Guy on Rocks: Uranium is starting to spark. These 3 small caps should be on the radar

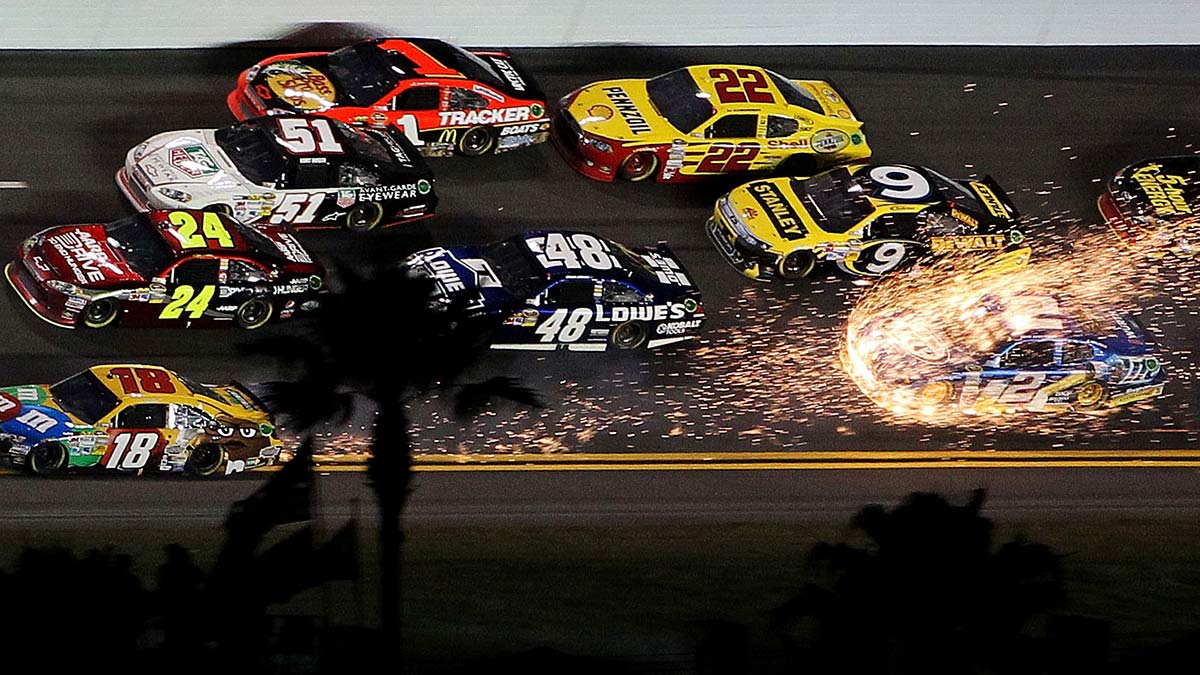

Kyle Busch, driver of #18, drives down on the apron throwing sparks on Brad Keselowski, driver of the #2 Miller Lite Dodge, during the NASCAR Budweiser Shootout at Daytona International Speedway. Pic: Getty.

Guy on Rocks is a Stockhead series looking at the significant happenings of the resources market each week.

Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market ructions

There’s lots of news this week driving commodities prices.

Iron ore continues its run up, reaching $US136 ($183) a tonne. And, as I said a couple of weeks back, the arrival of the cyclone season will likely see stronger prices in the near term.

I note that Vale’s 2021 iron ore production guidance has come in around 315-335 million tonnes below consensus estimates in the range of 350-360 million tonnes.

This should contribute to a tight iron ore market into 2021 given this would only contribute around 1 per cent of China’s steel production next year which is still showing strong growth.

Gold had a pretty strong bounce back, trading well over $US1800 again. There’s a lot of sabre rattling going around in the international community at the moment. While the vaccine may not be the driver of the gold price in the short term it may well be political instability.

There’s been a lot of renewed interest in uranium as a source of clean energy.

Unfortunately, a lot of people are driving coal-fire powered Tesla cars. People forget that the energy has got to come from somewhere and while they think they’re driving an electric vehicle that’s clean and green; the actual power source is coal.

So as that is declining, and markets move away from coal, I think uranium has got a very strong chance of filling that hole.

We’ve seen a lift in spot prices of uranium over this year, from around $US24 a pound, hitting a peak about $US34 a pound and now sitting at just under $US30. That’s going to be one to watch because it’s had about 13 years in the doldrums.

Significantly a lot of contracts are completed well above spot price. Particularly Australian deposits in Australian dollar terms are starting to look quite attractive with a 74c US exchange rate and a spot price of about $US30. You could add $US5-10 a pound for longer term contracts, so I think that’s quite interesting.

One of the interesting topics highlighted in a recent Morgan Stanley report was the falling base metal concentrate grades and rising impurities sourced by Chinese smelters that have characterised that market for the last few years, and the search for better quality concentrates.

I’ve mentioned before a lot of Chinese smelters have been pounding the pavement in Australia looking for clean nickel sulphide, copper and zinc concentrates.

Those lesser quality concentrates have certainly put pressure on the profitability of copper and zinc smelters, and I’ve been saying all year I think base metals is going to be very strong next year as a lot of interest comes back into base metals exploration in Australia, and offshore.

Looking at a lot of the data coming out of the smelters, the supply of concentrates is pretty tight. Zinc concentrates in particular are looking at a pretty significant deficit of over 600,000 tonnes by 2024. Copper, meanwhile, is moving into a deficit of over 400,000 tonnes by 2024.

I think that theme is only getting stronger.

Movers and shakers

Emerging iron ore producer Fenix Resources (ASX:FEX) had a very strong move on Thursday, which advanced 33.5 per cent to over 22.5c, after announcing it had secured port rights at Geraldton.

Fenix inked a deal with the Mid West Ports Authority allowing it to export 1.25 million tonnes of iron ore each year using the Berth 5 shiploader.

That deal gives them four years plus two additional two-year extensions, so that should take care of pretty much all of that mine life.

Traka Resources (ASX:TKL) has come off from its recent highs, closing Thursday at 2.3c, but I think that is a pretty good buy.

The company announced this week it is about to start a reverse circulation drilling program at its Mount Cattlin gold project down near Ravensthorpe in Western Australia.

The project sits adjacent to the Ravensthorpe project owned by Medallion Metals, which is due to complete an IPO late this year/early next year.

Traka’s 5,000m drilling program is targeting new geophysical anomalies at the Lone Hand, Maori Queen and Sirdar prospects.

I’m pretty optimistic the company will get some good results there, and I think you’ll see that share price tick up over 2.5-2.6c pretty quickly.

One that I mentioned last month that’s worth keeping an eye on is Auroch Minerals (ASX:AOU), which recently made the new Horn nickel discovery near Leinster in WA.

The junior explorer has completed a six-hole program there and got some very good results – 5m at just over 2 per cent nickel, 0.6 per cent copper and 0.5 grams per tonne (g/t) palladium from about 120m down hole.

The second hole also intersected around 7.2m of massive sulphides. So those essays will be eagerly awaited.

That prospect is pretty encouraging. It’s already got about 600,000 tonnes at 1.4 per cent nickel and 0.3 per cent copper from only 12 holes.

Of the six holes they drilled, five hit sulphide mineralisation, with three returning massive sulphides. I think that is one to keep an eye on given the scarcity of nickel explorers out there.

I also noticed Ausmex (ASX:AMG), which is a bit unloved in the market, hit some high-grade gold mineralisation.

On Thursday, the company reported intersections of up to 6m at 32.9g/t, including 4m at 48.9g/t, from its Trump project. That should be interesting — plenty of strike length, potentially well over 500m.

Hot stocks to watch

A couple of new stocks for those who want to take a medium-term view are in uranium, which is starting to get a bit of traction.

Whether it is going to take off this time and result in production and another uranium boom is yet to be seen, but the three stocks I think keen investors would want exposure to are Paladin Energy (ASX:PDN), Deep Yellow (ASX:DYL) and Boss Resources (ASX:BOE).

Paladin is a former producer at the Langer Heinrich mine in Namibia, which has been on care and maintenance but is ready to relaunch.

The company’s timetable envisages a restart of production by mid next year. It announced the restart in June this year, with a fairly modest capital outlay of around $80m.

Paladin has already sold 43 million pounds of uranium over a 10-year mine life and has a reputation of producing a good clean concentrate.

Life of mine costs are around $US27 a pound. The spot price is $US29 and if we add on a premium for offtake prices, there’s a reasonable chance that’s going to come back into production.

Deep Yellow, meanwhile, has three uranium projects in Namibia – Reptile, Nova and Yellow Dune.

The company, which closed Thursday at 42c giving it a market cap of around $105m, has a resource inventory of over 159 million pounds.

That is one stock to watch, as is Boss, which owns the fully permitted Honeymoon uranium mine in South Australia.

The company could export about 3.3 million pounds per annum. There’s about $170m in historical infrastructure and the reboot for Honeymoon is only about $US63m (about $85m Aussie).

Boss completed a feasibility study in 2017 that indicated a 12-year mine life with a starting resource of about 36 million pounds.

If you look at uranium’s performance back in 2007, it hit well over $US100 a pound. I’m not sure whether it will get back there, but if we see contract prices in that $US45 to $US50 a pound range over the next 12 months I think that would be enough to reboot the sector.

It’s a bit of a controversial one uranium, but if coal is on the way out, I can’t see a more practical replacement ahead of uranium.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada and the United States.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.