Gold: Pure Alumina puts HPA plans on ice, goes back to gold

Mining

Mining

In November, explorer Hill End Gold changed its name to reflect its focus on the burgeoning high purity alumina (HPA) sector.

HPA is used in lithium-ion battery components, LED lights, smart phone screens, and surgical tools. And demand is on the way up.

Hill End was now Pure Alumina (ASX:PUA) – the name of the company Hill End bought in July 2017. This deal included its now-flagship Yendon HPA project.

The sale of its gold assets was well underway at this point, the company said.

Then it announced the potential purchase of private Canadian HPA producer Polar Sapphire, a company it says makes some of the lowest cost HPA going around.

But the company had trouble raising the necessary funds to complete the acquisition – you could blame that on the current junior investment climate — and so this deal fell through.

“The challenge of raising the significant capital required to finance a commercial high purity alumina operation has proved difficult in the current environment,” the company said today.

“For this reason, the company has elected to place the development of the Yendon high purity alumina project on hold until market conditions improve or would consider alternative options for the future of the Yendon assets.”

It’s just fortuitous the company didn’t end up selling those advanced NSW-based gold assets — because that’s where Pure Alumina’s focus is going next.

“The attraction of the gold market is close to record high gold prices in Australian dollars and the lack of an apparent supply response indicating that robust gold prices may be sustained in the medium to long term outlook,” Pure Alumina says.

“Combining the outlook for gold with the fact that Pure Alumina owns the highly prospective Hill End gold project, it is logical that Pure Alumina has concluded that gold is the company’s preferred commodity going forward.”

Copper projects would also be considered should a suitable opportunity present itself, the company says.

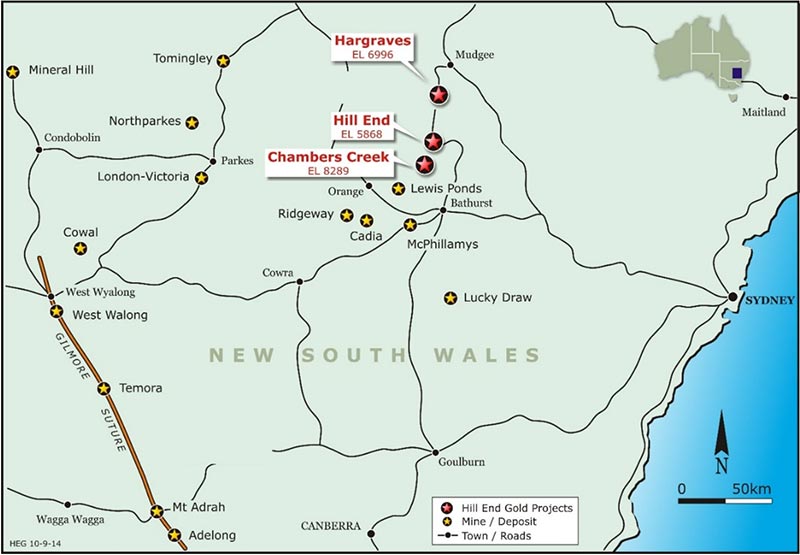

And guess where Hill End-Hargraves is? The Lachlan Fold Belt of Central NSW, where major miners and ambitious juniors are hunting for company making tier 1 deposits.

Its where Alkane Resources (ASX:ALK) recently snared itself a big porphyry trophy, hitting an incredible 502m at 0.48 grams per tonne (g/t) gold and 0.2 per cent copper, 211m from surface at the Boda prospect.

Hill End itself is the site of one of Australia’s earliest gold rushes, with an estimated +2 million ounces of gold mined historically, the company says.

The smallish Hargraves project already has a prefeasibility study completed in 2014 for a 100,000oz open pit and “low impact” processing project.

In 2017, the company noted that the project could be developed for just $15m, producing a net profit of $40m at a gold price of just $1600/oz (its currently up around $2180/oz – you do the math).

Going forward, Pure Alumina wants to generate a JORC-complaint gold resource estimate at Hargraves, complete some updated economic studies, and review exploration potential over the tenements. The company may also look to add other gold projects to its portfolio.

And change its name (probably).

The Newcrest Mining (ASX:NCM) – Encounter Resources (ASX:ENR) Tanami joint venture is on the ground and moving fast.

Phase 1 drilling at ‘Hutch’s Find’ is completed with assay results due in November. The Newcrest-funded program will now move to the ‘Afghan’ prospect where extensions of a 4km long, near-surface gold anomaly are being targeted. Assays are expected in December.

READ MORE about Encounter:

Barry FitzGerald: Will Encounter be the next junior to celebrate a big find?

Encounter and Newcrest are drilling for the big one at Hutch’s Find