Gold: Porphyry hunter Alice Queen has more than one hot iron in the fire

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

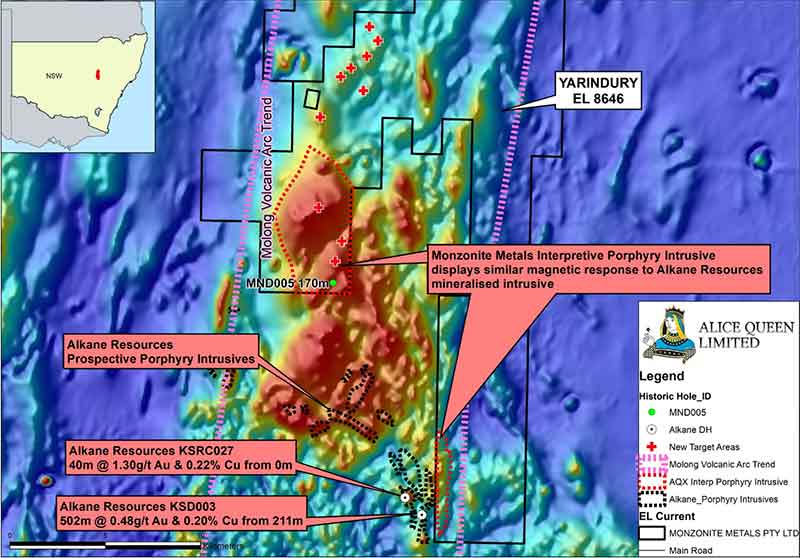

Alice Queen (ASX:AQX) was swept up in the excitement which followed Alkane Resources’ (ASX:ALK) big gold-copper porphyry discovery in NSW.

For Alice Queen, it doesn’t hurt that Alkane’s discovery is just 700m from its Yarindury exploration licence:

And there’s a good chance that Alkane’s mineralisation extends into their ground, the company says.

It’s the main reason the Alice Queen share price has jumped about 65 per cent over the past couple of months. But the explorer has another couple of irons in the fire.

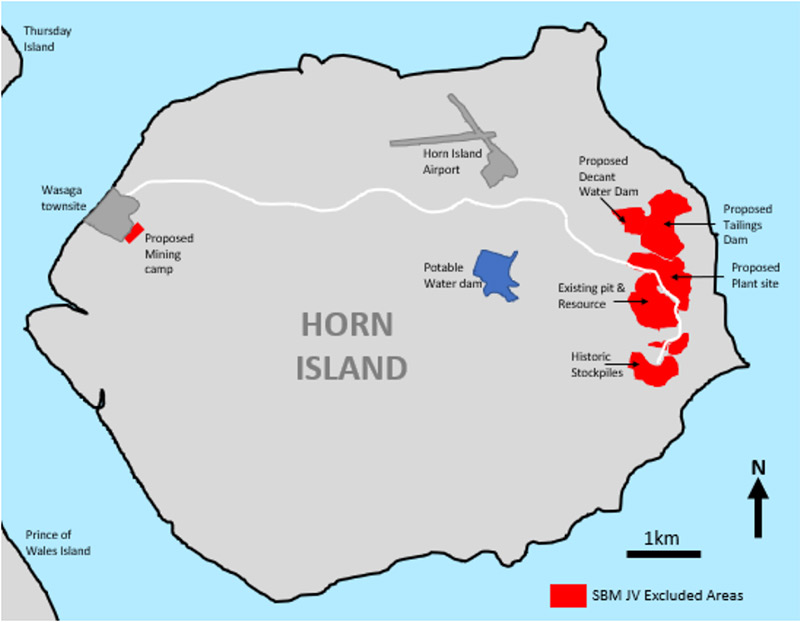

In June, Alice Queen entered into a joint venture (JV) with mid-tier gold producer St Barbara (ASX:SBM) over its Horn Island project in the Torres Strait.

Horn Island, mined on and off since the late 1890s, last operated as a mine in 1989.

It subsequently remained under a government moratorium where no exploration or mining occurred for 25 years, until Alice Queen picked up the project in 2014.

Now, as part of the JV deal, St Barbara will spend $4m over three years to earn 70 per cent of areas outside the ‘Excluded Zones’:

For Alice Queen, this is important because those ‘excluded zones’ incorporate the existing ~500,000oz resource, historic mine infrastructure and mine dumps, low-grade ore stockpiles, run-of-mine pad and all alluvial gold across Horn Island to a depth of 6m below surface.

While Alice Queen separately progresses this more advanced project, the JV is looking for something new, and something big.

Fresh JV surface sampling has just returned a maximum assay result of 215 grams per tonne (g/t) gold from rock chip sampling, with 14 samples returning greater than 1g/t.

The market liked the news, sending the stock up +10 per cent in morning trade.

“We are confident that these geochemical results combined with the geophysical survey, as well as further field work, will define targets that will set us up for a significant exploration program over the next 12 months,” Alice Queen managing director Andrew Buxton says.

And in those areas excluded from the JV, the explorer is looking to elevate the existing resource from ‘inferred’ to the higher confidence ‘indicated’ status.

“This program will commence with some additional diamond core drilling early in the New Year,” Buxton says.

“The core from these holes will also be used for ore sorting and metallurgical test work as we progress towards a BFS [bankable feasibility study] on the existing Horn Island open pit mining opportunity.”

In other ASX gold news today:

Kairos Minerals (ASX:KAI) is drilling to extend the historic 67,000oz Iron Stirrup deposit — part of the 643,000oz Mt York project in the Pilbara region of WA. The 1500m program will take two weeks, the explorer says, with results expected in early 2020.

“The Iron Stirrup drilling program is expected to form part of a much larger exploration push at Mt York next year,” Kairos exec chairman Terry Topping says. “The results of the current drilling will be incorporated as part of a review of the current 643,000oz resource that is already underway. This will, in turn, underpin mining studies commencing in Q1 next year.”

~$980m market cap miner Silver Lake Resources (ASX:SLR) now owns +90 per cent of takeover target EganStreet Resources (ASX:EGA). As a result of holding more than 90 per cent of EganStreet shares, Silver Lake now intends to compulsorily acquire any outstanding shares.

Not far behind is investment vehicle Ibaera, which now holds 77.54 per cent of African gold explorer Azumah Resources (ASX:AZM). The Azumah board initially resisted the hostile takeover bid before Ibaera upped the offer to 3.3c per share.

READ MORE:

Like Azumah, explorer EganStreet flies (again) on superior takeover offer

Azumah leaps 100pc on ‘highly opportunistic’ hostile takeover bid

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.