Gold price ready to challenge overhead resistance at $US1,900/oz

The price of gold is pushing toward $US1,900/oz after bouncing off $US1,865/oz several times. Image: Getty

- Price of gold advances toward $US1,900/oz on weaker US dollar

- Gold price has bounced off $US1,865/oz three times since September

- ASX Gold Stocks Guide: Everything you need to know

Gold prices are climbing back to $US1,900 per ounce on a weaker US dollar but reports of progress in developing a COVID-19 vaccine is sapping further gains for the yellow metal.

In Wednesday trade, gold was sitting at $US1,881 per ounce ($2,578/oz), and its price has bounced off the $US1,865/oz support line several times since September.

“The yellow metal found support around the $US1,850-$1,860/oz region, but it has since struggled to break back above $US1,900/oz,” Oanda senior market analyst, Craig Erlam told Market Watch.

Erlam added that gold needed to push through $US1,900/oz to consolidate its gains.

“The US economic calendar is data-dry and hence, the bright metal will likely remain at the mercy of the US dollar dynamics,” said FXStreet reporter Dhwani Mehta.

US equity markets attract capital flows

Investor funds are flowing into US stock markets, as reflected in stock indices like the Nasdaq and Dow Jones which are near to, or at record highs.

Tech-heavy index the Nasdaq is bumping up against the 12,000 points level and the Dow Jones was within a whisker of 30,000 points this week.

US investment bank Citibank suggested the US dollar could weaken by as much as 20 per cent in 2021, which would be good for gold prices.

Under the bank’s scenario, central banks would keep monetary policy loose while governments distribute Covid vaccines among their populations.

“Given this set-up, there is the potential for the dollar’s losses to be front-loaded, with the US dollar potentially falling by as much as 20 per cent in 2021,” Citibank said in a research note.

Federal Reserve chairman Jay Powell said progress in developing vaccines for COVID-19 was good news for the US economy, but it still has “a long way to go” to a full recovery.

Investment floods into silver market

Silver too is seeing some sunny times with the Silver Institute presenting key themes from its annual market review.

These include physical investment in silver surging 27 per cent in 2020 to 236.8 million ounces, with a 62 per cent jump in retail demand for silver in the US this year.

And, global holdings of silver-backed Exchange Traded Products reaching a new record high of 1 billion ounces, up 326 million ounces in 2020.

Silver’s price is trading around seven-year highs at $US24.50 per ounce ($33.60/oz), this week.

ASX newcomer Native Mineral Resources acquires WA gold tenements

Shares in Native Mineral Resources (ASX:NMR) rose as the copper and gold explorer acquired two exploration licences in WA.

The company listed on the ASX this week through an IPO that raised $5.7m.

The exploration ground is 60km north of Leonora in the Yilgarn Craton region and is highly prospective for gold mineralisation.

Called the Music Well gold property, the exploration tenements are close to four operating gold mines in the Eastern Goldfields.

Recent discoveries of intrusion-related gold systems (IRGS) in the Yilgarn like De Grey Mining’s (ASX:DEG) Hemi and Northern Star Resources’ (ASX:NST) Ramone deposit has led to a spike in exploration work targeting this type of system, the company said.

“Given Music Well is in an area known to host intrusive rocks, we believe there is a real opportunity for NMR to unlock value, potentially very quickly,” managing director, Blake Cannavo, said.

Chile gold-copper project yields results for Southern Hemisphere Mining

Southern Hemisphere Mining (ASX:SUH) did well on intercepting up to 12.8 grams per tonne for gold at its Colina2 project.

The company has collected more than 1,000 samples from 15 gold trenches for 2,230m at Colina2 in central Chile.

The project is at low altitude and within 12km of Southern Hemisphere Mining’s Llahuin copper-gold-molybdenum project.

Further follow-up drilling for 1,000m is planned for 2021.

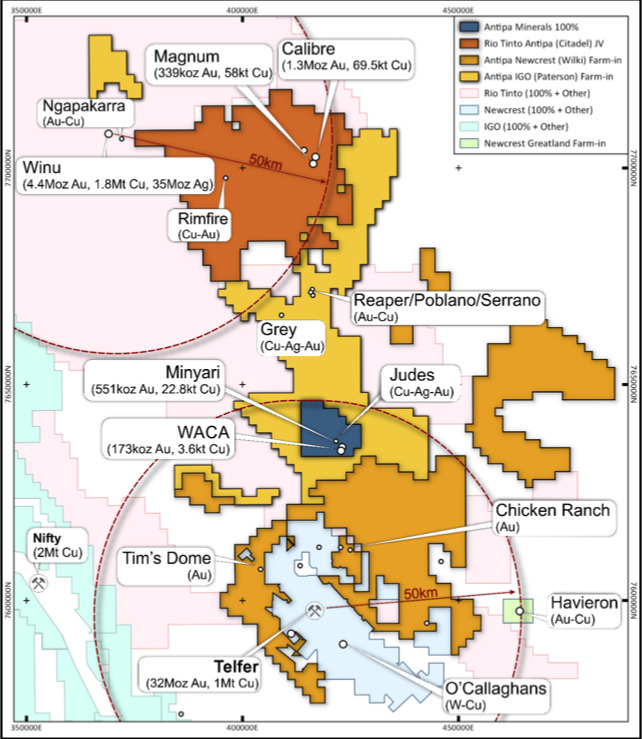

Antipa Minerals’ joint venture with Rio Tinto delivers results

Drilling has delivered significant high-grade intersections at Antipa Minerals’ (ASX:AZY) Calibre deposit that sits within its Citadel project in WA’s Paterson province, a joint venture with Rio Tinto (ASX:RIO).

Rio Tinto Exploration has a $12.6m budget to fund exploration at the Citadel project to produce new gold and copper discoveries.

Results from the drilling include 319.8m at 0.96 g/t gold and 0.05 per cent copper from 95m, said the company.

ASX share price for Antipa Minerals (ASX:AZY), Native Mineral Resources (ASX:NMR), Southern Hemisphere Mining (ASX:SUH)

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.