Golden Rim: Wrestling with a +2moz monster in 2020

Getty Images

Special Report: In 2020, Golden Rim will be drilling its way to a 2-million-ounce gold resource – and beyond – at the underexplored Kouri project in Burkina Faso. This is a hardworking, sub-$15m market cap explorer with very clear upside.

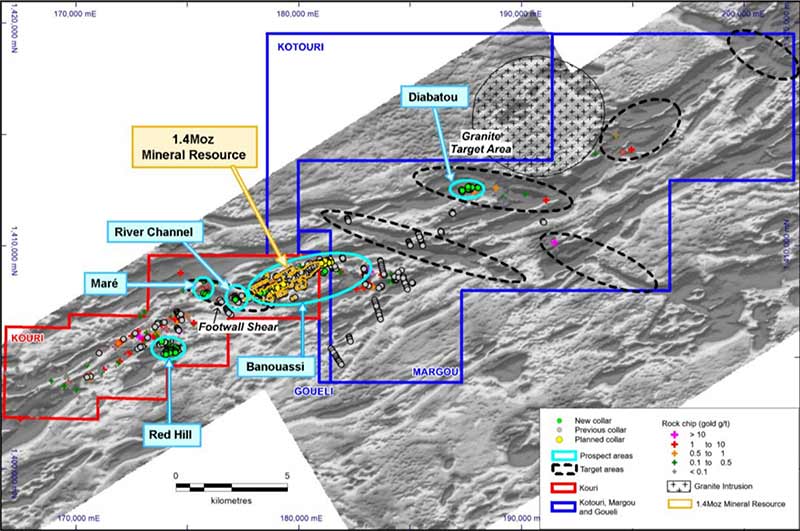

This time last year Golden Rim (ASX:GMR) was the proud owner of a recently upgraded 1.4-million-ounce (moz) gold resource at its flagship Kouri project in Burkina Faso.

But it was always going to get bigger. Kouri is connected to a major fault system which controls a number of mammoth gold deposits in Burkina Faso, like Kiaka (5.9moz), Bomboré (5.2moz), Essakane (7moz) and Sanbrado (2.8moz).

In other words, this is ‘elephant country’.

The Kouri deposit itself — about 3.2km long and defined to about 115m depth — remained ‘open’, which means Golden Rim hasn’t found where the gold ends in any direction.

And this mineralisation appeared to extend into the tenure next door so, in June, Golden Rim acquired the neighbouring Goueli and Margou licences, which expanded the size of its landholding substantially from 58sqkm to 245sqkm.

The initial plan was to drill extensions to the existing deposit, before Golden Rim stumbled upon some artisanal mining areas in the new licences, about 10km away.

These high-grade workings were granite hosted — quite different from the existing Kouri resource — so the explorer drilled a hole underneath a ~8-gram-per-tonne (g/t) surface rock chip.

Lo and behold in early August, Golden Rim announced near surface intersections like 1m at 783.8g/t gold from 44m, inside a larger 7m intercept grading 121.2g/t at this new Diabatou target.

Those are incredible grades.

Weeks later, the explorer hit a second mineralised zone at Diabatou with grades up to 66g/t.

Golden Rim had now discovered two spectacular high-grade gold zones hosted in granite, and at shallow depth, in its very first drilling program at Diabatou.

But there are opportunities to add ounces everywhere.

In September, Golden Rim launched a fully funded 21,000m, multi-pronged drilling program across its gold-rich tenure.

Managing director Craig Mackay says the explorer is now in the process of drilling ~100 holes to expand the resource further.

“But with the recent acquisition of the adjoining permits there is scope for the mineral resource to be much larger,” he told Stockhead.

Target #1 is Daibatou, where exploration success is coming thick and fast.

In November, Golden Rim announced initial results from an extensive geophysical survey which outlined a strong, 1.6km-long, anomaly at Diabatou which the explorer believes is directly related to those bonanza grade hits.

Two weeks later a second significant anomaly call Diabotou South East was uncovered about 2.5km away.

Surface rock chip samples from this 1.7km-long anomaly include high-grades like 21.2g/t, 21.1g/t, 9.2g/t and 5.2g/t gold.

It’s already looking very similar to Diabatou, Golden Rim says.

2020: adding ounces, adding value

Mackay says Golden Rim intends to be drilling at Kouri through all of 2020.

“We expect the regular release of drilling results to impact on share price,” he says.

“The main milestones (and share price re-rating events) will be mineral resource updates.

“At this stage, subject to drilling results, we expect to release a mineral resource update in ~April 2020 and another in ~December 2020.”

So far, the explorer has covered just 10km of the entire 40km-long mineralised shear zone at Kouri, says Mackay.

“By the end of 2020 we expect to have explored the entire 40km of the gold mineralised shear zone at Kouri and we believe we will have increased our mineral resource base considerably,” he says.

“We are creating value for shareholders with the addition of the gold ounces and we believe this value will eventually be reflected in our share price.”

This story was developed in collaboration with Golden Rim, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.