Golden Rim racing its way to +2moz with yet another high-grade find

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Special Report: At the rate Golden Rim is making new high-grade discoveries it will hit its 2-million-ounce-resource target in no time.

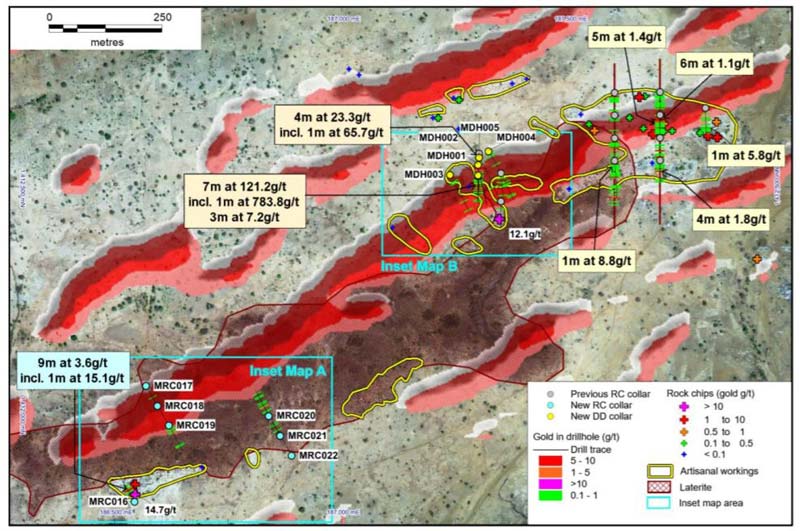

Golden Rim (ASX:GMR) has unearthed a new zone of high-grade gold mineralisation at its Diabatou prospect, part of its flagship Kouri project in Burkina Faso.

The latest drilling effort delivered a hit of 9m at 3.6 grams per tonne (g/t) gold from 49m, including 1m at 15.1g/t gold.

Anything above 5g/t is generally considered high-grade, though at the current strong gold price even 2g/t has the potential to be very profitable for Aussie miners.

Golden Rim has already defined a 1.4-million-ounce resource for the Kouri project and is working hard to grow that.

READ: Golden Rim: Wrestling with a +2moz monster in 2020

The prospects are looking pretty good with the discovery of this new zone of high-grade mineralisation that remains open along strike and at depth, meaning the end is not yet in sight.

The new zone is associated with a 400m, east-northeast trending corridor of intense artisanal workings.

Golden Rim had already previously discovered two high-grade gold zones hosted in granite, and at shallow depth, in its very first drilling program at Diabatou.

READ: Golden Rim hits new 1.7km-long high-grade gold target at Kouri

In early August, Golden Rim announced near surface intersections like 1m at 783.8g/t gold from 44m, inside a larger 7m intercept grading 121.2g/t.

satellite image (supplied)

Weeks later, the explorer hit a second mineralised zone at Diabatou with grades up to 66g/t.

Gravimetric re-assaying of that earlier bonanza-grade intercept returned a result of 7m at 116.2g/t gold, including 1m at 750.4g/t gold.

There’s no actual definition of ‘bonanza’ by the way – it’s just a way to describe speccy gold grades.

And while initial follow-up drilling around that intercept did not return extensions to the mineralisation, further studies indicate drilling may need to be conducted in a different orientation.

“Further studies have identified several cross-cutting structures that may host the high-grade mineralisation and that lie parallel to the current drilling direction,” managing director Craig Mackay said.

And of course, Golden Rim is planning to undertake additional follow-up drilling in January 2020.

Elephant country

To give you an idea of just how prospective this area of Burkina Faso is for Golden Rim, Kouri is connected to a major fault system which controls a number of mammoth gold deposits in Burkina Faso, like Kiaka (5.9moz), Bomboré (5.2moz), Essakane (7moz) and Sanbrado (2.8moz).

In other words, this is ‘elephant country’.

The Kouri deposit itself — about 3.2km long and defined to about 115m depth — remains ‘open’, which means Golden Rim hasn’t found where the gold ends in any direction.

Golden Rim is making good progress having already completed 1,652m of reverse circulation (RC) drilling (13 holes) and 1,031.9m of diamond drilling (7 holes) so far.

All up it plans to complete 9,200m of RC and 4,000m of diamond drilling.

Mackay said the diamond drilling program was designed to test the northeast strike extent of the gold lodes that comprised the 1.4moz resource.

“Strong mineralisation has been observed in drilling samples and we eagerly await our assay results from this area,” he said.

Golden Rim has also completed about a third of its 15,000m auger program on the Margou permit as well as a major 550-line km induced polarisation and ground magnetic geophysical survey across the Margou and Gouéli permits.

The final report is due out in January 2020.

“We expect this work to deliver additional exciting drill targets in what was previously an unexplored area as we head into 2020,” Mackay said

READ MORE:

That +783g/t gold hit is associated with a 1.6km-long anomaly, Golden Rim says

Golden Rim ramps up Burkina Faso gold hunt

This story was developed in collaboration with Golden Rim Resources, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.