Gold price sets up base camp at $US1,895/oz ready for 2021 ascent

Mining

Mining

Gold has risen to a five-week high of $US1,895 per ounce ($2,494/oz) in the lead-up to Christmas supported by a weak US dollar and talk of an incoming stimulus package for the US economy.

The yellow metal is less than $US200 from its record high price of $US2,070/oz ($2,845/oz) achieved in early August, in what has been an eventful year of trading.

US Federal Reserve chairman Jerome Powell said the central bank will keep its outlook for interest rates at zero out to 2024, and US Congress leaders are reportedly close to a deal on a $US900bn relief package for the COVID-19 hit economy.

“Solid gains across the precious metals complex came as US stimulus hopes rise and the FOMC [Federal Reserve] reaffirms its stance,” Swiss gold refining group MKS Pamp said in a research note.

“The continued low interest rate environment in the US should continue to support [gold prices],” it added.

“A combination of an additional stimulus package along with additional bond buying and asset purchases from the Fed has clearly driven gold and silver prices higher,” David Meger, director of metals trading at High Ridge Futures told Reuters.

Some market commentators believe the weaker US dollar is a sign of gathering inflation, which could lead investors to diversify their asset holdings into precious metals as a hedge.

“We have got a global reflation on the way,” Axel Merk, president and chief investment officer of California-based Merk Investments told Reuters.

US balance of payments trade data due for release later today is expected to lead to further US dollar weakness, analysts said.

The long-running battle for control of Cardinal Resources (ASX:CDV) has entered a key stage after nine months of twists and turns.

Shareholders in the West African gold explorer have until Wednesday to accept Russian gold company Nordgold’s takeover offer for the company.

Nordgold increased its bid price for Cardinal Resources to $1.05 per share, from $1/share in November.

The price matches rival takeover bidder Shandong Gold Mining’s $1.05 per share offer which is preferred by the Cardinal Resources board, and this closes on December 31.

Cardinal Resources is developing its Namdini gold project in northern Ghana which has an ore reserve of 5.1 million ounces based on 136.8 million tonnes at 1.13 grams per tonne gold.

The board of Cardinal urged both bidders to bring the takeover battle to a conclusion.

“The board of Cardinal, like many of our shareholders, is growing increasingly frustrated with the protracted duration of this takeover battle,” said the company in a release Friday.

“Despite the fact Shandong and Nordgold are now free to increase their respective offers from $1.05 per share neither bidder appears minded to draw this process to a conclusion,” the company added.

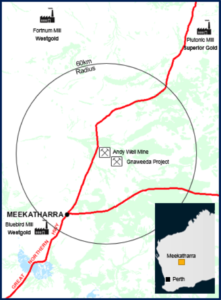

The ASX market looked favourably on Latitude Consolidated’s (ASX:LCD) acquisition of the Andy Well and Gnaweeda gold project from Silver Lake Resources (ASX:SLR) for $8m.

The projects cover 343sqkm of WA’s Murchison goldfield and have an estimated mineral resource of 776,000 ounces with the potential for further growth.

“The board’s intention has been to identify a strategic acquisition opportunity that provides our shareholders with exposure to a compelling geological story, with a clear pathway to generate growth through brownfields exploration, and we believe Andy Well and Gnaweeda tick both of these boxes comfortably,” chairman, Timothy Moore, said.

Andy Well produced 350,000 ounces at ~8 grams per tonne for Doray Minerals for five years up to 2017 when it went into care and maintenance on low gold prices.

Latitude has commissioned a study proposing to combine Andy Well and Gnaweeda into a single mining operation, and the mine is close to several large mines including, Superior Gold’s Plutonic.

Silver Lake Resources acquired Andy Well and Gnaweeda as part of its takeover of Doray Minerals in 2019, and said its divestment was consistent with its returns driven approach to capital allocation.

“The transaction structure realises immediate value for two non-core projects for Silver Lake shareholders, while providing the best opportunity for the Andy Well and Gnaweeda project to realise their potential within a focused exploration company,” added Silver Lake Resources.