited | -3% | -15% | -40% | 100% | 0.028 | $23,202,782.67 |

| JRL | Jindalee Resources | -4% | -6% | -17% | -32% | 2.46 | $144,594,994.32 |

| BKT | Black Rock Mining | -4% | -27% | -43% | -27% | 0.135 | $136,824,682.96 |

| WC8 | Wildcat Resources | -4% | 17% | -10% | 13% | 0.027 | $17,422,363.63 |

| NC1 | Nicoresourceslimited | -4% | -1% | 11% | 0% | 0.8 | $74,736,251.70 |

| CLA | Celsius Resource | -4% | 4% | -43% | -52% | 0.0125 | $17,932,416.52 |

| MMC | Mitremining | -4% | 9% | -36% | 0% | 0.125 | $3,521,063.00 |

| BUX | Buxton Resources | -4% | 35% | 17% | 46% | 0.115 | $15,312,054.87 |

| KZR | Kalamazoo Resources | -4% | 0% | -21% | -37% | 0.23 | $33,877,706.02 |

| SLZ | Sultan Resources | -5% | -5% | -34% | -36% | 0.105 | $8,744,860.85 |

| OCN | Oceanalithiumlimited | -5% | 31% | 0% | 0% | 0.59 | $19,444,500.00 |

| LYC | Lynas Rare Earths | -5% | -10% | -22% | 19% | 8.4 | $7,670,498,209.00 |

| CAI | Calidus Resources | -5% | -25% | -27% | -3% | 0.575 | $245,157,754.80 |

| ASO | Aston Minerals | -5% | 3% | -48% | -40% | 0.0835 | $92,979,832.99 |

| ILU | Iluka Resources | -5% | 3% | -6% | 0% | 9.83 | $4,170,244,274.01 |

| RNU | Renascor Res | -5% | -16% | -36% | 33% | 0.18 | $389,604,496.50 |

| MIN | Mineral Resources. | -6% | 5% | 26% | 10% | 60.34 | $11,352,693,602.34 |

| ARL | Ardea Resources | -6% | -15% | 22% | 86% | 0.835 | $150,217,928.22 |

| CML | Chase Mining Limited | -6% | 15% | 15% | -17% | 0.015 | $7,256,057.80 |

| BEM | Blackearth Minerals | -6% | -11% | -21% | -38% | 0.087 | $23,520,121.31 |

| TMB | Tambourahmetals | -6% | -17% | -33% | -37% | 0.145 | $6,384,852.69 |

| IXR | Ionic Rare Earths | -7% | -14% | -23% | 19% | 0.043 | $166,522,011.56 |

| A8G | Australasian Metals | -7% | 10% | -43% | 15% | 0.27 | $11,116,033.38 |

| LPM | Lithium Plus | -7% | 34% | 0% | 0% | 0.585 | $24,763,101.00 |

| PUR | Pursuit Minerals | -7% | -32% | -38% | -78% | 0.013 | $13,906,188.72 |

| NVX | Novonix Limited | -7% | -33% | -60% | -58% | 2.06 | $987,960,205.12 |

| AZS | Azure Minerals | -7% | -7% | -49% | -54% | 0.19 | $59,039,786.99 |

| MLS | Metals Australia | -7% | -18% | -43% | 25% | 0.05 | $30,351,809.55 |

| BMM | Balkanminingandmin | -8% | -8% | -31% | -80% | 0.185 | $6,058,750.00 |

| FRB | Firebird Metals | -8% | -10% | -34% | -68% | 0.185 | $12,423,683.52 |

| CNB | Carnaby Resource | -8% | -10% | -48% | 163% | 0.83 | $118,539,933.08 |

| MQR | Marquee Resource | -8% | -15% | -36% | 5% | 0.067 | $22,724,465.76 |

| AKN | Auking Mining | -8% | -21% | -50% | -51% | 0.087 | $8,073,643.49 |

| PAN | Panoramic Resources | -9% | 2% | -25% | 5% | 0.215 | $430,691,940.84 |

| BRB | Breaker Res NL | -9% | 2% | -9% | -5% | 0.21 | $68,426,595.09 |

| ODE | Odessa Minerals | -9% | 3% | 19% | 210% | 0.0155 | $8,594,417.73 |

| PGD | Peregrine Gold | -9% | -12% | 25% | 65% | 0.65 | $27,879,520.32 |

| MRR | Minrex Resources | -9% | -19% | -17% | 220% | 0.048 | $50,595,016.04 |

| FG1 | Flynngold | -10% | -1% | -42% | -42% | 0.095 | $6,085,799.75 |

| CAE | Cannindah Resources | -10% | 2% | -34% | 188% | 0.225 | $119,894,310.36 |

| ENT | Enterprise Metals | -10% | -10% | -36% | -47% | 0.009 | $5,876,826.19 |

| RAS | Ragusa Minerals | -10% | 162% | 315% | 193% | 0.22 | $29,588,135.64 |

| AR3 | Austrare | -10% | -13% | -55% | -66% | 0.35 | $34,272,558.72 |

| PAM | Pan Asia Metals | -10% | 10% | -19% | -15% | 0.43 | $32,155,305.27 |

| AQD | Ausquest Limited | -11% | -11% | 0% | -15% | 0.017 | $14,027,536.79 |

| BOA | Boadicea Resources | -11% | -22% | -36% | -34% | 0.125 | $9,712,486.88 |

| BHP | BHP Group Limited | -12% | -4% | -16% | -1% | 37.27 | $192,045,257,277.96 |

| NIC | Nickel Industries | -12% | -19% | -44% | -12% | 0.895 | $2,526,427,984.73 |

| ADV | Ardiden | -13% | -13% | -42% | -56% | 0.007 | $20,012,515.17 |

| ESR | Estrella Res | -13% | -13% | -50% | -65% | 0.014 | $19,911,980.90 |

| FTL | Firetail Resources | -13% | 2% | 0% | 0% | 0.245 | $15,445,625.00 |

| PRL | Province Resources | -13% | -34% | -9% | -34% | 0.096 | $112,241,848.59 |

| IPX | Iperionx Limited | -13% | 23% | -14% | -36% | 0.855 | $120,213,419.81 |

| GSM | Golden State Mining | -13% | 10% | -32% | -55% | 0.054 | $6,318,767.02 |

| RAG | Ragnar Metals | -14% | -10% | 41% | -14% | 0.038 | $13,271,471.12 |

| VML | Vital Metals Limited | -14% | -17% | -19% | -46% | 0.038 | $203,727,050.32 |

| OMH | OM Holdings Limited | -14% | 0% | -33% | -22% | 0.62 | $476,412,052.37 |

| EMN | Euromanganese | -14% | -24% | -23% | -53% | 0.3 | $82,755,565.43 |

| GRE | Greentechmetals | -14% | -14% | -2% | 0% | 0.24 | $7,663,599.76 |

| RMX | Red Mount Min | -14% | 0% | -25% | -33% | 0.006 | $11,496,547.01 |

| SBR | Sabre Resources | -14% | 20% | 50% | 50% | 0.006 | $16,738,386.05 |

| EMS | Eastern Metals | -15% | -29% | -48% | 0% | 0.11 | $4,252,187.50 |

| CLZ | Classic Min | -16% | -54% | -89% | -89% | 0.016 | $3,859,202.61 |

| DTM | Dart Mining NL | -16% | 35% | 24% | 0% | 0.105 | $14,878,617.60 |

| GAL | Galileo Mining | -16% | 2% | 388% | 218% | 1.05 | $204,317,549.10 |

| NWC | New World Resources | -17% | -14% | -48% | -54% | 0.03 | $60,947,793.13 |

| PNT | Panthermetals | -17% | -16% | -21% | 0% | 0.19 | $5,510,000.00 |

| GSR | Greenstone Resources | -18% | 12% | 76% | 171% | 0.065 | $68,474,489.79 |

| PGM | Platina Resources | -19% | -19% | -49% | -65% | 0.026 | $14,607,949.64 |

| LIT | Lithium Australia | -23% | -18% | -39% | -49% | 0.064 | $69,372,424.78 |

| CNJ | Conico | -30% | 13% | 270% | -42% | 0.044 | $62,563,628.77 |

Weekly small cap standouts

An outsized number of our top 50 resources stocks for September were hunting for rare earths, critical in the production of things like wind turbines and electric vehicles.

Leading the charge last week was KFM, which picked up rock chips grading up to 40% rare earths (including “significant” levels of the valuable magnet REEs) within the Gascoyne Mineral Field area in WA.

Gascoyne is a proverbial stone’s throw (~100km away) from Hastings Technology Metals’ (ASX:HAS) world-class 27.42Mt at 0.97% TREO ‘Yangibana’ deposit, which has just welcomed Twiggy Forrest’s Wyloo Metals as a strategic investor.

HAS is set to be the next REE producer outside of China by 2023.

Drilling at Gascoyne kicks off in Q4 this calendar year, KFM says.

Up on no news last week was micro-cap explorer EMT, which acquired a 469sqkm project prospective for ionic clay (IAC) rare earths in WA’s Albany Range province late last year.

The Salmon Gums acquisition is close to EMT’s existing ‘Cowlinya’ REE project.

It is also a stone’s throw from recent IAC discoveries made by Mount Ridley Mines (ASX:MRD) (~35km away) and Salazar Gold (~20km away).

WHITE CLIFF MINERALS (ASX:WCN)

This small battery metals/critical minerals explorer just wrapped up a $1.7m placement to drive lithium and REE exploration at the company’s Yinnetharra, Hines Hill and Diemals projects.

It’s been a nice recovery for WCN, which is now up 126% over the past month.

The recent IPO was spun out of New World Resources (ASX:NWC) to explore and develop its North American copper-cobalt assets.

It has five projects: the Blackpine, Colson and Panther cobalt-copper projects in the Idaho Cobalt Belt; the Elkhorn cobalt project in the same belt; and the Goodsprings copper-cobalt project in Nevada.

Blackpine and Panther were acquired in November last year.

Both projects have been the subject of historical mining but no drilling has been undertaken at Blackpine since 1996.

At Blackpine, IP surveying has delineated multiple undrilled, strong chargeability anomalies, coincident with strong cobalt-copper soil anomalism over 4km of strike. Very promising.

A maiden program is expected to kick off in the coming days.

ANOTHER rare earths stock.

In March, RR1 invested $1.8m into REEgenerate, an Australian private company which owns Coconut Club REE exploration project in Quebec, Canada.

It also recently acquired REEcycle Inc, a US based company focused on recovering REE from high powered permanent NdFeB magnets.

REEcycle has developed a process that has shown at pilot scale the ability to reclaim 15 of the 17 rare earths elements in discarded permanent NdFeB magnets, with a recovery efficiency in excess of 99%.

READ: Bargain Barrel: 10 cheap ASX rare earths stocks to jump into right now

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.