Gold price edges closer to $US2,000/oz on weaker US dollar, election uncertainty

Pic: John W Banagan / Stone via Getty Images

- Gold price advances on sliding US dollar and lack of US election clarity

- ‘The weaker dollar is…more a question of what markets would expect from a Biden presidency’

- ASX Gold Stocks Guide: Everything you need to know

The price of gold has powered past $US1,900 per ounce on a sliding US dollar as investors hedged their bets on the outcome of the US presidential election.

As trading got underway in Asia, Friday, the gold price was at $US1,945/oz ($2,675/oz), and has gained 3.5 per cent this week or close to $US70/oz.

The US dollar is heading into a three-year low, with the DXY currency index at 92.63, Friday.

With the US presidential election still in doubt – Biden leads Trump 253 to 214 in Electoral College votes – and several states are too close to call for either side, investors are cautious.

“The weaker dollar is not necessarily reflecting the loss of confidence or anything, it is more a question of what the markets would expect from a Biden presidency,” StoneX Group’s head of market analysis, Rhona O’Connell told Reuters.

Federal Reserve chairman Jerome Powell said after the central bank’s Thursday meeting that more economic stimulus was needed for US households and businesses amid a surge in COVID-19 cases.

The US central bank kept its lending rate steady at zero per cent, and has hinted at more quantitative easing.

A Commonwealth Bank of Australia report noted chairman Powell said the Federal Reserve will continue to “increase its holdings of Treasury securities and agency-mortgage-backed securities at least at the current pace”.

In the election for the US Senate, both the Democrat and Republican parties are neck-and-neck at 48 Senators each, and four contests remain to be decided, said the New York Times.

The White House and Congress have been deadlocked over passing a $US2 trillion stimulus package to revive the US economy.

“While a Republican Senate is interpreted as implying a smaller fiscal package and potential gridlock during the lame-duck session, a Biden presidency has done more to reduce the geopolitical premium, resulting in a weaker US dollar, which in turn is supporting gold prices,” said analysts at TD Securities.

Silver was steady at $US25.30 per ounce ($34.73/oz) Friday as investors have poured funds into Exchange Traded Products.

Several ASX gold explorers rise on publication of drilling reports

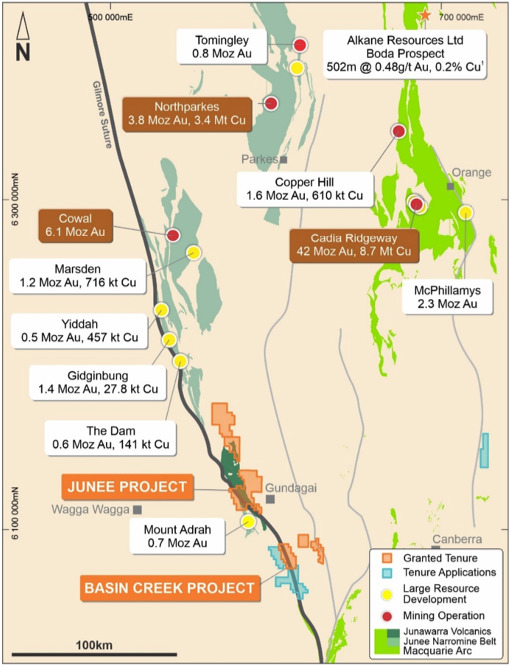

DevEx Resources (ASX:DEV) rose in Friday trade after completing first-pass reconnaissance drilling at its Main Ridge prospect within its Basin Creek gold project in NSW.

The drilling will refine next-stage exploration targets in a 3.5km gold system in the project which is near to Alkane Resources’ (ASX:ALK) Boda gold prospect in the Lachlan Fold Belt.

Assay results from the drilling include 4m at 2.1 grams per tonne gold from 174m.

DevEx Resources is to kick off drilling at its recently acquired Wilga Downs gold and base metals project in the NSW Cobar region in mid-November.

Canada-focused gold explorer Ardiden sparks investor interest

Shares in Ardiden (ASX:ADV) climbed Friday after it provided an update on drilling at its Kasagiminnis deposit inside its Pickle Lake gold project in Canada’s Ontario province.

An initial four drill holes included hits of 6m at 4.23 g/t gold, and 6.5m at 4.28 g/t, and historical underground mines at Pickle Lake have produced 3 million ounces of gold.

“Ardiden is hunting deep, high-grade gold deposits across its massive landholding, analogous to other well-known gold deposits in Ontario, such as Red Lake, Dixie, Musselwhite and Hemlo,” managing director and chief executive, Rob Longley, said.

Golden Mile chases Benalla gold trend in WA

Golden Mile Resources (ASX:G88) has completed a second phase of drilling on the Benalla gold trend at its Leonora East gold project in WA’s north-eastern goldfields.

Priority targets over a 1km strike of an auger geochemical anomaly were tested, and sampling work has yielded results of up to 387 parts per billion gold along the strike.

ASX share prices for Ardiden (ASX:ADV), DevEx Resources (ASX:DEV), and Golden Mile Resources (ASX:G88)

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.