Gold price surge: The 7 top gold stocks analysts say are ready for take-off

One must have a safe haven. Picture: Getty Images

With the gold price breaking a few new Aussie dollar records recently, the small cap gold players nearing production have started to look mighty attractive to investors.

With so much going on in global markets right now it can be a tough gig to cut through the noise and get to the crux of just what is happening when it comes to things like gold.

Gold has long been viewed as a “safe haven” asset in times of economic uncertainty, and right now there are plenty of global events fuelling that uncertainty – coronavirus, US-China trade tensions and Brexit.

In February, the gold price hit a new all-time record in Aussie dollar terms, punching through the $2500/oz mark (about $US1660/oz).

But while things like the coronavirus are having a near-term positive impact on gold, the rally started last year when investors began flocking to gold-backed exchange traded funds (ETFs).

The World Gold Council said gold had its best performance since 2010, rising by 18.4 per cent in US dollar terms last year.

“Gold prices rose most between early June and early September as uncertainty increased and interest rates fell,” the council said.

“But investors’ appetite for gold was apparent throughout the year, as seen by strong flows into gold-backed ETFs, growing gold reserves from central banks, and an increase in COMEX net longs positioning.”

A weaker US dollar is also supporting gold prices, according to Gavin Wendt, senior resources analyst and founding director of MineLife.

“A weak US dollar is very positive for gold, and a large contributing factor to the weakness in the US dollar was the fact that we’d seen a whole series of Fed rate hikes in the United States,” he told Stockhead.

“And the Fed came out towards the later part of the year and very much changed its tune. It pretty much said ‘look we’re putting rate rises on hold for the foreseeable future’.

“Given the uncertainty that we’ve seen in financial markets with ongoing trade issues between the United States and elsewhere, question marks over the US economy, China and coronavirus, I think we can probably safely say that we’re unlikely to see any interest rate hikes in the United States at all during calendar 2020.

“So as soon as markets have an interpretation that there’s not going to be any US changes in interest rates, then that immediately tends to put a cap on the value of the US dollar and in turn that’s had a very, very positive impact on the gold price.”

Tell us what you think

The content of this poll is not selected, modified or otherwise controlled by Stockhead. Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this poll.

How this translates into small cap buying

Simon Popple, of UK-based Brookville Capital, said the current global events were increasing uncertainty for investors, which made investing even more difficult.

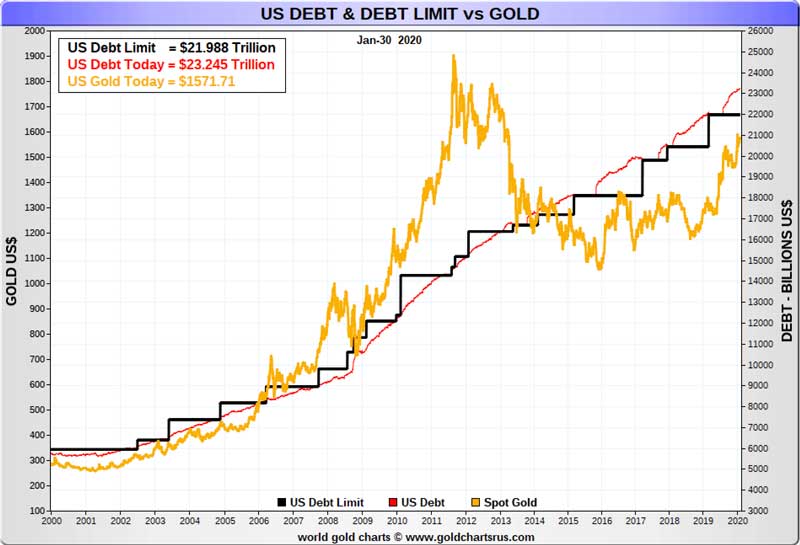

“The fact that debt levels are so high and interest rates are either negative or very low, compounds the problem,” he told Stockhead.

Popple noted that the tried and tested method of switching from equities into bonds as people approached retirement and living off the coupon was no longer as viable as it used to be, meaning investors had to be more “innovative”.

“Some are chasing yield by investing in increasingly risky products. In many cases they know little or nothing about these,” he said.

Many gold stocks may be off their lows, but Popple believes there are still a lot of stocks with “great potential for both capital gains and dividends”.

Typically, you’d expect the renewed investor interest in the gold space to be in companies already in production, but a large chunk of the much smaller gold players have also clambered onto investors’ radars.

MineLife’s Wendt said many investors had made gains in the big miners and were now looking for the next moneymaking opportunity.

“Investors have seen gains in the bigger gold producers, so naturally what then tends to happen is investors start to look for the value opportunities – the companies that are not yet in production but are very much advanced down the track in terms of moving towards production,” he said.

“Companies for example that have got funding, that are just waiting for the infrastructure to be finished so that they can pour gold, or companies that are looking for the funding to make that transition to production status.

“That’s the sector that’s now in vogue in the gold space and interestingly enough we have seen some significant moves at that end of the gold sector over the last six months.”

And while the junior miners are higher risk, the rewards can sometimes be much greater, according to Brookville Capital’s Popple.

“If you’re looking for lower risk companies that offer an income stream, then the majors with their dividends are worth looking at,” he noted.

“If you’re more interested in speculating, then having a broad portfolio of junior miners may be for you.

“These tend to be explorers rather than producers, so very risky, but potentially very rewarding if you get it right – some of these went up 10X, 50X even 100X in the 1970’s bull market.”

The top contenders

#1 West African Resources (ASX:WAF) Market Cap: $522.3m

First on Wendt’s list is West African Resources, which is aiming to be producing from its Sanbrado gold project in Burkina Faso around mid-2020.

Burkina Faso is Africa’s third largest exploration jurisdiction for gold and the continent’s fourth largest producer.

Proving just how gold-rich the nation is, West African previously reported hitting grades of up to 860 grams per tonne (g/t) and expects its Sanbrado mine to be a highly profitable operation producing as much as 301,000oz in the first year.

Estimated all-in sustaining costs (AISC) of $US497 ($754) an ounce in the first year would see the company make a nearly 62 per cent profit at a forecast price of $US1300 an ounce. At the current gold price of over $US1642.50/oz, West African’s profit increases to almost 70 per cent.

Over the past five years, West African’s share price has steadily risen 640 per cent to its current price of 59.2c.

“They’ve been a very, very steady performer, gradually de-risking their project,” Wendt said.

“Of course, it’s not necessarily an easy thing making the step up to production. A lot of companies as we know in the Aussie gold market can hit an iceberg when they make the leap into production, companies like Gascoyne Resources.

“But so far, the announcements that West African have been putting out in terms of project advancement have all been very, very good.”

Once West African is in production in the second half of this year, investors will be looking out for a positive ramp-up and some consistent quarterly production reports to show that everything is running according to plan, Wendt says.

“But certainly, companies like West African are on investor radar screens and their share price is starting to trickle up, not only because of the gold price but the fact that they are moving nearer towards production.”

#2 Cardinal Resources (ASX:CDV) Market Cap: $166.5m

Another emerging gold producer on Wendt’s list is Cardinal Resources, which late last year completed a feasibility study on its 5.1-million-ounce Namdini gold development in Ghana.

According to the study, the project could generate $US1.46 billion in pre‐tax free cashflow over the initial life on a gold price of $US1350 – which is well below the current spot gold price.

The all-in sustaining costs are forecast to be $US585/oz for the starter pit and $US895/oz over the life of the mine — while the development costs of $US390m are a big improvement on pre-feasibility study numbers. It will take about two years to pay that back.

Now, it’s all about securing the project finance.

“I think if they were to make a release along those lines tomorrow, we’d see the share price take off,” Wendt said.

“They have a very large resource; they’re going to make a lot of money out of it subject to securing project funding.”

The other factor that bodes well for these particular stocks, according to Wendt, is their attractiveness to the larger producers.

“It’s not so much them just making it into production themselves, but how attractive they will be to gold companies further up the food chain that might be looking at potential acquisitions,” he said.

“I think companies like West African and Cardinal will more than likely be on the radar screens in terms of corporate takeover activity for bigger players.”

#3 Capricorn Metals (ASX:CMM) Market Cap: $403.5m

On home soil, Wendt likes the look of Capricorn Metals.

This particular goldie has an interesting back story: It’s taken repeated management shuffles, failed takeover bids and a major financial restructuring exercise to get Capricorn back on track with its key asset, the Karlawinda gold project in WA.

“They’ve done studies that suggest it’s going to be a very robust sort of project,” Wendt said.

“They’re more advanced than say Cardinal is because they’ve executed debt and bank guarantee facility agreements with Macquarie Bank for the project.”

A $107m debt-funding package has been secured with Macquarie Bank with the project expected to cost $132m to build and is forecast to produce gold over an initial 8.5 years at an AISC of $1038/oz.

Macquarie, which recently initiated coverage of Capricorn, reckons the all-in cost will turn out to be more like $1350/oz and the pre-production capital requirement around $150m for a mine with a nine-year life at 100,000/oz a year.

READ: Tim Treadgold: Capricorn tries again, this time with top management and cash in the bank

But there is a resource upgrade on the cards very soon.

“They’re very interesting because like all of these companies the other big aspect to them is they’re resource growth potential if you like, the exploration potential is significant,” Wendt said.

#4 Chalice Gold Mines (ASX:CHN) Market Cap: $58.9m

Meanwhile, Popple’s picks include Chalice Gold Mines, which is exploring for gold in Victoria’s Bendigo goldfields, right next door to one of the highest-grade gold mines in the world.

Bendigo produced more than half the world’s gold for 40 years in the late nineteenth century, making it the world’s largest producer between 1850 and 1890.

But up until a few years ago, it had taken a backseat in the hunt for gold in Australia.

Canada-based Kirkland Lake Gold (ASX:KLA) is responsible for putting Bendigo back on the map as a hot gold exploration destination.

Kirkland owns the 7-million-ounce Fosterville mine, which is one of the world’s highest-grade gold mines and is currently the largest gold producer in Victoria.

And Chalice is exploring for gold at Pyramid Hill, very near to Fosterville.

The company is an interesting one. It isn’t yet mining, it doesn’t even have a resource yet, but it is making money and hasn’t needed to raise any capital since 2011.

Popple said Chalice had plenty of cash in the bank.

The company’s December quarterly puts the junior’s combined cash and investments at about $26.8m at the end of 2019.

This included $9.7m in cash, $8.7m in TSX Venture Exchange-listed O3 Mining shares and $7.3m in Spectrum Metals (ASX:SPX) shares.

Chalice’s investment in Spectrum Metals has been quite lucrative for the junior, with its investment almost tripling since it started picking up shares on-market in July last year.

“They also own the King Leopold nickel project which could well be very valuable,” Popple added.

#5 Pantoro (ASX:PNR) Market Cap: $100m

Although Pantoro is already producing from its flagship Nicolsons project in WA, where its goal is 50,000oz a year, the company recently picked up a 50 per cent stake in the high-grade Norseman project.

“They need to get the processing plant up and running, but once they do that, this asset should be producing around 200,000 ounces a year,” Popple explained.

“Given 100,000 ounces will be theirs, if things go to plan, they should be producing about 150,000 ounces a year for the next few years.”

#6 Bellevue Gold (ASX:BGL) Market Cap: $313.5m

Bellevue is advancing the historic gold mine of the same name in Western Australia, which is one of Australia’s highest-grade gold mines having produced 800,000oz at 15g/t from 1986 to 1997.

The company doesn’t yet have project financing, but if it keeps finding high-grade gold at its current rate, production may not be that far away, Popple told Stockhead previously.

“They are still very much explorers, but with a JORC inferred resource inventory of 1,800,000oz at 11.1g/t gold, it is one of the highest-grade undeveloped gold discoveries in the world,” Popple said.

“They’re obviously looking for more gold but appear to be looking in the right place.

“Whilst this is not a cheap company – the shares have already taken off – if they can find more gold of a similar grade, it could be a nice one to have in your portfolio.”

Formerly Draig Resources, Bellevue has witnessed a 155 per cent increase in its share price in the past two years, climbing from 22c to 56c.

#7 Oklo Resources (ASX:OKU) Market Cap: $90.8m

One of Wendt’s final picks, Oklo is little further from production than the rest. It also doesn’t yet have a resource.

However, its strategy seems to have caught the eye of investors.

“Oklo seem to be concentrating on the big picture in terms of coming out with a significant multi-million-ounce resource number, but they are a company in Africa that seems to be generating more market attention,” Wendt noted.

Oklo says it is exploring “among the golden giants”. It has 11 projects spanning 1393sqkm of some of Mali’s most fertile greenstone belts.

Since mid-October last year, the company’s share price has jumped from 9.9c to 22c – a 122 per cent increase.

“They haven’t got a resource, but they’ve got significant exploration potential and they’re drilling seems to be hanging together,” Wendt said.

“That’s a company that I would describe as being obviously further down the food chain, they’re not a near-term production story but you could call it a very, very advanced exploration story that the market is focusing on quite closely.”

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.