Hexagon expects the target-rich Halls Creek project to attract ‘keen interest’ from potential JV partners

Mining

Mining

Special Report: Hexagon’s main focus is commercialising its disruptive rare earths processing tech, called RapidSX. But for shareholders, the company’s legacy Halls Creek project represents plenty of upside.

There’s renewed exploration interest in the East Kimberley region of WA.

This has been sparked by successful mine operators like Pantoro (ASX:PNR), Panoramic Resources (ASX:PAN), and Northern Minerals (ASX:NTU) as well as high profile exploration from Buxton Resources (ASX:BUX), Chalice Gold Mines, (ASX:CHN) and Independence Group (ASX:IGO).

READ: $3.8bn miner IGO is seeing something it likes at Buxton’s massive frontier nickel-copper project

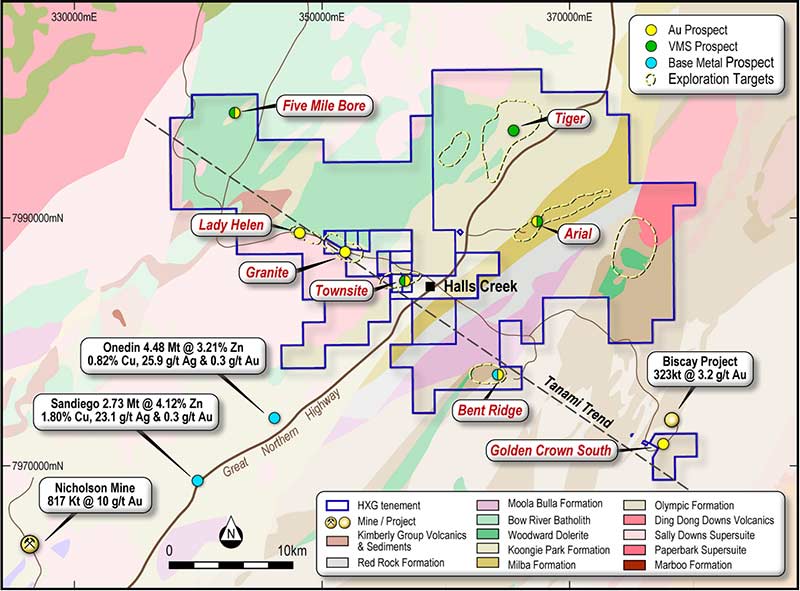

Hexagon Energy Materials’ (ASX:HXG) underexplored 657sqkm Halls Creek project (HCP) is part of this great neighbourhood.

A stone’s throw from the HGP is Pantoro’s ~50,000oz-per-year, high-grade Nicolsons gold project, which started production in 2015.

Pantoro is also reporting high-grade gold hits from the Mary River and Grants Creek projects, immediately south and north along strike, respectively, from the HCP tenements.

Similar styles of epithermal to mesothermal gold mineralisation have been identified within the HCP, Hexagon says.

And immediately to the south is Anglo Australian Resources’ (ASX:AAR) Onedin and Sandiego VMS-style base metal deposits.

Hexagon says a high-resolution geophysical survey, combined with re-interpreted geology and geochemical anomalies, has resulted in the identification of numerous gold and base metal “walk-up” drill targets.

Highlights include the “high-priority” Lady Helen gold-silver prospect where a small historical drilling program returned a best result of 4m at 22.6g/t gold and 17.3g/t silver from surface.

As Hexagon is focused on the rare earth JV, the company is seeking opportunities to commercialise the value of the HCP through a joint venture or spin-out.

The company expects keen interest from potential joint venture partners, Hexagon managing director Mike Rosenstreich says.

“This region is getting increased exploration attention and with a $2,300/oz gold price this is a unique opportunity for such a prospective, well located and sizable project,” he says.

NOW READ: Heavy rare earths prices are due some hefty gains in 2020, says Lynas