High Voltage: EV sales to nearly triple by 2030, lithium market manipulation, and 5 graphite stocks

Mining

Mining

Our High Voltage column wraps the news driving ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, manganese, magnesium, and vanadium.

There’s a lot to talk about regarding the critical minerals scene right now – locally and globally.

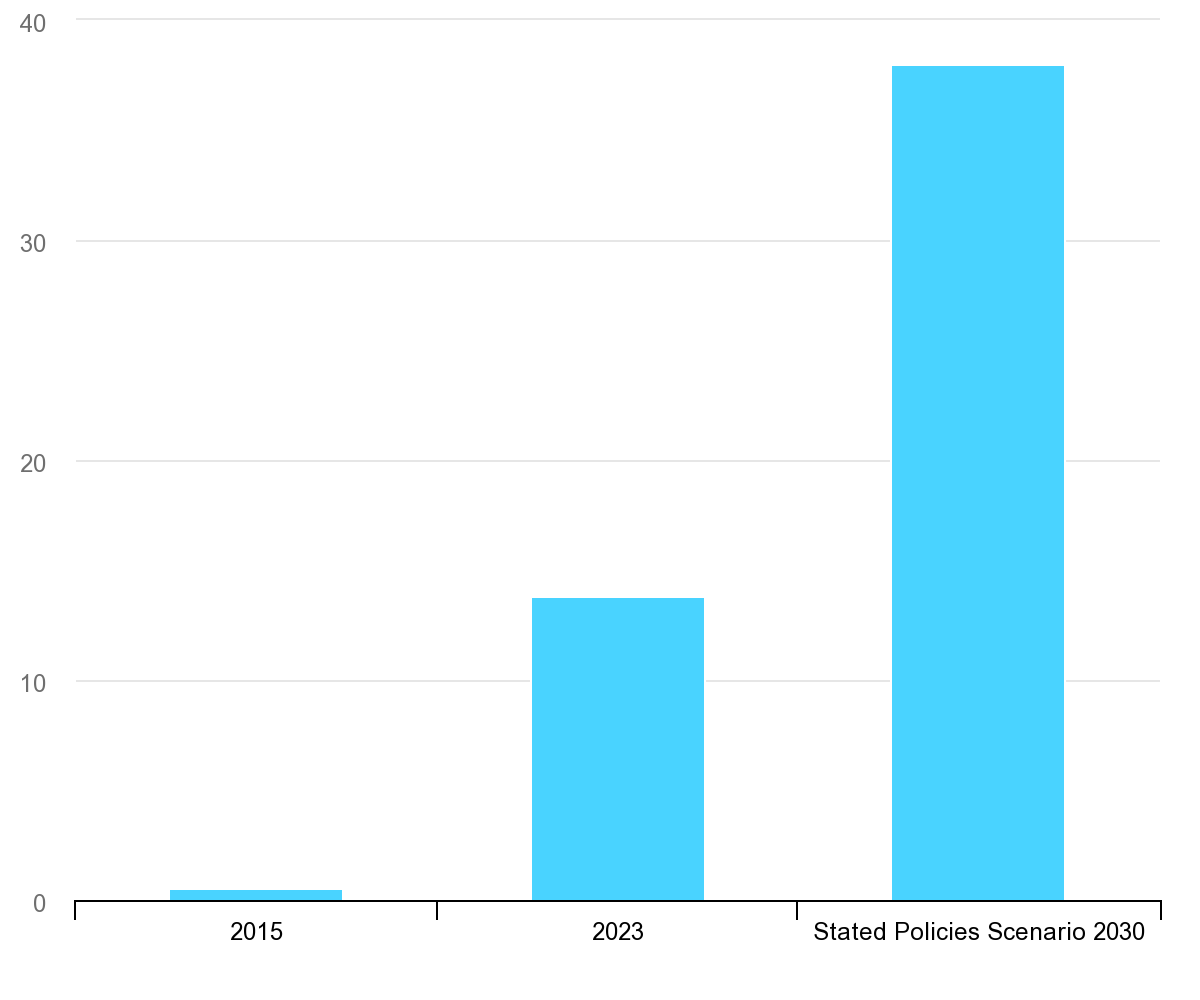

But let’s kick things off with a few stats that caught our eyes from the latest findings on renewable energy by the International Energy Agency, specifically regarding electric vehicles (EVs).

As the IEA notes: “The global energy crisis has prompted a range of new initiatives, notably in advanced economies and China, that aim to increase the pace of clean energy deployment. Measures vary from region to region, but they all tend to place greater emphasis on boosting the share of renewables in electricity generation, incentivising electric car sales and improving energy efficiency.”

Some key findings from the IAE’s World Energy Outlook report:

• In 2023, one in five cars sold are electric.

• EV sales are set to increase by about 2.75 times by 2030 from where things stand today.

• By 203o, 65% of all cars sold in the European Union will be electric.

• 100 million EVs will be on the road in China by 2030. [Note, that’d be close to a 10x increase from where things stand today.]

• 45% of two/three-wheelers sold in SE Asia to be electric by 2030.

There’s plenty more to be gleaned on “clean energy” transitioning, as well as where the land lies regarding fossil fuels, in the IAE’s extensive new report > here.

But what’s been electrifying the world of ASX-housed battery metal hunters this week? Budge over, lithium (although we’ll get to you further below) because graphite has joined you centre stage. (At least till you boot it back to the wings again.)

Right, I’m off to grab a coffee. Josh, could you write this next bit, please? Thanks very much…

There is a great lithium conspiracy afoot, as one of the world’s biggest miners takes a swipe at manipulation they say is depressing prices of the key battery metal.

It’s fallen downhill since late 2022, with chemical prices dropping from US$80,000/t to the low US$20,000/t range according to price agencies. 6% Li2O spodumene concentrate is down from the roughly US$8000/t highs to US$2150/t according to the usually reputable Fastmarkets.

Bearing in mind its lower grade material cops a discount to the index, Mineral Resources (ASX:MIN) saw prices for its Mt Marion concentrate fall 28% QoQ to US$1870/dmt. In the December quarter last year that same product was valued at US$3,262/dmt.

Why is the market on a downward trajectory? Market manipulation of course.

Quoth MinRes EGM Corporate Development James Bruce: “With regards to the lithium market, there’s nothing wrong with lithium fundamentals,” he told analysts.

“There are three factors at play in the short term. There’s market manipulation with plenty of paper trading, however end user demand is good and the endless supply chain is rebalancing.”

Bruce, presenting as stand-in for Mineral Resources’ (ASX:MIN) billionaire MD Chris Ellison, who will no doubt get a good showing at the miner’s AGM next month, was pressed on this by Jarden analyst Ben Lyons.

Lyons is the resources number-cruncher who was memorably called out for his cash flow projections by Chris Ellison on the July call. The best part was when Ellison invited the analyst over for a coffee if he flew out to Perth, to which Lyons said he already lived in the West, MIN’s PIs clearly off the money.

Yesterday he pressed Bruce on his comments and whether he thought that manipulation was impacting pricing indexes used to determine contract prices with customers.

“But then I also stated that there’s a lot of paper trading that is going on right now in the lithium market and that’s, that’s where my comment was referencing that,” Bruce responded.

“We do continue to sell product based on the industry indices pricing, so it’s an observation … but there are a number of indices out there and you can observe those prices.

“Ben, we supply to our customers based on those indices. It’s a negotiation between us and our customers and yes we do that. My observations stand alone and I’ve made those observations. There’s a lot of paper trading in the market right now.”

There have been concerns from within the sector about the impact of futures prices like the Wuxi exchange, which prompted an equity sell-off in December with a big one-day drop, and the Guangzhou contract launched in July.

According to Fastmarkets that one fell pretty much non-stop from August before a pause and slight bounceback in mid-October, with final quarter restocking approaching. But futures are a common feature of just about any commodity market.

Buyers may, too, have complained about the impact Pilbara Minerals’ publicly announced spot auctions played in lifting price indices during the 2021-2022 boom.

Ellison notably said he wanted to take control of the miner’s marketing, something it is doing after restructuring its Wodgina JV with Albemarle, indicating he would take the price of the day as he did for any other commodity rather than hedge via long-term contracts.

“Albemarle asked me what I’m going to do one day when it all turns around and there’s more supply than demand, and I said I’ll do what I always do, I’ll change,” Ellison said last year, indicating he thought lithium would be short on supply until 2030.

“But in the meantime while supply is short we’re going to take advantage of the price on the way up and I am fairly convinced that I’ve got five to seven years of that.”

Bruce reiterated that confidence yesterday, saying the market was still growing 20% a year ahead of decisions to expand its Wodgina mine in the Pilbara.

There will always be suspicions about what goes on in an opaque and largely Chinese end market like lithium and MinRes is closer than we are. Other experts, like Mr Lithium Joe Lowry, have said this year as prices fell that China is creating a false narrative.

But sometimes a little more detail wouldn’t hurt if you’re going to cry wolf.

Thanks, Josh. I’m back… what’d I miss? Hmm, I might just bang on about graphite for a bit…

Lithium-ion batteries, as you might know, are about 50% comprised of graphite, making the non-metal the largest component of EV batteries. Additionally, almost all EV battery anodes are comprised of 100% graphite.

Critical, then? Yes. Especially when you consider EV purchases are on the rise globally, and are projected to dominate the automotive industry by 2030 as the world hurtles faster into cleaner energy narratives.

And as for local graphite stocks coming further into focus this week? There’s a very clear over-arching reason for that, which we’ve covered so far this week in various resources updates.

But in case you’ve been living under a high-grade metamorphic rock, it’s do do with…

China has thrown the cat among the pigeons this week. Actually, it’s shut the cat flap and the pigeons are all squabbling about for attention around semiconductor chips. Or something like that.

Last Friday, China’s commerce minister said the Asian powerhouse would be requiring export permits for some graphite products to “protect national security”, creating fresh tension in ongoing trade wars between the US/allies and the Middle Kingdom.

The US is desperate to push itself ahead of China in the strategic materials game.

Per The Australian:

Australian graphite stocks surged on Monday after China announced late last week it would soon implement export controls on two types of the mineral which are crucial for battery manufacturing.

China produces about two thirds of all natural graphite used globally and refines more than 90 per cent of graphite battery anode material.

Graphite is used as the anode material in lithium-ion battery manufacturing and is therefore used in virtually all electric vehicle batteries.

The Chinese move follows the US imposing new limits on the types of semiconductors which can be sold to Chinese firms, and the EU announcing last month it would investigate whether to impose tariffs on Chinese-made EVs, which the European Commission says are benefiting from government subsidies.

China tightens exports of crucial EV battery component graphite, citing national security concerns

China said on Friday that it would require export permits for some graphite products to protect national security, springing a surprise with another bid to control critical mineral… pic.twitter.com/8Nn5kqEEqC

— Spotlight on China (@spotlightoncn) October 24, 2023

Stockhead‘s Josh Chiat wrote about it further in one of his Monsters of Rock editions this week:

One stroke of the pen in Beijing has brought Syrah Resources -SYR (ASX:) and its graphite peddling peers back to the good books of investors, who are punting that the west will accelerate efforts to build ex-China supply chains after a dramatic export decision late last week — the latest in a tit for tat game of F’ You between it and the west over EV and tech materials.

China will bring in restrictions from December 1, requiring companies to get special export permits if they want to ship high purity, high-hardness and high intensity synthetic graphite and natural flake graphite-derived products out of the Middle Kingdom.

Other graphite materials used in steel, metallurgy and chemical production won’t be subject to the restrictions.

🚨 China and #graphite

This sums up the main issue the rest of the world faces with graphite and anode material.

There is a lot of anode capacity planned but hardly any for the rest of the world.

2023: China dominates with 93%

2035: China dominates with 90%

The issue… pic.twitter.com/hnypJOUd5D

— Simon Moores (@sdmoores) October 21, 2023

Here are five movers and shakers making graphite-related noise on the local bourse this week, and perhaps ones to keep an eye on, Chinese export bans or not…

Syrah Resources – SYR (ASX): +61% this week, down 62% YTD

Shaw and Partners analyst Peter Kormendy, who leads Shaw’s graphite coverage, has a $1.30 price target and buy rating on it this major Aussie graphite player (current market cap: $520m).

Again, leaning on Josh’s notes on this from earlier in the week:

No stock signifies the volatility of the graphite market like SYR.

Emerging as one of the first true battery metals hopefuls under the watch of Tolga Kumova in the mid-2010s, the company’s fortunes have vacillated wildly since announcing first production under still serving MD Shaun Verner in late 2017.

Its Balama mine in Mozambique went under review as oversupply struck the market in 2019, eventually going into a temporary suspension as Covid hit in early 2020.

It was revived as Syrah’s fortunes soared as its strategy to go downstream via an anode materials plant in Louisiana in the USA caught the attention of the market.

But enthusiasm for the future Tesla supplier has waned amid a stagnant graphite price which has seen its Balama mine run on a campaign basis in recent months.

Sovereign Metals (ASX:SVM): +10% this week, +8% YTD

This $247m market capped explorer is backed by mining giant Rio Tinto and has just appointed experienced Africa-based mining executive Frank Eagar as its new managing director to lead development of its Kasiya rutile-graphite project in Malawi.

According to our special report on SVM this week, Kasiya is the largest natural rutile deposit and the second largest flake graphite deposit in the world, with a total resource of 1.8Bt grading 1% rutile and 1.4% graphite and ore reserve of 538Mt at 1.03% rutile and 1.66% TGC, or 5.5Mt of contained rutile and 8.9Mt of contained graphite.

Evolution Energy Minerals (ASX:EV1): +12.5% this week, -20% YTD

EV1 is a mineral exploration company spun from Marvel Gold (ASX:MVL), focused on the development of the Chilalo graphite project in southern Tanzania.

Earlier this month, EV1 announced it’s in the process of raising $4.6 million to further advance the Chilalo project.

via @MiningNewsNet#EV1 has received firm commitments to raise $4.6 million via a two-tranche placement managed by Canaccord Genuity, Argonaut Securities and Ashanti Capital.

The funds will be used to advance the Chilalo #graphite project in Tanzania.https://t.co/XcnlrM8Dcc

— Evolution Energy Minerals Limited (@Evolution_EV1) October 13, 2023

Along with Syrah, above, Shaw and Partners analyst Peter Kormendy has also rated EV1 as a “buy”. And he also likes Black Rock Mining (ASX:BKT) in this corner of the battery metals market, too.

Lincoln Minerals (ASX:LML): +21% this week, +6% YTD

This small (12m market capped) Aussie graphite explorer came off a trading halt earlier this week amid announcing the completion of a $1.7m (at 0.6c per share) placement led by Sequoia Wealth Management.

Lincoln Minerals is focused on development of the Kookaburra Gully graphite project, on the Eyre Peninsula in South Australia.

The aim for this fresh funding is to accelerate exploration at the company’s flagship project, including upcoming drilling programs at both the Kookaburra Gully and Koppio graphite deposits.

Kingsland Minerals (ASX:KNG): flat this week – trading halt?, +66% YTD

Another $12m capped Aussie graphite junior, Kingsland has just intersected more wide, high-grade graphite at the Leliyn project in the NT.

Metallurgical testwork and a resource estimation is now underway, with the latter on track for release in 2024.

Here’s a snapshot of ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, magnesium, manganese, and vanadium are performing lately>>>

Battery metals stocks missing from our list? Shoot a mail to [email protected] or [email protected]

| Code | Company | Price | % Week | % Month | % Year | Market Cap |

|---|---|---|---|---|---|---|

| VIA | Viagold Rare Earth | 0 | -100% | -100% | -100% | $166,624,808 |

| PVW | PVW Res Ltd | 0.066 | 0% | -1% | -56% | $6,692,715 |

| A8G | Australasian Metals | 0.195 | 0% | 39% | -20% | $10,163,496 |

| INF | Infinity Lithium | 0.084 | -7% | -6% | -63% | $38,395,144 |

| LPI | Lithium Pwr Int Ltd | 0.525 | 27% | 123% | -13% | $330,349,719 |

| PSC | Prospect Res Ltd | 0.096 | 30% | 16% | -9% | $43,914,649 |

| PAM | Pan Asia Metals | 0.15 | -23% | -29% | -62% | $31,764,287 |

| CXO | Core Lithium | 0.35 | -3% | -1% | -75% | $747,927,440 |

| LOT | Lotus Resources Ltd | 0.245 | 20% | 0% | 9% | $305,340,760 |

| AGY | Argosy Minerals Ltd | 0.185 | -5% | 0% | -67% | $266,837,425 |

| AZS | Azure Minerals | 2.44 | -3% | -6% | 687% | $1,087,665,095 |

| NWC | New World Resources | 0.028 | 0% | -13% | -10% | $61,067,035 |

| QXR | Qx Resources Limited | 0.023 | -4% | 5% | -67% | $24,326,013 |

| GSR | Greenstone Resources | 0.0085 | -6% | -15% | -66% | $11,606,039 |

| CAE | Cannindah Resources | 0.096 | -13% | -17% | -48% | $55,471,675 |

| AZL | Arizona Lithium Ltd | 0.015 | 7% | 7% | -81% | $47,920,345 |

| HNR | Hannans Ltd | 0.007 | 0% | -13% | -67% | $19,072,234 |

| COB | Cobalt Blue Ltd | 0.24 | 7% | -14% | -66% | $86,337,881 |

| ESS | Essential Metals Ltd | 0.495 | 3% | 3% | -16% | $123,675,585 |

| LPD | Lepidico Ltd | 0.01 | -9% | 0% | -50% | $76,383,079 |

| MRD | Mount Ridley Mines | 0.002 | 0% | 0% | -60% | $15,569,766 |

| CZN | Corazon Ltd | 0.018 | 29% | 64% | 20% | $10,465,164 |

| LKE | Lake Resources | 0.175 | -5% | 9% | -84% | $256,040,047 |

| DEV | Devex Resources Ltd | 0.29 | 0% | -9% | -2% | $117,192,453 |

| INR | Ioneer Ltd | 0.15 | -17% | -35% | -74% | $337,764,212 |

| AVZ | AVZ Minerals Ltd | 0.78 | 0% | 0% | 0% | $2,752,409,203 |

| MAN | Mandrake Res Ltd | 0.034 | -3% | -11% | 0% | $20,357,837 |

| RLC | Reedy Lagoon Corp. | 0.005 | -17% | 0% | -60% | $3,083,418 |

| GBR | Greatbould Resources | 0.067 | 5% | 12% | -27% | $33,508,974 |

| FRS | Forrestaniaresources | 0.031 | -11% | -33% | -85% | $3,069,048 |

| STK | Strickland Metals | 0.1 | 8% | 89% | 75% | $176,125,063 |

| MLX | Metals X Limited | 0.28 | 2% | -10% | 2% | $235,889,177 |

| CLA | Celsius Resource Ltd | 0.011 | -4% | -8% | -15% | $24,706,568 |

| FGR | First Graphene Ltd | 0.077 | -11% | 24% | -30% | $47,639,682 |

| HXG | Hexagon Energy | 0.008 | -11% | -11% | -43% | $4,103,327 |

| TLG | Talga Group Ltd | 1.165 | 21% | 3% | -3% | $414,867,298 |

| MNS | Magnis Energy Tech | 0.074 | 0% | -3% | -80% | $88,762,863 |

| PLL | Piedmont Lithium Inc | 0.475 | -12% | -25% | -50% | $179,940,675 |

| EUR | European Lithium Ltd | 0.069 | 0% | 1% | -23% | $96,202,503 |

| BKT | Black Rock Mining | 0.12 | 35% | 48% | -31% | $131,655,131 |

| QEM | QEM Limited | 0.19 | -3% | -12% | -5% | $28,007,467 |

| LYC | Lynas Rare Earths | 7.12 | 6% | 4% | -9% | $6,368,621,553 |

| ESR | Estrella Res Ltd | 0.008 | 0% | 0% | -27% | $11,868,575 |

| ARL | Ardea Resources Ltd | 0.485 | -5% | -18% | -50% | $93,437,719 |

| GLN | Galan Lithium Ltd | 0.66 | -8% | 6% | -56% | $231,360,593 |

| JRL | Jindalee Resources | 1.37 | 1% | -29% | -39% | $81,435,394 |

| VUL | Vulcan Energy | 2.25 | -14% | -26% | -67% | $393,904,604 |

| SBR | Sabre Resources | 0.048 | 30% | 7% | -13% | $9,619,044 |

| CHN | Chalice Mining Ltd | 1.8 | -9% | -29% | -60% | $713,747,663 |

| VRC | Volt Resources Ltd | 0.008 | 0% | 0% | -73% | $29,545,679 |

| NMT | Neometals Ltd | 0.29 | -8% | -29% | -75% | $149,393,143 |

| AXN | Alliance Nickel Ltd | 0.057 | -5% | -14% | -36% | $42,824,537 |

| PNN | Power Minerals Ltd | 0.245 | -2% | -11% | -49% | $19,131,883 |

| IGO | IGO Limited | 10.85 | -7% | -12% | -33% | $8,231,501,127 |

| GED | Golden Deeps | 0.053 | 2% | 0% | -62% | $6,007,162 |

| ADV | Ardiden Ltd | 0.005 | -17% | -9% | -29% | $10,753,341 |

| SRI | Sipa Resources Ltd | 0.024 | -8% | 20% | -55% | $5,019,479 |

| NTU | Northern Min Ltd | 0.03 | 3% | 7% | -27% | $171,418,398 |

| AXE | Archer Materials | 0.395 | -5% | -14% | -48% | $103,213,040 |

| PGM | Platina Resources | 0.022 | -8% | -19% | 10% | $14,333,148 |

| AAJ | Aruma Resources Ltd | 0.033 | 6% | 3% | -55% | $6,497,420 |

| IXR | Ionic Rare Earths | 0.021 | -9% | -13% | -53% | $87,034,308 |

| NIC | Nickel Industries | 0.765 | -4% | -2% | 6% | $3,278,644,558 |

| EVG | Evion Group NL | 0.04 | 33% | 21% | -60% | $13,838,367 |

| CWX | Carawine Resources | 0.11 | -12% | -15% | 28% | $21,649,921 |

| PLS | Pilbara Min Ltd | 3.88 | -5% | -9% | -28% | $11,405,863,481 |

| HAS | Hastings Tech Met | 0.71 | 0% | -7% | -81% | $88,616,157 |

| BUX | Buxton Resources Ltd | 0.22 | 7% | 7% | 110% | $35,968,499 |

| ARR | American Rare Earths | 0.135 | 4% | 8% | -31% | $55,802,912 |

| SGQ | St George Min Ltd | 0.042 | 2% | 8% | -18% | $33,862,999 |

| TKL | Traka Resources | 0.005 | 0% | 0% | -17% | $4,376,646 |

| PAN | Panoramic Resources | 0.038 | 0% | -3% | -75% | $109,877,305 |

| PRL | Province Resources | 0.041 | 0% | 0% | -52% | $48,441,219 |

| IPT | Impact Minerals | 0.01 | 0% | -17% | 67% | $28,647,039 |

| LIT | Lithium Australia | 0.033 | 6% | -11% | -34% | $37,276,846 |

| AKE | Allkem Limited | 10.56 | -9% | -12% | -29% | $6,508,290,763 |

| ARN | Aldoro Resources | 0.088 | -2% | -20% | -66% | $11,846,889 |

| JRV | Jervois Global Ltd | 0.032 | -6% | -11% | -94% | $86,480,662 |

| MCR | Mincor Resources NL | 0 | -100% | -100% | -100% | $751,215,521 |

| SYR | Syrah Resources | 0.74 | 56% | 57% | -70% | $476,507,900 |

| FBM | Future Battery | 0.099 | 10% | -14% | 65% | $48,950,975 |

| ADD | Adavale Resource Ltd | 0.01 | -9% | -23% | -66% | $6,573,324 |

| LTR | Liontown Resources | 1.81 | -35% | -40% | -4% | $4,280,959,388 |

| CTM | Centaurus Metals Ltd | 0.49 | -8% | -29% | -50% | $241,529,027 |

| VML | Vital Metals Limited | 0.01 | 0% | 0% | -71% | $53,061,498 |

| BSX | Blackstone Ltd | 0.11 | -4% | -4% | -39% | $52,105,780 |

| POS | Poseidon Nick Ltd | 0.015 | -6% | -21% | -70% | $55,622,664 |

| CHR | Charger Metals | 0.185 | 28% | 32% | -62% | $11,180,586 |

| AVL | Aust Vanadium Ltd | 0.026 | -4% | -4% | -26% | $129,183,776 |

| AUZ | Australian Mines Ltd | 0.012 | -8% | -20% | -82% | $10,075,588 |

| TMT | Technology Metals | 0.23 | -10% | -22% | -38% | $61,028,636 |

| RXL | Rox Resources | 0.22 | -2% | -4% | 16% | $79,207,053 |

| RNU | Renascor Res Ltd | 0.165 | 43% | 50% | -33% | $368,214,087 |

| GL1 | Globallith | 1.265 | -11% | -13% | -52% | $322,227,267 |

| BRB | Breaker Res NL | 0 | -100% | -100% | -100% | $158,126,031 |

| ASN | Anson Resources Ltd | 0.17 | 21% | 13% | -43% | $205,718,267 |

| SYA | Sayona Mining Ltd | 0.085 | -1% | -11% | -64% | $844,050,273 |

| FFX | Firefinch Ltd | 0.2 | 0% | 0% | 0% | $236,569,315 |

| EGR | Ecograf Limited | 0.145 | 16% | 32% | -61% | $70,151,741 |

| ATM | Aneka Tambang | 1.19 | 0% | 3% | 19% | $1,551,342 |

| TVN | Tivan Limited | 0.068 | 3% | -9% | -16% | $108,383,735 |

| ALY | Alchemy Resource Ltd | 0.01 | -9% | -23% | -62% | $12,958,839 |

| GAL | Galileo Mining Ltd | 0.32 | -2% | 3% | -73% | $63,239,977 |

| BHP | BHP Group Limited | 44.72 | -2% | 1% | 14% | $220,946,367,315 |

| LEL | Lithenergy | 0.58 | 5% | -5% | -51% | $60,260,850 |

| MMC | Mitremining | 0.21 | -9% | -16% | 11% | $9,523,521 |

| RMX | Red Mount Min Ltd | 0.0045 | 0% | 13% | -25% | $10,694,304 |

| GW1 | Greenwing Resources | 0.115 | -4% | -18% | -67% | $20,910,178 |

| AQD | Ausquest Limited | 0.013 | 18% | -13% | -24% | $10,726,940 |

| LML | Lincoln Minerals | 0.008 | 14% | 33% | 17% | $11,365,694 |

| 1MC | Morella Corporation | 0.005 | -17% | -23% | -77% | $30,693,279 |

| REE | Rarex Limited | 0.032 | 7% | -9% | -45% | $20,501,597 |

| MRC | Mineral Commodities | 0.04 | 21% | 5% | -50% | $27,658,238 |

| PUR | Pursuit Minerals | 0.011 | 38% | 5% | 0% | $26,495,743 |

| QPM | Queensland Pacific | 0.06 | -4% | 3% | -64% | $120,750,169 |

| EMH | European Metals Hldg | 0.64 | 3% | -4% | -14% | $85,019,074 |

| BMM | Balkanminingandmin | 0.135 | -4% | -36% | -51% | $8,600,897 |

| PEK | Peak Rare Earths Ltd | 0.4 | 0% | 3% | -22% | $101,886,964 |

| LEG | Legend Mining | 0.024 | 0% | 0% | -31% | $60,994,021 |

| MOH | Moho Resources | 0.007 | 0% | -22% | -71% | $2,380,311 |

| AML | Aeon Metals Ltd. | 0.012 | -14% | -25% | -56% | $14,253,208 |

| G88 | Golden Mile Res Ltd | 0.021 | 11% | -38% | -17% | $6,258,401 |

| WKT | Walkabout Resources | 0.13 | 18% | 18% | -25% | $86,678,156 |

| TON | Triton Min Ltd | 0.028 | 33% | 33% | 12% | $40,595,246 |

| AR3 | Austrare | 0.2 | -2% | -11% | -42% | $29,291,533 |

| ARU | Arafura Rare Earths | 0.22 | 10% | -12% | -29% | $464,940,232 |

| MIN | Mineral Resources. | 60.09 | -5% | -13% | -21% | $11,209,556,560 |

| VMC | Venus Metals Cor Ltd | 0.1 | -5% | -20% | 43% | $18,972,868 |

| S2R | S2 Resources | 0.19 | -10% | 9% | 36% | $84,068,762 |

| CNJ | Conico Ltd | 0.005 | 0% | -17% | -67% | $6,280,380 |

| VR8 | Vanadium Resources | 0.046 | -6% | -27% | -42% | $23,679,752 |

| PVT | Pivotal Metals Ltd | 0.02 | 0% | 0% | -53% | $10,957,366 |

| BOA | Boadicea Resources | 0.038 | -3% | 0% | -63% | $4,800,522 |

| IPX | Iperionx Limited | 1.23 | -8% | -15% | 76% | $242,425,121 |

| SLZ | Sultan Resources Ltd | 0.02 | 5% | -23% | -79% | $2,815,611 |

| NKL | Nickelxltd | 0.054 | -2% | -14% | -63% | $4,742,019 |

| NVA | Nova Minerals Ltd | 0.275 | -2% | 17% | -59% | $55,885,840 |

| MLS | Metals Australia | 0.035 | 6% | 0% | -15% | $22,465,303 |

| MQR | Marquee Resource Ltd | 0.026 | -4% | -30% | -61% | $10,747,994 |

| MRR | Minrex Resources Ltd | 0.015 | -12% | 3% | -66% | $17,357,880 |

| EVR | Ev Resources Ltd | 0.011 | -8% | -21% | -58% | $11,809,747 |

| EFE | Eastern Resources | 0.007 | -22% | -22% | -82% | $8,693,625 |

| CNB | Carnaby Resource Ltd | 0.785 | -8% | -6% | -10% | $132,719,765 |

| BNR | Bulletin Res Ltd | 0.105 | -5% | 38% | -13% | $30,827,066 |

| AX8 | Accelerate Resources | 0.036 | 13% | 50% | 9% | $15,844,075 |

| AM7 | Arcadia Minerals | 0.09 | -14% | -10% | -71% | $9,814,509 |

| AS2 | Askarimetalslimited | 0.185 | -3% | -12% | -61% | $13,824,038 |

| BYH | Bryah Resources Ltd | 0.014 | 0% | -18% | -43% | $5,020,474 |

| DTM | Dart Mining NL | 0.019 | -14% | -24% | -77% | $3,287,232 |

| EMS | Eastern Metals | 0.032 | 3% | 3% | -74% | $2,062,735 |

| FG1 | Flynngold | 0.065 | 8% | 8% | -38% | $8,864,868 |

| GSM | Golden State Mining | 0.019 | -49% | -51% | -47% | $4,203,942 |

| IMI | Infinitymining | 0.12 | -8% | -11% | -45% | $9,318,166 |

| LRV | Larvottoresources | 0.105 | -16% | -19% | -50% | $6,725,472 |

| LSR | Lodestar Minerals | 0.005 | 0% | -17% | 0% | $10,116,987 |

| RAG | Ragnar Metals Ltd | 0.023 | -8% | 0% | 0% | $10,901,562 |

| CTN | Catalina Resources | 0.004 | 33% | 0% | -56% | $4,953,948 |

| TMB | Tambourahmetals | 0.125 | -4% | -34% | -7% | $10,782,246 |

| TEM | Tempest Minerals | 0.007 | -13% | -30% | -77% | $3,579,684 |

| EMC | Everest Metals Corp | 0.1 | -13% | -13% | 0% | $13,328,311 |

| WML | Woomera Mining Ltd | 0.0105 | 5% | -19% | -19% | $10,040,043 |

| KZR | Kalamazoo Resources | 0.096 | -2% | -4% | -48% | $15,771,289 |

| LMG | Latrobe Magnesium | 0.046 | 7% | 2% | -41% | $86,001,759 |

| KOR | Korab Resources | 0.017 | 0% | -11% | -50% | $6,239,850 |

| CMX | Chemxmaterials | 0.072 | -13% | -28% | -64% | $3,992,442 |

| NC1 | Nicoresourceslimited | 0.31 | -10% | -31% | -51% | $26,817,126 |

| GRE | Greentechmetals | 0.355 | 16% | -20% | 122% | $19,890,111 |

| CMO | Cosmometalslimited | 0.05 | -4% | -11% | -64% | $1,734,833 |

| FRB | Firebird Metals | 0.16 | 10% | 14% | -24% | $11,126,250 |

| S32 | South32 Limited | 3.25 | -6% | -3% | -11% | $14,603,919,649 |

| OMH | OM Holdings Limited | 0.455 | -4% | -9% | -31% | $336,073,618 |

| JMS | Jupiter Mines. | 0.19 | 0% | 0% | 0% | $372,208,296 |

| E25 | Element 25 Ltd | 0.36 | -4% | -19% | -68% | $79,398,572 |

| EMN | Euromanganese | 0.12 | -14% | -20% | -55% | $30,565,435 |

| KGD | Kula Gold Limited | 0.0135 | 13% | -13% | -67% | $4,851,755 |

| LRS | Latin Resources Ltd | 0.27 | 2% | -2% | 145% | $658,126,550 |

| CRR | Critical Resources | 0.029 | -12% | -28% | -57% | $48,001,958 |

| ENT | Enterprise Metals | 0.003 | 0% | -25% | -67% | $2,398,413 |

| SCN | Scorpion Minerals | 0.054 | -4% | -10% | -30% | $19,068,841 |

| GCM | Green Critical Min | 0.007 | 0% | 0% | -36% | $9,092,680 |

| ENV | Enova Mining Limited | 0.007 | -13% | 17% | -46% | $4,486,505 |

| RBX | Resource B | 0.115 | -4% | -26% | 42% | $9,095,293 |

| AKN | Auking Mining Ltd | 0.044 | -24% | -23% | -63% | $8,980,563 |

| RR1 | Reach Resources Ltd | 0.012 | 0% | -25% | 140% | $35,203,268 |

| EMT | Emetals Limited | 0.007 | -13% | -22% | -42% | $5,950,000 |

| PNT | Panthermetalsltd | 0.075 | 6% | 10% | -58% | $4,586,250 |

| WIN | Widgienickellimited | 0.19 | -5% | -3% | -32% | $55,119,835 |

| WMG | Western Mines | 0.315 | 7% | 9% | 142% | $19,704,142 |

| AVW | Avira Resources Ltd | 0.001 | -33% | -33% | -67% | $2,133,790 |

| CAI | Calidus Resources | 0.155 | 15% | -9% | -56% | $94,221,378 |

| GT1 | Greentechnology | 0.4 | -14% | -13% | -56% | $84,126,122 |

| KAI | Kairos Minerals Ltd | 0.019 | -5% | -14% | -28% | $52,418,244 |

| MTM | MTM Critical Metals | 0.023 | -23% | -39% | -80% | $2,185,416 |

| NWM | Norwest Minerals | 0.036 | 9% | 24% | 9% | $9,202,224 |

| PGD | Peregrine Gold | 0.3 | 28% | 0% | -49% | $15,870,175 |

| RAS | Ragusa Minerals Ltd | 0.039 | 3% | 11% | -86% | $4,848,359 |

| RGL | Riversgold | 0.011 | -8% | -8% | -74% | $9,512,615 |

| SRZ | Stellar Resources | 0.009 | -18% | -18% | -31% | $10,059,642 |

| STM | Sunstone Metals Ltd | 0.016 | 23% | -11% | -47% | $46,229,773 |

| ZNC | Zenith Minerals Ltd | 0.095 | 4% | 6% | -68% | $33,476,184 |

| WC8 | Wildcat Resources | 0.745 | 57% | 89% | 2228% | $697,369,168 |

| ASO | Aston Minerals Ltd | 0.034 | -6% | -11% | -57% | $49,212,442 |

| THR | Thor Energy PLC | 0.026 | 13% | -40% | -71% | $4,408,413 |

| YAR | Yari Minerals Ltd | 0.016 | 14% | -16% | -43% | $7,235,367 |

| IG6 | Internationalgraphit | 0.18 | 0% | -8% | -42% | $14,683,038 |

| LPM | Lithium Plus | 0.39 | -6% | -3% | -34% | $25,075,516 |

| ODE | Odessa Minerals Ltd | 0.0075 | -6% | -42% | -56% | $6,629,783 |

| KOB | Kobaresourceslimited | 0.066 | -13% | -19% | -34% | $7,062,917 |

| AZI | Altamin Limited | 0.065 | 3% | -7% | -24% | $23,111,288 |

| FTL | Firetail Resources | 0.105 | 12% | 0% | -43% | $14,890,556 |

| LNR | Lanthanein Resources | 0.006 | -14% | -25% | -83% | $6,729,453 |

| CLZ | Classic Min Ltd | 0.001 | 0% | 0% | -94% | $12,357,082 |

| NVX | Novonix Limited | 0.72 | 14% | -15% | -76% | $364,014,595 |

| OCN | Oceanalithiumlimited | 0.155 | 0% | -24% | -66% | $7,961,475 |

| SUM | Summitminerals | 0.095 | 2% | -32% | -46% | $4,432,113 |

| DVP | Develop Global Ltd | 3.17 | 1% | -2% | 19% | $587,410,675 |

| XTC | Xantippe Res Ltd | 0.001 | 0% | 0% | -79% | $17,528,005 |

| OD6 | Od6Metalsltd | 0.18 | -3% | 9% | -5% | $10,728,022 |

| HRE | Heavy Rare Earths | 0.057 | -23% | -37% | -69% | $3,326,836 |

| LIN | Lindian Resources | 0.19 | -5% | -21% | -14% | $213,105,614 |

| PEK | Peak Rare Earths Ltd | 0.4 | 0% | 3% | -22% | $101,886,964 |

| ILU | Iluka Resources | 7.01 | -6% | -12% | -26% | $2,931,102,238 |

| ASM | Ausstratmaterials | 1.385 | -1% | -14% | -32% | $215,140,054 |

| ETM | Energy Transition | 0.035 | -3% | -3% | -27% | $50,162,528 |

| VMS | Venture Minerals | 0.0095 | -5% | -5% | -60% | $19,500,130 |

| IDA | Indiana Resources | 0.052 | -10% | -15% | -9% | $30,621,853 |

| VTM | Victory Metals Ltd | 0.22 | -2% | 22% | 33% | $17,393,426 |

| M2R | Miramar | 0.026 | -41% | -48% | -74% | $5,061,564 |

| WCN | White Cliff Min Ltd | 0.012 | 9% | 0% | -40% | $15,084,223 |

| TAR | Taruga Minerals | 0.01 | 0% | -9% | -68% | $7,060,268 |

| ABX | ABX Group Limited | 0.073 | -3% | -6% | -50% | $18,175,561 |

| MEK | Meeka Metals Limited | 0.042 | 11% | -13% | -31% | $49,810,275 |

| RR1 | Reach Resources Ltd | 0.012 | 0% | -25% | 140% | $35,203,268 |

| DRE | Dreadnought Resources Ltd | 0.034 | -23% | -35% | -69% | $123,969,007 |

| KFM | Kingfisher Mining | 0.14 | -15% | -22% | -71% | $8,057,250 |

| AOA | Ausmon Resorces | 0.0035 | 17% | 0% | -50% | $2,935,948 |

| WC1 | Westcobarmetals | 0.067 | -12% | -22% | -68% | $6,410,822 |

| GRL | Godolphin Resources | 0.038 | 6% | 9% | -54% | $6,092,713 |

| DM1 | Desert Metals | 0.04 | 0% | -11% | -90% | $3,046,725 |

| PTR | Petratherm Ltd | 0.051 | -4% | -9% | -20% | $11,462,308 |

| ITM | Itech Minerals Ltd | 0.14 | 17% | 0% | -55% | $17,105,699 |

| KTA | Krakatoa Resources | 0.021 | 24% | 5% | -66% | $8,263,060 |

| M24 | Mamba Exploration | 0.035 | -22% | -39% | -73% | $2,134,417 |

| LNR | Lanthanein Resources | 0.006 | -14% | -25% | -83% | $6,729,453 |

| TKM | Trek Metals Ltd | 0.053 | 66% | -5% | -12% | $22,891,444 |

| BCA | Black Canyon Limited | 0.15 | 0% | 15% | -40% | $9,846,657 |

| CDT | Castle Minerals | 0.01 | 11% | 0% | -58% | $12,933,173 |

| DLI | Delta Lithium | 0.61 | -14% | -22% | 14% | $312,252,304 |

| A11 | Atlantic Lithium | 0.395 | -17% | -15% | -34% | $272,447,539 |

| KNI | Kunikolimited | 0.265 | -12% | -16% | -61% | $22,765,161 |

| CY5 | Cygnus Metals Ltd | 0.16 | 14% | -16% | -66% | $34,805,117 |

| WR1 | Winsome Resources | 1.25 | 3% | -17% | 225% | $210,404,675 |

| LLI | Loyal Lithium Ltd | 0.455 | -13% | -40% | -5% | $34,196,870 |

| BC8 | Black Cat Syndicate | 0.19 | 12% | -25% | -42% | $55,637,477 |

| BUR | Burleyminerals | 0.185 | 12% | 0% | 9% | $19,246,384 |

| PBL | Parabellumresources | 0.345 | 0% | 0% | -18% | $18,879,263 |

| L1M | Lightning Minerals | 0.14 | -7% | 4% | 0% | $5,701,509 |

| WA1 | Wa1Resourcesltd | 5.6 | 17% | 4% | 4048% | $224,955,663 |

| EV1 | Evolutionenergy | 0.18 | 13% | 9% | -29% | $29,811,666 |

| 1AE | Auroraenergymetals | 0.105 | 12% | -13% | -46% | $15,602,279 |

| RVT | Richmond Vanadium | 0.36 | 3% | -6% | 0% | $31,465,849 |

| PMT | Patriotbatterymetals | 1.185 | -4% | -8% | 0% | $419,274,961 |

| PAT | Patriot Lithium | 0.18 | 3% | -3% | 0% | $11,180,313 |

| BM8 | Battery Age Minerals | 0.23 | -4% | -21% | -54% | $19,164,431 |

| OM1 | Omnia Metals Group | 0.078 | 0% | -12% | -46% | $3,446,405 |

| VHM | Vhmlimited | 0.47 | 1% | -11% | 0% | $72,340,579 |

| LLL | Leolithiumlimited | 0.505 | 0% | 0% | -15% | $498,553,663 |

| SRN | Surefire Rescs NL | 0.014 | 8% | -7% | 12% | $23,119,089 |

| SRL | Sunrise | 0.785 | -1% | 2% | -64% | $70,828,586 |

| EG1 | Evergreenlithium | 0.21 | -18% | -25% | 0% | $11,527,150 |

| WSR | Westar Resources | 0.02 | 5% | -5% | -58% | $3,521,793 |

| LU7 | Lithium Universe Ltd | 0.04 | -13% | -22% | 0% | $15,540,876 |

| MEI | Meteoric Resources | 0.245 | 14% | 2% | 1942% | $446,351,139 |

| REC | Rechargemetals | 0.14 | -11% | -30% | -26% | $15,589,276 |

| SLM | Solismineralsltd | 0.21 | -24% | -25% | 239% | $16,708,554 |

| DYM | Dynamicmetalslimited | 0.16 | -11% | -26% | 0% | $5,600,000 |

| TOR | Torque Met | 0.16 | -55% | -52% | -11% | $19,308,001 |

| ICL | Iceni Gold | 0.064 | -12% | -26% | -9% | $16,070,429 |

| TMX | Terrain Minerals | 0.005 | 0% | 0% | -17% | $5,659,397 |

| MHC | Manhattan Corp Ltd | 0.005 | -17% | -38% | -29% | $14,684,899 |

| MHK | Metalhawk. | 0.088 | -9% | -23% | -52% | $6,695,536 |

| ANX | Anax Metals Ltd | 0.033 | -3% | -28% | -44% | $14,186,829 |

| FIN | FIN Resources Ltd | 0.026 | 30% | 136% | 37% | $13,662,778 |

| LM1 | Leeuwin Metals Ltd | 0.305 | 2% | 13% | 0% | $12,987,650 |

| HAW | Hawthorn Resources | 0.095 | 4% | -21% | 12% | $30,486,421 |

| LCY | Legacy Iron Ore | 0.017 | -6% | 6% | -15% | $115,322,872 |

The week’s biggest gains 🚀

Wildcat Resources (ASX:WC8) +57%

Syrah Resources -SYR (ASX) +56%

Renascor Resources (ASX:RNU) +43%

Pursuit Minerals (ASX:PUR) +38%

The week’ s biggest falls 📉

Golden State Mining (ASX:GSM) -49%

Avira Resources (ASX:AVW) -33%

Liontown Resources (ASX:LTR) -35%

Had your fill of graphite for one column? Then here’s a quick look at what’s been shaking in the land of lithium this week…

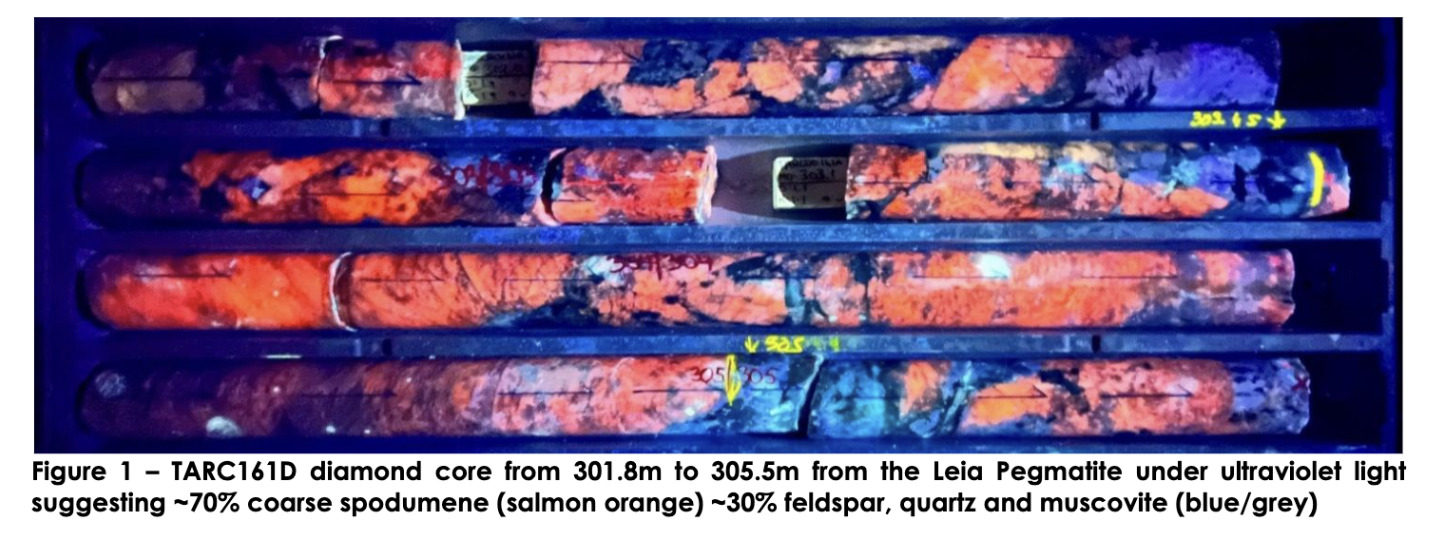

The Pilbara-lithium-exploring junior announced this week it’s drilled into some broad, high-grade lithium intersections at the promising Tabba Tabba lithium-tantalum project near Port Hedland, WA.

These latest assay results continue the rich vein of form the company has been digging up since it delivered its batch of figures from an extensive 3.2km trending pegmatite system at the project in September.

The announced results come from a specific pegmatite system within that area, dubbed Leia, and they provide the best yet from the Central Cluster structure, including, as the headline highlight:

85m at 1.5% Li2O from 133m (including 9m at 3.0% Li2O from 199m and 13m at 2.3% Li2O from 136m).

That’s some thick, spod-tastic action right there…

The company notes that pending results from a further 58 RC holes (22 of them are from Leia) indicate that Tabba Tabba has potential to host a Tier-1 lithium deposit.

Stockhead‘s Reuben Adams put it this way:

“Like Azure, WC8 has bucked the trend to be a huge winner in 2023. It is currently all rigs blazing at Tabba Tabba, an old tantalum occurrence once explored by Pilbara Minerals (ASX:PLS) in its pre-Pilgangoora days”.

WC8, up a, frankly stupendous, 2,962% YTD, now sports an outrageously big market cap of $765m.

As Josh writes:

“That is despite tumbling — but still profitable — lithium prices in 2023. Its current market cap captures how significant the shift in the profile of the industry is.

In early 2020, when the lithium industry was hobbled by oversupply, one of its largest producers Pilbara Minerals was trading at the same MC.”

[Side note… er, yeah, that longer-term turnaround for lithium prices we were kinda hoping for last week? It hasn’t exactly eventuated yet. Some of the hopium expressed by this columnist might’ve been a tad premature.]

2023-10-25#Lithium Carbonate 99.5% Min China Spot

Price: $23,542.52

1 day: $-139.3 (-0.59%) 📉

YTD: -68.05%#Spodumene Concentrate (6%, CIF China)Price: $2,220.00

1 day: $-35 (-1.55%) 📉

YTD: -61.89%Sponsored by @SiennaResources $SIE $SNNAFhttps://t.co/Bdbe53cei6

— Lithium Price Bot (@LithiumPriceBot) October 25, 2023

Did they say “surge” in #lithium futures prices? Time will tell if this is a “false flag” or the inevitable upturn in price. pic.twitter.com/0RlbtaDlCZ

— Joe Lowry (@globallithium) October 23, 2023

Minerals-exploring junior Sabre was rattling up the local bourse on Wednesday on the back of two key lithium tenement acquisitions in the Pilbara.

The big news here is that they’re not far from the major Andover discovery belonging to ASX lithium gun Azure Minerals (ASX:AZS).

We’re sick of saying it this year, but we’ll say it anyway… nearology.

The tenement additions confirm Sabre as one to watch in the world-class lithium pegmatite region, establishing some 235km2 along strike and on parallel structures to Andover, which seems likely to be the subject of a takeover bid from one of the world’s biggest lithium players SQM.

The company notes the new tenements cover key lithium pegmatite targets only about 5km northeast of the Andover site (which, within a 5km wide corridor, has so far this year produced drilling intersections of up to 209.4m at 1.42% Li2O).

The new Sabre tenements reportedly lie over an inflexion in the area’s lithium structural corridor, “close to a magnetic intrusion in a similar setting to the Andover discovery”.

Geophysicists will get to work soon at the tenements, along with aircore drilling programs to test the peggies for hopefully some spod-tastic outcomes.

• Liontown Resources (ASX:LTR)

In the aftermath of the highly publicised Albemarle/Hancock push-me-pull-you takeover drama for Liontown, LTR has at least managed to see its much-vaunted Kathleen Valley lithium project fully funded.

And, according to The Australian (via analysts at Wilsons), it’s a raise that ended up being larger than expected.

A $367m raise, then, at $1.80 per share after US lithium giant Albemarle walked away from its $3 a share, $6.6 billion offer following Gina Rinehart’s Hancock Prospecting acquiring a 19.9% blocking stake in a series of on-market deals at or near the offer price.

It seemed Liontown’s only option was to raise capital immediately after the news at a significant discount.

The raise comes with the securing of a $760m debt facility, which includes a refinancing of a pre-existing $300m Ford Debt facility.

The LTR share price is down 35% this week.

A message for #shareholders from $LTR Chair @timgoyder. We thank you for your continued support and are excited for our future.#LTR #Lithium #Mining #Thankyou pic.twitter.com/XpvmV1wfFa

— Liontown Resources (@LiontownRes) October 20, 2023

Coming to a #lithium transaction near you? The lightest metal’s greatest dabbler? https://t.co/nYX73odw0w

— Joe Lowry (@globallithium) October 21, 2023