Ground Breakers: Global mining equities hit a 10-year high of US$2.34 trillion in February

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

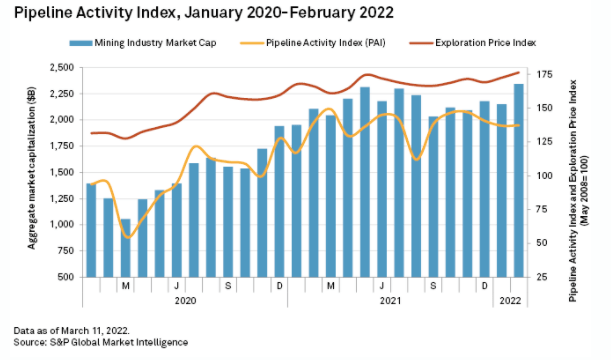

- S&P Global analysis shows global mining equities hit s 10 year high of US$2.34 trillion in February

- Pipeline activity index, a measure of activity globally in the mining industry, steady last month with few new resource announcements

- Stanmore completes financing for US$1.2 billion purchase of BHP’s 80% stake in BMC coal

What stage of the cycle are we at?

That’s a question being asked pretty often in these days of booming commodity prices and investment in metals for the “energy transition”.

Data from S&P Global shows mining equities globally hit a 10-year high in February, rising 9% month on month to a value of US$2.34 TRILLION ($3.11t Aussie).

All up the aggregate market cap of the top 100 miners in the world rose 10% in February to US$1.92t.

That was heavily impacted by rising commodity prices, with virtually every metal on our main watchlist seeing big price rises last month from iron ore, to coal, to gold and base metals, with the Russian invasion of Ukraine fuelling supply fears in pretty much everything.

The ratings agency’s pipeline activity index, which rates the level of activity in the mining industry based on significant drill results, exploration prices, financings, resource announcements and project milestones was steady at 137 in February.

Most metrics were up but initial resources were down, signalling what could become an enduring issue for the industry. While investment is rising it may not be enough to find resources to fill growing supply gaps in metals like copper, nickel, lithium and graphite among others.

You need all of these in large quantities to fuel that electric vehicle boom Elon Musk and everyone else is talking about.

To the winners will go the spoils.

Stanmore has one foot in the door at BHP coal mine

It’s been slow going for Stanmore Coal (ASX:SMR) over the past few months since it was revealed as the surprise winner of the bidding process for BHP’s (ASX:BHP) 80% share in the BHP-Mitsui Coal business.

The Poitrel and South Walker Creek mines have a combined production profile of ~10Mtpa but were on the chopping block for BHP because of their lower quality and value met coal compared to the premium hard coking coal mined at BHP’s BMA business.

That dynamic has shifted because Russia is a large exporter of PCI met coal (the kind mainly mined at Poitrel and SWC), sending PCI prices which normally trade at a discount to Australian hard coking coal above US$600/t in recent weeks.

It was great timing for Stanmore, which just completed the equity portion of its fundraising for the BMC acquisition. It was an ambitious purchase given the reluctance of many banks to fund coal deals, and its lowly market cap, around a sixth of the US$1.2 billion ($1.6b) purchase price at the time the mine buy was announced.

Stanmore has closed its $38 million, $1.10 a share retail offer, taking its total equity raising to $694m along with an institutional raising that will slightly reduce majority owner Golden and Energy Resources, controlled by Indonesia’s Widjaja family.

Along with an already announced debt deal that will complete Stanmore’s requirements for the BMC purchase. The deal is expected to close on May 3.

While Stanmore shares barely budged when the deal was initially announced they have bounded by 82.47% year to date on rising coal prices and growing realisation in the market it will be able to complete the transaction.

Stanmore Coal (ASX:SMR) share price today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.