Hedley Widdup’s mining clock is ticking past 11pm, but the boom could have years still to run

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

The latest mining boom is edging towards midnight, but leading market observer Lion Selection Group’s (ASX:LSX) Hedley Widdup reckons we could have years to run yet.

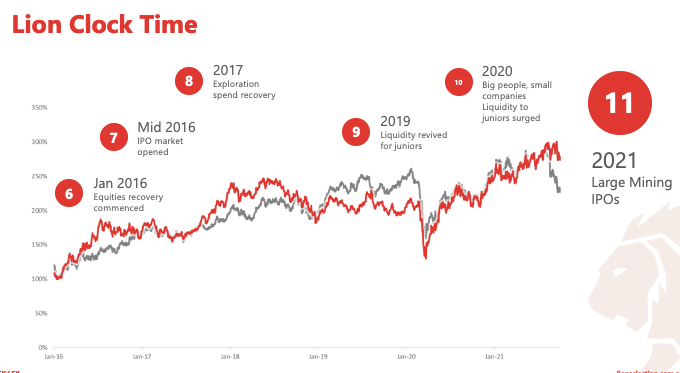

Widdup is well known for his thoughts on the mining industry via Lion’s investment clock, which tracks the stage of the mining cycle from the start of the bust at midnight through its recovery and into the next boom.

He thinks the hands have just hit 11pm, but that does not mean the good times being enjoyed across the sector are nearing a screeching halt.

“Here we sit at 11 o’clock. And that’s not far in terms of just how the clock moves from the top of the cycle,” he told delegates at last week’s Boom in a Room conference in Perth last week.

“But I would hasten to add that 11 o’clock in previous cycles has gone on for years.

“I think we’re at the start, not the end of 11 o’clock.”

So far this version of the mining boom has been absent the enormous wave of investment in expansions and major M&A we saw in the famous mining boom of the late 2000s and early 2010s and really set it into overdrive.

But Widdup believes that could be just on the horizon.

Miners are better operators, but where’s the growth?

Mining and resources are fields that are reliant on continuous investment to maintain growth and sustain revenues long-term.

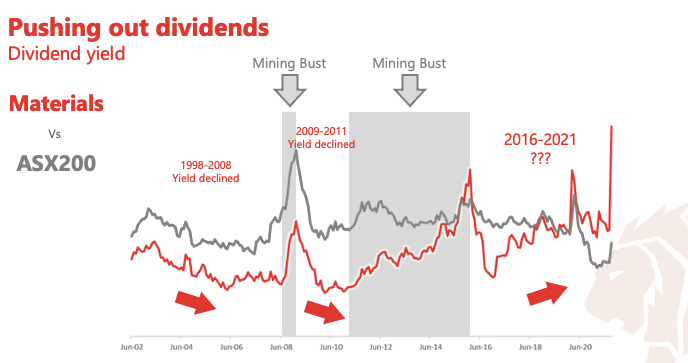

For that reason profits are often reinvested in sparking or maintaining growth, something that has seen resources companies (and particularly gold companies) be lower yield stocks relative to the broader market.

Widdup says that has flipped in recent years.

“This is a really unusual phenomenon as far as the history of markets go,” he said.

“And I think there’s probably some pretty good explanations for it. Mines are pushing out great dividends.

“BHP and Rio declared absolute record dividends in the last 12 months. So it stands to reason that it should be yielding but the materials sector here is outperforming the rest of the market.

“And I find that interesting all on its own. Miners have had windfall events in the past, but it hasn’t made them a yield play… but here we are.”

Conditions ripe for premium M&A, capex

Historically the boom and bust cycle has been bookended by megadeals and investments in expansions, things that can be accompanied by massive leaps in share prices.

Widdup says that is a stage in the cycle we have not reached yet that could last for years.

BHP, he noted, was trading at an 8x EV multiple in 2008 during the last boom, but despite record profits was only trading at 5.3x before the iron ore price came off.

“My hypothesis, and I’m very happy to stick to this for now, is that the market’s willingness to increase what it pays for miners is tied very strongly to the growth outlook,” he explained.

“And I think the growth outlook ties very strongly to that dividend yield and what the dividends are being paid.”

Widdup said growth-oriented thinking could be starting to creep back into the mining industry, which could see M&A premiums get larger.

Equities have also softened in recent months, creating a ‘buying opportunity’.

“Historically, you haven’t been able to pay those dividends, because you’ve been so dead-set on investing and reinvesting it in the industry that you’re in. And I think that’s where we’re at loggerheads there,” Widdup said.

“And it’s not to suggest that I think that miners should be acting in a hostile and irresponsible way. But I think that that’s what’s missing.

“So if that more aggressive attitude to growth were to start to creep into the mining space, then I think you might start to see the premiums that are paid for miners creeping up a bit.

“And given that we’re out of 11 o’clock, this is exactly the stage of the market where you start to see that happening.”

Are we in a resources bull market? Check the listings

Widdup says while growth expenditure has not been as significant as in previous cycles, he can see the investment in capex ‘coming’.

Another indication of the stage in the cycle we are at is the enormous level of liquidity to support IPOs.

Mining IPOs are listing virtually on a daily basis in 2021, a far cry from 2014 when just one, Victorian copper-gold explorer Stavely Minerals (ASX:SVY) was able to get a successful float away.

Among those floats this year have been the $527 million IPO of copper miner 29Metals (ASX:29M) the largest hard rock mining IPO in around a decade.

“Each mining boom we’ve had has been punctuated by a growing amount of IPOs coming through and listing and most of those are exploration companies,” Widdup said.

“In previous cycles, we’ve seen some of the largest listings coming in the … it might be even the two or three years leading up and this is what tells me that I think we’re moving into 11 o’clock.

“But there’s room for this to go on for some time. We’ve just seen in Australia, the largest listing, $500 and something million dollars raised in order to facilitate the listing of a new copper miner.

“It’s not a new copper miner, but it’s new to ASX. And the Canadian market has just welcomed its largest listing for nine years in the mining space.

“So these two things coinciding in 2021 tells me there’s a fair bit of money around.”

Market reshaped by lithium, gold mini-booms

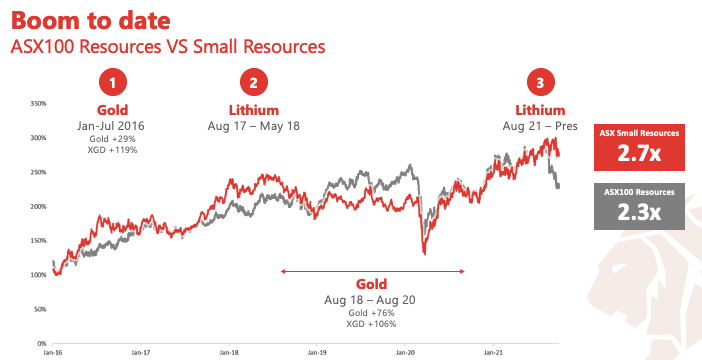

Widdup calls the current run in mining equities an ‘unconventional boom’.

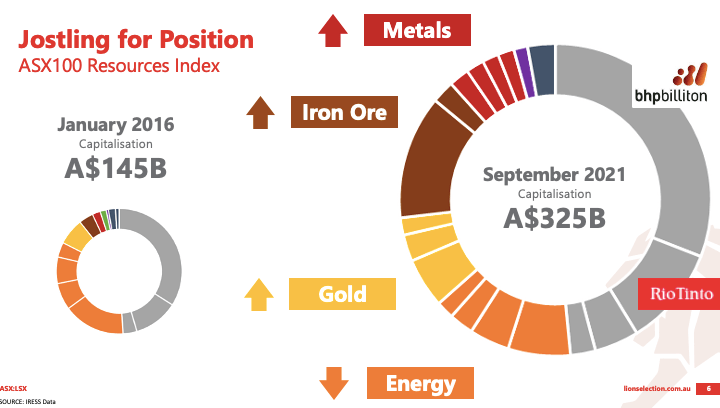

In part that is because the make-up of the resources sector has fundamentally changed over its course.

The All Ordinaries is up 56% since January 2016 and 67% since March 2020, while mining stocks are up 132% and 46% over those time periods and the NASDAQ in the US is up 223% and 111%.

The ASX 100 Resources index has risen in value from $145-325 billion.

But it is not the same companies in the same weights. Energy stocks have ceded market share to iron ore (up from 4% to 17% of the index), with Fortescue Metals Group (ASX:FMG) a ’10-bagger’ over that time, a rarity for a mining giant.

Base metals have risen from 2% to 8% of the mix, whole gold stocks have gone from 7% to 11%.

On top of that the Small Resources Index has, unusually, outperformed the ASX 100.

Widdup puts that down to the role of two big spikes in the value of gold and two lithium mini booms, both commodities where capital is more concentrated at the junior end of the spectrum.

“This is the first boom, I think probably in recent memory but perhaps forever, that started with a circa 30% movement in the gold price,” Widdup said.

“Now the small resources index is packed with gold companies. It certainly was in January 2016.

“And this movement in the gold price affected them, but it also affects a whole host of juniors, which sit below those indices.

“Having that strong commodity price movement enabled an infusion … a lot of institutional (money) into companies which would often have to wait years to see that and sit behind the majors to receive that attention.

“Lithium is a tiny, tiny market, which the majors will not be able to get invested in, in a really significant sense, for quite some time.”

How long is left?

With copper and other base metals prices on the rise, iron ore prices still historically strong despite headwinds from China, and gold miners producing at record margins, it feels like the current market will never end.

Widdup says there is still plenty of distance to travel, but warned history dictates that all booms come to an end.

“Something will take us to the top of this, and it’s gonna be very difficult to predict what that will be because it’s the excesses of a boom which cause the crash,” he said.

“It’s not really the catalyst which tips (it) over the edge when we get there.

“But I think it’s just really important to remember that every single mining boom we’ve ever been in has come to an end.

“And the thing about it that has been most hard to predict is when that will be because often the closer you get to the end of it, the more you feel like it’s going to go on forever.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.