You might be interested in

Mining

Fortescue is dialled in to critical minerals; here's some areas the major miner is tuned into

Mining

Monsters of Rock: One year wait to revive manganese for South32 and Base becomes Ace

Mining

We take a look at the major commodities and what moved them, including winning and losing metals in the month of February.

Is this how the next mining boom starts or ends?

Global commodities are going bonkers right now. ANZ’s world commodity price index surged 3.9% to a new all time high of 398.8.

In fact the only major commodity tracked by Up, Up, Down, Down in February in the losers column last month was iron ore and that’s pretty much over now.

China’s latest efforts to jawbone down the price of Australia’s most valuable commodity were predicted by many analysts to be short-lived and that’s how its gone so far.

The driving force behind the stunning commodity run in February was the Russian invasion of Ukraine.

While inflation wary western governments have avoided putting official sanctions on energy and mining exports out of Russia, customers seem to be voting with their feet and looking elsewhere expecting future sanctions, logistical nightmares and bad press if they keep buying from Putin’s cronies.

Russia is a major exporter of oil, gas, coal, nickel, aluminium and palladium (the world’s largest), while investors also dived head first into pools of gold and silver in the hunt for safe haven commodities to hide from the geopolitical instability.

Price: US$274.50/t

%: +23.00%

US$275/t looks a little tame now. In just three days the price of thermal coal has exploded to US$400/t.

Concerns about Russia’s war with Ukraine are the driving force.

“European thermal coal prices have surged to record highs with futures prices above US$400/t until Q4 2022,” Woodmac principal analyst Rory Simington said.

“Some buyers in Japan and Europe have already indicated they are looking to replace Russian supply, and non-Russian thermal coal in Europe is attracting a significant premium over Russian material.

“Prices in the Asian market have also responded with Newcastle physical prices reaching US$400/t. Metallurgical coal, used in coke production and injected into blast furnaces, spiked with PCI prices – a key Russian export – leaping to an unprecedented level and nearing towards US$400/t.”

Even Chinese buyers are nervous about Russian coal, potentially redirecting flows already tortured by supply disruptions in almost every coal producing country on Earth, an Indonesian export ban and China’s unofficial blockade of Australian coal.

Most people who keep statistics on this sort of thing are showing Russian coal cargoes aren’t dropping off the edge of the cliff yet – at 7.06Mt its shipments to Asia were only slightly down in February on the 7.26Mt shipped in January.

But the threat of sanctions or boycotts also looms large when it comes to future shipments, while financial restrictions have stopped many customers doing business with Russian coal exporters.

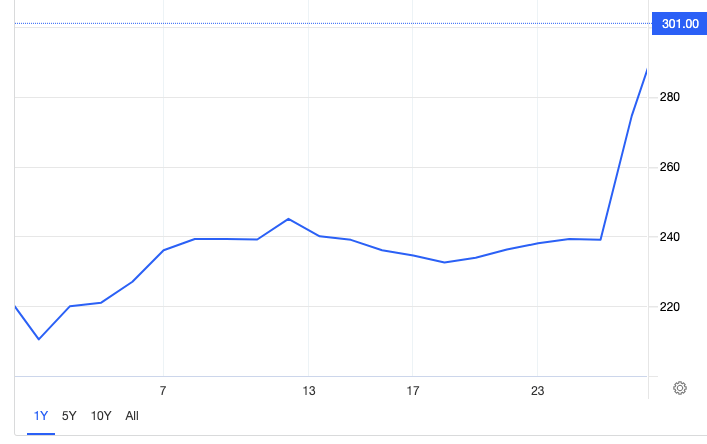

Newcastle 6000kcal thermal coal rose from already hot prices of US$222/t at the start of February to a record US$275/t on February 28, eclipsing last year’s record high of US$269/t.

They have since sprinted through the US$300/t mark, which would have seemed unfathomable when the pandemic torched energy demand in mid 2020.

Australian premium hard coking coal finished the month at US$457.54/t, slightly up on US$442.92/t at the end of January. Aussie met coal prices continue to outstrip those in China after overtaking them early this year.

Where to start? Coal stocks have enjoyed a remarkable reporting season, with high prices and consequently fat margins driving them to back to profit levels they haven’t seen in years.

So much for the death of the world’s least favourite commodity.

The three largest coal plays on the ASX, Coronado (ASX:CRN), Yancoal (ASX:YAL), and Whitehaven (ASX:WHC) will send ~$1.2 billion in the hands of long-suffering shareholders, who have gone without since the start of the pandemic.

Around $930m will come from Yancoal.

Elsewhere at the big end of the town South32 (ASX:S32) and BlueScope Steel (ASX:BSL) say met coal will have a major role to play in steelmaking for 20 years. BlueScope is planning to invest $1 billion relining a blast furnace at the Port Kembla steelworks, adding two decades to its life beyond 2026.

S32, its supplier which is trying to get the Dendrobium mine extension at its nearby Illawarra coal operations approved this year despite environmental challenges, is comfortable with the role of met coal in its portfolio even as it stages a strategic shift to a battery metal dominant commodity mix.

The small end of town is singing as well. Once struggling Terracom (ASX:TER) made $54.9m in EBITDA at its Australian and South African mines in January alone and announced a US$60m coal sales prepayment which will help it clear its debt by the end of the financial year and return to dividend payments.

Price: US$78,178.20/t

%: +35.50

Lithium continues to be the talk of the town around commodity markets, with tight supplies and surging EV demand sending prices to stratospheric levels.

It was only October last year Benchmark Minerals Intelligence boss Simon Moores was reflecting on Twitter on his opinion carbonate prices could touch record levels of US$40,000/t and above in this price cycle.

<thread> Lithium prices.

In 2019 I was asked whether lithium prices in the next price surge would ever reach the highs of 2016.

My response was this time it would be more aggressive. Instead of the late 20s, prices in China would exceed $40,000/t

There are a few reasons… pic.twitter.com/SLqxRRLF4X

— Simon Moores (@sdmoores) October 6, 2021

Battery grade products are now asking as much as double that just two months into the new year.

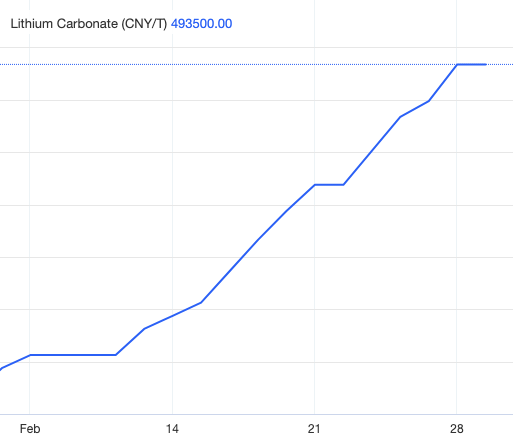

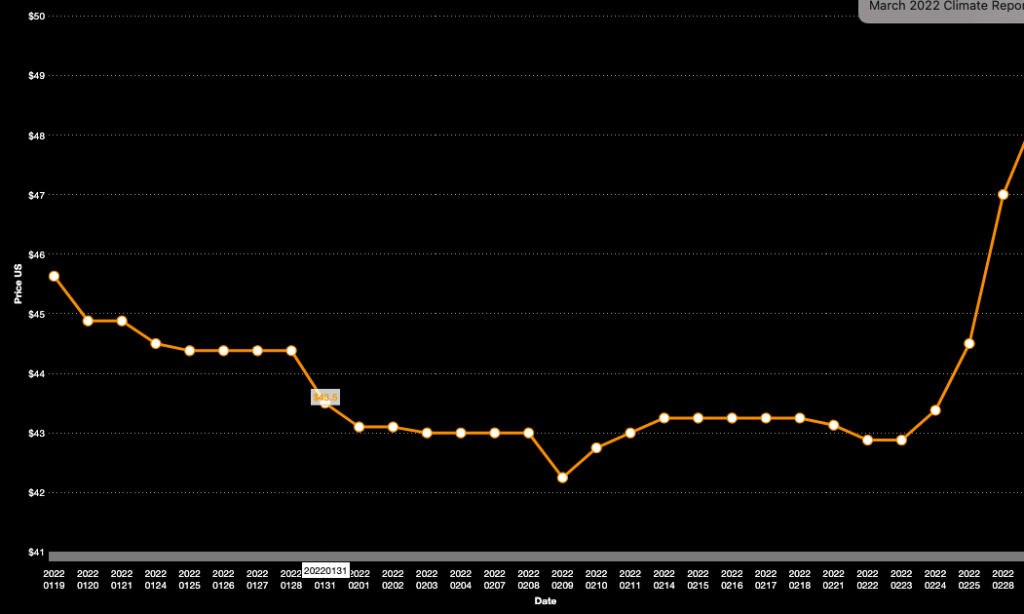

In fact, as Fastmarkets senior price development manager Peter Hannah notes, even after a roughly 600% rise over the past 12 months lithium chemical prices recorded their largest ever monthly gain in February.

Just ludicrous. As the graph below shows, the hockey stick is getting so straight it’s threatening to bend backwards and do some yoga.

Spodumene, the raw material produced sold to chemical producers from hard rock mines in Australia by companies like Pilbara Minerals (ASX:PLS) and Allkem (ASX:AKE) was trading at a mid point of US$3750/t on the spot market.

That’s almost 50% higher than the then record US$2,629/t 6% equivalent spot sale PLS made on its Battery Materials Exchange platform just five months ago.

There could be more room to give. Converters would still be profitable at over US$5000/t for 6% spod, experts say.

The big factor is the astonishing inflection in EV sales.

Electric vehicle sales more than doubled in 2021 to 6.6 million vehicles.

Sales in China in January were down 18% month on month to 431,000 units from 518,000 units in December, but were 136% up on sales in January 2021.

Pilbara Minerals boss Ken Brinsden has become something of a celebrity in the lithium investment community after leading a remarkable turnaround story at the Pilgangoora mine owner.

After seeing the rest of the lithium class of 2017 head to the wolves when prices dived, including Alita Resources and Altura Mining, Pilbara was one of the few that scrapped its way through the downturn to enjoy the boom on the other side.

It swung from a $21.2m loss in 2020 to its first half year profit of a $114m statutory profit for the first half of 2022, announced the same day as Brinsden revealed he would step down as managing director at the end of the year to spend more time with his family.

Going out on a win no doubt.

Elsewhere, project developer Lake Resources (ASX:LKE) has set its sights on becoming a global scale player in lithium carbonate production, planning to deliver 100,000t a year by 2030.

Lake has brought forward a US$15 million exploration project across its 100% owned Olaroz, Cauchari and Paso projects in Argentina to accelerate them as part of its newly announced TARGET 100 program.

That is double the capacity of its planned Kachi lithium brine project, already doubled in planned capacity for an upcoming DFS on the back of immense demand for the battery and EV driven commodity.

And two up and coming hard rock miners have got Tesla in their corner to as a customer to back them into production, with Liontown Resources (ASX:LTR) announcing up to 30% of spodumene production from the initial stage of its 500,000tpa Kathleen Valley lithium mine in WA will be sold to Elon Musk’s Tesla.

NT-based Core Lithium (ASX:CXO) announced a 110,000t, four year supply deal with Tesla for its Finniss project. Due to come online in December 2022, Core will be one of two ASX-listed companies expected to enter production this year along with South American brine producer Argosy Minerals (ASX:AGY).

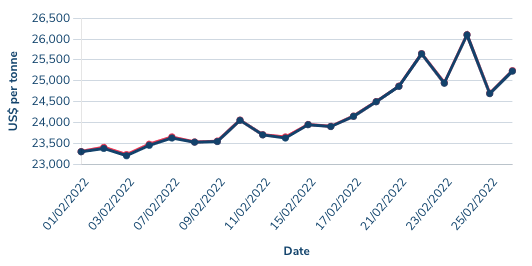

Price: US$25,230/t

%: +10.65%

Nickel prices are also a Russia story right now.

Norilsk is one of the largest nickel miners in the world, making Russia the largest supplier of class 1 nickel – that is the stuff that’s good for EV batteries.

Its major shareholder is Russian oligarch Vladimir Potanin, something that makes it particularly vulnerable to sanctions.

Shipper Maersk has also pulled its services in Russia, hitting supply chains that bring nickel and aluminium from Russia into Europe.

Even before then nickel had posted healthy gains as LME stocks dropped below the psychological 100,000t level, not seen since 2019.

The big question for the market outside of Russia is whether increased supply from Indonesia this year can service demand that is rising as EVs take a larger share of a market traditionally dominated by stainless steel producers.

Even Indonesian producers, like ASX-listed Nickel Mines (ASX:NIC) think tightness is likely to persist.

Mincor Resources’ (ASX:MCR) six year odyssey to return the famous Kambalda nickel district in WA to a semblance of its former glory is nearly complete.

It has trucked its first lot of nickel ore from its northern operations on the Kambalda Dome to the BHP Nickel West Kambalda concentrator, more than half a decade after low nickel prices forced Mincor to shut up shop.

The concentrator has been on ice since 2018, when IGO (ASX:IGO) shut the Long mine four years ago, the last operation supplying ore to the mill.

IGO, by the way, looks like it has secured its $1.1b cash purchase of WA nickel rival Western Areas (ASX:WSA) after securing the support of WSA shareholder and Perth billionaire Andrew Forrest. Forrest had spent weeks building a potential blocking stake in the takeover target through his private company Wyloo Metals.

Price: US$175.00/kg

%: +16.6%

Australia’s bellwether rare earths stock Lynas Rare Earths (ASX:LYC) says customers in Asia want companies to grow “as fast as possible” to meet demand, driven by electric vehicles, wind turbines and permanent magnets.

China, the world’s largest producer of rare earths with over 80% of the downstream market, has increased its production quota by 20% from 2021 in H1 2022, but even that has not stalled price increases.

Lynas is the largest supplier of processed rare earths outside the Chinese market and boss Amanda Lacaze said last week even Lynas’ 2025 growth plan of increasing production 50% on 2019 levels will “clearly” not keep up with the market.

EVP of downstream Pol Le Roux added: “So situation is very tight and that means that all the existing suppliers, of course the Chinese but also Lynas, have a very simple crystal clear priority – grow as fast as possible.”

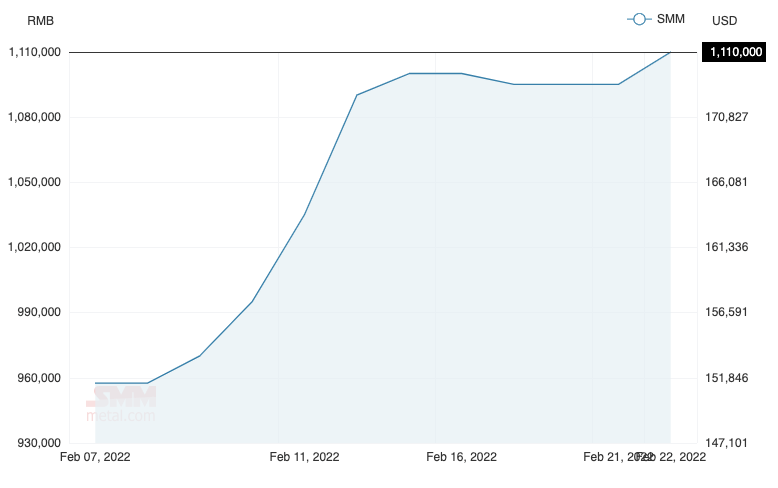

Prices of neodymium-praseodymium oxide, the highest value product churned out by Lynas and a benchmark for the rare earths market, were at record levels on the Shanghai Metals Market last month.

They only crossed US$100/kg in November last year, the first time they had reached that level since the last rare earths boom in 2011.

Iluka Resources (ASX:ILU) is best known as a mineral sands producer (side note: prices for zircon and rutile, largely used in things like ceramics and tiles, are very healthy right now as well).

But its next phase of growth could be as the developer of Australia’s first onshore rare earths refinery.

The company is pushing ahead with a feasibility study, due this month, on the third stage of its Eneabba plant on WA’s Mid West coast.

A stage 2 development which will see Eneabba make a 90% monazite concentrate, a refinery grade feedstock containing neodymium, praseodymium, dysprosium and terbium, is nearly complete.

The third stage, which Iluka hopes to get Federal support for after securing environmental approvals, would see the company separate those elements in Australia for the first time.

That would help build supply chains outside the dominant Chinese market, which has stoked concern over the control of the Communist country over critical minerals supply.

It is a step further as well than Lynas, which is building a $500 million cracking and leaching plant in Kalgoorlie, just one component of the process completed at its Malaysia refinery.

Iluka, which also owns the undeveloped Wimmera deposit in Victoria, has left the door open to third party processing at Eneabba and there are plenty of locally-listed juniors waiting in the wings.

Hastings Technology Metals (ASX:HAS) secured a $140 million NAIF loan for its Yangibana project in WA last month.

Fellow WA explorer RareX (ASX:REE) meanwhile announced an exploration target for its Cummins Range primary zone of 23Mt-43Mt at 1.6-2.4% total rare earths oxide, raising $10m in a placement after the month’s end to fund a 30,000m drilling program.

It already boasts a JORC 2012 resource at Cummins Range outside the primary zone target area of 18.8Mt at 1.15% TREO + 0.14% Nb2O5.

Price: US$47.00/lb

%: +8.17%

Nuclear news was pretty scary these past few days what with all that “deterrent forces” stuff Putin was talking about.

Uranium is yet to see the outlandish gains of oil and gas and coal but picked up a nice bump after Germany’s economy minister pulled an about face on local TV over the weekend.

The European nation initiated a plan to shutdown its nuclear fleet after the Fukushima disaster and has been trying with mixed success to switch from fossil fuels to renewables since.

Robert Habeck intimated Germany could keep its last three nuclear power plants running beyond their planned 2022 end date. Cue mini-bump to close a dour month for one of last year’s better equity markets.

US utilities have also lobbied the White House not to sanction Russian uranium in a bid to keep supply secure, Reuters reported this week. Not only is Russia’s supply a concern, but also Kazakhstan, one of Russia’s closest allies and the world’s most prolific uranium producer.

Russia, Kazakhstan and Uzbekistan supply around half of America’s uranium stocks.

In global company news Canadian giant Cameco announced the phased restart of the McArthur River uranium mine in Saskatchewan in response to rebounding prices.

Boss Energy (ASX:BOE) managing director Duncan Craib, whose company is aiming to redevelop the mothballed $107 million Honeymoon uranium mine in South Australia, told Stockhead in early February despite modest price activity so far this year catalysts were emerging for “massive price movement” in 2022.

“I think this year you’re going to see some rapid price movements that’ll take the market by surprise and there’s several catalysts for that,” Craib told Stockhead.

“On the positive side you’ve got Sprott listing on the New York Stock Exchange, Russia might not back down over the Ukraine if the US imposes sanctions, more unrest in Kazakhstan (the world’s biggest uranium miner), supply chain impacts on production because of Covid.

“On the negative side global stock movements may effect it or very negative would be a major accident.

“But I think we’re in for a fascinating year; I really do.”

The company released a string of drilling results with the aim of extending the mine life at Honeymoon. Most new mines are believed to need contract prices of US$60/lb and above to be economic.

There’s been a flurry of activity at the small end of town as well. Okapi Resources (ASX:OKR) tripled down on their uranium bet in the USA, adding the Maybell project in Moffat County to the stable in February.

Union Carbide produced around 5.3Mlb of yellowcake in the district in two stints between 1954 and 1981.

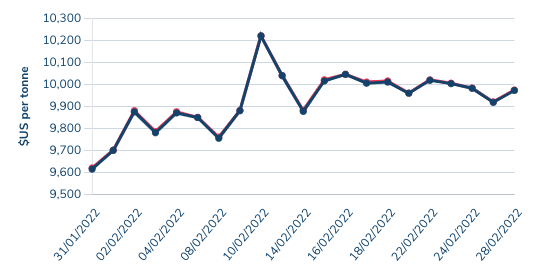

Price: US$9972/t

%: +3.65%

Copper lit up the market like a Christmas Tree last year as it charged to all time highs.

This year? It’s still strong, just chugging along at that tasty ~US$10,000/t level.

Prices broke through that barrier earlier this week (after the end of February) after Chile recorded its lowest countrywide output for January since 2011.

Longer term market watchers will be looking at Chile and Peru’s increasingly nationalistic tax policies for signs it could restrict investment in new mines and expansions in the world’s two largest copper producing nations.

Russia produces around 4% of global copper supply and isn’t a major exporter, but the Ukraine conflict could have an impact on market prices given how low copper inventories are.

On the plus side Goldman thinks an “extreme scarcity episode” is possible this year with copper inventories on the LME, Shanghai and Comex exchanges falling to around 200,000t last month, about 3 days of global consumption.

Sandfire Resources (ASX:SFR) was handed the keys to its new MATSA copper mining complex in Spain.

The US$1.865b buy comes with its challenges, with rising energy costs already a concern, but Sandfire and longtime boss Karl Simich remain bullish about the operation’s long term exploration potential and high zinc prices, which should help generate by-product credits.

OZ Minerals (ASX:OZL) meanwhile announced plans to hit ambitious net zero targets from its own operations by 2030 after high copper prices drove the firm to a 150% increase in NPAT to $531 million in 2021 on record revenue of $2.1 billion.

“As a miner of copper and potentially nickel which are both important minerals in global electrification activities, we are acutely aware of our responsibility to reduce emissions,” CEO Andrew Cole said.

ESG and emissions reduction targets will also be tied to long term and short term pay incentives for senior executives.

IGO (ASX:IGO) was revealed as the exclusive frontrunner in the auction for Glencore’s $1 billion CSA Cobar copper mine before unceremoniously dumping the deal after shareholders let Peter Bradford and the IGO management know what they thought (it wasn’t good).

Down the road from the 50,000tpa mine things are shaping up nicely for Peel Mining (ASX:PEX), after it secured an $23 million injection of capital in a raising that was cornerstoned by Red Hill Iron’s (ASX:RHI) Josh Pitt, famed for his discovery of the Golden Grove polymetallic mine with Capricorn Metals director Mark Okeby coming on board as chairman.

Our resident man on rocks Guy Le Page thinks Peel is pretty good value right now.

“I believe the company would be looking to delineate +10Mt of JORC Resources into the Indicated category across the various deposits to achieve their objective of a 10yr mine life producing 20Ktpa of copper (equivalent),” he wrote this week.

“Based on the provenance of the Cobar district (including the CSA Mine operated by Glencore at 50Ktpa of Cu) PEX is a good chance of delivering on its aspirational statements and at an EV of around $80 million, represents good value in a tight market for base metals.”

Peel is targeting a standalone operation with 10 years of life after a review which showed the geology of its South Cobar project was analogous to CSA.

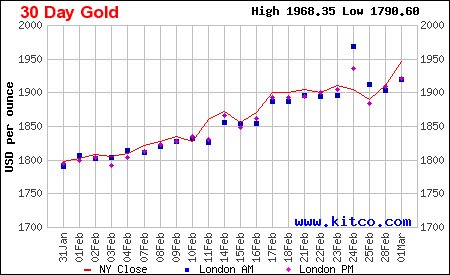

Price: US$1,909.33/oz

%:+6.11%

There’s nothing like World War 3 to bring gold back from the brink.

Despite the threat of future rate rises investors piled into the safe haven asset and its poor cousin silver as Russia launched its assault on Ukraine.

Gold has swung on the pendulum with almost predictable volatility since last week, hitting new 12 month highs.

ASX gold stocks – long thought oversold by gold bulls – are now around 3% in the green YTD based on the ASX All Ords gold index.

One has to imagine a few Russians oligarchs are looking longingly at their gold vaults right now (and probably their crypto investments), with the Ruble collapsing to record lows against the US dollar after the country was effectively cut off from the western financial system.

Gold miners had a torturous earnings season, with profits down and costs up across the board, with a number of companies disappointing by cutting or even dumping their dividends.

Regis Resources (ASX:RRL) has become a long-term laggard as rising costs due to rising costs at its Duketon mine, issues getting approvals for the McPhillamy’s project in New South Wales and concerns from investors it overstretched in its $900 million purchase of IGO’s 30% share of AngloGold Ashanti’s Tropicana gold mine.

St Barbara (ASX:SBM) too dropped its payout after profits slid 63% to just $15m as Covid cases in Papua New Guinea forced the company to withdraw guidance for its Simberi operations.

The big three gold miners of Northern Star (ASX:NST), Evolution (ASX:EVN) and Newcrest (ASX:NCM) all saw profits drop with only a failsafe clause in Newcrest’s new dividend policy protecting shareholders’ payout.

On the other side of the ledger was $2 billion capped African gold producer Perseus Mining, which took gold medal status for earnings season with a 159% increase in profit to US$127 million before announcing it would spend $215m in shares to acquire Canadian gold explorer Orca.

Its Block 14 project in Sudan will see Perseus become a 500,000ozpa producer “well into the next decade”.

Price: US$$138.09/t

%: -2.58%

The big headline for iron ore in February was China’s interventions in the spot market.

These are pretty regular occurrences and, as history tells us, they tend to have a short term impact before fundamentals take hold again.

China’s best opportunity to kill iron ore prices is by altering those fundamentals.

Last year it sent prices tumbling from record highs by sending steel mills in a time machine back to 2018 through the second half of the year with emissions-related restrictions that sent production of crude steel to its lowest levels in 3.5 years.

With the Winter Olympics finishing last month, and the hope those restrictions would end after this quarter once Beijing no longer needed “clear blue skies”, the assumption was demand would pick up again.

China has tried a couple other things since then, one of them especially unusual. It reportedly wants to create a single purchasing platform to take price setting power away from Australia’s iron ore majors and put that power back in China’s hands.

That and a move to increase fees on the Dalian futures exchange had a short-term impact on prices, but they’re back on an upwards trend this month.

Mineral Resources (ASX:MIN) shocked to the downside, copping a major hit after posting an underlying loss of $36 million in the first half of FY2022.

Chris Ellison’s iron ore miner saw off a price query from the ASX without a case to answer about whether it could have notified investors about its loss and decision to suspend the half year dividend earlier.

The main culprit was a blend of falling iron ore prices and rising discount rates for its lower grade iron ore.

Despite the slip MinRes is still plotting the development of two large scale export hubs in the Pilbara at its Ashburton and Marillana projects Ellison says will have low enough costs to prosper through any iron ore cycle.

It was one of four companies along with its port and rail JV partner Hancock Prospecting, BHP and Fortescue Metals Group to secure additional berth space at Port Hedland in plans to increase the export capacity of the world’s largest iron ore export hub by over 100Mt to 660Mtpa.

The Pilbara majors, who operate with the lowest costs in the world, paid out more than $20 billion in dividends, but are seeing rising costs amid labour shortages and stretched supply chains.

Rio delivered the largest profit in its 149 year history at more than US$21 billion, but also drew headlines for a report commissioned by its new management that revealed a disturbing culture of sexual harassment, bullying and racism it had allowed to fester in the organisation.

BHP became a $240 billion ASX listed company, over 10% of the value of the ASX 200 after unifying its Australian and British businesses. Fortescue (ASX:FMG) continued to announce green energy initiatives pushed by its founder and major shareholder Andrew “Twiggy” Forrest but chopped its dividend after lower iron ore prices and discounts for lower grade ore curbed its still healthy profits.

The surprise packet came from Grange Resources (ASX:GRR), with the high grade Tasmanian producer climbing over 30% in a day on Monday after stunning with a $322 million profit and 10c a share dividend.

With its premiums it will be making bag loads of cash at current benchmark prices.

The junior iron ore market returned to action as prices improved as well, with GWR Group (ASX:GWR) resuming operations at its C4 mine near Wiluna it suspended in September and Strike Resources (ASX:SRK) announcing plans to become the Pilbara’s next producer after securing funding for its 2Mtpa Paulsens East mine.

Silver

Price: US$24.47/oz

%: +8.34%

Tin

Price: US$45,525/t

%: +6.99%

Zinc

Price: US$3705/t

%: +0.84%

Cobalt

Price: $US73,220/t

%: +3.54%

Aluminium

Price: $3448/t

%:+12.27%

Lead

Price: $2400/t

%: +4.89%

At Stockhead, we tell it like it is. While Strike Resources, Okapi Resources, Peel Mining and Lake Resources are Stockhead advertisers, they did not sponsor this article.