Ground Breakers: Pilbara spod sales hit US$8000/t and ASX large cap resources sector a literal gold mine

Pic: Rudall30/iStock via Getty Images

- Pilbara Minerals claims 6% equivalent US$8000/t spot spodumene sale — crazy stuff that

- Battery metals sector charges like one of those juiced up new iPhone lightning cables

- Resources investors in exuberant mood as speculation on lower rate rises emerges in the US

We’ve run out of superlatives to describe the current state of the lithium market, which has today driven Pilbara Minerals’ (ASX:PLS) much watched BMX spot sales to a new record.

This time it’s not even an auction, but another cargo contracted off the back of the last one a week ago.

$PLS, which 100% deserves the dollar sign the Twitterati use to tag ASX stocks, has sold its latest 5000dmt cargo of 5.5% Li2O spodumene for US$7255/dmt.

Adjusted for grade that’s the equivalent of ~US$8000/t on a benchmark 6% basis inclusive of freight costs. Last week’s pre-auction record bid came in at US$7100/dmt (5.5% Li2O), equivalent to US$7833/dmt.

Speaking of the Twitterati, how do they feel about this one?

$PLS.ax gone #beastmode with BMX auctions & sales! US$8000/t another new high!

$PLS $PILBF #lithium@PilbaraMinerals pic.twitter.com/bBFtkiqEEw— Jordan (@jorpra86) October 23, 2022

Watch the Lithium Companies fly after this $PLS has entered into a sale contract for 5,000dmt SC5.5 FOB Port Hedland priced at US$7,255/dmt which is the equivalent of

~US$8,000/dmt on an SC6.0 CIF China basis after adjusting for lithia content pic.twitter.com/MwlfF7hc8l

— Pilbara☀️Wanderer ⛏ (@PilbaraWandy) October 23, 2022

Pretty darn good.

Cue an epic run in battery metals, which has been on the nose for a couple weeks amid some concerning analyst notes (countered by equally optimistic ones) about the near term picture for lithium supply and demand.

Pilbara is up 5.92%, Allkem (ASX:AKE) rises 2.59% to more than $15 a share, IGO (ASX:IGO) and Mineral Resources (ASX:MIN) are at fresh all time highs as well.

Heading down into the mid-caps, battery recycler Neometals (ASX:NMT) was up 11% after receiving environmental approval for its 9000tpa Vanadium Recovery Project in southern Finland, while $453 million Galan Lithium (ASX:GLN) surged by 17.3% to $1.49 after announcing a massive 2.5x increase in its flagship Hombre Muerto West project resource to 5.8Mt contained lithium carbonate equivalent (LCE).

Galan’s total resources in Argentina now increase to 6.5Mt LCE.

Among the other big movers were Vulcan Energy (ASX:VUL), which announced the highest purity lithium hydroxide produced to date from its pilot plant at its geothermal brine project in Germany, and Novonix (ASX:NVX) and Syrah (ASX:SYR), the graphite battery plays which secured one of 20 US Department of Energy critical minerals grants last week.

Battery metals share prices today:

You can feel it all over people

But it’s not just the stuff that goes into batteries.

To channel the words of Stevie Wonder in his 1976 classic Sir Duke (from the equally classic Songs in the Key of Life) you can feel it all over (the ASX) today.

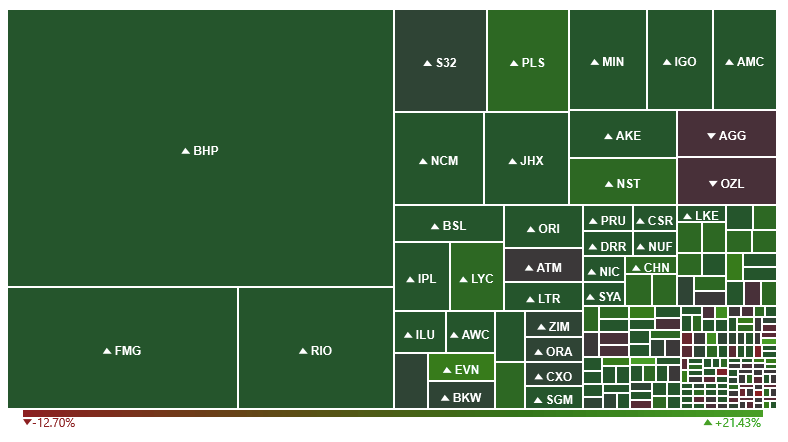

Just have a look at all that green. Materials is up 3.26%.

It’s a literal gold mine out there. And the gold stocks are doing a lot of the heavy lifting.

A falling US dollar and treasury yields have given bullion investors hope rate rises will be reined in. Gold lifted 2.2% to US$1657.69/oz on Friday according to ANZ.

“Gold surged on Friday after Japan’s intervention in currency markets saw the USD fall sharply,” ANZ’s David Plank said in a note.

“Investor appetite for the precious metal was also supported by falling yields on US Treasuries as expectations that large interest rate hikes by the Fed may soon be over. The move dragged silver and platinum higher. Palladium fell as concerns over Russian supply disruptions eased.”

Newcrest Mining (ASX:NCM) was up 3.39% with Northern Star (ASX:NST) surging 5.28%, while diversified market giant BHP (ASX:BHP) was up 3.28%.

Evolution Mining (ASX:EVN) bounced back from a hefty whack in response to its quarterly results last week with a 9.12% gain.

On the flipside South32 (ASX:S32) saw a tepid response to its quarterly report, with production guidance revised down 5% to 7Mt at its Illawarra met coal operations in New South Wales after a longwall move and industrial action at its Appin mine.

On the other hand it enjoyed higher copper and manganese production, with copper equivalent production growth across its commodity suite of 13% expected in FY23.

OZ Minerals (ASX:OZL) also fell 0.63% after a negative reaction to its quarterly.

The copper and gold miner was notably mum on the status of talks or approaches from BHP, whose $8.4 billion cash bid it rejected in August. It could raise concerns the takeover affected bump in its share price to over $25 a share could fade as excitement around the bid slides further from view.

Ground Breakers share prices today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.