The boss of mega copper float 29Metals talks the bright future for the red metal

Mining

Mining

Australia’s biggest non-coal mining IPO in several years is arguably one of its best timed as well.

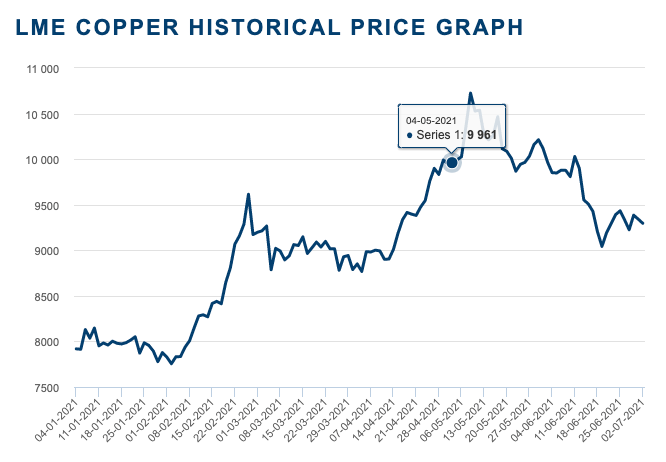

Born from combining the copper mines owned by Owen Hegarty’s private equity play EMR Capital, 29Metals (ASX: 29M) was preparing its float around the time copper was soaring to all time highs upwards of US$10,700/t in May.

While they have retreated from those heights down to around US$9300/t as of 29Metals’ listing on July 2, the fundamental long-term outlook for the red metal continues to look positive and it remains around 25% up year to date.

The stimulus fueled post-covid infrastructure splurge in China, Europe and the US was one short-term factor behind copper’s rapid ascent this year.

But it is copper’s future in technologies that support the electrification of energy and transport like electric vehicles that has some analysts like Goldman Sachs’ calling it ‘the new oil’.

Known as Dr Copper due to the commodity’s reputation for gauging the temperature of the global economy, the 29Metals float was testament to the current strength in equities markets, raising $527.8 million at $2 a share to list with a market cap of $960.9 million.

On its books are the well-known Golden Grove polymetallic mine in WA, the Capricorn copper mine near Mt Isa in Queensland and the Red Hill project in Chile.

Stockhead caught up with the new miner’s managing director Peter Albert to talk about his outlook for the copper market and why Golden Grove still has years to run.

It’s always a better outcome to bring these things to market. I can’t talk for EMR, it’s not my place to talk for them, but of course it is well known in the public domain that there was a potential trade sale process happening at roughly the same time as the IPO process.

EMR was doing what it needs to do for its investors which is to find the best outcome for its investors.

From my perspective it was obvious very early that the best value that could be delivered was to bring the assets together, for EMR to retain a significant position in 29Metals, which they’ve done and being here for the long term.

Being here for this incredibly strong copper market we sit in, being here for the incredibly strong assets and the growth potential that we have in our portfolio and for them to be sitting here having secured an exit of some degree but retaining a very significant albeit minority stake in the business.

If anybody a year ago, or 18 months ago when covid hit, could foresee what had happened in the last six months they would have a crystal ball better than anybody else.

No one could have foreseen the hockey stick recovery in not just copper, but in other commodities as well.

Longer term we’ve always had a view that copper is the place to be. It’s just come at us faster than we expected as an industry, it’s come at us like a steam train over the last six months and it’s likely to be sustained in our view.

You look at the greening of the global economy, decarbonisation, electric vehicles, industrialisation and infrastructure builds.

And you look at the data and you can see a 10 million tonne deficit in the copper space over the next 10 years, it doesn’t really matter if there’s a short term hiccup or not, the outlook is tremendously positive.

At Golden Grove we make three different concentrates, we make a copper concentrate, a zinc concentrate and a high precious metals concentrate.

All of those go into Asia very successfully through an agreement we have with Trafigura and likewise at Capricorn we have an agreement there with Trafigura as well.

It’s a very strong market and we produce very clean, high quality concentrates and they’re in great demand.

When EMR secured this asset some four years ago it had a mine life of only 3 years, it only had about 3 million tonnes in reserves.

Today it’s got a 10 year mine life, it’s got 13Mt in reserves, it’s got a copper equivalent grade of over 4% because we produce copper, zinc, lead, gold and silver there, and a copper grade of over 4% is just outstanding.

With these systems and it’s a VMS system, they just keep on giving. Golden Grove has been going for over 30 years and whilst we’ve got a 10 year mine life now it’s almost certainly going to go for a lot longer than that.

Once you get into these orebodies and you’re able to establish drill platforms underground you can extend orebodies, you can go deeper and you can go laterally.

We’ve got two mines at Golden Grove with multiple orebodies, so multiple mining fronts and we’re in the process of a feasibility study for a third mining front. So this thing is going to keep on growing as long as we keep committing the dollars to the drill bit and that is what our intention is.

It’s been done very successfully by EMR over the last four years and 29Metals will leverage off that. We’re ideally positioned to be continuing that growth plan and that strategy.

At Capricorn copper we sit in the Mt Isa inlier and there are orebodies all around us and operations all around us.

At Capricorn copper we’ve got almost 2000sqkm of tenure with multiple exploration targets on that ground and it’s a tremendous hunting ground for copper, base metals and exploration/development.

So we’ve got a massive amount of potential on our footprint at Capricorn copper. At Golden Grove, again VMS systems tend to multiply.

We’ve got other VMS systems also extending beyond that. We also have gold potential beyond that. So our two operating assets, the surrounding tenements we have are really attractive so we will be spending dollars on that and not dissimilar at Red Hill in Chile.

It’s been a bit challenging in the last year in terms of the restrictions with Covid, but we’ve got five targets there, one of which is an historical mining operation so it’s a known mineral field.

None whatsoever, it’s an exploration development play. We have a vision and a goal within 29M to grow this company 50% over the next five years from our existing organic growth opportunities at Golden Grove and Capricorn Copper.

Red Hill is an exploration play and development which will be outside of that 5 year time frame.

A lot can happen in five years and if it does come to pass then you’re certainly putting pressure on the copper supply from the country that supplies the most amount of copper in the world.

That can only put pressure on the supply side and keep pushing up the price on the other side of the equation, so we’re not anxious about that.

Absolutely, so many people these days understand where the copper market is headed and the money people they want to have a piece of that action.

The best place to have a piece of that action is in the equity space.

On the Australian bourse there aren’t many others of this size and this attractiveness in terms of grade, life, jurisdiction, not diluted by extraneous factors so we are and will be a very attractive investment proposition.

When we went to market and we went to the investors and spoke to many people we had a fantastic response. We’ve got a fantastic register, really strong, really long, very supportive and we were oversubscribed.